Hunting Accessories Market Research, 2032

The global hunting accessories market size was valued at $20.3 billion in 2022, and is projected to reach $43.1 billion by 2032, growing at a CAGR of 7.9% from 2023 to 2032. Hunting accessories refer to various tools, equipment, and gears used by hunters to improve their hunting experience and increase their chances of success. These accessories are designed to provide hunters with practical and functional tools that aid in various aspects of the hunting process.

Hunting optics include binoculars, riflescopes, spotting scopes, and rangefinders. These devices help hunters observe and locate game from a distance, determine the range to their target, and improve accuracy when taking shots. Hunting knives are essential tools for dressing and processing game in the field. They are used for tasks such as field dressing, skinning, and butchering the harvested animals. Field dressing kits often include additional tools like gut hooks, bone saws, and skinning blades.

Hunting has gained popularity as a recreational activity, attracting a larger number of participants. As more individuals engage in hunting, the demand for hunting accessories inherently increases. These accessories enhance the hunting experience by providing practical and functional tools that aid in tracking, concealment, and game calling. Moreover, the interest in outdoor activities, including hunting, has been boosted by the growing outdoor enthusiast culture. This cultural shift has driven the demand for hunting accessories. Furthermore, hunting accessories have benefited from advancements in technology. Manufacturers have developed innovative products that improve the efficiency and effectiveness of hunting. For example, advancements in camouflage patterns and fabrics have led to better concealment options for hunters. In addition, game calls have evolved with improved sound quality and versatility. Technological advancements have made hunting accessories more appealing and useful, attracting both new and experienced hunters.

Hunting activities are often subject to strict regulations imposed by local, regional, or national authorities. Many authorities establish specific hunting seasons to manage wildlife populations and protect endangered species. These seasons may limit the time period during which hunting is allowed further reducing the demand for hunting accessories outside of those designated times. Furthermore, bag limits define the number and type of animals that hunters are permitted to harvest within a specific time period. Moreover, hunting regulations often require hunters to obtain licenses or certifications demonstrating their knowledge of hunting laws, safety practices, and ethical guidelines. These requirements may act as barriers to entry for individuals interested in hunting, potentially reducing the overall demand for hunting accessories. These regulations can present challenges for the hunting accessories market demand in the coming years.

The introduction of technologically advanced hunting accessories has created a surge in demand among hunters. These products offer enhanced performance, increased precision, and improved functionality, attracting hunters who seek the latest tools to enhance their skills and success rates. Moreover, rangefinders and GPS tracking devices have revolutionized hunting by providing precise measurements of distances and accurate navigation. Hunters can now determine the exact distance to their targets and track their positions effectively, resulting in more successful hunts. Moreover, trail cameras have become a popular accessory among hunters. These cameras capture images and videos of wildlife in specific areas, allowing hunters to monitor game patterns, behavior, and movement. This technology assists hunters in selecting optimal hunting locations and strategies.

Moreover, game calls have evolved with technological advancements, offering improved sound quality and versatility. Hunters can mimic various animal sounds and attract game more effectively. These advanced game calls contribute to increased hunting success rates. Furthermore, with the advent of e-commerce, manufacturers and retailers have a wider reach to target hunting enthusiasts worldwide. Online platforms provide a convenient avenue for customers to explore and purchase hunting accessories, contributing to the growth of the market.

The key players profiled in this report include American Outdoor Brands Corp., Sturm Ruger and Co. Inc., Beretta Holding SA, Dick’s Sporting Goods, Inc., BPS Direct LLC, SPYPOINT, Buck Knives, Inc., Vista Outdoor Inc., Under Armour, Inc., and Spyderco, Inc. Investment and agreement are common strategies followed by major market players. For instance, in July 2020, FORLOH, a new direct-to-consumer hunting, fishing, and outdoor brand, launched premium technical apparel with superior technology. In addition to unveiling FORLOH.com, the brand’s flagship retail store opened in Whitefish, Montana, the same city as its headquarters.

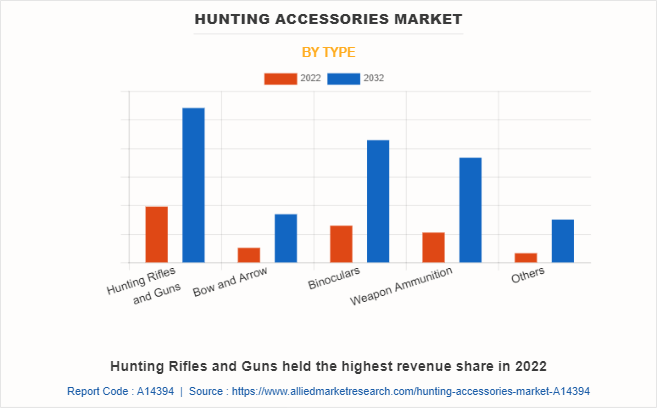

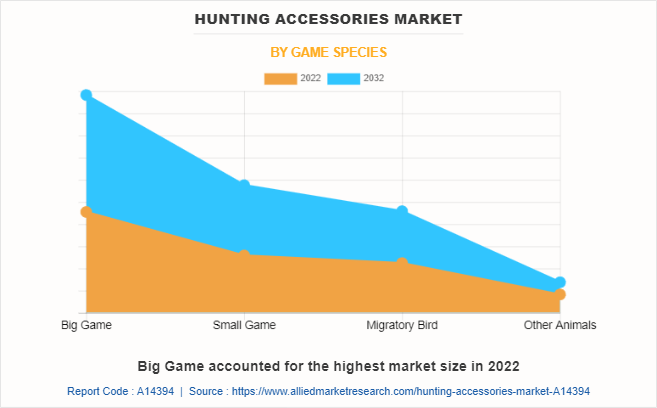

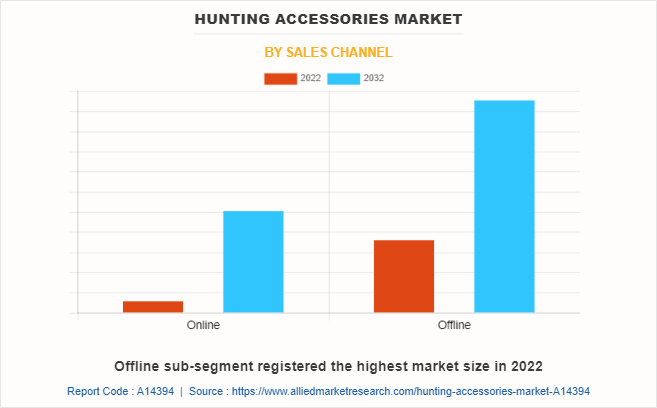

The hunting accessories market is segmented on the basis of type, game species, sales channel, and region. By type, the market is divided into hunting rifles & guns, bow & arrow, binoculars, weapon ammunition, and others. By game species, the market is classified into big game, small game, migratory bird, and others. By sales channel, the market is classified into online and offline. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The hunting accessories market is segmented into Type, Game Species and Sales Channel.

By type, the hunting rifles & guns sub-segment dominated the hunting accessories market in 2022. The hunting rifle and gun industry has seen advancements in technology, leading to the development of more accurate, reliable, and efficient firearms. Manufacturers are introducing innovative features such as improved scopes, adjustable triggers, and lightweight materials, which attract hunters seeking better performance and enhanced shooting experiences. Moreover, the regulations surrounding hunting and firearm ownership impact the demand for hunting rifles and guns. Laws and regulations that permit hunting activities create a market for hunting firearms. The ease of obtaining licenses, permits, and certifications also plays a key role in the growth of the segment.

By game species, the big game sub-segment dominated the global hunting accessories market share in 2022. Big game hunting, which involves pursuing large and often challenging species such as deer, elk, moose, bears, and big cats, has gained significant popularity among hunting enthusiasts. The thrill and excitement associated with big game hunting is boosting the demand for specialized hunting accessories. As more individuals take up hunting as a recreational activity or a way to source sustainable, organic meat, the demand for hunting accessories, including those specifically designed for big game hunting, increases. Furthermore, big game hunting is often associated with outdoor recreation and adventure tourism. Many individuals, including tourists, seek unique and thrilling experiences in natural environments. This trend drives the demand for hunting accessories in destinations known for big game hunting, benefiting the segment.

By sales channel, the offline sub-segment dominated the global hunting accessories market in 2022. Offline retail stores offer a personalized customer experience that allows hunters to physically examine and try out products before making a purchase. This hands-on experience provides customers with a sense of confidence and satisfaction, particularly when it comes to specialized hunting equipment. Moreover, the offline segment allows customers to physically handle, test, and try out hunting accessories. This is especially relevant for products that require a practical demonstration or fitting, such as firearms, ammunition, clothing, boots, or tree stands. Trying out products before purchasing ensures customers make informed decisions and select the best-suited items for their needs.

By region, North America dominated the global market in 2022. North America has a relatively high disposable income level, which allows individuals to invest in leisure activities. Higher disposable income leads to hunters have more purchasing power to buy high-quality and specialized hunting gear, boosting market growth. Moreover, hunting is a popular recreational activity in North America, with a significant number of enthusiasts participating in various hunting activities. This creates a consistent demand for hunting accessories such as firearms, ammunition, blinds, game calls, and clothing. The rise of e-commerce and online retail channels has made hunting accessories more accessible to consumers in the region. Online platforms provide a convenient way for hunters to explore a wide range of products, compare prices, read reviews, and make purchases. The ease of online shopping contributes to the growth of the hunting accessories market in North America.

Impact of COVID-19 on the Global Hunting Accessories Industry

- The COVID-19 pandemic has had a significant impact on the hunting accessories market. The pandemic caused disruptions in global supply chains due to lockdown measures, travel restrictions, and temporary closures of manufacturing facilities. This disruption affected the production and distribution of hunting accessories, leading to potential shortages or delays in product availability.

- The COVID-19 pandemic resulted in economic uncertainties and changes in consumer behavior. With restrictions on travel and outdoor activities, there has been a decline in hunting participation, leading to a reduced demand for hunting accessories. Many hunting seasons and events were canceled or postponed during the pandemic, which further impacted the demand for related equipment.

- During the pandemic, there has been a growing interest in outdoor activities and recreational pursuits that allow for social distancing. This led to a shift in consumer preferences towards hunting accessories that cater to individual or small-group activities, such as hunting blinds, trail cameras, or portable hunting gear.

- With physical retail stores facing restrictions and consumers opting for online shopping, the hunting accessories market, like many other sectors, witnessed a surge in online sales. E-commerce platforms and direct-to-consumer channels have become increasingly important for businesses to reach their customers and compensate for the decline in traditional retail.

- The COVID-19 pandemic resulted in various regulatory measures, including changes in hunting seasons, licensing, and restrictions on hunting activities in certain regions. These regulations had an impact on the overall hunting industry, which in turn affected the demand and sales of hunting accessories.

Key Benefits For Stakeholders

- The report provides exclusive and comprehensive analysis of the global hunting accessories market trends along with the hunting accessories market forecast.

- The report elucidates the hunting accessories market opportunities along with key drivers, and restraints of the market. It is a compilation of detailed information, inputs from industry participants and industry experts across the value chain, and quantitative and qualitative assessment by industry analysts.

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the market for strategy building.

- The report entailing the hunting accessories market analysis maps the qualitative sway of various industry factors on market segments as well as geographies.

- The data in this report aims on hunting accessories market statistics by studying the market dynamics, trends, and developments affecting the hunting accessories market growth.

Hunting Accessories Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 43.1 billion |

| Growth Rate | CAGR of 7.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 290 |

| By Type |

|

| By Game Species |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | Sturm, Ruger & Co., Inc., Vista Outdoor Inc., SPYPOINT, Beretta Holding S.A., BPS Direct LLC, Spyderco, Inc., Buck Knives, Inc., Under Armour, Inc., AMERICAN OUTDOOR BRANDS INC., DICK's Sporting Goods |

The growing popularity of hunting as a recreational activity and sport is a significant driver for the hunting accessories market growth. As more people engage in hunting, the demand for hunting accessories such as firearms, ammunition, optics, clothing, and footwear increases, which is estimated to generate excellent opportunities in the hunting accessories.

The major growth strategies adopted by hunting accessories market players are investment and agreement.

Europe is projected to provide more business opportunities for the global hunting accessories market in the future.

American Outdoor Brands Corp., Sturm Ruger and Co. Inc., Beretta Holding SA, Dick’s Sporting Goods, Inc., BPS Direct LLC, SPYPOINT, Buck Knives, Inc., Vista Outdoor Inc., Under Armour, Inc., and Spyderco, Inc. are the major players in the hunting accessories market.

The big game sub-segment of the game species acquired the maximum share of the global hunting accessories market in 2022.

The market for hunting is often associated with wildlife conservation efforts, as regulated hunting can help maintain balanced ecosystems and control wildlife populations. Many hunters actively participate in conservation programs, which drives the demand for hunting accessories that support ethical and sustainable hunting practices, which is estimated to drive the adoption of hunting accessories.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global hunting accessories market from 2022 to 2032 to determine the prevailing opportunities.

The hunting accessories market has benefited from technological advancements in recent years. Improved firearms, optics, rangefinders, trail cameras, and other innovative hunting gear have enhanced the hunting experience and attracted avid hunters who seek advanced equipment which is anticipated to boost the hunting accessories market in the upcoming years.

Loading Table Of Content...

Loading Research Methodology...