Hydraulic Workover Units Market Research, 2031

The global hydraulic workover units market size was valued at $7.1 billion in 2021, and is projected to reach $11.0 billion by 2031, growing at a CAGR of 4.5% from 2022 to 2031.

Hydraulic workover units are movable pulling devices that are cost-effective and offer a variety of advantages for onshore & offshore projects. The hydraulic workover unit is a versatile, economical, and secure tool for drilling, maintaining, and repairing wells along the shore. It is used to replace traditional drilling and workover rigs. A hydraulic workover device is beneficial when well intervention is being performed on gas wells. The equipment increases lifting capability during well intervention operations that would be impossible with a wireline or coiled tubing unit.

The demand for this equipment has expanded globally as a result of the significant advancement in technology for oil and gas applications. It is crucial to increase crude oil output due to industrialization and urbanization, including the automobile, energy, and digitalization. The increase in brownfields coupled with a surging energy demand has made this market relevant. The market for hydraulic workover units is driven by the rising primary energy demand in APAC, expanding shale oil & gas production, and growing shale oilfield gas production.

Mexico, Algeria, Argentina, and Kuwait are in special focus for future demand of hydraulic workover units

Mexico and Algeria are anticipated to encourage the production of shale resources with the help of technological advancements. Besides, foreign investment is on the rise in Argentina, so the shortage of advanced rigs and fracking equipment is needed to be addressed. Mexico's shale resource basins are anticipated to expand with the recent opening of the upstream sector to foreign investors.

Furthermore, Kuwait signed a USD 600 billion offshore exploration contract with Halliburton with the aim for the drilling of six exploration wells over the course of the following two to three years, with a predicted increase in production of about 100,000 barrels per day. In addition for new offshore oil and gas projects. Russia announced a substantial expenditure of about $300 billion in January 2020. Offshore production is projected to contribute significantly to the globe's oil and gas supply. The more exhausting production conditions in offshore locations increase the investment in more complex and newer technologies such as hydraulic workover units.

In addition, the shale rock that contains large accumulations of natural gas and oil, shale natural gas supplies are found. Shale gas production, which is anticipated to increase and industrial shale gas production in nations such as the U.S., Canada, China, and Argentina comprise the majority of this growth. Furthermore, countries such as Mexico and Algeria are anticipated to encourage the production of shale resources with the help of technological advancements. Besides, foreign investment is on the rise in Argentina, so the shortage of advanced rigs and fracking equipment is needed to be addressed. Mexico's shale resource basins are anticipated to expand with the recent opening of the upstream sector to foreign investors.

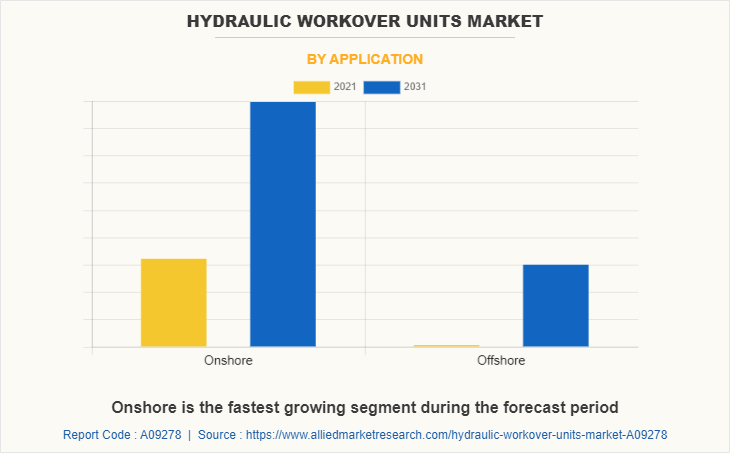

The hydraulic workover unit market forecast is segmented on the basis of service, capacity, installation, application, and region. On the basis of service, it is classified into workover and snubbing. By capacity type, the market is categorized into 50 tons, 51 to 150 tons, and above 150 tons. On the basis of installation, it is divided into skid mount and trailer mount. On the basis of application, the market is segregated as onshore and offshore.

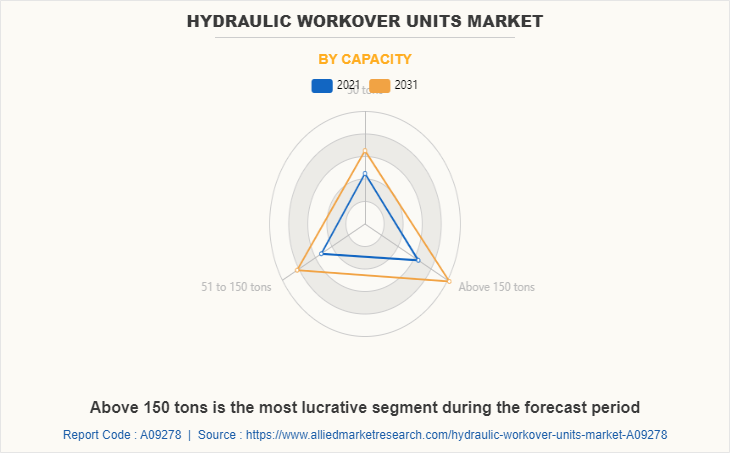

On the basis of capacity, Above 150 tons the spread segment dominated the market in 2020. This is attributed to the exponential rise in consumption of crude oil for a diverse range of applications, such as fuel for automobiles and industrial machines and power generation. Due to enormous draw capacity needed on vast brownfields for diverse services, the concentrated amount of the equipment manufactured and used are above 200 tonnes.

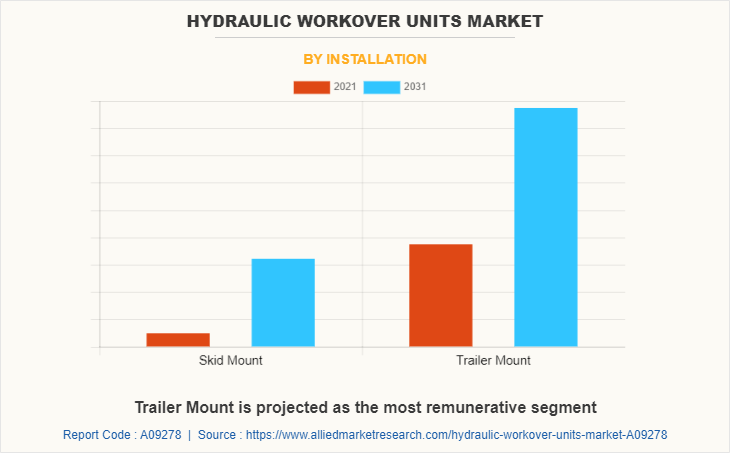

By installation, trailer mount dominated the global market in 2020, in terms of share. Owing to the optimum structure and high-level integration of workover rigs. A trailer-mounted hydraulic workover unit requires less working space. Efficient drilling, cruise capability, and lateral stability are among the key features of these units. They can work under ambient temperature and are suitable for cold fields in countries such as Russia and Canada.

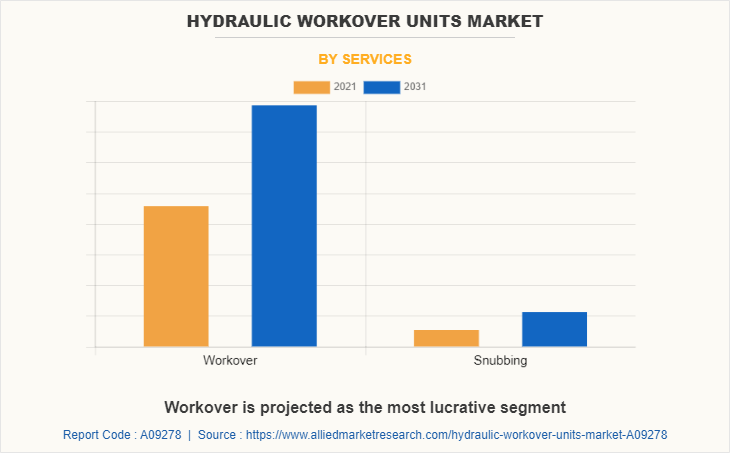

By service workover segment dominated the global market in 2020, in terms of share. This is attributed to Hydraulic workover units are less prone to erosion and comparatively cost-effective maintenance and are normally required to temporarily abandon or to plug and abandon a well. Operations may include squeeze cementing, setting plugs (cement or mechanical), retrieving production equipment, and perhaps cutting and pulling casing. Workover costs vary depending on well conditions and regulatory requirements. This may anticipate increasing the demand for workover segment; thus, creating lucrative opportunities for the global hydraulic workover unit market.

By application, onshore segment dominated the global market in 2020, in terms of share. Owing to the high oil production from the onshore segment and the larger number of onshore oil rigs, the segment dominates the market. Additionally, the majority of onshore oil rigs are established and provide a sizable amount of market demand. In the past, operators concentrated on production from easily accessible reservoirs with relatively little cost and effort.

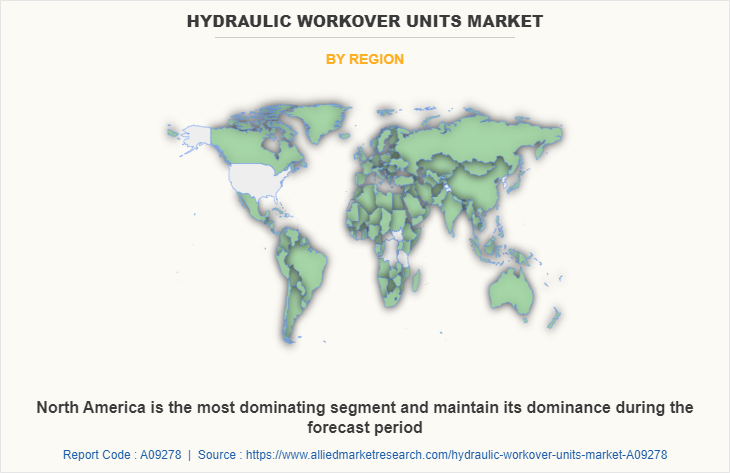

North America garnered the highest hydraulic workover units market share in 2020, in terms of revenue, and is anticipated to maintain its dominance during the forecast period. Owing to increase in hydraulic fracturing activities due to rising oil production from shale plays such as the Bakken formation and Permian Basin in the past few years. Moreover, the region is expected to witness the fastest CAGR over the forecast timeframe, owing to the substantial regional increment in both production and consumption of shale oil and gas.

Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. It is expected that North America dominated the global market in terms of revenue share and is expected to continue its dominance during the forecast period. The growth can be attributed to increasing offshore projects, particularly in US and Canada. Furthermore, rise in demand for hydraulic fracturing from shale gas reserves is anticipated to drive product demand across this region.

Positively, in the second half of 2021, the market for hydraulic workover unit rebounded from the COVID-19 pandemic. Moreover, to get a competitive edge in the market, the leading manufacturers have implemented a number of strategies, such as product launches and expansion investments, which are anticipated to support market growth throughout the forecast period. Furthermore, increasing demand for hydraulic workover units from the oil and gas industry, as a result of increasing production & exploration activities, rising investments in the oil and gas sector across the globe, and growing number of hydraulic fracturing operations, increase production from unconventional reserves.

For instance, "in July 2021 quarterly results, Norwegian Energy Company ASA reported that the Noble Sam Turner drilling program had started a well workover and maintenance campaign in the spring of 2021 and had finished three well workovers, which helped to add up to almost 2000 bpd and improve operating performance in the second quarter. The success of the campaign was greatly influenced by the employment of HWUs."

The global hydraulic workover unit market analysis profiles leading players that include, Ceem Canadian Energy, Key Energy Services LLC, Precision Drilling Corporation, Superior Energy Services, Inc., National Oilwell Varco, Inc., ARCHER, Basic Energy Services, Inc., Cudd Energy Services, High Arctic Energy Services, Inc., Halliburton Inc, Nabors Industries Ltd. The global hydraulic workover unit market report provides in-depth competitive analysis as well as profiles of these major players.

Latest strategic developments undertake by key players:

- In March 2022,GA Drilling, a geothermal technology company by integrating its innovative, contactless PLASMABITR. drilling tool into Nabors' industry, this collaboration aims to accelerate field commercialization and eliminate traditional economic barriers of ultra-deep projects to expand global access to geothermal energy.

- In February 2022, Archer Limited is pleased to announce that Pan American Energy LLC has agreed to extend the duration of Archer's drilling services contract for further two years. The extended contract covers 2 drilling rigs, 13 workover units and 13 pulling units on Pan American's Cerro Dragon field in the Golfo San Jorge basin in southern Argentina.

- In September 2021, Halliburton will collaborate with Energean to deliver exploration, appraisal, and development wells offshore Israel economically and safely. The contract is for three firm and two optional wells to deliver all services including project management, directional drilling, drill bits, drilling fluids, cementing, solids control, wireline, slickline, completions, production enhancement, and subsea services.

- In July 2021,precision drilling, provider of safe and high-performance services to the oil and gas industry; announced strategic alliances Cathedral Energy; the Calgary-based upstream company. Under the alliance, Precision's Alpha digital products, which include AlphaApp; AlphaAutomation and also AlphaAnalytics, will pair with Cathedral's premium downhole equipment and directional drilling expertise.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hydraulic workover units market analysis from 2021 to 2031 to identify the prevailing hydraulic workover units market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the hydraulic workover units market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global hydraulic workover units market trends, key players, market segments, application areas, and market growth strategies.

Hydraulic Workover Units Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 11 billion |

| Growth Rate | CAGR of 4.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 276 |

| By Capacity |

|

| By Installation |

|

| By Services |

|

| By Application |

|

| By Region |

|

| Key Market Players | Ceem Canadian Energy Equipment Manufacturing FZE, Halliburton Inc, National Oilwell Varco, Inc., High Arctic Energy Services, Inc., Superior Energy Services, Inc., ARCHER, Nabors Industries Ltd., Precision Drilling Corporation, Cudd Energy Services, Key Energy Services LLC., Basic Energy Services, Inc. |

Analyst Review

According to CXOs of leading companies, the global hydraulic workover unit market is projected to exhibit high growth potential. Owing to the growing number of older oil fields, there is a significant increase in demand for creating a reliable, adaptable, and affordable instrument for workover and well-intervention operations. This element increases demand for hydraulic workover units (HWUs) on a worldwide scale. This equipment can be efficiently used with low setup times and are more cost-effective. Earlier workover rigs were used for similar operations, which took a lot of time and effort to be set up and used.

In addition, the proliferation of technologically advanced hydraulic workover units that offer improved performance & efficiency as well as increasing demand for rental services of hydraulic workover units to reduce capital expenditure by end-users are anticipated to boost demand for hydraulic workover units. The introduction of multiphase projects is a major trend gaining popularity in the hydraulic workover unit market. Prominent competitors in the hydraulic workover unit sector have launched multiphase projects in collaboration with leading manufacturers to set a new offshore workover world record.

For instance, SBS Energy Services (SBS), a U.S.-based provider of hydraulic workover and snubbing services, entered into a strategic partnership with Helix Solutions in September 2020 to complete a multi-phase project that deactivates about 29,000 feet of 10 inches by 6 inches insulated pipeline in the Gulf of Mexico. The CXOs further added that sustained economic growth and increasing attention to brownfields to support market expansion have surged the popularity of the hydraulic workover unit market.

Onshore is the leading application of Hydraulic Workover Units Market

Rising primary energy demand in APAC, expanding shale oil & gas production, and growing shale oilfield gas production.

Ceem Canadian Energy, Key Energy Services LLC, Precision Drilling Corporation, Superior Energy Services, Inc., National Oilwell Varco, Inc., ARCHER, Basic Energy Services, Inc., Cudd Energy Services, High Arctic Energy Services, Inc., Halliburton Inc, Nabors Industries Ltd. are the top companies to hold the market share in Hydraulic Workover Units

North America is the largest regional market for Hydraulic Workover Units

The global hydraulic workover unit market was valued at $7.1 billion in 2021, and is projected to reach $11.0 billion by 2031, growing at a CAGR of 4.5% from 2022 to 2031.

Loading Table Of Content...