Hvac Actuators Market Research, 2031

The Global HVAC Actuators Market Size was valued at $3.9 billion in 2021, and is projected to reach $6.2 billion by 2031, growing at a CAGR of 4.6% from 2022 to 2031.The dampers are managed by actuators in HVAC chillers. The actuator positions the damper anywhere between fully open and fully closed by using a low-voltage signal. Zone dampers are a crucial component of an HVAC system, and without suitable actuators, the dampers won't operate at all.

Market Dynamics

Increase in commercial construction activities has led to a surge in demand for heating and cooling equipment in various industries, which is anticipated to boost the demand for HVAC actuators. For instance, the commercial construction industry in India is expected to witness growth by nearly 4.0% from 2016 to 2022. All such instances are anticipated to contribute toward the growth of the HVAC actuators market. Moreover, rise in population and per capita income is creating demand for appliances such as heaters and air conditioners is driving the demand for HVAC actuators for such equipment. In addition, urban population is growing rapidly. As per the estimates and forecasts of the WHO, the global urban population is expected to grow by approximately 1.84% every year until 2020, which is at the rate of around 1.63% per annum from 2020 to 2025, and around 1.44% per annum from 2025 to 2030.

Rapid penetration of HVAC system has been witnessed in building automation systems (BASs), which acts as one of the critical factors driving the overall HVAC actuators market growth. In addition, the adoption of BASs is increasing considerably, owing to advancements in wireless sensor network technology and wireless protocols. Moreover, rise in need for the deployment of BASs in office buildings and large shopping complexes to improve the productivity of management systems augments the growth of the market, globally.HVAC system in industries is one of the most complex systems.

The existing HVAC systems are incorporated with a wide range of equipment such as actuators and sensors that monitor and control temperature, airflow, and other parameters. These HVAC systems are sensitive to electrical issues, thermal sensation, and cooling sensation. Each facility project in which HVAC has been installed is distinctive and unique. Thus, upgradation of the existing HVAC systems is a complex process and requires a clearly defined plan, which hampers the HVAC actuators industry growth.

The demand for HVAC actuators decreased in 2020, owing to low demand from different regions due to lockdown imposed by the government of many countries. The COVID-19 pandemic has shutdown production of HVAC actuators for the end-user, mainly owing to prolonged lockdowns in major global countries. This has hampered the growth of the HVAC actuators market significantly during the pandemic. The major demand for HVAC actuators was previously noticed from giant manufacturing countries including China, U.S., Germany, Italy, and the UK which was badly affected by the spread of coronavirus, thereby halting demand for HVAC actuators. This is expected to lead to re-initiation of manufacturing industry at their full-scale capacities, which is likely to help the HVAC actuators market to recover by end of 2022.

Air conditioning is one of the major expenses for the residential and nonresidential building management. To control these expenses and ensure efficient functioning of HVAC, end users are turning to cloud computing in HVAC. The demand for cloud computing in HVAC is increasing significantly, owing to factors such as scalability, flexibility, and enhanced collaboration. This indirectly increases the demand for upgraded HVAC systems and drives the demand for HVAC actuators in the market. These electronics provide high efficiency to HVAC system.

Moreover, many companies are focusing on the development of cloud computing in HVAC to sustain their business and increase their customer base across the globe. Thus, all these factors collectively are anticipated to provide remunerative opportunities for the expansion of the global HVAC actuators market during the forecast period.

The HVAC actuators market is segmented on the basis of type, technology, application, and region. By type, the market is divided into spring return HVAC actuator, and non-spring return HVAC actuator. By technology, the market is divided into smart and conventional. By application, the market is segmented into commercial building, industrial facilities, and public utilities. Region-wise, the HVAC actuators market analysis is conducted across North America (the U.S., Canada, and Mexico), Europe (the UK, France, Germany, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

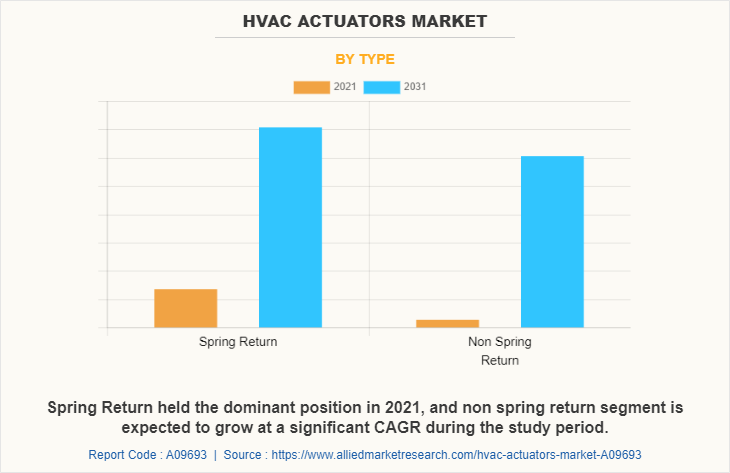

By Type:

The HVAC actuators market is categorized into spring return HVAC actuator, and non-spring return HVAC actuator. Spring return actuator uses spring force to generate power. To push or pull the piston, air or liquid is spread in one direction. The valve's ability to open or close is determined by this action. And innovative self-centering shaft adapter used in non-spring return actuators, which concentrically retains the damper shaft without slippage or callbacks, or the single point centered connection used in lesser torque actuators, both contribute to the non-spring return actuators' energy efficiency. Spring return HVAC actuator is expected to exhibit the largest revenue contributor during the forecast period. Non-spring return HVAC actuator is expected to exhibit the highest CAGR share in the type segment in the HVAC actuators market during the forecast period.

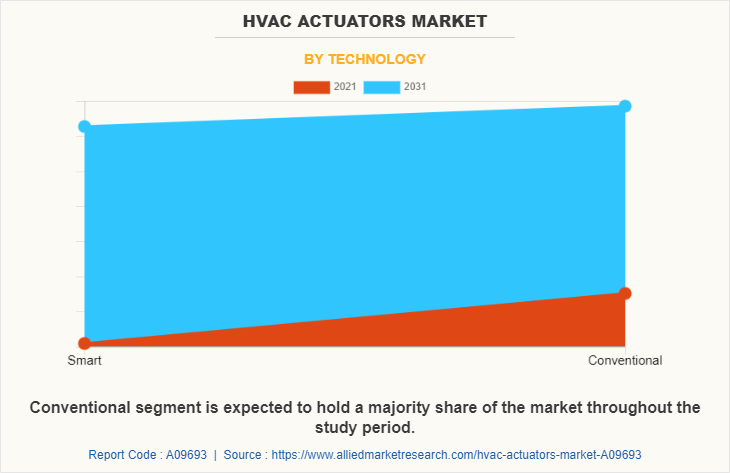

By Technology:

The HVAC actuators market is classified into smart, and conventional. Smart actuators are integrated devices that can provide actuation and damping capabilities in response to one or more external inputs. They are made of smart and artificial materials (such as light, heat, magnetism, electricity, humidity, and chemical reactions). And conventional actuators use hydraulic, pneumatic, and electric motors for an input power. In hydraulic and pneumatic actuator they use fluid to create mechanical motion whereas the electric motor converts electrical energy into mechanical energy. Conventional segment is expected to exhibit largest revenue during forecast period, and smart segment expected to exhibit highest CAGR share in technology segment in HVAC actuators market during forecast period.

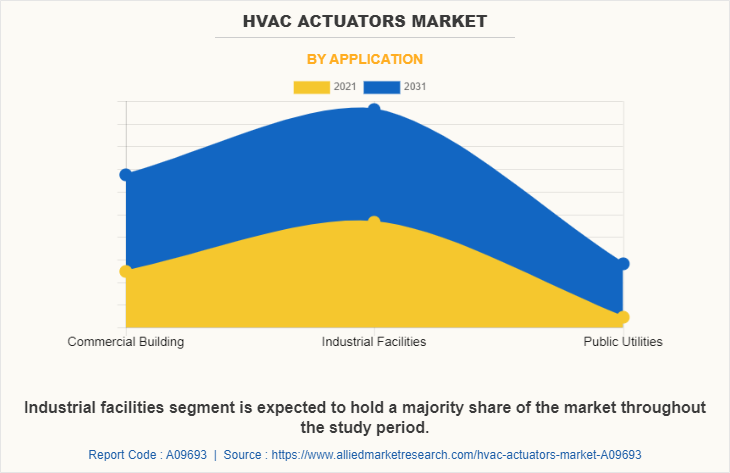

By Application:

The HVAC actuators market is divided into a commercial building, industrial facilities, and public utilities. The commercial segment includes the use of HVAC actuators for resorts, multiplex, IT parks, and other commercial buildings. Moreover, industrial HVAC actuators and systems are used in manufacturing and food & beverage industries to operate, control, and monitor temperature, humidity, and other key parameters. And public utility is an entity that provides goods or services to the general public. Public utilities may include common carriers as well as corporations that provide electric, gas, water, heat, and television cable systems.

Industrial facilities is expected to exhibit the largest revenue share in the application segment in the HVAC actuators market during the forecast period. the commercial building segment is expected to exhibit the largest CAGR during the forecast period.

By Region:

The HVAC actuators market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, Asia-Pacific had the highest revenue in HVAC actuators market share. And LAMEA is expected to exhibit the highest CAGR during the forecast period.

COMPETITION ANALYSIS

The major players profiled in the HVAC actuators market include Continental AG, Denso Corporation, Dwyer Instruments Inc, Electro Craft Inc., Honeywell International Inc., Johnson Controls International plc., Robert Bosch GmbH, Rotork Plc., Schneider Electric SE, Siemens AG.

Major companies in the market have adopted product launch, acquisition and partnership as their key developmental strategies to offer better products and services to customers in the HVAC actuators market.

Some examples of acquisition and partnership in the market

In December 2021, Dwyer Instruments portfolio company of Arcline Investment Management has acquired the Universal Flow Monitors, Inc. a leader in the design, development, and manufacture of flow meters and controls in industrial applications. by means of this acquisition expand the portfolio of HVAC system.

In April 2021, Arkamys and Continental has colloborated to develop automotive audio solutions where Continental sound actuators were installed in a demonstration vehicle originally equipped with conventional commodity speakers. Arkamys combined its sound enhancement software with various loudspeaker and actuator configurations. The demo car features various sound reproduction systems, and manufacturer-friendly perks, like scalability, space and weight savings, reduced components, and concealed integration.

In July 2021, Audax Private Equity has collobrated to Partners Group to sell Reedy Industries, commercial heating, ventilation, and air conditioning (HVAC).

In June 2021, Marelli Corporation and Highly International (Hong Kong) Limitedhas colloborated to establish a new joint venture, Highly Marelli Holdings Co. Ltd. This joint venture may focus on creating new solutions for customers and suppliers in the electrification of compressors and heating, ventilation, and air conditioning (HVAC).

In July 2022, Honeywell has collaborated with Archer Aviation Inc. to supply of flight control actuation and thermal management technologies.

In December 2021, Rotork PLC. collaborated with Milano San Rocco Wastewater Treatment Plant (WWTP) to provide Rotork IQ electric modulating actuators.

In May 2021, Continental and Nexteer's has collaborated with CNXMotion expands brake-to-steer technology to enhance safety redundancies. it replaces the mechanical steering connection between the hand wheel and road wheels with algorithms, electronics and actuators.

The product launch and product development in the market

In January 2020, Honeywell has developed new actuator product line for eVTOL market. the actuators will use electricity alone to move primary flight control surfaces, in contrast to the hydraulics, cables, and pushrods found on most conventional aircraft. Specifically designed to meet the vibration, power, and weight profiles of eVTOL aircraft.

In September 2022, MAHLE has developed a smart air-conditioning system to support the fight against fine particulates in vehicle cabins. Its main innovative feature is the integration of fine-particulate sensors directly into the air-conditioning system. As this feature gives the sensors immediate access to both cabin air and external air, the air-conditioning system can react quickly and precisely to the changing pollution levels and use the appropriate cleaning strategy to keep the air in the vehicle clean.

In May 2020, AUMA has launched the high-performance PROFOX actuator series with advanced features. It has built-in intelligence, low operating costs, high mechanical efficiency, compact design. It is suitable for various industries such as combined heat and power plants, process industries, shipbuilding, and water treatment.

In December 2020, Rotork PLC has launched its newly developed AC version of PAX1 linear actuator. This new actuator has the capacity to control the pressure of 0-0.5 psig to 0-3,000 psig.

In January 2021, Curtiss-Wright Corporation has launched its new ASSIGN™ motor program for Exlar FTP and FTX Series actuators. The FTP and FTX series actuator are ideal for a wide range of factory automation applications.

In December 2022, Continental has launched solutions for user experience, automated driving and the Software-defined Vehicle in order to makes driving safer, cleaner, and more comfortable with high-performance computers, vehicle sensors, actuators, and electronic control units. Additionally, they provide smart power distribution and ensure the reliable execution of x-Domain real-time vehicle functions, such as audio, external sound, parking, HVAC or suspension.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the HVAC actuators market overview, segments, current trends, estimations, and dynamics of the HVAC actuators market analysis from 2021 to 2031 to identify the prevailing HVAC actuators market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the HVAC actuators market forecast and segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global HVAC actuators market trends, key players, market segments, application areas, and market growth strategies.

Hvac Actuators Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 6.2 billion |

| Growth Rate | CAGR of 4.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 198 |

| By Type |

|

| By Technology |

|

| By Application |

|

| By Region |

|

| Key Market Players | Rotork Plc., Continental AG, ElectroCraft Inc., Johnson Controls International plc., Siemens AG, Schneider Electric SE, Robert Bosch GmbH, Denso Corporation, Dwyer Instruments Inc, Honeywell International Inc. |

Analyst Review

The global HVAC actuators market witnessed a huge demand in Asia-Pacific followed by Europe. The highest share of the Asia-Pacific market is attributed to increasing demand for HVAC actuators in the commercial and industrial sectors.

Actuators in HVAC systems regulate the dampers. The demand for HVAC actuators for such equipment is being driven by an increase in population and per capita income, which is generating demand for appliances like heaters and air conditioners. Additionally, a rise in the demand for heating and cooling equipment across a number of industries has been brought on by increased commercial development activity, which is predicted to enhance demand for HVAC actuators. Moreover, upgrading current HVAC systems is a difficult procedure that needs a well-thought-out plan, which restrains the growth of the HVAC actuators market. One of the primary expenses for residential and nonresidential building management is air conditioning. End users are turning to cloud computing in HVAC to manage these costs and guarantee the HVAC's effective operation. In addition, several businesses are concentrating on the advancement of cloud computing in HVAC in order to maintain and grow their clientele globally. Therefore, it is predicted that the sum of all these variables would offer lucrative prospects for the growth of the worldwide HVAC actuators market over the forecast period.

The major players profiled in the HVAC actuators market include Continental AG, Denso Corporation, Dwyer Instruments Inc, Electro Craft Inc., Honeywell International Inc., Johnson Controls International plc., Robert Bosch GmbH, Rotork Plc., Schneider Electric SE, Siemens AG

The global HVAC actuators market was valued at $3,919.7 million in 2021, and is projected to reach $6,227.1 million by 2031, registering a CAGR of 4.6% from 2022 to 2031.

The forecast period considered for the global HVAC actuators market is 2022 to 2031, wherein, 2021 is the base year, 2022 is the estimated year, and 2031 is the forecast year.

The latest version of global HVAC actuators market report can be obtained on demand from the website.

The base year considered in the global HVAC actuators market report is 2021.

The major players profiled in the HVAC actuators market include Continental AG, Denso Corporation, Dwyer Instruments Inc, Electro Craft Inc., Honeywell International Inc., Johnson Controls International plc., Robert Bosch GmbH, Rotork Plc., Schneider Electric SE, Siemens AG.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Based on valve type, the spring return HVAC actuator segment dominated the market in 2021.

Loading Table Of Content...