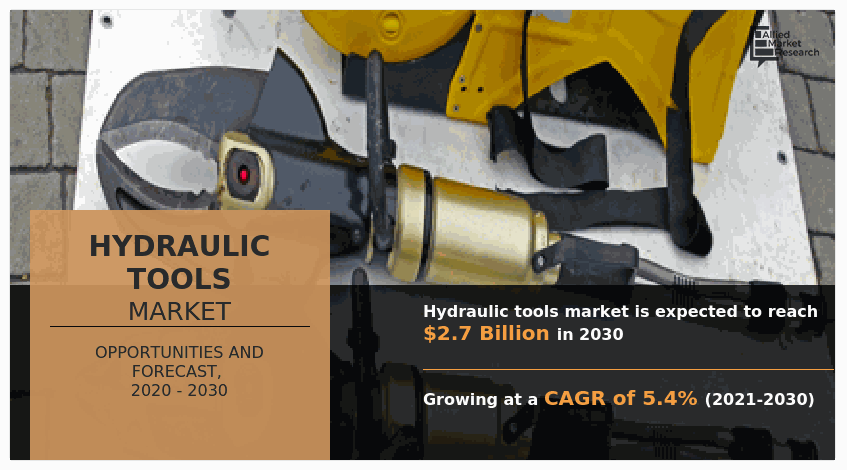

Hydraulic Tools Market Research - 2030

The global hydraulic tools market size was valued at $1.6 billion in 2020, and is projected to reach $2.7 billion by 2030, growing at a CAGR of 5.4% from 2021 to 2030.

Market Dynamics

Hydraulic tools are machines with a hydraulic drive. They are employed for various operations such as tightening threaded joints and pressing in & out parts. In this type of tools, hydraulic fluid is transmitted to various hydraulic cylinders and are pressurized according to the resistance present. The fluid is controlled by control valves and distributed through hoses & tubes.

Increase in urbanization has led to expansion of the industrial sector throughout the globe. The industrialization has increased, owing to development in transportation, high immigration, new inventions, and high investments, majorly in Asia-Pacific. Moreover, the increase in urbanization has resulted in increased construction activities, thereby fueling demand for cranes and other mining equipment, including hydraulic tools.

Segmental Overview

Manufacturers focus on development of high-efficiency impact wrench with enhanced speed control. For instance, ITH Bolting Technology, a Germany-based producer of tensioning tools, hydraulic torque wrenches, offers hydraulic torque wrenches and bolt tensioning cylinders. High demand for tunnels, new canal channel, and bridges drive the hydraulic tools market growth. Moreover, new construction activities involve demolition of older structures, which is assisted using hydraulic tools.

Furthermore, growth in infrastructural projects related to underground electric transmission and pipelines around the globe is anticipated to boost the hyraulic tools industry growth in the future.

Major players are operating in this market such as Actuant Corporation and Emerson Electric Co. and are adopting product launch to intense the competition and improve the product portfolio. For instance, Actuant Corporation launched new enerpac MIIT series mechanical isolation & test tools. This product line provides a safe and efficient method for inline piping isolations and localized pressure testing of new welds. Such instances drive the growth of the hydraulic tools market.

In addition, an increase in oil, gas, and petrochemical and industrial manufacturing activities in Italy, positively contributes to the growth of the market. For instance, the construction industry in Italy is anticipated to experience growth by 3.3% from 2020 to 2022. However, high cost and regular maintenance are anticipated to hamper growth of the market. Conversely, increase in construction and mining activity is anticipated to provide lucrative for the hydraulic tools market opportunity.

Based on type, the hydraulic tools market is segmented into hydraulic cylinder and jack, hydraulic rescue tools, tension, and torque tools. The hydraulic cylinder and jack segment generated the largest hydraulic tools market share in 2020, Based on distribution channel, the market is segmented into offline, and online. Offline segment dominate the market in 2020.

Based on end user, the market is segmented into industrial manufacturing, oil, gas, and petrochemical, utility, railway, and others. Industrial manufacturing segment dominate the market in 2020.

The hydraulic tools market is analyzed across four regions, which include North America (U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). North America is expected to dominate the market throughout the forecast period.

The key players profiled in this report include Actuant Corporation, Atlas Copco AB, SPX Flow, Kudos Mechanical Co., Ltd., IDEX Corporation, Hi-Force, and Cembre S.P.A., Emerson Electric Co., Robert Bosch GmbH, and Stanley Black & Decker, Inc.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hydraulic tools market analysis from 2020 to 2030 to identify the prevailing market growth and opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the hydraulic tools market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global hydraulic tools market trends.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global hydraulic tools market forecast trends, key players, market segments, application areas, and market growth strategies.

Hydraulic Tools Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Distribution Channels |

|

| By END USER |

|

| By Region |

|

| Key Market Players | Kudos Mechanical Co., Ltd, Emerson Electric Co., Cember S.P.A., SPX FLOW, Inc., IDEX Corporation, Stanley Black & Decker, Inc., hi-force hydraulic tools, Atlas Copco, Actuant Corporation, robert bosch gmbh |

Analyst Review

According to insights of CXOs of leading companies, the hydraulic tools market is witnessing considerable growth in the emerging markets such as China, Latin America, and India, owing to rapid urbanization and increased agricultural spending. Rise in purchasing power has led to higher spending in the construction industry, owing to the quick and substantial returns especially in the developing countries such as China, India, and Brazil. Furthermore, demand for hydraulic tools is expected to increase at a faster pace in the future, owing to rise in infrastructural investments and surge in need for modern machinery in the agriculture sector. Apart from infrastructure growth, increase in population has led to surge in agricultural and mining activities in many countries across the world. Manufacturers of hydraulic tools are taking continuous efforts to minimize leakages from tools used at high operating pressure. Moreover, efforts have been taken to improve surface technology to increase durability of hydraulic actuators. Players operating in the hydraulic tools market have adopted product launch as their key growth strategies to gain a stronger foothold. Thus, all these factors together are anticipated to significantly contribute toward growth of the global hydraulic tools market.

A rise in industrial manufacturing and oil and gas industry, which is expected to drive the growth of the hydraulic tools market.

A hydralic tools are used in applications such as industrial manufacturing, oil, gas, and petrochemicals, and railway industry.

North America region dominates the market in 2020.

The hydraulic tools market size was $1,571.1 million in 2020, and is expected to reach $2,726.4 million by 2030, registering a CAGR of 5.4% from 2021 to 2030.

Actuant Corporation, Atlas Copco AB, SPX Flow, and Kudos Mechanical Co., Ltd. are top companies holds the largest market share.

Loading Table Of Content...