Hydraulic Cylinders Market Research, 2030

The global hydraulic cylinders market was valued at $14,070.0 million in 2020 and is estimated to reach $21,243.2 million by 2030, exhibiting a CAGR of 4% from 2021 to 2030.

Hydraulic cylinders are mechanical devices that convert hydraulic energy into linear mechanical force and motion. They play a crucial role in various industrial applications where heavy lifting, pushing, pulling, or holding tasks are required. The basic principle behind hydraulic cylinders is the use of pressurized hydraulic fluid to generate force, typically using a piston enclosed within a cylindrical housing.

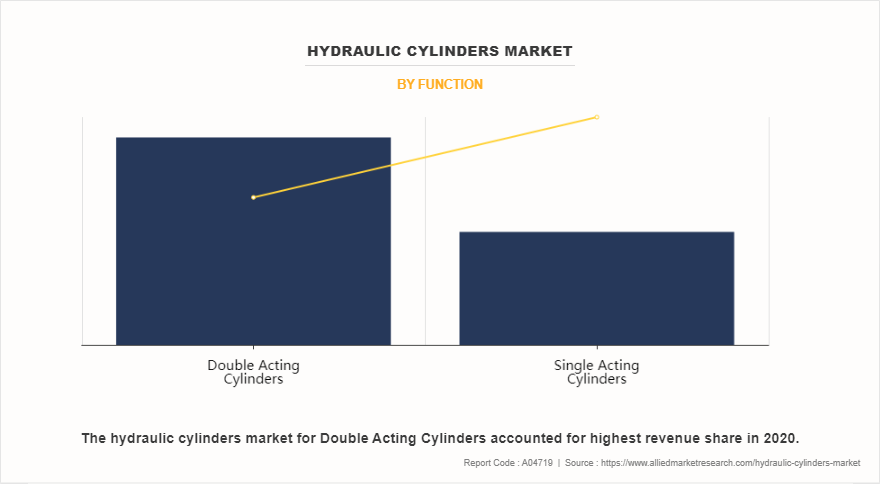

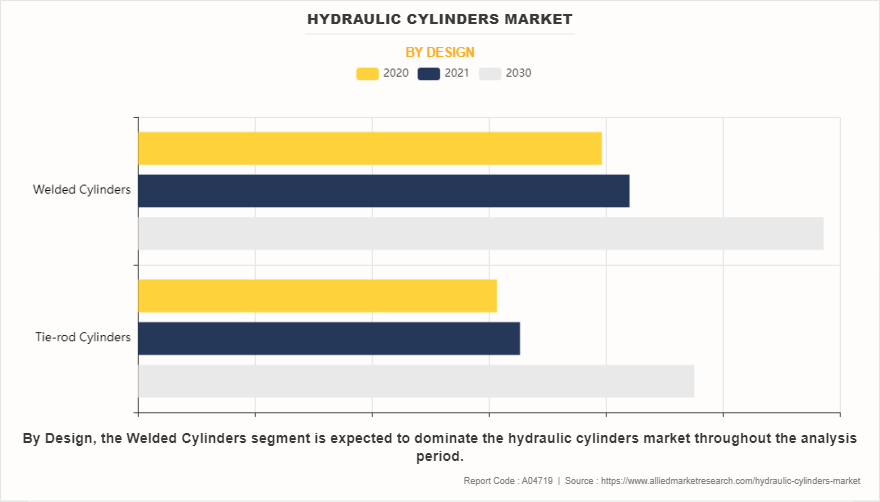

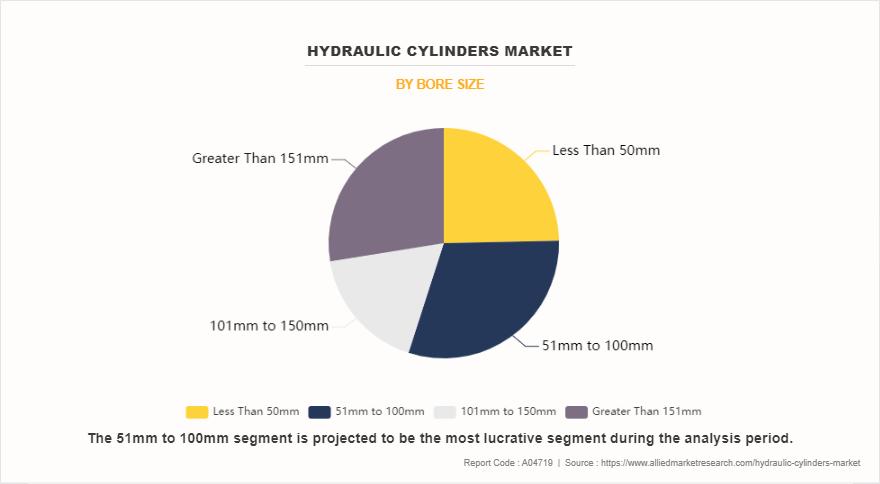

The hydraulic cylinders market is segmented into function, design, bore size, and region. On the basis of function, the market is classified into single acting cylinders, and double acting cylinders. On the basis of design, the market is categorized into tie-rod cylinders, and welded cylinders. On the basis of bore size, the market is segregated into less than 50mm, 51mm to 100mm, 101mm to 150mm, and greater than 151mm.

Report Key Highlighters

- Hydraulic cylinders Market studies more than 16 countries. The analysis includes a country-by-country breakdown analysis in terms of value ($million) available from 2021 to 2030.

- The research combined high-quality data, professional opinion and research, with significant independent opinion. The research methodology aims to provide a balanced view of the Hydraulic cylinders Market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

- The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the market.

- Hydraulic cylinders Market share is marginally fragmented, with players such as Actuant Corporation, Caterpillar Inc., Eaton Corporation Plc, JARP Industries Inc., Hengli Hydraulic, Kawasaki Heavy Industries Limited, Parker Hannifin Corporation, Robert Bosch GmbH (Bosch Rexroth AG), Texas Hydraulics Inc., and Wipro Limited.

Growth in global construction sector

Hydraulic cylinders are crucial components in heavy construction machinery, including excavators, bulldozers, and cranes. The demand for efficient, powerful, and dependable equipment increases as urbanization accelerates and infrastructure projects expand. Rapid urban development in emerging economies, especially in Asia-Pacific and Latin America, drives construction activities. The hydraulic cylinders industry plays a crucial role in the development of heavy machinery and equipment. Moreover, the push for smart and sustainable infrastructure requires advanced machinery, thereby increasing the adoption of hydraulic cylinders. Technological advancements that improve the efficiency and durability of hydraulic systems also support market growth.Increased investment in construction and mining is boosting the hydraulic cylinders market size.

Rapid industrialization coupled with increasing infrastructural spending

As industries expand, the demand for machinery and equipment that use hydraulic cylinders for various applications, such as manufacturing, construction, and mining, grows significantly. Hydraulic cylinders provide essential force and motion control in these sectors, enabling efficient operation of heavy machinery and equipment. Steady demand in the construction and manufacturing sectors is driving hydraulic cylinders market growth

Furthermore, governments and private sectors are investing heavily in infrastructure projects, including transportation networks, urban development, and energy facilities. These projects require robust construction machinery, such as excavators, loaders, and cranes, which rely on hydraulic cylinders for their functionality. The surge in infrastructural development fuels the demand for hydraulic systems, as they are critical for the precise and powerful movements needed in construction and engineering tasks.

Retrofit and replacement of existing equipment

Aging hydraulic systems often suffer from wear and tear, leading to reduced productivity and increased maintenance costs. Retrofitting and replacing outdated equipment with modern, advanced hydraulic cylinders can significantly improve operational efficiency, reduce downtime, and lower long-term maintenance expenses. In addition, increase in use of pneumatic hydraulic cylinders have led to the development of more energy-efficient and environmentally friendly hydraulic solutions, aligning with the industry's growing emphasis on sustainability. Regulatory requirements and safety standards also compel industries to upgrade their equipment to ensure compliance. Moreover, the rising demand for automation and precision in industries such as construction, manufacturing, and agriculture further propels the need for updated hydraulic systems.

Competitive Analysis

Competitive analysis and profiles of the major hydraulic cylinders market players that have been provided in the report include Actuant Corporation, Caterpillar Inc., Eaton Corporation Plc, JARP Industries Inc., Hengli Hydraulic, Kawasaki Heavy Industries Limited, Parker Hannifin Corporation, Robert Bosch GmbH (Bosch Rexroth AG), Texas Hydraulics Inc., and Wipro Limited. Major strategies such as contracts, partnerships, expansion, and other strategies of players operating in the market are tracked and monitored.

Top Impacting Factors

Retrofit and replacement of existing equipment, rapid industrialization coupled with increasing infrastructural spending, and growth in global construction sector. The hydraulic cylinders market forecast indicates a robust expansion over the next few years, supported by global industrialization. The hydraulic cylinders market opportunity offers diversification, particularly in specialized and customized applications.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hydraulic cylinders market analysis from 2020 to 2030 to identify the prevailing hydraulic cylinders market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the hydraulic cylinders market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global hydraulic cylinders market trends, key players, market segments, application areas, and market growth strategies.

Hydraulic Cylinders Market Report Highlights

| Aspects | Details |

| Market Size By 2030 | USD 21.2 billion |

| Growth Rate | CAGR of 4% |

| Forecast period | 2020 - 2030 |

| Report Pages | 245 |

| By Function |

|

| By Design |

|

| By Bore Size |

|

| By Region |

|

| Key Market Players | Texas Hydraulics, Hengli Hydraulics, Eaton Corporation plc, Caterpillar Inc., Jarp Industries, Inc., Actuant Corporation, Wipro Limited, Kawasaki Heavy Industries Ltd., Robert Bosch GmbH, Parker Hannifin Corporation |

Analyst Review

Hydraulic cylinder converts mechanical force in a linear motion. It consists of a tube capped with a rod sticking out on one side. A piston is attached to the rod in the cylinder. These cylinders are used in excavators, dump trucks, loaders, graders, back hoes, and dozers.

The global hydraulic cylinder market is expected to experience growth during the forecast period, owing to increase in material handling equipment industries in the developing nations such as India, China, Brazil, and Mexico. Competition among players and adaptation of new technologies such as electronic componentry and sensors have fueled the adoption of the hydraulic cylinder market.

R&D and emergence of innovations such as SGH10, a Rota position sensor that measures the position to maintain dimensions of existing cylinders. This factor is expected to fuel the growth of the hydraulic cylinder market during the forecast period.

The double acting cylinder segment was the highest contributor to the global hydraulic cylinder market in terms of revenue in 2017 and is expected to maintain its dominance during the forecast period, owing to rapid urbanization, presence of emerging economies, and increase in construction activities in the residential & industrial projects.

The key players operating in the global hydraulic cylinder market include Actuant Corporation, Bosch Rexroth AG, Caterpillar Inc., Eaton Corporation Plc, Jarp Industries, Jiangsu Hengli Hydraulic Co., Ltd., Kawasaki Heavy Industries, Parker Hannifin Corporation, Texas Hydraulics, and Wipro Enterprises Limited.

The market players have adopted product launch as their key developmental strategy to provide better products and meet customer demands. Acquisitions and partnerships are other strategies adopted by the players to improve their offerings and boost their production processes. In addition, these strategies have helped the companies to develop technologically advanced products and expand their market share across different regions.

The hydraulic cylinders market is projected to reach $21,243.2 million by 2030, registering a CAGR of 4% from 2021 to 2030.

The base year calculated in the Hydraulic cylinders Market report is 2020.

The top companies analyzed for hydraulic cylinders market report are Actuant Corporation, Caterpillar Inc., Eaton Corporation Plc, JARP Industries Inc., Hengli Hydraulic, Kawasaki Heavy Industries Limited, Parker Hannifin Corporation, Robert Bosch GmbH (Bosch Rexroth AG), Texas Hydraulics Inc., and Wipro Limited.

The forecast period in the hydraulic cylinders market report is 2021 to 2030.

The Asia-Pacific holds the maximum market share of the Hydraulic cylinders Market.

The 51mm to 100mm segment is the most influential segment in the hydraulic cylinders Market.

The company profile has been selected on the basis of revenue, product offerings, and market penetration.?

The market value of the hydraulic cylinders Market in 2020 was $14,070.0 million

Loading Table Of Content...

Loading Research Methodology...