Human Recombinant Insulin Market Research, 2033

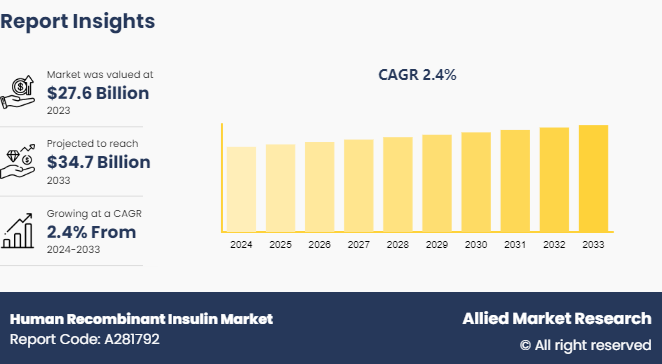

The global human recombinant insulin market size was valued at $27.6 billion in 2023 and is projected to reach $34.7 billion by 2033, growing at a CAGR of 2.4% from 2024 to 2033.

Market Overview

Human recombinant insulin refers to synthetic insulin created using recombinant DNA technology. It involves inserting the gene for human insulin production into bacteria, which then produces insulin identical to that naturally produced in the human body. This method revolutionizes insulin therapy, offering a safer and more reliable alternative to insulin derived from animal sources. Human recombinant insulin significantly reduces the risk of allergic reactions and improves insulin purity and consistency. Since its introduction in the 1980s, it has become the standard treatment for diabetes, providing millions of people worldwide with a life-saving medication to manage their blood sugar levels.

Key Takeaways

- The human recombinant insulin market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major human recombinant insulin industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The rising prevalence of type 1 and type 2 diabetes worldwide has sparked a significant surge in demand for insulin therapies. This growing need has notably boosted the human recombinant insulin market growth. As diabetes cases continue to rise globally, the reliance on insulin treatments becomes more pronounced, highlighting the vital role of recombinant human insulin in managing this chronic condition. With its effectiveness and compatibility, recombinant human insulin emerges as a key factor in addressing the rising health challenge posed by diabetes, offering hope and improved quality of life for millions of individuals affected by this condition.

However, effective patient education and support are essential for proper administration and adherence to insulin therapy. Challenges such as language barriers, health literacy, and cultural factors can impede these efforts, ultimately hindering the growth of human recombinant insulin industry.

Advancements in biotechnology drive the evolution of recombinant human insulin production, promising more efficient methods. These innovations pave the way for substantial expansion in the upcoming years, indicating a new era in insulin production. Improved processes hold the potential to enhance accessibility and affordability, transforming diabetes management worldwide. Thus, would progess human recombinant insulin market forecast positively.

Analysis of Insulin Market

Diabetes is of two primary forms: type 1 and type 2. Type 1, previously known as insulin-dependent or childhood-onset diabetes, arises from inadequate insulin production, necessitating daily insulin administration. Its causes remain elusive, with no known prevention methods. In 2022, approximately 9 million individuals suffered from type 1 diabetes, predominantly in affluent nations. Conversely, type 2 diabetes disrupts sugar (glucose) utilization for energy, leading to higher blood sugar levels if untreated. This variation interferes with insulin's efficacy, posing significant health risks. In 2021, data from the U.S. indicated that 1.7 million adults aged 20 or older had type 1 diabetes, necessitating insulin use, while 3.6 million adults within the same age group commenced insulin treatment within a year of diagnosis. These statistics highlight the pervasive impact and management challenges associated with diabetes across diverse populations.

Market Segmentation

The human recombinant insulin market share is segmented into product type, distribution channel, application, and region. On the basis of product type, the market is divided into long-acting, short-acting, premixed, and intermediate-acting. As per distribution channel, the market is classified into hospital pharmacies, online pharmacies, and retail pharmacies. By application, the market is divided on the basis of type I diabetes and type II diabetes. Region wise, the human recombinant insulin market share is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

North America is observing high demand for human recombinant insulin, a vital medication for diabetes management. This region's dominance in the distribution and consumption of insulin is driven by several key factors. Primarily, the region features advanced healthcare infrastructure and widespread access to medical services, facilitating the production and distribution of insulin products. Moreover, the high prevalence of diabetes in North America necessitates a significant demand for insulin medications, further providing human recombinant insulin market opportunity. In addition, the region benefits from extensive R&D initiatives, fostering innovation in insulin therapies and enhancing treatment options for patients. Consequently, North America's prominent share in the human recombinant insulin market highlights its major role in addressing the healthcare needs of diabetic populations and driving advancements in diabetes care.

- In April 2023, Eli Lilly and Company introduced its insulin glargine biosimilar, Rezvoglar (insulin glargine-aglr) , in the U.S. market, marking it as the second interchangeable insulin biosimilar accessible to American diabetes patients. Rezvolgar earned approval as the fourth biosimilar to achieve interchangeability status in November 2022, following its original FDA approval in December 2021. This development is significant as insulin glargine products play a crucial role in enhancing glycemic control for both adult and pediatric patients with type 1 diabetes, as well as for adults with type 2 diabetes. With its availability, Rezvoglar not only expands treatment options for patients but also potentially offers cost-saving benefits compared to its reference product, contributing to improved access to essential diabetes management medications in the U.S.

Competitive Landscape

The major players operating in the human recombinant insulin market size include Novo Nordisk A/S, Sanofi S.A., Biocon Limited, Bioton S.A., Wanbang Biopharmaceuticals Co., Ltd., Eli Lilly and Company, Zhuhai United Laboratories Co., Ltd., Julphar Gulf Pharmaceutical Industries, Dongbao Enterprise Group Co., Ltd, Medtronic plc., Gan & Lee Pharmaceuticals, Ltd., and others.

Recent Key Strategies and Developments

- In March 2024, Biocon's strategic divestment trend continues with the recent $150 million deal selling insulin and other brands to Eris. This follows their earlier agreement in November 2023, where Biocon parted with its dermatology and nephrology businesses for $42.38 million. The latest transaction includes Biocon's metabolic, oncology, and critical care products in India. Notably, insulin treatments Basalog and Insugen, the latter being India's first domestically developed recombinant human insulin, are part of the deal. The market responded positively, with Biocon's shares rising by 4.3% and Eris witnessing a 3.1% increase.

- In March 2021, Ipsen Biopharmaceuticals Canada Inc. announced the commercial availability of INCRELEX (mecasermin) in Canada following its approval by Health Canada in December 2020. This therapy is specifically tailored for children and adolescents aged 2 to 18 years diagnosed with severe primary insulin-like growth factor 1 deficiency (SPIGFD) , a condition affecting fewer than five individuals per 10, 000 worldwide. As the first and sole recombinant human IGF-1 therapy endorsed for SPIGFD in Canada, INCRELEX addresses a critical unmet medical need, offering treatment for improved growth outcomes in this ultra-rare patient population.

Industry Trends

- In May 2023, Medtronic plc signed an agreement to acquire EOFlow Co. Ltd., renowned for its EOPatch device, a tubeless, disposable insulin delivery system. This strategic move, along with Medtronic's advanced meal detection technology and continuous glucose monitor (CGM) , signifies a significant step in broadening their diabetes management solutions. By integrating EOFlow's innovative technology with their existing portfolio, Medtronic aims to cater to a wider range of diabetes patients, accommodating various treatment preferences and stages in their journey.

- In March 2023, Eli Lilly and Company announced the price deduction by 70% for popular insulins, bolstering its Insulin Value Program, limiting patient expenses to $35 monthly. This initiative aims to enhance accessibility to Lilly insulin, particularly for Americans facing challenges navigating the healthcare system, ensuring affordability for those in need.

Key Sources Referred

- Centers for Disease Control and Prevention (CDC)

- American Diabetes Association (ADA)

- International Diabetes Federation (IDF)

- Eli Lilly and Company

- Novo Nordisk A/S

- Medtronic plc

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the human recombinant insulin market analysis from 2023 to 2033 to identify the prevailing human recombinant insulin market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the human recombinant insulin market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

Apart form the above mentioned points, the report includes the analysis of the regional as well as global human recombinant insulin market trends, key players, market segments, application areas, and market growth strategies.

Human Recombinant Insulin Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 34.7 Billion |

| Growth Rate | CAGR of 2.4% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Application |

|

| By Product Type |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Dongbao Enterprise Group Co., Ltd., Novo Nordisk A/S, Zhuhai United Laboratories Co. Ltd., Biocon Limited, Bioton S.A., Julphar Gulf Pharmaceutical Industries, Sanofi S.A., Eli Lilly and Company, Medtronic plc., Wanbang Biopharmaceuticals Co., Ltd. |

Advancements in biotechnology drive the evolution of recombinant human insulin production, promising more efficient methods.

The type II diabetes sub-segment is expected to dominate during the forecast years.

North America region to dominate the human recombinant insulin market.

The global human recombinant insulin market was valued at $27.64 billion in 2023.

The major players operating in the human recombinant insulin market include Novo Nordisk A/S, Sanofi S.A., Biocon Limited, Bioton S.A., Wanbang Biopharmaceuticals Co., Ltd., Eli Lilly and Company, Zhuhai United Laboratories Co., Ltd., Julphar Gulf Pharmaceutical Industries, Dongbao Enterprise Group Co., Ltd, and Medtronic plc.

Loading Table Of Content...