Housing Finance Market Research, 2031

The global housing finance market size was valued at $4,520.67 billion in 2021, and is projected to reach $33,298.79 billion by 2031, growing at a CAGR of 22.3% from 2022 to 2031.

Housing finance is a type of lending service that offers money to purchase new properties such as land or home to end user. It helps individuals and businesses to purchase housing properties without giving entire buying price upfront. The borrower repays the loan amount and interest up to specified number of years. In addition, increase in adoption of housing finance services among businesses and individuals for several purposes such as purchasing new lands, buying new homes, and constructing new buildings propels growth of the market globally. Furthermore, several leading financial service providers such as Wells Fargo & Company across the U.S. have started housing finance comparing platform to offer affordable lending services to businesses, which drives the growth of housing finance market.

Rise in need to streamline housing lending service and increase in need for money among businesses and individuals to purchase housing boost the growth of the housing finance market. In addition, flexible period to repay the finance amount positively impacts the growth of the market. However, factors such as enforcement of strong rules by banks and financial institutions for providing finance is expected to hamper the market growth. On the contrary, rising prices of housing properties in developing countries and penetration of metropolitan cities across the globe are expected to offer remunerative global housing finance market opportunity during the forecast period.

The housing finance market is segmented on the basis of application, provider, and region. By application, it is segmented into home purchase, refinance, home improvement, and other purpose. The home purchase segment is further sub segmented into conventional and non-conventional. The conventional sub segment is further divided into low & moderate income (LMI) borrowers, and high income borrowers. By provider, it is bifurcated into banks, housing finance companies, real estate agents, and others. By region, it is analyzed across North America, Europe, Asia-Pacific and LAMEA.

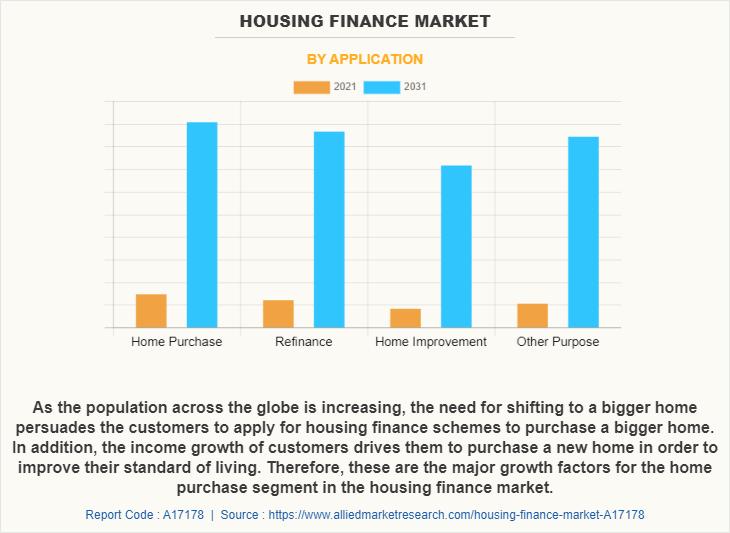

Based on application, the home purchase segment attained the highest growth in 2021. This is attributed to the need to shift to a bigger home as the family member increase in size propels customers to apply for housing finance for purchasing new homes. In addition, the improvement in the standard of living of consumers is a major factor for the growth of housing finance industry, since customers want to live in a good society and they are not satisfied with the amenities of their present homes, for which they decide to purchase new home by taking housing finance.

Based on region, North America attained the highest growth in 2021. This is attributed to increase in adoption of digital lending platforms among banking and financial services for improving financing services is considered as an important factor for growth of the market in this segment. In addition, rise in adoption of advance technologies such as e-signatures, artificial intelligence (AI), machine learning, and advanced analytics among house financing service companies for identifying fraudulent activities in lending service propels growth of the market in North America.

The report focuses on growth prospects, restraints, and trends of the housing finance market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the housing finance industry.

The report analyzes the profiles of key players operating in the housing finance market such as Bank of America Corporation, Charles Schwab & Co., Citigroup, Inc., CREDIT SUISSE GROUP AG, Dewan Housing Finance Corporation Ltd., Goldman Sachs, HSBC Group, JPMorgan Chase & Co., LIC Housing Finance Ltd., Lloyd's Banking Group, Morgan Stanley, Royal Bank of Canada, Royal Bank of Scotland plc., UBS, Wells Fargo, Divvy Homes, Inc., and Pronto Housing. These players have adopted various strategies to increase their market penetration and strengthen their position in the housing finance market.

COVID-19 impact analysis

The housing finance market witnessed significant growth in past few years. However, due to the outbreak of the COVID-19 pandemic, the market witnessed a sudden decline in 2020. This is attributed due to implementation of lockdown by governments in majority of the countries and shut down the businesses across the globe which led to huge job loss and unemployment all over the globe. Therefore, people were not able to fulfil their daily needs, as they were quarantined and the source of their income was stopped. Thus, most of the tenants were forced to move to their hometown or to a rural area, as they were not able to pay their rent due to unemployment. Therefore, making it difficult for the property owners to repay their loans. In addition, no one was ready to opt for home loans, home mortgages and other services related to housing finance market overview. Therefore, the demand for housing finance services fell during the COVID-19.

Top impacting factors

Streamlined house financing services

Leading housing finance providers such as Bank of America Corporation, Wells Fargo and U.S. Bank have been offering hassle free property finance services, which accelerates growth of the market across the globe. In addition, increase in adoption of digital lending technology among banks to improve loan distribution services is considered as an important factor for growth of the market. Moreover, increase in adoption of artificial intelligence and machine learning technology among banks as it offers several benefits such as immediately calculating optimum loan repay time-based on relevant user risk factors drives growth of the market. Furthermore, housing finance companies have been using analytical technologies to monitor finance applications in week, month, quarter, and year and to allocate suitable supporting resources to provide accommodations seasonal demands. This all factors are contributing to streamline the house financing services, which propels the growth of the market across the globe.

Enforcement of strong rules by banks and financial institutions for providing housing finance

Several banks and financial service providers have been imposing strong regulations to offer housing finance services, which restricts growth of the market across the globe. Housing finance providers have been demanding several documents to deliver lending services, which includes owner’s bank account statement, credit score document, historical information of property, and no criminal cases document. Furthermore, banks have been selling customer mortgage property while loans are not repaid from users, which hampers housing finance market growth.

Key benefits for stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the housing finance market analysis from 2021 to 2031 to identify the prevailing housing finance market opportunities.

- In-depth analysis of the housing finance market share assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global housing finance market forecast.

- The report includes the analysis of the regional as well as global housing finance market trends, key players, market segments, application areas, and market growth strategies.

Housing Finance Market Report Highlights

| Aspects | Details |

| By Application |

|

| By Providers |

|

| By Region |

|

| Key Market Players | LIC Housing Finance Limited, CREDIT SUISSE, Royal Bank of Canada, Lloyd's Banking Group, UBS, Charles Schwab & Co., HSBC Group, Dewan Housing Finance Corporation Limited, Wells Fargo, Citigroup, Inc., Goldman Sachs, JPMorgan Chase & Co., Bank of America Corporation, The Royal Bank of Scotland Plc, Morgan Stanley |

Analyst Review

The adoption of housing finance has increased over the years, owing to rise in costs of real estates and growth in need of buying properties among general public. Moreover, with low interest rates of housing finance, the burden is minimized to minimum, which allows borrowers to repay at their pace. In addition, with growing economy, mindset of people is changing regarding owning a property either for investments or for living, which drives growth of the market. Moreover, companies are innovating solution to expand their services to all sectors of the society from low earners to high earners. For instance, in May 2021, Bank of America and the Neighborhood Assistance Corporation of America (NACA) partnered to expand their national affordable home ownership mortgage program, with a goal of providing $15 billion in mortgages to low-to-moderate income (LMI) homebuyers. This partnership also helps to build wealth for those historically locked out of affordable home ownership, thus reducing racial disparity gap. In addition, it enables the Bank of America to provide more housing finance to families at time of substantial needs, which drives growth of the market. Furthermore, companies are partnering and collaborating with each other to make it easier for borrowers during the COVID-19 pandemic. For instance, in January 2021, JPMorgan Chase & Co. funded $686 million in the UK house finance originated by London-based fintech LendInvest Ltd. to finance properties that will be leased, known as buy-to-let loans. Some of the key players profiled in the report include Bank of America Corporation, Charles Schwab & Co., Citigroup, Inc., CREDIT SUISSE GROUP AG, Dewan Housing Finance Corporation Ltd., Goldman Sachs, HSBC Group, JPMorgan Chase & Co., LIC Housing Finance Ltd., Lloyd's Banking Group, Morgan Stanley, Royal Bank of Canada, Royal Bank of Scotland plc., UBS, Wells Fargo, Divvy Homes, Inc., and Pronto Housing. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Rise in need to streamline housing lending service and increase in need for money among businesses and individuals to housing finance are some of the major trends in the housing finance market.

Based on application, the home purchase segment attained the highest growth in 2021. This is attributed to the need to shift to a bigger home as the family member increase in size propels customers to apply for housing finance for purchasing new homes. In addition, the improvement in the standard of living of consumers is a major factor for the growth of housing finance industry, since customers want to live in a good society and they are not satisfied with the amenities of their present homes, for which they decide to purchase new home by taking housing finance.

Based on region, North America attained the highest growth in 2021. This is attributed to increase in adoption of digital lending platforms among banking and financial services for improving financing services is considered as an important factor for growth of the market in this segment. In addition, rise in adoption of advance technologies such as e-signatures, artificial intelligence (AI), machine learning, and advanced analytics among house financing service companies for identifying fraudulent activities in lending service propels growth of the market in North America.

The global housing finance market size was valued at $4,520.67 billion in 2021, and is projected to reach $ 33,298.79 billion by 2031, growing at a CAGR of 22.3% from 2022 to 2031.

Bank of America Corporation, Charles Schwab & Co., Citigroup, Inc., CREDIT SUISSE GROUP AG, Goldman Sachs, HSBC Group, JPMorgan Chase & Co., UBS, and Wells Fargo hold the major share in housing finance market.

Loading Table Of Content...