Household Insecticides Market Research, 2032

The global household insecticides market was valued at $15.2 billion in 2022 and is projected to reach $31.1 billion by 2032, growing at a CAGR of 7.5% from 2023 to 2032.

Report Key Highlighters:

- Quantitative information mentioned in the global household insecticides market includes the market numbers in terms of value ($Million) and volume (Kilotons) with respect to different segments, pricing analysis, annual growth rate, CAGR (2023-32), and growth analysis.

- The analysis in the report is provided on the basis of product type, consumption and application. The study will also contain qualitative information such as the market dynamics (drivers, restraints, opportunities), Porter’s Five Force Analysis, key regulations across the region, and value chain analysis.

- A few companies, including FMC Global Specialty Solutions, S. C. Johnson & Son, Inc., Dabur India Ltd., Neogen Corporation., Spectrum Brands, Inc., Shogun Organics, Amplecta AB, hold a large proportion of the household insecticides market.

- This report makes it easier for existing market players and new entrants to the household insecticide business to plan their strategies and understand the dynamics of the industry, which ultimately helps them make better decisions.

Household insecticides are chemical formulations designed to eliminate or control insects within residential settings. These products play a crucial role in maintaining a pest-free environment, safeguarding human health, and preserving the integrity of structures. Typically, available in various forms such as sprays, powders, and baits, household insecticides target a broad spectrum of pests including mosquitoes, flies, ants, cockroaches, and spiders. The active ingredients in these formulations often include pyrethroids, organophosphates, or neonicotinoids, which act on the nervous system of insects, disrupting their vital functions.

In addition, household insecticides may contain inert ingredients, such as solvents and carriers, to enhance effectiveness and ease of application. Regular use of household insecticides helps create a comfortable living environment by preventing the spread of diseases carried by insects and protecting household goods from damage caused by pest infestations.

The increase in the prevalence of insect-borne diseases is expected to drive the growth of the household insecticide market.

Numerous diseases are transmitted by insects, most notably parasites and mosquitoes; among them are West Nile virus, malaria, dengue fever, Zika virus, and Lyme disease. The increase in the incidence of insect-borne disease can be attributed to several factors, including global travel, urbanization, and climate change. The urban population around the world has become more health-conscious with an awareness of the dangers associated with mosquito infections.

In addition to diseases, rural communities are developing a greater apprehension regarding sanitation and health, with the rise in incidences of mosquito-borne disease. Furthermore, the proliferation of water-holding appliances such as air conditioning units is projected to serve as reproductive grounds for mosquitoes. Climate change has emerged as a principal factor contributing to the surge in the incidence of insect-borne illnesses. An increase in global temperatures leads to an expansion of the geographic range of numerous insect vectors. For example, the Asian tiger mosquito, which transmits the dengue and Zika viruses, has expanded to new regions of Europe and the Americas, owing to global surge in temperature.

Government initiatives promoting the use of insecticides in households are poised to be a significant driver of the household insecticides market.

Recognizing the public health risks associated with vector-borne diseases and the importance of effective pest control, governments globally are increasingly implementing campaigns and regulations to encourage the use of insecticides. These initiatives often include public awareness programs educating citizens about the health hazards posed by insects and the benefits of using household insecticides. In addition, regulatory measures may be put in place to ensure the availability and proper use of approved insecticide products. Such governmental support not only increases consumer awareness but also fosters a conducive environment for market growth by instilling a sense of responsibility in households to adopt insecticide solutions.

The household insecticides market is anticipated to experience growth due to a surge in awareness of health and hygiene among consumers.

Individuals are becoming more conscious of the need for effective pest control measures with an increasing understanding of the critical link between a clean living environment and overall well-being. The awareness of the role insects play in the transmission of diseases has propelled the demand for household insecticides, as consumers seek proactive solutions to create healthier home environments. This trend is particularly evident in urban settings where lifestyles involve prolonged periods indoors. As urbanization progresses, and populations concentrate in smaller spaces, the prevalence of pests becomes a significant concern. Consequently, the rise in awareness of health and hygiene acts as a compelling driver, steering consumers toward insect control products that promise a safer and more sanitary living space, thereby stimulating growth in the household insecticides market.

The widespread use of insecticides, containing toxic chemicals like DEET and Benzyl Benzoate, poses health concerns, leading to skin irritation, rashes, and infections, particularly for individuals prone to allergies. In addition, the noxious odors and aerosols present in spray-format insecticides contribute to respiratory issues and discomfort among users. These challenges are increased when these products are used indoors, impacting the air quality in enclosed spaces, especially those with poor ventilation. Consequently, the extensive reliance on such chemical-laden insecticides is impeding their market growth, especially among individuals with sensitivities, who are deterred by the potential health risks associated with these products. This resistance among consumers, driven by health and environmental considerations, poses a barrier to the expansion of the global household insecticides market.

The increase in the construction of premium housing in developing economies presents a lucrative opportunity for the household insecticides market. As these economies experience rapid urbanization and an upswing in disposable income, there is a parallel surge in the demand for high-end residential spaces. The construction boom in premium housing is driven by a growing middle class seeking modern amenities and improved living standards. However, this surge in construction also brings about challenges in pest management, as new and upscale properties may attract a variety of household insects. This creates a significant market opportunity for household insecticides, as homeowners and property developers alike seek effective solutions to safeguard these premium living spaces from unwanted pests.

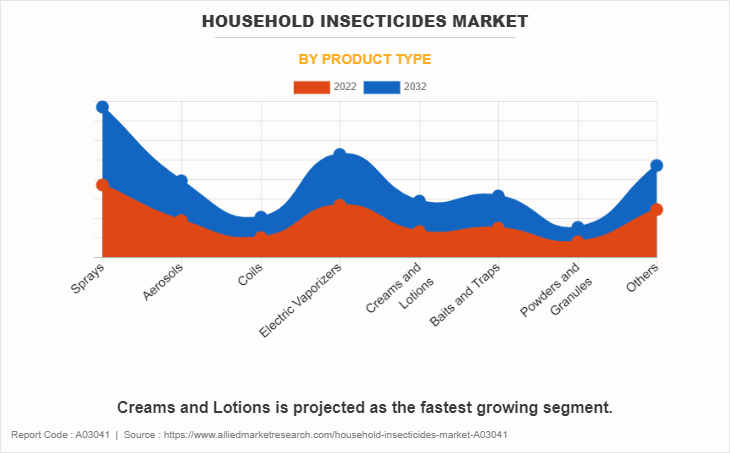

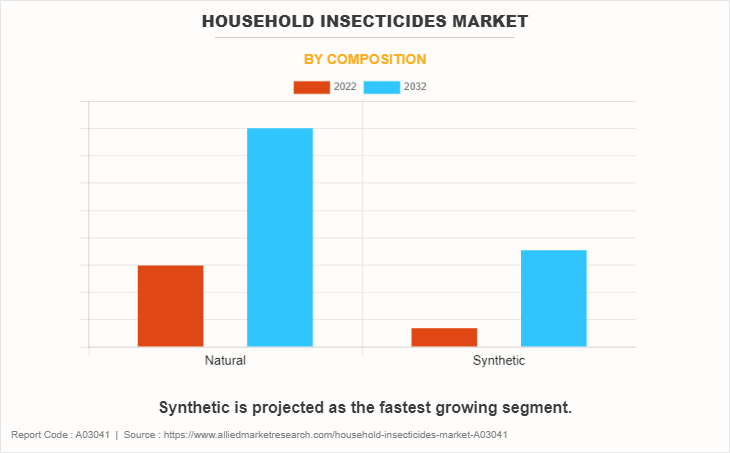

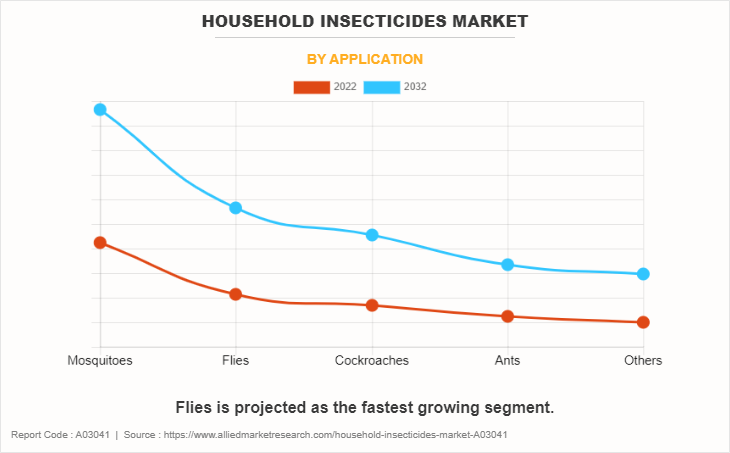

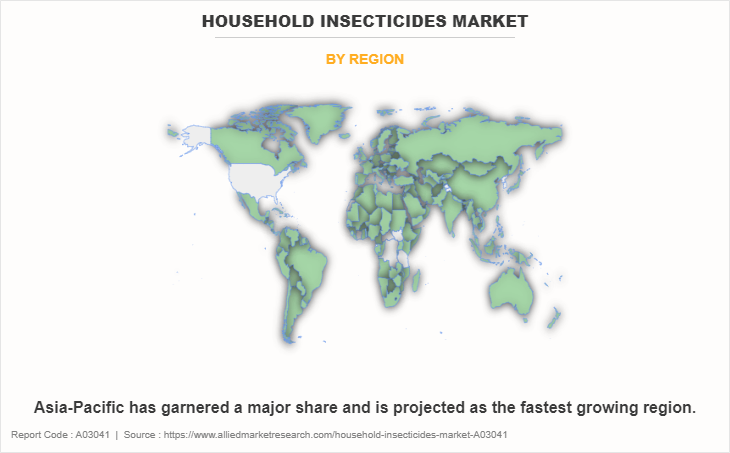

The household insecticides market is segmented on the basis of product type, composition, application, and region. By product type, the market is divided into sprays, aerosols, coils, electric vaporizers, creams and lotions, baits and traps, powders and granules, and others. By composition, it is categorized into natural and synthetic. By application, it is categorized into mosquitoes, flies, cockroaches, ants, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The sprays segment accounted for the largest share in 2022 accounting for nearly one-fourth of the global household insecticides market revenue. It can be attributed to their convenience, targeted application, and quick effectiveness. Sprays offer ease of use, precise coverage in hard-to-reach areas, and immediate action, making them a preferred choice for consumers seeking efficient and hassle-free solutions for insect control in homes.

Creams and lotions is expected to register the highest CAGR of 8.2%. The rising concern for health and hygiene, coupled with a growing awareness of insect-borne diseases, fuels the demand for creams and lotions in household insecticides. Consumers seek convenient and targeted solutions for personal protection, driving the popularity of these products in safeguarding against insect bites and related health risks.

The natural segment accounted for the largest share in 2022 accounting for more than half of the global household insecticides market revenue. It can be attributed to a growing awareness of environmental sustainability and health concerns. Consumers are increasingly seeking products with ingredients derived from natural sources, driven by a desire for eco-friendly alternatives and a preference for safer options for their homes.

Synthetic is expected to register the highest CAGR of 7.7%. It can be attributed to their effectiveness in pest control, longer shelf life, and enhanced stability. Consumers increasingly prioritize efficient and long-lasting solutions, driving the preference for synthetic formulations that offer superior performance in combating household insect issues.

The mosquitoes segment accounted for the largest share in 2022, accounting for more than one-third of the global household insecticides market revenue. The rising concern for vector-borne diseases and the desire for effective pest control drive the increasing demand for mosquito applications in household insecticides. Consumers seek convenient and targeted solutions to protect their homes, making mosquito-specific products a popular choice in the growing market for residential insect repellents.

Flies is expected to register the highest CAGR of 8.0%. The rising demand for flies application in household insecticides can be attributed to growing awareness of health risks associated with flies, increased urbanization leading to higher pest populations, and a preference for convenient and effective solutions. Consumers seek efficient products to maintain a hygienic living environment, driving the demand for fly-targeted household insecticides.

Asia-Pacific garnered the largest share in 2022 accounting for nearly two-fifths of the global household insecticides market revenue. The increasing demand for household insecticides in the Asia-Pacific region can be attributed to rising awareness of vector-borne diseases, population growth, urbanization, and changing climatic conditions. As households seek effective solutions to control pests and maintain hygiene, the demand for insecticides has surged, driving market growth in the region.

The major players operating in the global household insecticides market include FMC Global Specialty Solutions, S. C. Johnson & Son, Inc., Dabur India Ltd., Neogen Corporation., Spectrum Brands, Inc., Shogun Organics, Amplecta AB, Reckitt Benckiser Group PLC, Jyothy Laboratories Ltd., and Sumitomo Chemical India Ltd.

Other players include BASF SE, Bayer AG, Jaico RDP NV., Earth Chemicals Co. Ltd., The Scotts Miracle-Gro Co., Enesis Group, Godrej Consumer Products Ltd., Sanmex International, Gharda Chemicals Ltd., Natural Insecto Products Inc., Walco-Linck Company and Zapi SpA.

Public Policies:

Environmental Protection Agency (EPA): The EPA regulates and approves the use of pesticides, including household insecticides, in the U.S. Manufacturers must submit extensive data on the safety and efficacy of their products before they can be registered for use. The EPA sets tolerance levels for pesticide residues on food and establishes guidelines for product labeling.

Occupational Safety and Health Administration (OSHA): OSHA ensures workplace safety, including the safe use and handling of household insecticides in manufacturing facilities.

Consumer Product Safety Commission (CPSC): CPSC oversees product safety, including the packaging and labeling of household insecticides to protect consumers.

Pest Management Regulatory Agency (PMRA): In Canada, the PMRA, a branch of Health Canada, is responsible for the regulation of pesticides, including household insecticides. Similar to the EPA, the PMRA evaluates the safety, efficacy, and environmental impact of these products before granting registration.

Workplace Hazardous Materials Information System (WHMIS): WHMIS is Canada's hazard communication standard, which ensures that information about hazardous products, including household insecticides, is communicated to workers through labels and safety data sheets.

Biocidal Products Regulation (BPR): The BPR provides a harmonized regulatory framework for the placing on the market and use of biocidal products in the EU. It establishes procedures for the authorization of active substances and biocidal products. Manufacturers and suppliers must comply with the requirements set out in the regulation to ensure the safety and efficacy of the products.

Active Substance Approval: Before a biocidal product can be authorized, its active substances must be approved at the EU level. This involves a thorough evaluation of the substance's safety and efficacy.

Product Authorization: After the approval of the active substance, individual biocidal products must undergo an authorization process. This includes a comprehensive assessment of the product's safety, efficacy, and environmental impact. Each Member State has a Competent Authority responsible for granting authorizations.

Product Labeling and Packaging: Biocidal products must be labeled with relevant information, including instructions for use, precautions, and safety advice. Packaging should also comply with specific requirements to ensure the safe use and storage of the product.

Registration and Approval Process: Many countries in the Asia-Pacific region require household insecticides to undergo a registration and approval process before they can be sold in the market. This process often involves providing data on the product's safety, efficacy, and environmental impact. Regulatory authorities typically set criteria for active ingredients, labeling, packaging, and usage instructions.

Chemical Control and Pesticide Management: The use of certain active ingredients in household insecticides may be regulated, and specific limits or bans might be imposed based on their potential harm to human health and the environment. Regulatory bodies often conduct risk assessments to determine the safety of these products.

Impact Of Russia Ukraine War On the Household Insecticides Market:

- Russia or Ukraine is a significant supplier of raw materials or finished products for the household insecticides market, a conflict could disrupt the supply chain. This could lead to shortages, increased prices, or both.

- Geopolitical tensions can lead to fluctuations in currency values. Changes in currency exchange rates can impact the cost of importing raw materials or finished products for companies in the household insecticides market.

- During times of geopolitical uncertainty or conflict, consumers may alter their spending habits. They may prioritize essential goods over non-essential items like household insecticides, leading to changes in demand.

- Geopolitical events can contribute to overall market volatility. Investors may react to uncertainty by selling or buying stocks, which can influence the financial health of companies in the household insecticides sector.

- Governments may implement new regulations or change existing ones in response to geopolitical events. These changes could impact the manufacturing, distribution, or marketing of household insecticides.

- Geopolitical events can have broader economic consequences, affecting global economic growth. A slowdown in the global economy may impact consumer spending on various products, including household insecticides.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the household insecticides market analysis from 2022 to 2032 to identify the prevailing household insecticides market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the household insecticides market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global household insecticides market trends, key players, market segments, application areas, and market growth strategies.

Household Insecticides Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 31.1 billion |

| Growth Rate | CAGR of 7.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 350 |

| By Product Type |

|

| By Composition |

|

| By Application |

|

| By Region |

|

| Key Market Players | FMC Global Specialty Solutions, Spectrum Brands, Inc., Sumitomo Chemical India Ltd, Jyothy Laboratories Ltd., Neogen Corporation, Dabur India Ltd, Shogun Organics, Reckitt Benckiser Group PLC, Amplecta AB, S.C. Johnson & Son Inc. |

Analyst Review

According to the insights of the CXOs of leading companies, the increase in awareness of health and hygiene, coupled with the rise in urban population, fuels the demand for effective household insecticides. The rise in vector-borne diseases and concerns about the transmission of illnesses such as dengue and malaria increase the need for preventive measures, propelling the market. In addition, advancements in technology have led to the development of efficient and user-friendly insecticide products, further boosting consumer adoption.

However, stringent regulations and an increase in environmental concerns associated with the use of chemical-based insecticides pose challenges to market players. The push towards eco-friendly and sustainable alternatives places pressure on manufacturers to innovate and adapt to changing consumer preferences. Economic factors, such as fluctuations in disposable income and purchasing power, also impact market growth, especially in emerging economies where affordability plays a crucial role in product adoption.

The CXOs further added that the ongoing urbanization trend, coupled with a rising middle-class population, creates a conducive environment for market expansion. Product diversification, with a focus on natural and bio-based formulations, provides a strategic avenue for companies to differentiate themselves and tap into the growing demand for eco-friendly solutions. Furthermore, increasing investments in marketing and promotional activities, along with strategic collaborations, offer lucrative opportunities for market players to strengthen their market presence.

The household insecticides market attained $15.2 billion in 2022 and is projected to reach $31.1 billion by 2032, growing at a CAGR of 7.5% from 2023 to 2032.

The household insecticides market is segmented on the basis of product type, composition, application, and region. By product type, the market is divided into sprays, aerosols, coils, electric vaporizers, creams and lotions, baits and traps, powders and granules, and others. By composition, it is categorized into natural and synthetic. By application, it is categorized into mosquitoes, flies, cockroaches, ants, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Household Insecticides Market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Asia-Pacific is the largest regional market for Household Insecticides.

FMC Global Specialty Solutions, S. C. Johnson & Son, Inc., Dabur India Ltd., Neogen Corporation., Spectrum Brands, Inc., Shogun Organics, Amplecta AB, Reckitt Benckiser Group PLC, Jyothy Laboratories Ltd., and Sumitomo Chemical India Ltd. are the top companies to hold the market share in Household Insecticides.

Advancement in insecticide release technologies is the upcoming trend of Household Insecticides Market in the world.

Government initiatives promoting the use of insecticides in households and rise in awareness of health and hygiene are the driving factors of the Household Insecticides Market.

Loading Table Of Content...

Loading Research Methodology...