Hydrogen Aircraft Market Research, 2050

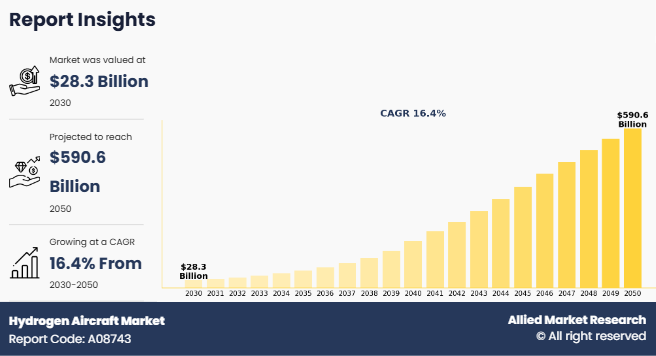

The global hydrogen aircraft market was valued at $28.3 billion in 2030, and is projected to reach $590.6 billion by 2050, growing at a CAGR of 16.4% from 2030 to 2050.

Report Key Highlights

• The hydrogen aircraft market is studied in more than 16 countries. The analysis includes a country-by-country breakdown analysis in terms of value available from 2022 to 2032.

• The research combined high-quality data, professional opinion and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

• The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the market.

• The hydrogen aircraft market share is marginally fragmented, with players such as Thales, AeroVironment, Inc., GKN AEROSPACE, PIPISTREL, URBAN AERONAUTICS LTD, Alaka'I, Airbus, AeroDelft, HES Energy Systems, and ZeroAvia, Inc. Major strategies such as contracts, partnerships, expansion, and other strategies of players operating in the market are tracked and monitored.

Market Definition and Introduction

A hydrogen airplane is an aircraft that utilizes hydrogen as its primary fuel source instead of conventional jet fuel. Hydrogen-powered aircraft are considered as a solution to decarbonize the aviation sector, aligning with global initiatives to combat climate change and reduce greenhouse gas emissions. The two main models of hydrogen aircraft are combustion hydrogen planes, and fuel cell hydrogen planes. Combustion of hydrogen planes relies on modified engines that use hydrogen as fuel. In fuel cell hydrogen planes model, hydrogen is converted into electricity within fuel cells, which then power electric propulsion systems to turn propellers. The only by-products of this process are heat and water, resulting in zero emissions during flight. Research on hydrogen as a potential fuel to power zero-emission aircraft has been on rise in the recent years. The aviation sector is working to develop technologies to address challenges related to hydrogen storage, safety concerns, and cost considerations.

The hydrogen aircraft market growth is majorly driven by increase in air passenger traffic across the globe, high suitability of hydrogen as an aviation fuel, and a rise in environmental awareness and zero emission targets. However, high costs associated with production and handling hydrogen, and technical challenges related to aircraft design and hydrogen storage hinder the growth of the market. On the contrary, development of green hydrogen ecosystem, and proactive government initiatives toward hydrogen powered aircraft are anticipated to offer remunerative opportunities for the players operating in the market during the forecast period.

Market Dynamics

Increase in air passenger traffic across the globe

A surge has been witnessed in the number of individuals seeking and utilizing air transportation services due to various factors such as economic growth, enhanced air travel, expansion of travel and tourism, and globalization. For instance, according to International Air Transport Association (IATA), in 2024, global air traffic, measured in revenue passenger kilometers (RPKs), grew by 10.4% as compared to 2023, surpassing prepandemic (2019) levels by 3.8%. Increase in demand for air traffic directly impacts on the hydrogen aircraft industry, leading to a rise in the need for additional aircraft to accommodate the growing numbers of passengers. As air travel becomes increasingly popular, there is rise in awareness of its environmental impact, prompting the aviation industry to prioritize sustainability. This pressure drives the adoption of alternative fuels like hydrogen, which offer both cost-effectiveness and environmental benefits. As airlines strive to minimize operational expenses, the attractiveness of hydrogen as a sustainable aviation fuel grows with rise in demand for air travel.

Technical challenges related to aircraft design, and hydrogen storage

Accommodating hydrogen propulsion systems in aircraft design demands extensive alterations as compared to conventional designs, leading to escalated development costs and complexities. Moreover, ensuring the safety and dependability of onboard hydrogen storage systems presents additional engineering challenges. Hydrogen's volatile nature mandates specialized storage solutions capable of withstanding extreme conditions encountered during flight. Redesigning commercial planes to meet hydrogen storage requirements, such as cryogenic conditions and larger storage space, significantly increases the intricacy and expenses of aircraft development. Despite the lighter weight of hydrogen, it demands up to four times more storage space than traditional jet fuel for comparable speed and range, further complicating storage solutions. In addition, safely containing superchilled liquid hydrogen poses engineering hurdles, particularly in maintaining effective insulation to prevent leaks and metal absorption. Achieving efficient hydrogen combustion in airborne turbines or developing advanced fuel cells and electric powertrains presents technical obstacles. These systems must exhibit reliability and performance on par with or superior to existing propulsion technologies. These technical challenges prolong development timelines and heighten operational risks associated with hydrogen-powered aircraft. Thus, aerospace manufacturers and operators hesitate to invest in or adopt hydrogen aircraft until these technical barriers are adequately addressed.

Development of green hydrogen ecosystem will create lucrative growth opportunities

The aerospace industry continues to develop technology to build the world’s first zero-emission commercial aircraft by 2035. Green hydrogen is one of the most recent developments in aviation fuel, which has been an essential component of net-zero climate strategies. For the aviation industry, green hydrogen is expected to play a key role as fuel in future aircraft. Thus, aviation authorities across the world are increasing investments in green hydrogen as it is an essential component for net-zero climate strategies. For instance, in June 2021, Airbus aimed for green hydrogen to power future zero-emission aircraft when it reaches the market by 2035. In addition, the European Commission announced that it is working on installing at least 40 GW capacity of electrolyzers or up to 10 million megatons of green hydrogen by 2030. Along with the European Union, Japan, China, South Korea, and the U.S. have also started to invest on green hydrogen for aviation fuels. However, it is also necessary to develop infrastructure to distribute green hydrogen once generated. Hence, Airbus urged airports to develop on-site facilities to produce hydrogen within proximity to operations. However, a green hydrogen ecosystem is expected to need to take shape to ensure its availability to fuel future needs of the aviation industry. Therefore, the development of the green hydrogen ecosystem is expected to offer lucrative growth opportunities for the hydrogen aircraft market. Such factors will create lucrative growth opportunities in the hydrogen aircraft.

Segment Review

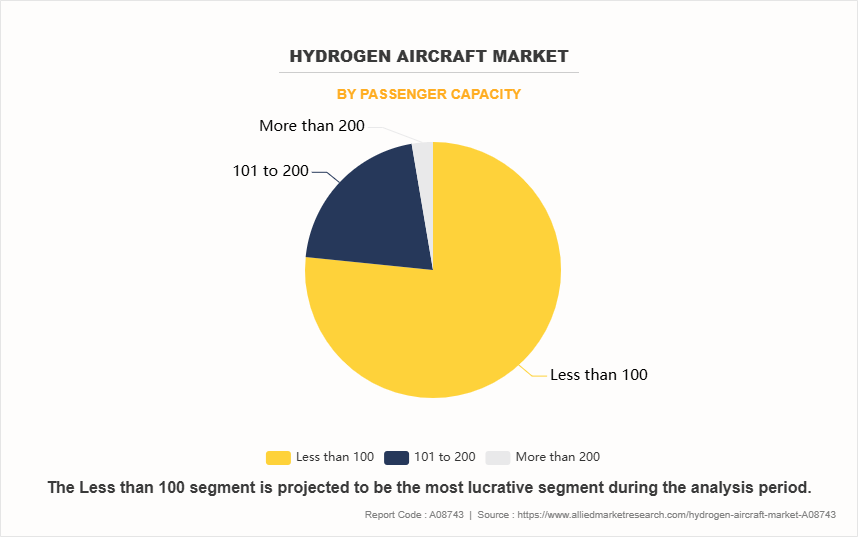

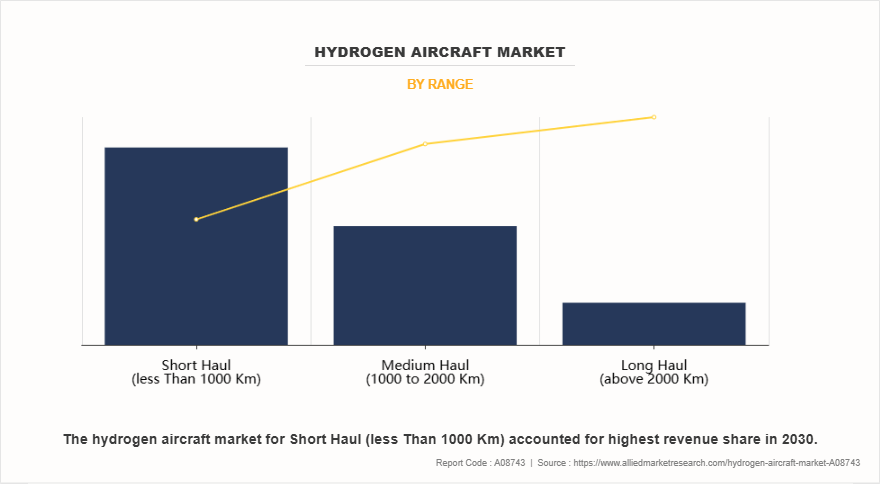

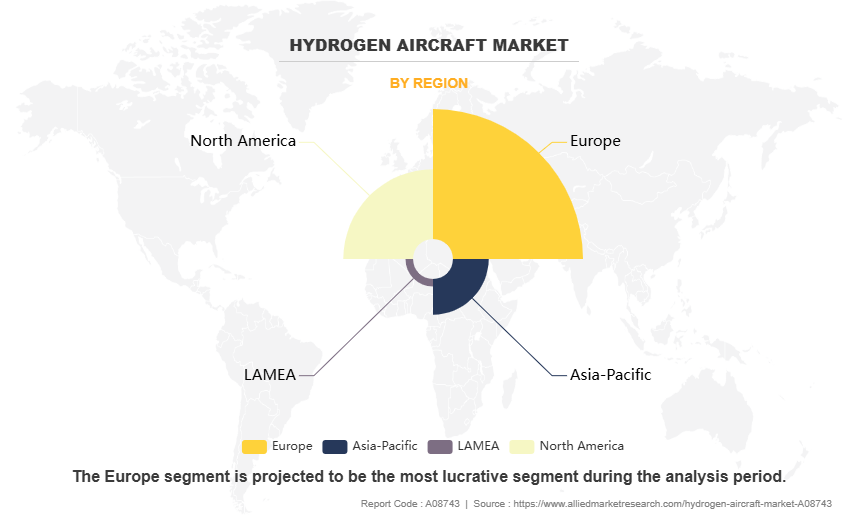

The hydrogen aircraft market report is segmented into passenger capacity, range, application, power source, power input, and region. By passenger capacity, the market is divided into less than 100, 101 to 200, and more than 200. On the basis of range, it is classified into short haul (less than 1000 km), medium haul (1000 to 2000 km), and long haul (above 2000 km). Depending on application, it is bifurcated into passenger aircraft and cargo aircraft. By power source, the market is divided into liquid hydrogen aircraft, fully hydrogen powered aircraft, hybrid electric aircraft, and hydrogen fuel cell aircraft. On the basis of power output, it is classified into 0 to 100 KW, 100 KW to 1 MW, and 1 MW and above. Region-wise, the market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, Russia, Italy, Spain, and Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and Rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

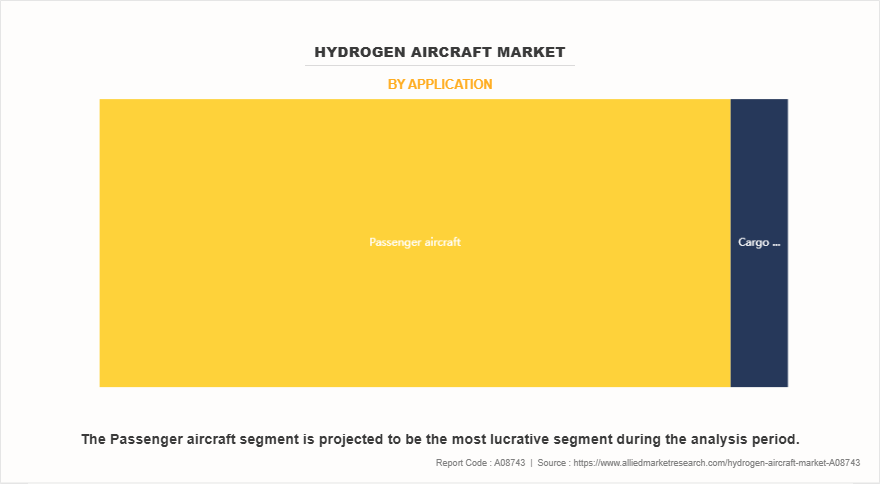

By Application

On the basis of application, the market is classified into application, it is bifurcated into passenger aircraft and cargo aircraft. The passenger aircraft segment holds a significant share due to the rising demand for air travel, fleet expansion by airlines, and increasing investments in advanced aviation technologies. The growth is further driven by the surge in international and domestic tourism, coupled with the need for efficient passenger management systems. buildings, parking structures, and transit hubs, to develop efficient solutions.

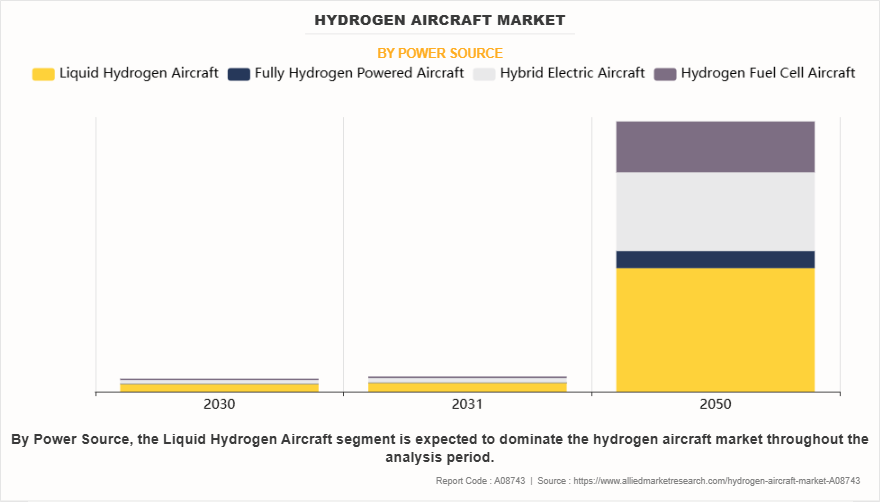

By Power Source

On the basis of power source, the market is divided into liquid hydrogen aircraft, fully hydrogen powered aircraft, hybrid electric aircraft, and hydrogen fuel cell aircraft. The liquid hydrogen aircraft segment accounted for the largest share in 2030. Owing to its high energy density, making it a viable alternative to conventional jet fuels for long-haul and high-capacity flights. Liquid hydrogen offers superior fuel efficiency and lower carbon emissions compared to other hydrogen-based propulsion systems, aligning with global sustainability goals and stricter aviation emission regulations.

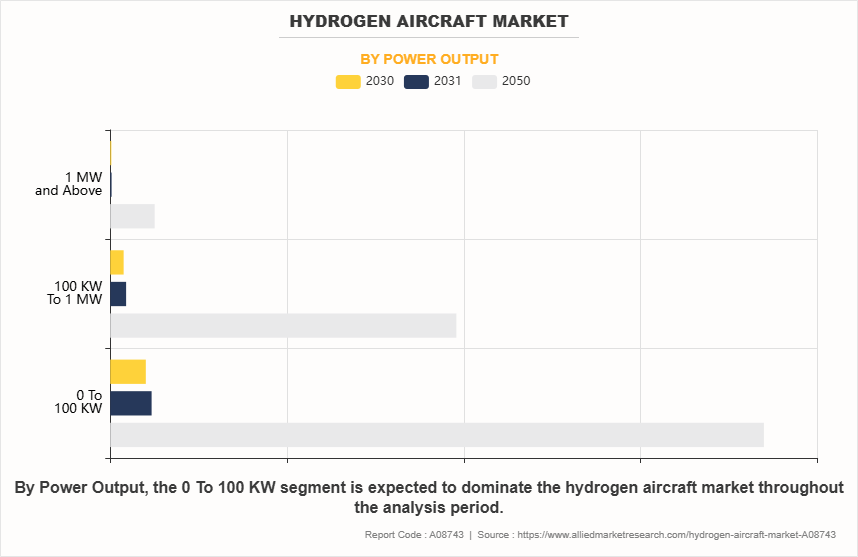

By Power Output

On the basis of power output, it is classified into 0 to 100 KW, 100 KW to 1 MW, and 1 MW and above. The 0 to 100 KW is expected to generate the largest share in 2030, driven by the growing adoption of hydrogen-powered propulsion systems in small aircraft, drones, and urban air mobility solutions. The demand for lightweight and energy-efficient powertrains in short-haul and regional aviation is further accelerating the segment's growth.

By Passenger Capacity

By passenger capacity, the market is divided into less than 100, 101 to 200, and more than 200. The less than 100 segments accounted for the largest share in 2030. This segment is driven by increasing demand for compact and efficient solutions, advancements in technology enhancing performance and reliability, and a growing preference for cost-effective options across various industries. Additionally, rising investments in research and development, coupled with supportive government policies, have further fueled the expansion of this segment.

By Range

On the basis of range, the market is classified into short haul (less than 1000 km), medium haul (1000 to 2000 km), and long haul (above 2000 km). The short haul (less than 1000 km) segment holds a significant share, driven by the increasing deployment of vertiports to support urban air mobility (UAM) initiatives. The growing demand for safe and efficient takeoff and landing infrastructure for eVTOL aircraft is also a key factor proposing the segment’s growth. In addition, advancements in materials and smart technologies, such as automated lighting and weather monitoring systems, enhance the operational efficiency of landing pads.

By Region

Region-wise, the hydrogen aircraft market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, Russia, and rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). The market in the Europe region is growing rapidly due to stringent emissions regulations and aggressive sustainability goals. The EU’s commitment to achieve net-zero carbon emissions by 2050 is pushing the aviation sector toward alternative fuels, including hydrogen. Investment in hydrogen-powered aircraft projects has increased, with Airbus’ ZEROe concept leading the way. For instance, in July 2024, Airbus partnered with aircraft lessor Avolon to explore the potential of hydrogen-powered aircraft, marking the first collaboration of the ZEROe Project with an operating lessor.

Competitive Analysis

Competitive analysis and profiles of the major global hydrogen aircraft market players that have been provided in the report include Thales, AeroVironment, Inc., GKN AEROSPACE, PIPISTREL, URBAN AERONAUTICS LTD, Alaka'I, Airbus, AeroDelft, HES Energy Systems, and ZeroAvia, Inc. The key strategies adopted by the major players of the global market are product launch and mergers & acquisitions.

Top Impacting Factors

The global hydrogen aircraft market is expected to witness notable growth registering a CAGR of 16.4%, The market is expected to witness notable growth owing to increase in air passenger traffic across the globe, rise in environmental awareness and zero emission targets, and high suitability of hydrogen as an aviation fuel. Moreover, proactive government initiatives toward hydrogen powered aircraft and development of green hydrogen ecosystem are expected to provide lucrative opportunities for the growth of the market during the forecast period. On the contrary, technical challenges related to aircraft design, hydrogen storage and high costs associated with production and handling of hydrogen limit the growth of the hydrogen aircraft market forecast.

Historical Data & Information

The global hydrogen aircraft market is competitive, owing to the strong presence of existing vendors. Vendors in the global vertiports market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors as they can cater to market demands, which are higher than the supply. The competitive environment in this market is expected to increase owing to technological innovations, product extensions, and different strategies adopted by key vendors.

Key Developments/Strategies in hydrogen aircraft

- In July 2024, GKN AEROSPACE developed H2FlyGHT, a $54 million project to create a 2-megawatt cryogenic hydrogen-electric propulsion system, advancing sustainable aviation. It builds on H2GEAR technology that introduced advanced thermal management solutions to enhance efficiency.

- In March 2024, GKN AEROSPACE developed & tested a cryogenic liquid hydrogen fuel system as part of an industry consortium in the UK called HyFIVE. The HyFIVE consortium aims to develop and test scalable liquid hydrogen fuel system technologies, culminating in a fully integrated hydrogen fuel system ground demonstration. The UK Government is funding half of the $50 million three-year program through the Aerospace Technology Institute with the other half coming from industry. This strategy helps to establish robust cryogenic hydrogen systems supply chain for future hydrogen aircraft.

- In February 2024, AIRBUS developed hydrogen-powered commercial aircraft, ZEROe with a plan to launch it by 2035. It is currently studying the use of hydrogen fuel cells with a propeller propulsion system that generates nearly zero emissions. It is laying the groundwork to establish a green hydrogen production and distribution network in the Asia-Pacific region.

- In September 2023, PIPISTREL, German Aerospace Center (DLR), EKPO Fuel Cell Technologies, Fundación Ayesa, and H2FLY, a wholly owned subsidiary of Joby Aviation jointly developed piloted flight of a liquid hydrogen-powered electric aircraft. The aircraft uses liquid hydrogen to power a hydrogen-electric fuel system that powered the aircraft for the entire flight. H2FLY developed aircraft in partnership with Pipistrel, German Aerospace Center (DLR), EKPO Fuel Cell Technologies, and Fundación Ayesa.

Key Benefits of Stakeholders

- This study comprises analytical depiction of the global hydrogen aircraft market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall global hydrogen aircraft market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current global market forecast is quantitatively analyzed from 2023 to 2033 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in hydrogen aircraft.

- The report includes the market share of key vendors and the global market.

Hydrogen Aircraft Market Report Highlights

| Aspects | Details |

| Market Size By 2050 | USD 590.6 billion |

| Growth Rate | CAGR of 16.4% |

| Forecast period | 2030 - 2050 |

| Report Pages | 347 |

| By Application |

|

| By Power Source |

|

| By Power Output |

|

| By Passenger Capacity |

|

| By Range |

|

| By Region |

|

| Key Market Players | AeroVironment, Inc., Thales, HES Energy Systems Pte. Ltd., GKN AEROSPACE, Urban Aeronautics Ltd., AeroDelft, ZeroAvia, Inc., AIRBUS, Alaka'i, PIPISTREL |

Europe is the largest regional market for hydrogen aircraft.

The upcoming trends of hydrogen aircraft market include increase in air passenger traffic across the globe, rise in environmental awareness and zero emission targets, and high suitability of hydrogen as an aviation fuel.

The passenger aircraft is the leading application of hydrogen aircraft market.

The hydrogen aircraft market is expected to reach at $28.3 billion in 2030.

Thales, AeroVironment, Inc., GKN AEROSPACE, PIPISTREL, URBAN AERONAUTICS LTD are the top companies to hold the market share in Hydrogen Aircraft.

Loading Table Of Content...

Loading Research Methodology...