Hybrid Electric Car Market Insights, 2032

The global hybrid electric car market size was valued at USD 229.2 billion in 2022, and is projected to reach USD 489.8 billion by 2032, growing at a CAGR of 7.8% from 2023 to 2032.

Report Key Highlighters:

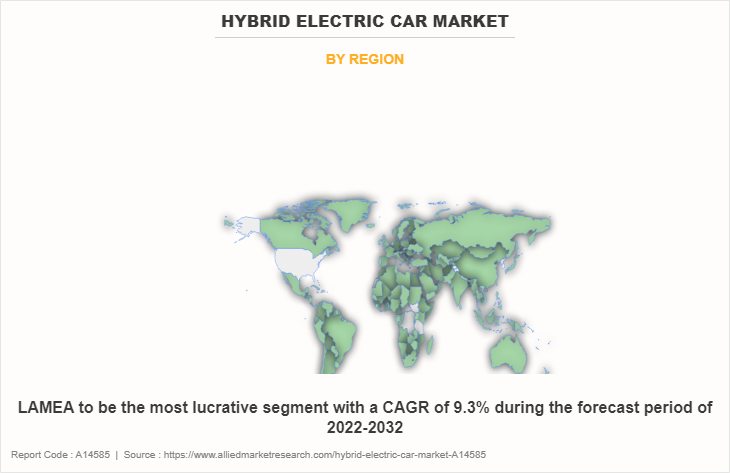

- The hybrid electric car market study covers 16 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- Top companies operating in the industry has been profiled in the research study.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The hybrid electric car market share is highly fragmented, into several players including TOYOTA MOTOR CORPORATION, Honda Motor Co., Ltd, Mercedes-Benz Group AG (Former Daimler AG), BMW AG, Ford Motor Company, Hyundai Motor Company, Volkswagen Group, Kia Corporation, Nissan Motor Co., Ltd., and AB Volvo. The companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

A hybrid electric car comprises an internal combustion engine and one or more electric motors that utilize energy stored in batteries to power the vehicle. A hybrid electric cannot be plugged in to charge the battery like other EVs. In hybrid electric car the battery is charged utilizing engine power and through regenerative braking. The additional power provided by the electric motor helps OEM to reduce the size of engine in their vehicles. The battery utilized in hybrid electric vehicle can also power additional equipment. These features result in better fuel economy without sacrificing performance.

The strengthening of government rules and regulations toward reducing emissions from traditional internal combustion engine vehicles positively drives the consumer demand toward hybrid electric cars. As hybrid electric cars use two fuel sources, they can be switched to drive on electricity in areas where emission norms are stricter. Similarly, the vehicle can be shifted for use as fuel-powered when required.

For instance, in April 2020, India Introduced BS6 norms, which outline a permissible level of pollutants from a vehicle, especially from a vehicle using diesel and petrol as fuel. In addition, the country introduced a vehicle scrapping policy that outlines that older commercial vehicles need to be re-registered after 15 years; if the vehicles are found unfit, they are expected to be scrapped. Rise in such strengthening emissions norms by the government positively affect the demand for hybrid electric cars.

The hybrid electric car market is driven by strengthening emission norms, increase in demand for efficient transportation, and increase in R&D activities. However, increase in trend toward electric vehicles is hindering the market growth. Furthermore, increase in demand for hybrids is expected to create additional revenue-generation opportunities for maintenance and other services, and increase in price of fossil fuel is expected to provide market growth opportunities for the players operating in the market.

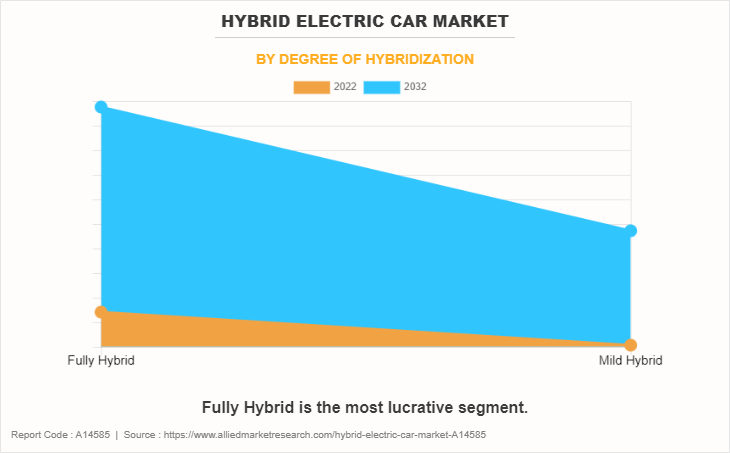

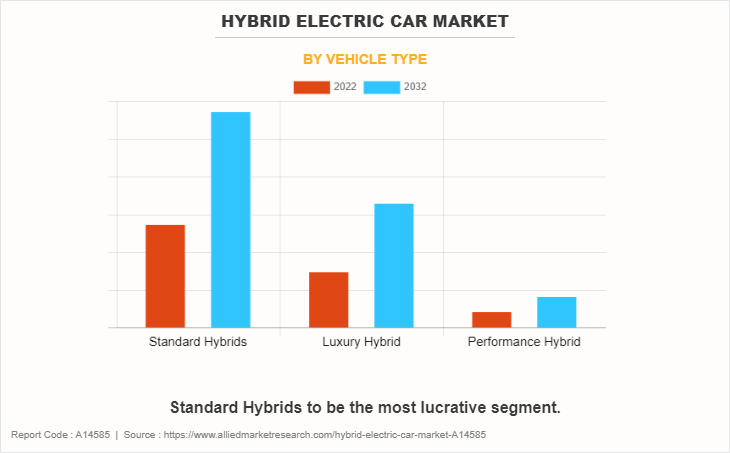

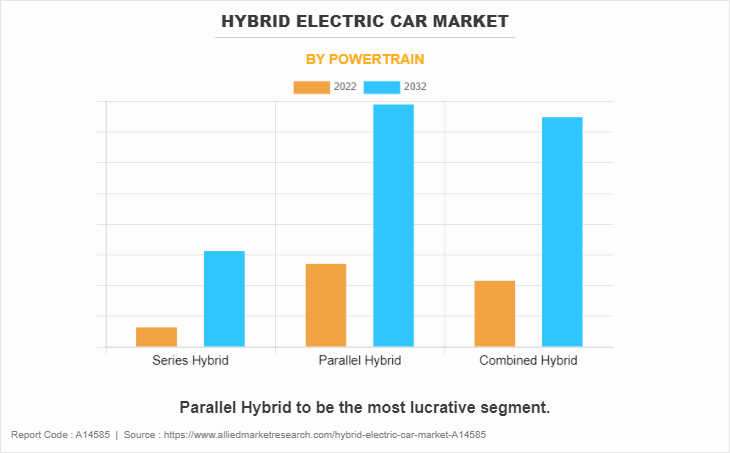

The hybrid electric car market is segmented on the basis of powertrain, degree of hybridization, and vehicle type. By powertrain, the market is segmented into series hybrid, parallel hybrid, and combined hybrid. On the basis of degree of hybridization, the market is fragmented into fully hybrid, and mild hybrid. By vehicle type, the market is divided into standard hybrids, luxury hybrids, and performance hybrids. Region-wise, the hybrid electric car industry is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

hybrid electric car market growth in the Asia-Pacific region is witnessing significant growth and it is anticipated to offer fascinating opportunities for the companies operating in the market. The increasing focus of consumers toward fuel-efficient vehicles if fuelling the market demand during the forecast period. Likewise, government across the globe are also supporting the adoption of fuel-efficient cars in the form of tax benefits and subsidy for purchase of new vehicle.

For instance, in July 2021, the Government of Japan set a target for all new cars sold in Japan to be environmentally friendly. The plan also outlines subsidy programs offered by the government for the purchase of environmentally friendly vehicles. The demand for hybrid electric vehicles in Japan has seen positive growth since the first launch of the Toyota Prius in 1997. Similarly, on October 11, 2022, Toyota, along with India’s Minister of Road Transport and Highways of India Nitin Gadkari, launched a pilot project Flexi-Fuel Strong Hybrid Electric Vehicles (FFV-SHEV). The pilot program outlines Toyota's first step towards creating the importance of carbon-neutral pathways and increasing awareness regarding ethanol as an alternative fuel parallel with strong hybrid electric vehicle technology, the program is also aligned with India's goal towards meeting its net-zero emission targets.

Key Developments

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- On May 2022, Honda Motor Co., Ltd. launched hybrid electric car City in the Indian market. It is the first vehicle in the mainstream market category that is equipped with standard powerful hybrid electric technology. The car is an extension of its City model range. This vehicle is equipped with a self-charging two-motor strong hybrid system that is paired to a 1.5-liter petrol engine. This results in a peak power output of 126 horsepower and a fuel economy of 26.5 kilometers per liter.

- On January 2023, TOYOTA MOTOR CORPORATION Toyota Motor Corporation launched all-new Prius HEV in Japan. The new Prius is equipped with the latest fifth-generation hybrid system in both the 2.0-liter and 1.8-liter models. The Prius (U and X grades) achieves great fuel efficiency of 32.6 km/L. The car utilizes a high-output motor in addition to other features, which enables it to provide enhanced uphill performance on low-friction road surfaces, such as roads covered in snow, as well as increased stability when turning.

- On May 2023, Kia Corporation showcased its new lineup of HEV at a launch event in Saudi Arabia. The new models introduced by the company are K5, K8, Sorento, and Niro Plus. According to the company, the new HEV models can achieve a fuel economy of up to 40%. The launch of the new model showcased Kia Corporation's commitment to reducing carbon emissions and adding more eco-friendly and fuel-efficient car lineups in its product offerings.

Increase in R&D activities

A rise in R&D activities and increase in strategic collaboration with other manufacturers operating in the industry for the development of the hybrid electric cars are anticipated to drive the hybrid electric cars market during the forecast period. For instance, on March 2023, Automobili Lamborghini, to mark its 60th anniversary, unveiled Revuelto. The car is a V12 hybrid, which offers high performance, innovative design, and highly efficient aerodynamics. The supercar is equipped with three electric motors, a double-clutch box, and a 12-cylinder engine. The 127 CV/Liter combustion engine works in synergy with two front electric motors, which are powered by lithium-ion batteries pack of 4500 W/kg, which also supports fully electric dive mode. The supercar can accelerate from 0-100 in 2.5 seconds and reach top speed of 350 km/h. The supercar is an important launch for the company as it aligns with its ‘Direzione Cor Tauri’ strategy, which aligns with the company's goal towards decarbonization of future car models and electrified future.

Increase in demand for efficient transportation

Hybrid electric cars utilize power from different sources, such as by burning fuel and electricity. Moreover, hybrid vehicles allow users to switch between different fuel sources while driving.

For instance, an electric motor does not consume energy while it is idle. It uses less energy at low speeds and thus, is optimal for use in urban areas for driving less than 40 miles/hour, in the rush hour in the city, driving through electric energy source provide an added benefit, and it does not provide any smog and are more fuel efficient. Furthermore, the internal combustion engine starts automatically when the battery energy gets low. Similarly When going faster than 60 mph, hybrid electric cars can switch to an internal combustion engine, which gives them more power. Simultaneously, the hybrid car chargers the battery while driving at higher speed through engine power and regenerative braking. Hybrid electric cars are considered to be fuel efficient of all cars. On an average a hybrid electric car can deliver fuel economy 20-35% more when compared to a traditional ICE car, a hybrid electric can deliver an fuel economy of 48-60 miles per gallon. The steep increase in fuel prices has resulted in consumers shifting away from traditional ICE vehicles. Thus the increase demand for fuel-efficient transportation is anticipated to drive the hybrid electric cars market during the review period

Increase in trend towards electric vehicles

Rise in inclination of consumers towards fully electric vehicles is a major restrain hindering the growth of the hybrid electric car market. In recent years, the cost of electric vehicles is decreasing. At the same time, EVs are experiencing rapid technological enhancements such as fast charging time, increased range, and lower maintenance costs. Similarly, governments globally are offering tax benefits and subsidies for buying electric vehicles.

According to the International Energy Agency, as of 2022, the electric vehicle segment sales were around 10 million, according to the data the sales of EVs have more than tripled in three years, accounting for 4% in 2020 and reaching 14% in 2022. In the first quarter of 2023, EV car sales reached 2.3 million, accounting for 25% share, which is more as compared to 2022. The increasing demand for EVs will continue to grow during the forecast period due to proactive steps taken by the government to subsidize electric vehicles. Hence, the increase in trend towards electric vehicles is a major factor restraining the growth of the hybrid electric carmarket during review period.

Increase in demand for hybrids to create lucrative growth opportunities for maintenance and aftersales services

Increase in adoption of hybrid electric cars will create a lucrative growth opportunity for hybrid electric car manufacturers to expand their revenue source by offering after-sales service and maintenance services to consumers. Hybrid electric cars are complex and expensive as they utilize two motors to propel the car and are equipped with all the ancillary systems to manage the operation of the car. Additionally, the vehicle is equipped with heavy batteries and a regeneration system to recharge the batteries. To efficiently run all these systems together requires continuous car maintenance and monitoring, and thus, during the review period, growth in a hybrid electric car is anticipated to generate a new revenue growth opportunity for the manufacturers operating in the market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hybrid electric car market analysis from 2022 to 2032 to identify the prevailing hybrid electric car market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the hybrid electric car market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global hybrid electric car market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the hybrid electric car market players.

- The report includes the analysis of the regional as well as global hybrid electric car market trends, key players, market segments, application areas, and market growth strategies.

Hybrid Electric Car Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 489.8 billion |

| Growth Rate | CAGR of 7.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 284 |

| By Degree of Hybridization |

|

| By Vehicle Type |

|

| By Powertrain |

|

| By Region |

|

| Key Market Players | Kia Corporation, Ford Motor Company, Mercedes-Benz Group AG (former Daimler AG), Hyundai Motor Company, AB Volvo, Nissan Motor Co., Ltd., Toyota Motor Corporation, BMW AG, Honda Motor Co., Ltd., Volkswagen Group |

The hybrid electric car market was valued at $229,225.39 in 2022

The global hybrid electric car market is projected to grow at a compound annual growth rate of 7.8% from 2023-2032.

Asia-Pacific is the largest region for hybrid electric car market

The increasing demand for EVs will continue to grow during the forecast period due to proactive steps taken by the government to subsidize electric vehicles. Hence, the increase in trend towards electric vehicles is a major factor restraining the growth of the hybrid electric carmarket during review period.

The key players that operate in the hybrid electric car market such as TOYOTA MOTOR CORPORATION, Honda Motor Co., Ltd, , Hyundai Motor Company and Volkswagen Group are the major players operating in the market.

Loading Table Of Content...

Loading Research Methodology...