HVAC Chillers Market Research, 2031

The global hvac chillers market size was valued at $9.5 billion in 2021, and is projected to reach $15 billion by 2031, growing at a CAGR of 4.5% from 2022 to 2031.

HVAC chillers are refrigeration systems that provide cooling for industrial and commercial applications. These use water, oils or other fluids as refrigerants. They play a crucial role in maintaining the required temperature of any room, machine or device. These chillers can be used in a wide range of living spaces, such as small to large rooms, garages, basement and crawl spaces. There has been a rise in popularity of HVAC chillers due to various advantages such as portability, convenience, and quick and easy maintenance.

The increase in demand for district cooling systems in many industries and high-rise buildings is expected to boost the HVAC chillers market growth during the forecast period. District cooling is also known as centralized generation and distribution of cooling energy, replaces traditional air-cooling systems as it is less expensive and more energy efficient. Moreover, developments in the tourism industry boosts the construction of hotels and public infrastructure where HVAC chillers can be used on a large scale. In addition, the growth of skyscrapers is expected to fuel the growth of HVAC chillers market opportunity as these chillers are widely used in cooling and ventilation of skyscrapers.

An increase in government spending on construction building activities, requires more chillers for temperature control. This, in turn, is anticipated to be opportunistic for the growth of the HVAC chillers market. Rapid increase in urbanization and surge in disposable income of people are the factors anticipated to fuel the growth of the global HVAC chiller market. Moreover, surge in industrial and residential construction activities with government initiatives such as “National Infrastructure Program”, and “Nation Program on Strategies for Sustainable Smart Cities”, and others, are expected to drive the growth of the market during the forecast period.

Major players have adopted various strategies such as product launch and acquisition to sustain the competition and improve the operation portfolio. For instance, in March 2022, Carrier Global launched Aqua Force Vision 30KAV with puretec refrigerant. It is a compact process cooling chiller range with ultra-low global warming potential (GWP) refrigerant R-1234ze. It is ideal for industrial processing such as food manufacturing, pharmaceuticals, chemicals, plastics, metal industries and applications requiring ultra-reliable cooling up to -12° C.

Segment Review

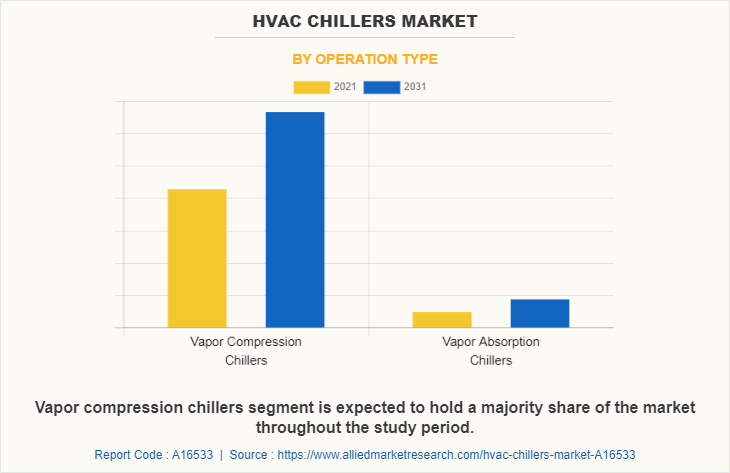

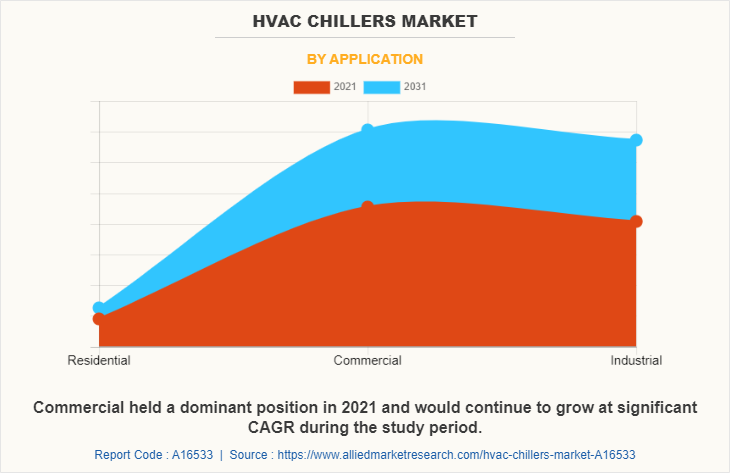

The hvac chillers market is segmented into Operation Type, Condenser Type and Application.On the basis of operation type, the market is bifurcated into vapor compression chillers and vapor absorption chillers. On the basis of condenser type, the market is divided into water cooled, air cooled and evaporative. On the basis of application, the market is classified into residential, commercial and industrial. On the basis of region, the global market analysis is conducted across North America (the U.S., Canada, and Mexico), Europe (UK, France, Germany, Italy, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Indonesia, Thailand, Taiwan and Rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

On the basis of operation type, the vapor compression chillers segment generated the highest revenue in 2021, due to increase in demand for district cooling systems in many industries.

On the basis of application, the commercial segment accounted for the highest revenue in the global market in 2021 owing to rise in construction-related activities of new buildings.

On the basis of region, Asia-Pacific registered highest market share in the global HVAC chillers market share in 2021, owing to strong economic growth, rapid urbanization, and presence of large population base.

Competitive Analysis

The key players that operate in the HVAC chillers market are Ab Electrolux, Airedale International Air Conditioning Ltd., Carrier Global Corporation, Daikin Industries Ltd., Honeywell International Inc., Johnson Controls International Plc, Shuangliang Eco-Energy Co.Ltd., Kaltra, LG Electronics Inc., Mitsubishi Electric Corp., Panasonic Corp., PolyScience, Samsung Electronics Co. Ltd., Siemens AG, SKM Air Conditioning, Trane Technologies Plc, Thermal Care, Inc.

Key Benefits For Stakeholders

- The report provides an extensive analysis of the current and emerging global HVAC chillers market trends and dynamics.

- In-depth global HVAC chillers market analysis is conducted by constructing market estimations for key market segments between 2022 and 2031.

- Extensive analysis of HVAC chillers market is conducted by following key operation positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- HVAC chillers market forecast analysis from 2022 to 2031 is included in the report.

- The key players with in HVAC chillers market are profiled in this report and their strategies are analysed thoroughly, which help understand the competitive outlook of HVAC chillers industry.

HVAC Chillers Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 15 billion |

| Growth Rate | CAGR of 4.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 232 |

| By Operation Type |

|

| By Condenser Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Trane Technologies Plc, Carrier Global Corporation, AIREDALE INTERNATIONAL AIR CONDITIONING LTD., Kaltra, LG Electronics Inc., Shuangliang Eco-Energy Co.Ltd., PolyScience, Panasonic Corporation, Ab Electrolux, Mitsubishi Electric Corp., Siemens AG, Samsung Electronics Co. Ltd., Thermal Care Inc., Honeywell International Inc., Daikin Industries Ltd., SKM Air Conditioning, Johnson Controls International plc |

Analyst Review

The HVAC chillers market witnesses huge demand in North America, Asia-Pacific, and Europe. Asia-Pacific is projected to register significant growth in near future, owing to strong economic growth, rapid urbanization, and presence of large population base. Furthermore, the majority of countries in the region spend on construction sector for the growth of their economies. The vapor compression chillers segment generated the highest revenue in 2021, due to increase in demand for district cooling systems in many industries.

Various market players have adopted strategies, such as product launch, business expansion, acquisition, and agreement to expand its business and strengthen its market position. For instance, in May 2022, Carrier launched the innovative Aqua Edge 19MV oil-free water-cooled centrifugal chiller designed to deliver reliable performance, incredible efficiency, easy installation and a wide operating range. This launch will add enrichment to its product line. As a result, such strategic moves are expected to provide lucrative growth opportunities in the global HVAC chillers market during the forecast period.

Increase in demand for district cooling systems in many industries and high-rise buildings are the upcoming trends of HVAC Chillers Market in the world.

Commercial is the leading application of HVAC Chillers Market.

Asia-Pacific is the largest regional market for HVAC Chillers.

The global HVAC chillers market size was valued at $9,512.9 million in 2021.

Ab Electrolux, Airedale International Air Conditioning Ltd., Carrier Global Corporation, Daikin Industries Ltd., Honeywell International Inc., Johnson Controls International Plc, Shuangliang Eco-Energy Co.Ltd., Kaltra, LG Electronics Inc., Mitsubishi Electric Corp., Panasonic Corp., PolyScience, Samsung Electronics Co. Ltd., Siemens AG, SKM Air Conditioning, Trane Technologies Plc, Thermal Care, Inc. are the top companies to hold the market share in HVAC Chillers.

The base year considered in the global HVAC Chillers market report is 2021.

The top 17 market players are selected based on two key attributes- competitive strength and market positioning.

The report contains an exclusive company profile section, where leading 17 companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Loading Table Of Content...