Hydrogel Market Research, 2033

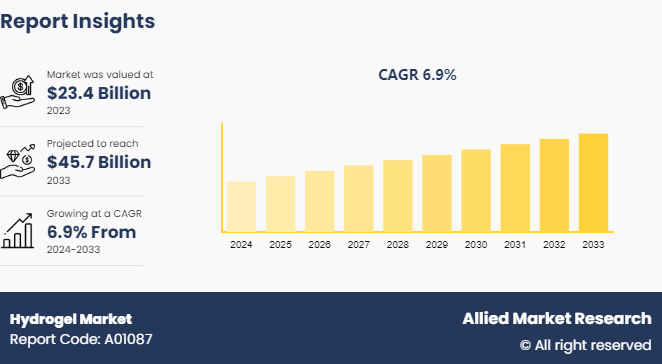

The global hydrogel market was valued at $23.4 billion in 2023, and is projected to reach $45.7 billion by 2033, growing at a CAGR of 6.9% from 2024 to 2033.

Market Introduction and Definition

Hydrogels are three-dimensional, cross-linked polymer networks capable of retaining large amounts of water within their structure. These versatile materials possess unique properties that make them valuable in various applications, including biomedical, agricultural, and environmental fields. One defining characteristic of hydrogels is their high water content, often exceeding 90% of their total weight, which grants them a soft and rubbery consistency resembling natural tissues. This property enables hydrogels to mimic the extracellular matrix, making them suitable for tissue engineering and drug delivery systems.

In addition, hydrogels exhibit swelling behavior when exposed to water or aqueous solutions, allowing for controlled release of encapsulated substances. They can also be tailored to respond to external stimuli such as pH, temperature, or light, leading to smart hydrogels capable of dynamic changes in their properties. Overall, the ability to customize their composition, swelling behavior, and responsiveness to stimuli makes hydrogels highly versatile and promising materials in a wide range of applications.

Key Takeaways

- The hydrogel market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 2, 500 product literatures, industry releases, annual reports, and other such documents of major hydrogel industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The expanding personal care and hygiene sector is poised to significantly drive the growth of the hydrogel market. Hydrogels, with their unique properties such as high water content, excellent absorbency, and soft texture, are increasingly incorporated into various personal care and hygiene products. In items such as diapers, sanitary napkins, and adult incontinence products, hydrogels enhance moisture retention, providing improved comfort and dryness for users. In addition, hydrogel-based products offer advantages such as odor control and leakage prevention, further augmenting their appeal in the personal care sector.

According to Cosmetic Europe, the personal care association, Europe's 500 million consumers rely on cosmetic and personal care products daily for health protection, well-being enhancement, and self-esteem boost, including antiperspirants, fragrances, makeup, shampoos, soaps, and sunscreens. Oberlo reports that the personal care industry in the U.S. grew by 2.95% in 2022 and is expected to continue expanding in 2023, reaching $ 42.2 billion, stimulating demand. consumer awareness regarding hygiene and comfort continues to rise, demand for innovative hydrogel-based solutions is expected to surge. Moreover, the aging population and increasing disposable income in emerging economies contribute to market growth, as consumers seek higher-quality and more sophisticated personal care products. Overall, the expanding Personal Care and Hygiene sector represents a significant driver for the continued expansion of the hydrogel market.

The growth of the hydrogel market is significantly impeded by the limited availability of raw materials. Hydrogels, which are crucial in various applications such as wound care, agriculture, and drug delivery, rely on specific polymers and cross-linking agents. The scarcity of these raw materials can lead to increased production costs and supply chain disruptions. For instance, key components like polyacrylamide and natural polymers may face supply constraints due to environmental regulations or competition from other industries. This limitation not only affects the production capacity but also the ability to innovate and meet market demands. As a result, companies might experience delays and increased operational costs, which can ultimately hinder market expansion. Addressing these challenges requires strategic sourcing, investment in alternative materials, and advancements in recycling and sustainability practices to ensure a stable supply of raw materials and support the hydrogel market’s growth trajectory.

Agricultural and soil management present a significant opportunity for the growth of the hydrogen market. Hydrogen, particularly when produced using renewable energy sources through electrolysis, can be utilized in various agricultural applications to improve soil health, enhance crop yields, and optimize water usage. Hydrogen-based technologies, such as fuel cells and hydrogen-powered machinery, offer sustainable solutions for irrigation, fertilization, and soil remediation, reducing greenhouse gas emissions and dependence on fossil fuels. Additionally, hydrogen can be integrated into precision agriculture systems to monitor soil moisture levels, nutrient content, and crop health, enabling farmers to make data-driven decisions and optimize resource allocation. As the agricultural sector faces challenges related to climate change, water scarcity, and sustainable farming practices, there is growing interest in hydrogen-based solutions to address these issues. By collaborating with agricultural stakeholders and leveraging technological advancements, the hydrogen market can capitalize on this opportunity to support sustainable agriculture and contribute to global food security.

Patent Analysis of Global Hydrogel Market

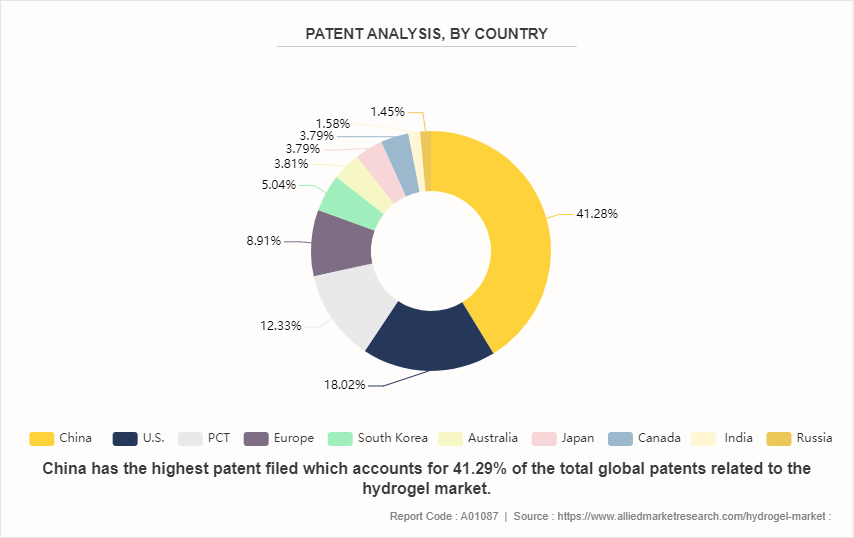

Based on the distribution of patents, China holds the largest share in the hydrogel market, with 41.29% of patents. Following China is the U.S., with 18.02%, and the PCT (Patent Cooperation Treaty) region with 12.33%. The Europe holds 8.91% of patents, while the South Korea, Australia, Japan, and Canada each contribute between 3.79% and 5.04%. India and the Russian Federation have smaller shares, with 1.58% and 1.45% respectively. This analysis indicates a strong emphasis on hydrogel innovation in China and the U.S., with notable contributions from other regions as well.

Market Segmentation

The hydrogel market is segmented into raw material, composition, form, product, application and region. Based on raw material, the market is classified into synthetic, natural, and hybrid. Based on composition, the market is classified into polyacrylate, polyacrylamide, silicone-modified hydrogels, agar and others. By form, the market is divided into amorphous and semicrystalline. Based on product, the market is classified into semicrystalline buttons, amorphous gels, impregnated gauze, films and matrices and hydrogel sheets. By application, the market is divided into contact lenses, hygiene products, wound care, drug delivery, tissue engineering, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

The major players operating in the hydrogel market include 3M Company, Procyon Corporation, Essity Aktiebolag AB, PAUL HARTMANN AG, Ashland Global Holdings Inc, Medline Industries, Inc., Smith & Nephew plc, The Cooper Companies, Inc., B. Braun Holding GmbH & Co. KG, Cardinal Health, Inc.

Recent Key Strategies and Developments

- In November 2023, Innosphere Ventures Fund has decided to make an additional investment in GelSana, a company specializing in advanced wound care. This move highlights GelSana's hydrogel technology's potential for innovation in meeting the requirements of advanced wound treatment.

- In March 2022, CooperVision's recent announcement in the U.S. introduced plastic-neutral silicone hydrogel 1-day contact lenses, broadening choices for eye care professionals. This move not only enhances the company's position but also reinforces its commitment to environmental responsibility by reducing plastic waste.

- In January 2022, NEXGEL, Inc., a prominent developer of gentle hydrogel products with high water content for both healthcare and consumer applications, recently introduced the MEDAGEL ClearComfort Hydrogel Patch.

- In March 2021, Johnson & Johnson Vision has been granted authorization by the Japanese Ministry of Health, Labour and Welfare (MHLW) for ACUVUE Theravision with Ketotifen, marking it as the inaugural vision correction contact lens to alleviate allergic eye itch. This strategic move facilitated the company's expansion and advancement.

- In February 2021, Axonics Modulation Technologies Inc. expanded its business and product portfolio through the acquisition of Contura and its Bulkamid injection, a hydrogel treatment for stress urinary incontinence. This acquisition broadened Axonics' offerings, strengthening its position in the market for treating this condition.

- In January 2020, Ferring B.V. obtained approval from the Minister of Health, Labor, and Welfare (MHLW) Japan to market their hydrogel-based drug delivery device designed for cervical ripening. This approach facilitated the company's customer base expansion.

Regional Market Outlook

Asia-Pacific is experiencing robust economic growth. The Asia-Pacific region is witnessing a surge in demand for hydrogels, driven by robust growth in various sectors. Countries like China, India, and Japan are experiencing rapid expansion in personal care and hygiene, agriculture, pharmaceuticals, and healthcare industries. Hydrogels find extensive application in these sectors due to their unique properties such as moisture retention, absorbency, and biocompatibility. In personal care and hygiene, hydrogels are used in products like diapers and sanitary napkins. In agriculture, they aid in water retention and soil conditioning. In addition, hydrogel-based pharmaceuticals and medical devices are gaining popularity, further fueling market growth in the region.

- ECHEMI projected a 17% year-on-year growth for China's pharmaceutical industry in 2022. Approximately 14% of the nation's total pharmaceutical market is attributed to digestive and metabolic drugs.

- The expanding middle-class and aging demographic, alongside increasing urbanization and rising incomes, are key drivers of pharmaceutical sales growth in China. As per CEIC Data, pharmaceutical sales revenue in China surged to $ 223, 946 million in June 2022 from $ 146, 041 million in April 2022. The nation hosts a sizable and varied domestic pharmaceutical industry, featuring roughly 5, 000 manufacturers, including numerous small to medium-sized enterprises.

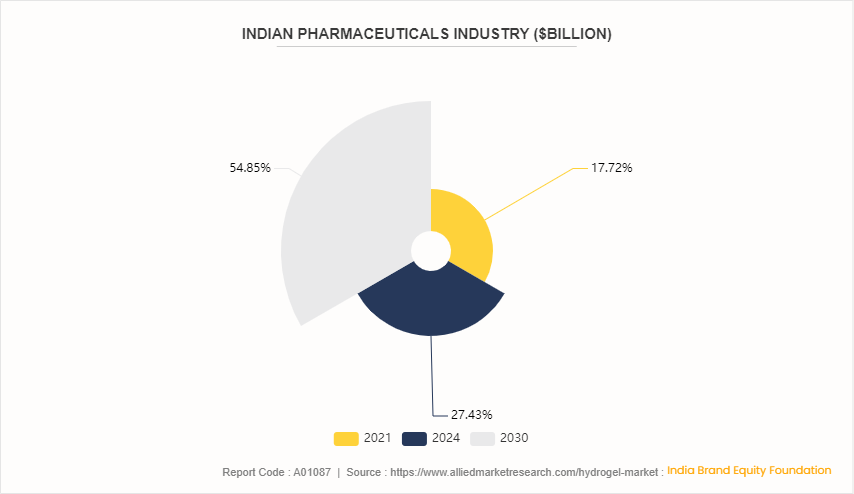

- India stands out as a significant and growing participant in the global pharmaceutical industry. As per PIB India, it serves as one of the leading sources of generic medications globally, contributing 20% of the global supply in terms of volume. Indian pharmaceuticals are shipped to over 200 nations, with particular emphasis on the U.S. as a primary destination.

- As per the Director General of the Pharmaceutical Export Promotion Council of India (Pharmexcil) , India shipped pharmaceutical products, encompassing bulk drugs and drug intermediates, valued at $ 24.62 billion (INR 1, 75, 040 crore) during the fiscal year 2021-22.

- In addition, India experienced a 4.22% increase in pharmaceutical exports from April to October 2022, reaching $ 14.57 billion, compared to $ 13.98 billion in the preceding fiscal year.

- Moreover, the Indian Pharma industry is projected to achieve a market value of $ 130 billion by 2030, as per the Indian Brand Equity Foundation. In contrast, global pharmaceutical production revenue is predicted to approach almost $ 1 trillion by the conclusion of 2023.

- Thus, expanding pharmaceuticals, and healthcare industries are expected to drive the growth of hydrogel market in Asia-Pacific.

The Expanding India Pharmaceutical Industry Will Drive the Growth of the Hydrogel Market

The expanding Indian pharmaceutical industry is set to drive the growth of the hydrogel market. Hydrogels, known for their versatile applications in drug delivery, wound care, and tissue engineering, are increasingly in demand due to the rising production of advanced medical products in India. With the Indian government's initiatives to boost healthcare infrastructure and local pharmaceutical manufacturing, the hydrogel market is poised for significant growth. Enhanced R&D activities and the adoption of innovative medical technologies further bolster the market's expansion prospects in the region.

Industry Trends

- The advent of 3D printing technology has transformed biomedical engineering, especially in crafting intricate hydrogel structures. Hydrogels, resembling the natural extracellular matrix of tissues and possessing high water content, exhibit ideal properties for biomedical use. Precise 3D printing capabilities enable the customization of implants and tissue scaffolds, closely mimicking biological environments for enhanced functionality.

- Key players in the hydrogel market are actively securing funds to expand production and advance development. For instance, in March 2023, SolasCure concluded a series B investment round, bolstering the progress of Aurase Wound Gel. This innovation in wound care holds promise for improved patient outcomes, underscoring ongoing advancements in the field.

- The emergence of smart hydrogels represents a significant advancement in material science and biomedical engineering. Smart hydrogels possess responsive properties that enable them to adapt to environmental stimuli such as temperature, pH, or specific molecules. This responsiveness allows for precise control over drug delivery, tissue engineering, and sensing applications. By incorporating elements such as nanoparticles or responsive polymers, smart hydrogels can dynamically alter their structure, making them valuable tools for targeted therapy, controlled release systems, and biosensing devices in various biomedical fields.

- Major players in the hydrogel market are actively engaged in innovative efforts to expand their product lines and improve existing offerings.

- For instance, On August 31, 2023, the Biomedical Engineering team at HKU unveiled a groundbreaking hydrogel with potential applications in wound healing.

- On June 20, 2023, FesariusTherapeutics, a biogenerative technology firm, revealed in its announcement that DermiSphere™, an innovative hydrogel, demonstrated efficacy in treating full-thickness skin loss in a single application.

Key Sources Referred

- Indian Brand Equity Foundation

- Pharmaceutical Export Promotion Council of India

- PIB India

- CEIC Data

- ECHEMI

- Cosmetic Europe - The Personal Care Association

- Menstrual Hygiene Management (MHM)

- The World Bank Group

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hydrogel market analysis from 2024 to 2033 to identify the prevailing hydrogel market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the hydrogel market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global hydrogel market trends, key players, market segments, application areas, and market growth strategies.

Hydrogel Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 45.7 Billion |

| Growth Rate | CAGR of 6.9% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Raw Material Type |

|

| By Composition |

|

| By Form |

|

| By Product |

|

| By Application |

|

| By Region |

|

| Key Market Players | Cardinal Health, Inc., Medline Industries, Inc., Procyon Corporation, The Cooper Companies, Inc., Smith & Nephew plc, 3M Company, B. Braun Holding GmbH & Co. KG, Essity Aktiebolag AB, PAUL HARTMANN AG, Ashland Global Holdings Inc |

Asia-Pacific is the largest regional market for Hydrogel.

The hydrogel market was valued at $23.4 billion in 2023 and is estimated to reach $45.7 billion by 2033, exhibiting a CAGR of 6.9% from 2024 to 2033.

The Contact lenses is the leading application of Hydrogel Market.

3M Company, Procyon Corporation, Essity Aktiebolag AB, PAUL HARTMANN AG, Ashland Global Holdings Inc, Medline Industries, Inc., Smith & Nephew plc, The Cooper Companies, Inc., B. Braun Holding GmbH & Co. KG, Cardinal Health, Inc. are the top companies to hold the market share in Hydrogel.

Agriculture and environmental applications is the upcoming trend of Hydrogel Market in the globe.

Loading Table Of Content...