Hydrocracker Market Research, 2033

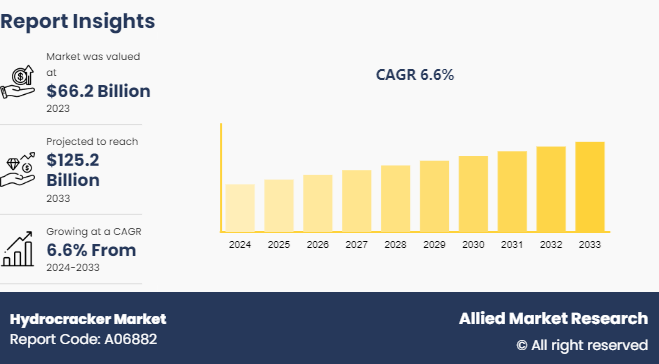

The global hydrocracker market was valued at $66.2 billion in 2023, and is projected to reach $125.2 billion by 2033, growing at a CAGR of 6.6% from 2024 to 2033.

Market Introduction and Definition

A hydrocracker is a crucial component in the petroleum refining process, designed to break down larger, heavier hydrocarbon molecules into more valuable, lighter products such as gasoline, diesel, jet fuel, and other high-demand petroleum derivatives. This process, known as hydrocracking, combines catalytic cracking with hydrogenation. It occurs under high pressure and temperature in the presence of a hydrogen-rich environment and a specialized catalyst, typically a combination of metals such as nickel or molybdenum supported on a base of alumina or silica-alumina.

Key Takeaways

The hydrocracker market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period 2023-2033.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major hydrocracker industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

Hydrocracking is a refining process that converts heavy crude oil fractions into lighter, more valuable products such as diesel, jet fuel, and gasoline. Innovations in this technology have led to significant improvements in the efficiency, selectivity, and versatility of hydrocracking units, that make them more attractive to refineries. These technological advancements include the development of more robust catalysts, o ptimized reactor designs, and enhanced process control systems. These improvements allow refineries to achieve higher conversion rates, produce a greater yield of high-quality fuels, and operate more cost-effectively, thereby boosting the demand for hydrocracker technology. All these factors are expected to drive the demand for the hydrocracker market during the forecast period.

However, hydrocracker, an essential unit in refining crude oil into more valuable products such as diesel, jet fuel, and gasoline, requires substantial financial investment. The initial capital expenditure for setting up a hydrocracking unit is enormous due to the complexity and scale of the equipment involved. This includes costs for reactors, high-pressure compressors, heat exchangers, and extensive piping systems, all designed to operate under harsh conditions of high pressure and temperature. All these factors are expected to hamper the growth of the hydrocracker market during the forecast period.

Refining infrastructure refers to the facilities and equipment used in the refining process to convert crude oil into valuable products such as gasoline, diesel, and petrochemicals. As global energy demand continues to rise, particularly in emerging economies, there is a growing need to expand and modernize existing refineries to meet this demand efficiently and sustainably. In addition, the expansion of refining infrastructure supports economic growth by creating jobs, attracting investment, and strengthening energy security. It enables refineries to adapt to changing market dynamics and consumer preferences, such as the shift towards cleaner energy sources and increased demand for petrochemical feedstocks used in various industrial applications. All these factors are anticipated to offer new growth opportunities for the hydrocracker market during the forecast period.

Market Segmentation

The hydrocracker market is segmented by technology, by application, and region. By technology, the market is segmented into single-stage and two-stage. By application, the market is divided into jet fuel, diesel, gasoline and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

In North America, several factors drive the demand for hydrocrackers, which are critical units in the refining industry aimed at converting heavy hydrocarbon feedstocks into lighter, more valuable products such as gasoline, diesel, and jet fuel. Hydrocracking plays a crucial role in refining processes to meet stringent environmental regulations, particularly in North America where emissions standards are high. Hydrocrackers help in producing low-sulfur diesel and gasoline, which are essential for compliance with emissions regulations such as the Environmental Protection Agency's Tier 3 standards in the United States. Moreover, technological advancements in hydrocracking processes have also spurred demand. Innovations in catalysts and process design have improved efficiency, reduced operating costs, and increased the flexibility of hydrocracking units, making them more attractive investments for refineries in North America looking to optimize their operations and stay competitive in a hydrocracker market.

Competitive Landscape

The major players operating in the hydrocracker market include Shell, Exxon Mobil Corporation, Chevron Lummus Global, Total Energies, Indian Oil Corporation Ltd, Reliance Industries Limited, Eni SPA, Fluor Corporation, Valero, CITGO Petroleum Corporation, and others

Analysis of Crude Oil

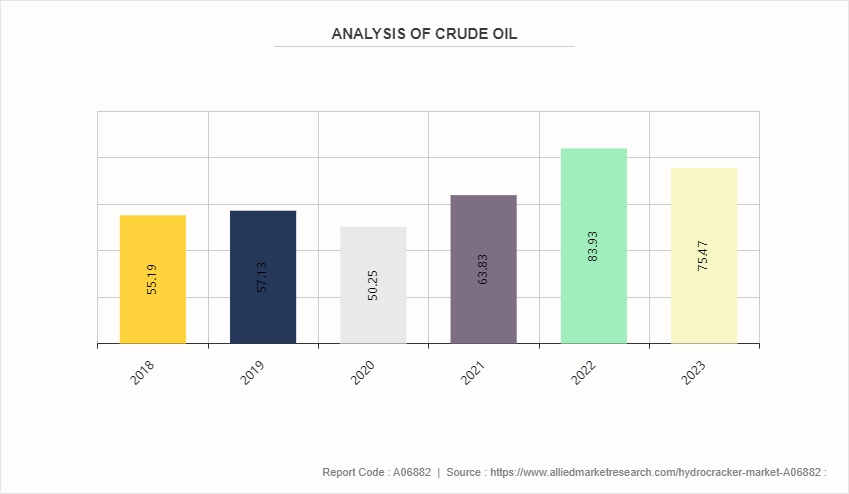

The fluctuating crude oil prices observed from 2018 to 2023 would have had varying impacts on hydrocrackers, which are crucial units in petroleum refining. In 2018 and 2019, when crude oil prices were relatively stable and moderate, hydrocrackers might have operated under predictable cost structures, potentially benefiting from steady feedstock costs. The decline in crude oil prices in 2020 could have led to reduced operational costs for hydrocrackers, thereby improving margins, although this might also have been accompanied by decreased profitability due to lower selling prices for refined products. The subsequent rise in oil prices from 2021 to 2023 would likely have increased feedstock costs for hydrocrackers, potentially squeezing margins unless they were able to pass these costs onto consumers. Overall, the volatility in crude oil prices would have necessitated agile operational strategies for hydrocrackers to manage input costs, optimize production, and maintain profitability in a fluctuating market environment.

Industry Trends

India, the world’s fourth-largest refiner, plans to increase its crude oil refining capacity by up to 56.6 million tons per annum (mtpa) over the next seven years, with 84% of this growth coming from brownfield expansions.

According to U.S. Energy Information Administration, Indonesia is accelerating efforts to boost its oil refining capacity in a bid to reduce dependency on imported petroleum products. By 2030, the government aims to significantly enhance domestic petroleum output, targeting an increase to 1 million barrels per day (bpd) . This ambitious goal involves stimulating further research and investment in advanced recovery techniques for aging oil fields. These initiatives are part of Indonesia's strategic plan to strengthen its energy security, bolster domestic production capabilities, and reduce reliance on external sources for refined petroleum products.

As per the Centre for High Technology (CHT) , a technical wing of MoPNG, the refining capacity of Indian refineries is projected to increase by about 56 mtpa by 2028.

According to the International Energy Agency (IEA) , China is projected to add the most crude refining capacity between 2022 and 2028, and will maintain the largest volume of spare capacity during this period.

Key Sources Referred

Invest in India

International Renewable Energy Agency (IREA)

India brand Equity foundation (IBEF)

International Energy Agency (IEA)

ACS Publication

Biofuels Academy

U.S. Energy Information Administration

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hydrocracker market analysis from 2024 to 2033 to identify the prevailing hydrocracker market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the hydrocracker market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global hydrocracker market trends, key players, market segments, application areas, and market growth strategies.

Hydrocracker Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 125.2 Billion |

| Growth Rate | CAGR of 6.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 340 |

| By Technology |

|

| By Application |

|

| By Region |

|

| Key Market Players | Fluor Corporation, Total Energies, Exxon Mobil Corporation, Shell plc, Chevron Lummus Global, CITGO Petroleum Corporation, Valero, Eni SPA, Reliance Industries Limited, Indian Oil Corporation Ltd |

Increased demand for clean fuels, expansion of refinery capacity are the upcoming trends of Hydrocracker Market in the world.

Diesel is the leading application of Hydrocracker Market

North America is the largest regional market for Hydrocracker

$125.2 billion is the estimated industry size of Hydrocracker

Shell plc, Exxon Mobil Corporation, Chevron Lummus Global, Total Energies, Indian Oil Corporation Ltd, Reliance Industries Limited, Eni SPA, Fluor Corporation, Valero, CITGO Petroleum Corporation are the top companies to hold the market share in Hydrocracker

Loading Table Of Content...