HVAC Cables Market Research, 2033

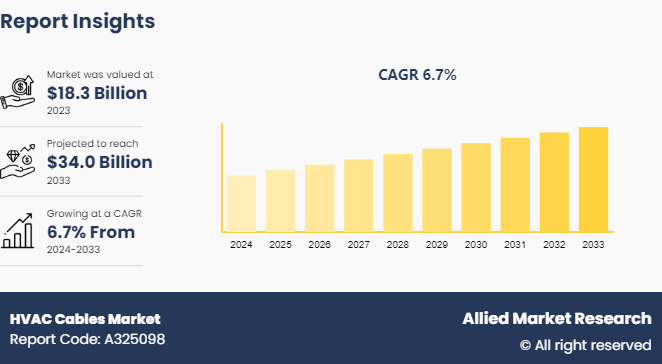

The global HVAC cables market size was valued at $18.3 billion in 2023, and is projected to reach $34.0 billion by 2033, growing at a CAGR of 6.7% from 2024 to 2033.

Market Introduction

HVAC cables are specialized electrical cables designed for use in heating, ventilation, and air conditioning systems. These cables are essential for the reliable operation of HVAC systems, as they transmit electrical power and control signals between various components such as thermostats, compressors, and fans. HVAC cables are engineered to handle high temperatures and resist environmental factors, including moisture and UV radiation, ensuring durability and long-term performance. They typically feature insulated conductors to prevent electrical short circuits and ensure safe and efficient operation of HVAC systems.

Key Takeaways

- The HVAC cables market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major HVAC cables industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The rapid urbanization and increasing concentration of populations in major cities are driving the demand for HVAC cables in the market. As urban areas expand due to population growth and improved health and medical facilities, there is a significant need for reliable power transmission solutions. The reduction in urban death rates, thanks to advancements in healthcare, sanitation, and infrastructure, further underscores the growing power demands in these regions. Additionally, the expansion of industries and trade within urban centers creates a favorable environment for the deployment of HVAC cables. These cables are essential for ensuring efficient and reliable power distribution in increasingly dense urban environments, where overhead lines are often impractical. Consequently, the HVAC cables market size is experiencing growth driven by the need to support expanding urban infrastructure and industrial developments.

The installation of HVAC cables, especially in underground or underwater environments, involves substantial upfront costs, which can present a significant barrier for many projects and utilities. High expenses are associated with complex and specialized equipment required for installation, as well as the labor and materials needed to ensure proper placement and protection of the cables. These initial costs can be a deterrent for some stakeholders, potentially delaying or limiting the implementation of HVAC cable projects. Despite their benefits, such as enhanced reliability and reduced visual impact, the financial implications of installation are a critical factor that must be carefully considered in the planning and budgeting stages of power transmission projects. These factors are anticipated to restrain the HVAC cables market growth.

HVAC cables are commonly employed as an alternative to overhead transmission lines in situations where overhead lines are unsuitable, such as in densely populated areas, protected zones, or underwater and offshore environments. These cables are typically insulated with cross-linked polyethylene (XLPE) , which has seen significant advancements due to improvements in material science. XLPE offers high dielectric strength, a low dielectric constant, excellent insulation resistance, and strong mechanical properties, making it an ideal choice for underground power transmission. Globally, HVAC cables are utilized for voltage levels up to 550 kV. XLPE insulation provides a key advantage due to its low dielectric loss, which is about one-tenth of that found in paper-insulated cables and approximately one-hundredth of that in PVC-insulated cables. Furthermore, advancements in manufacturing and installation processes have greatly increased the deployment and efficiency of HVAC cables, driving their widespread adoption in various applications.

HVAC Cables Market and Clean Energy Transitions

As the world transitions to cleaner energy sources and seeks to achieve net-zero emissions, the importance of robust and advanced electrical grids is increasingly highlighted. HVAC cables are integral to this transformation, as they provide essential high-voltage transmission capabilities required to support the growing demand for electricity. With the projected need for a 20% increase in global electricity use over the next decade and the necessity to add or refurbish over 80 million kilometers of grid infrastructure by 2040, HVAC cables will play a crucial role.

The expansion of grids is vital to accommodate the surge in electric vehicles, electric heating and cooling systems, and renewable energy sources such as wind and solar power. However, while investments in renewable energy are soaring, investment in grid infrastructure, including HVAC cables, has remained relatively stagnant. This discrepancy highlights the urgent need for increased focus and funding in grid development to avoid bottlenecks and ensure the efficient integration of clean energy technologies.

Investment Discrepancy and Infrastructure Needs for HVAC Cables in the Transition to Clean Energy

Investment Category | Amount |

Current Investment in Grids | $300 billion per year |

Investment Needed to Meet Climate Goals | $500 billion per year (estimate based on required infrastructure expansion) |

Total Investment in Renewable Projects Awaiting Grid Connection | $900 billion (estimate based on 3,000 GW of renewable projects) |

Market Segmentation

The HVAC cables market is segmented into voltage, category, and region. On the basis of voltage, the market is divided into 110 kV-220 kV and above 220 kV. As per category, the market is segregated into overhead, submarine, and underground. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The HVAC cables market share in North America is experiencing robust growth, fueled by several key factors. The increasing demand for reliable and efficient power transmission infrastructure, driven by rapid urbanization and industrial expansion, is a major factor driving the market. As cities and industries expand, the need for HVAC cables to support high-voltage transmission in densely populated areas and across challenging environments, such as underwater and underground, is growing. Additionally, the transition to cleaner energy sources and the integration of renewable energy projects, including solar and wind farms, are boosting the demand for advanced HVAC cables industry share in the region.

On July 10, 2024, LS Cable & System, a South Korea-based manufacturer specializing in offshore wind cables, announced plans to establish a high-voltage direct current (HVDC) subsea cable manufacturing facility in Virginia. The company claims this facility will become the largest of its kind in the United States.

Competitive Landscape

The major players operating in the HVAC cables market forecast include ABB Ltd, BaoSheng, Inc., Furukawa Electric Co. Ltd, KEC International Ltd, LS Cable & System Ltd., Lutze Inc., Nexans S.A., NKT A/S, Prysmian Group, and Quanta Services, Inc. Other players in HVAC cables market include SAB North America, Sumitomo Electric Industries, Ltd, TFKable, and ZTT International Ltd.

Recent Key Strategies and Developments

- In June 2023, LEONI, a global leader in energy and data management solutions for automotive and other sectors, announced the launch of its new LEONI HVAC cable system, specifically developed for e-mobility applications. The cable system incorporates a new type of insulation that provides superior resistance to heat and abrasion, making it ideal for electric vehicles.

- In November 2023, the joint venture between Orsted and New England utility Eversource achieved a significant milestone by installing and testing the first offshore wind export cable made in the US. The 68-mile (110 km) three-phase 138kV high voltage alternating current (HVAC) cable, manufactured by Nexans in South Carolina, was used for the 132MW South Fork array located 55km off Montauk Point, Long Island, highlighting progress in the US supply chain challenges.

Industry Trends

- In April 2023, NKT, a prominent global supplier of power cable solutions, unveiled its latest NKT HVAC cable system tailored for interconnectors. This new cable system boasts an innovative insulation material that enhances resistance to high temperatures, making it particularly suitable for long-distance transmission and a key asset in the energy sector's shift towards renewable sources.

- In May 2023, General Cable, a leading provider of electrical and communications infrastructure solutions, introduced its new General Cable HVAC cable system designed for underground transmission and distribution. This system features advanced insulation that offers greater resistance to heat and moisture, making it well-suited for challenging environments.

Key Sources Referred

- Prysmian Group

- Nexans S.A.

- General Cable (a subsidiary of Prysmian Group)

- Southwire Company, LLC

- LS Cable & System

- Fujikura Ltd.

- Sumitomo Electric Industries, Ltd.

- NKT A/S

- Encore Wire Corporation

- Finolex Cables Ltd.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hvac cables market analysis from 2024 to 2033 to identify the prevailing hvac cables market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the hvac cables market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global hvac cables market trends, key players, market segments, application areas, and market growth strategies.

HVAC Cables Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 34.0 Billion |

| Growth Rate | CAGR of 6.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 320 |

| By Voltage |

|

| By Category |

|

| By Region |

|

| Key Market Players | LS Cable & System Ltd., Quanta Services, Inc., Prysmian Group, BaoSheng,Inc., Furukawa Electric Co. Ltd, KEC International Ltd., lutze inc., NEXANS S.A., NKT A/S, ABB Ltd |

The global HVAC cables market is trending towards advanced materials, increased efficiency, and integration with renewable energy and smart grid systems.

The leading end use of the HVAC cables market is in the construction and infrastructure sector for power distribution and control systems.

Asia-Pacific is the largest regional market for HVAC cables market.

The HVAC Cables Market is estimated to reach $34.0 billion by 2033, exhibiting a CAGR of 6.7% from 2024 to 2033.

The major players operating in the HVAC cables market include ABB Ltd, BaoSheng,Inc., Furukawa Electric Co. Ltd, KEC International Ltd, LS Cable & System Ltd., Lutze Inc., Nexans S.A., NKT A/S, Prysmian Group, and Quanta Services, Inc.

Loading Table Of Content...