Hydrogen Compressor Market Overview

The Global Hydrogen Compressor Market size was $2.3 billion in 2022, and is projected to reach $3.3 billion by 2032, growing at a CAGR of 4% from 2023 to 2032. This is driven by increasing use in the automotive sector. Additionally, rising investments in the oil, gas, and energy industries have positively influenced market expansion. Their efficiency in compressing small to medium volumes of hydrogen to high pressure makes them widely applicable in chemical and oil & gas sectors.

Market Dynamics & Insights

- The hydrogen compressors industry in Asia-Pacific held a significant share of over 32.7% in 2022.

- The hydrogen compressors industry in U.S. is expected to grow significantly at a CAGR of 3.7% from 2023 to 2032

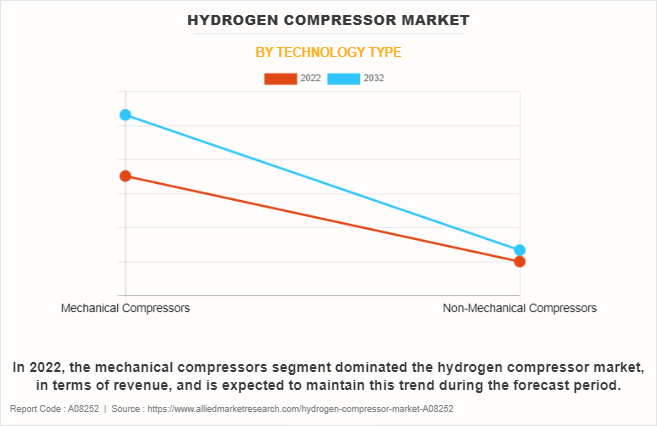

- By technology type, mechanical compressors segment is one of the dominating segments in the market and accounted for the revenue share of over 78% in 2022.

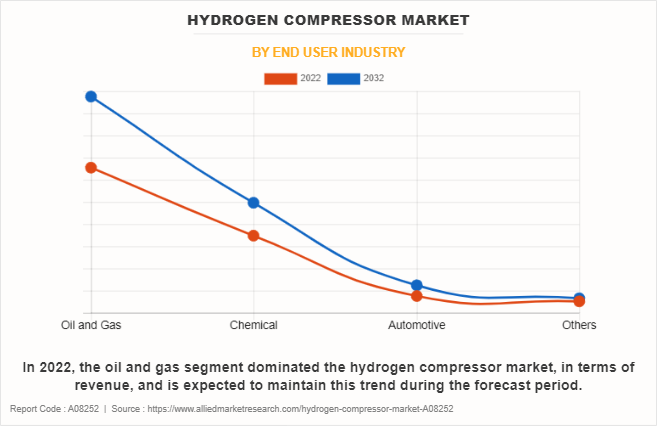

- By end-user, the automotive segment is the fastest growing segment in the market.

Market Size & Future Outlook

- 2022 Market Size: $2.3 Billion

- 2032 Projected Market Size: $3.3 Billion

- CAGR (2023-2032): 4%

- Asia-Pacific: Largest market in 2022

- Asia-Pacific: Fastest growing market

What is Meant by Hydrogen Compressor

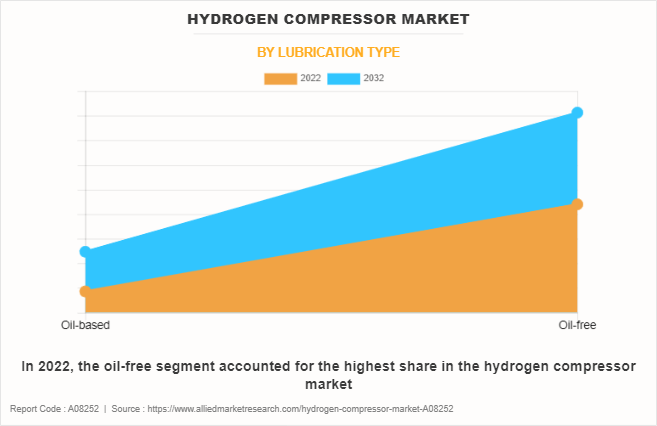

A hydrogen compressor reduces the volume of hydrogen gas to increase the pressure, resulting in compressed hydrogen or liquid hydrogen. Positive displacement or centrifugal compressors are the most common kind of compressors used to compress gaseous hydrogen. The oil-based hydrogen compressor exhibits various advantages in several end-user industries.

Market Dynamics

Factors such as an increase in hydrogen consumption from end-user industries and the construction of hydrogen pipeline infrastructure are expected to boost the market growth. Furthermore, the demand for oil-based compressors has been witnessed to increase significantly in the recent years. This is attributed to the fact that oil-based compressors are more efficient than oil-free compressors, as oil functions as a cooling medium, eliminating around 80% of the heat generated by the compressor during compression. Thus, this factor is expected to notably contribute toward the hydrogen compressor market growth during the forecast period. However, risk of early wear and tear of hydrogen compressor components, owing to inadequate lubrication, potentially increases the maintenance cost of oil-based hydrogen compressors.

Hence, high purchasing and maintenance costs of hydrogen compressor hamper the market growth. Several firms are developing and launching new products. In addition, various key players in this market are signing agreement to develop new hydrogen compressors with latest technology. For instance, in February 2021, Burckhardt Compression signed an agreement with Switzerland-based company, GRZ Technologies. The aim of this agreement is to develop new hydrogen compression technology.

Thermal active metal hydrides will be used in the technology, which will be used in several hydrogen fuel stations, energy storage systems, and other applications. In the next years, such technical advancements are anticipated to generate huge potential for the industry during the forecast period. In addition, growth associated with the oil industry and natural gas production is a prominent factor that may fuel the market demand during the forecast period. According to EIA's Annual Energy Outlook, U.S. crude output is going to increase by 20% by 2030, and the demand for natural gas is estimated to attain around 15.6% growth over the next few years. Further, expenditure by the U.S. oil and gas companies is expected to increase during the forecast period.

However, an increase in environmental awareness is likely to emerge as a restraining factor for the global market. On the contrary, the surge in demand for hydrogen compressors in ethylene plants is anticipated to provide lucrative opportunities for the growth of the market.

The hydrogen compressor market is witnessing various obstructions in its regular operations due to the COVID-19 pandemic and inflation. Earlier, the global lockdowns resulted in reduced industrial activities, eventually leading to reduced demand for hydrogen compressor from various sectors such as construction and industrial. However, COVID-19 has subsided, and the major manufacturers in 2023 are performing well. However, rise in global inflation is a new major obstructing factor for the entire industry.

The inflation, which is a direct result of the Ukraine-Russia war, and few long-term impacts of the coronavirus pandemic, have introduced volatility in the prices of raw materials used for manufacturing hydrogen compressor. In addition, the cost of oil & gas has also increased substantially, and many countries, especially, the countries in Europe, Latin America, and developing economies in Asia-Pacific are experiencing severe negative impacts on industrial production, including the production of hydrogen compressor. However, India and China are performing relatively well. In addition, inflation is expected to worsen in the coming years, as the possibility of the ending of the war between Ukraine and Russia is less. However, a peace agreement between Ukraine and Russia can be devised, with continued talks between different countries.

Hydrogen Compressor Market Segmental Overview

The hydrogen compressor market is segmented into Technology Type, Lubrication Type, End User Industry and Region. On the basis of technology type, the market is bifurcated into mechanical and nonmechanical. By lubricant type, it is segregated into oil-based and oil-free. Depending on the end-user industry, it is fragmented into oil & gas, chemical, automotive, and others. Region-wise, the market analysis is conducted across North America, Europe, Asia-Pacific, and LAMEA.

By Technology Type:

The hydrogen compressor market is divided into mechanical and nonmechanical. In 2022, the mechanical compressors segment dominated the hydrogen compressor market, in terms of revenue, and is expected to maintain this trend during the forecast period. Mechanical hydrogen compressors reach gravimetric and volumetric energy densities close to the DOE 2017 targets with efficiencies up to 95%. In addition, mechanical compressors have large-volume requirements, slow reaction kinetics, and the need for special thermal control systems, all of which limit large-scale development. Moreover, these compressors are safe, inexpensive, and efficient for operations. Thus, all these factors collectively drive the growth of the market.

Moreover, mechanical hydrogen compressor does not have moving components, have noiseless operations, and exhibits high reliability & safety along with structural simplicity and enhanced compactness, which further offer lucrative opportunities for the market players. In addition, various government are investing in hydrogen fuel plants which will create demand for mechanical hydrogen compressors. For instance, in April 2022, the UK government announced the creation of a new Future System Operator (FSO) to oversee the UK’s energy system including emerging technologies and the arrival of the UK Energy Security Strategy. the UK government published a package of proposals in support of the UK hydrogen policy, including in particular a policy paper titled "Hydrogen Investor Roadmap: leading the way to Net zero". Thus, all these factors collectively drive the growth of the market.

By Lubrication Type:

The hydrogen compressor market is categorized into oil based and oil-free. In 2022, the oil-free segment accounted for the highest share in the hydrogen compressor market. In applications such as fuel cells, semiconductor manufacturing, and certain industrial processes, maintaining high-purity hydrogen is crucial for optimal performance. Oil-free compressors eliminate the risk of oil contamination, ensuring the purity of compressed hydrogen, which drives the demand for these compressors in industries that require ultra-clean hydrogen. In addition, oil-free compressors mitigate safety concerns associated with oil-based compressors.

Hydrogen is highly flammable, and the presence of oil in the compression system can pose a safety risk. Oil-free compressors address this concern, making them more desirable, especially in applications where safety is a top priority. The use of oil-free compressors aligns with these goals with increase in emphasis on sustainability and environmental responsibility. These compressors reduce the potential for oil leaks and minimize the environmental impact associated with oil disposal by eliminating the need for oil lubrication, making them more environment friendly.

By End-User Industry:

The Hydrogen Compressor Market is categorized into oil and gas, chemical, automotive and others. In 2022, the oil and gas segment dominated the hydrogen compressor market, in terms of revenue, and is expected to maintain this trend during the forecast period. Increase in investment in the oil & gas sector is likely to boost the demand for hydrogen compressors. In addition, surge in adoption of hydrogen fuel cell vehicles is expected to positively influence the demand for hydrogen compressors. For example, a Combined Hybrid Solution of Metal Hydride and Mechanical Compressors (COSMHYC), a research project funded by the Fuel Cell and Hydrogen Joint Undertaking of the European Commission, developed an innovative metal hydride compressor prototype and started its testing. In the preliminary tests, the COSMHYC metal hydride compressor prototype achieved high-pressure values of more than 430 bar.

Expansion of oil & gas sector in Middle East region has created demand for hydrogen compressors and thus is anticipated to drive the market growth. For instance, in May 2022, ADNOC announced a plan to construct a new liquefied natural gas plant in Fujairah that would more than double its export capacity, with production of as much as 9.6 million tons a year. The newly formed UAE Hydrogen Alliance between ADNOC, ADQ, and Mubadala is projected to offer opportunities to include potential partnerships, production, storage, transportation, security, and other technologies. Moreover, Asia-Pacific is expected to be the promising market for hydrogen compressors in the coming years, on account of the favorable government policies for boosting the manufacturing sector in countries such as China, Japan, and India. China is one of the largest and fastest growing hydrogen compressor markets in Asia-Pacific, owing to the development of its oil & gas sector in recent years.

By Region:

The Hydrogen Compressor Market analysis is done across North America, Europe, and Asia-Pacific. Asia-Pacific accounted for the highest market share in 2022 and is expected to maintain its dominance during the forecast period. Asia-Pacific constitutes the fastest growing manufacturing hubs such as China, Japan, India, South Korea, and Thailand for the hydrogen compressors industry, which acts as a key driving force of the market. In addition, the availability of labor and increase in industrialization drive the market growth in Asia-Pacific. Moreover, China is the highest producer and exporter of hydrogen compressors in Asia-Pacific, followed by Japan and India, which is still expanding its manufacturing capabilities. Furthermore, rapid in industrialization and government initiatives for upliftment of manufacturing sector in automotive and chemical industries drive the growth of the hydrogen compressors market in Asia-Pacific. For instance, in March 2022, Sinopec, China’s second-largest oil company invested $476 million in hydrogen technology research and development and has planned a number of pilot green hydrogen projects. The company will prioritize the development of renewable-energy projects, particularly those involving hydrogen, in its transition to a low-carbon business structure. Hence, such factors are providing lucrative growth in the hydrogen compressors market.

Competition Analysis

Competitive analysis and profiles of the major players having significant hydrogen compressor market share are Ariel Corporation, Atlas Copco AB, Burckhardt Compression AG, Fluitron, Inc, HAUG Sauer Kompressoren AG, Hitachi, Ltd., Chart Industries (Howden Group), IDEX Corporation, Ingersoll Rand, Inc., and Nel ASA. There are some important players in the market such as Ariel Corporation, Atlas Copco AB, and . Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the hydrogen compressor market.

What are the Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging hydrogen compressor market trends and dynamics.

- In-depth analysis is conducted by constructing market estimations for the key market segments between 2020 and 2032.

- Extensive analysis of the hydrogen compressor market is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive analysis of all regions is provided to determine the prevailing hydrogen compressor market opportunities.

- The hydrogen compressor market forecast analysis from 2023 to 2032 is included in the report.

- The key market players within hydrogen compressor market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the hydrogen compressor industry.

Hydrogen Compressor Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 3.3 billion |

| Growth Rate | CAGR of 4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 234 |

| By Technology Type |

|

| By Lubrication Type |

|

| By End User Industry |

|

| By Region |

|

| Key Market Players | ARIEL CORPORATION, Ingersoll Rand Inc., Burckhardt Compression Holding AG, Hitachi Ltd., Fluitron Inc., Chart Industries, Inc. (Howden Group), ATLAS COPCO AB, NEL ASA, HAUG SAUER KOMPRESSOREN AG, IDEX CORPORATION |

Analyst Review

The hydrogen compressors are used in different industries such as chemical, oil & gas, and automobile. Multiple types of hydrogen compressors are available in the market, including piston compressors, hydrogen electrochemical compressors, hydride compressors, and piston-metal diaphragm compressors, which are chosen depending on the application. Each form of hydrogen compressor has a particular way of functioning, which changes according to the design.

Hydrogen compressors are massively used in hydrogen refueling stations. Major market key players are improving their product portfolio by launching hydrogen compressors for this application. For instance, in September 2023, Atlas Copco launched the H2P, a hydrogen compressor capable of following the electrolysis production profile. The compressor compensates for fluctuations in hydrogen production and ensures optimal efficiency, thereby reducing energy losses.

These new products are technologically sophisticated and work more efficiently and effectively than their prior product line. Hence, they are extensively employed in several end-user industries, which, in turn, is anticipated to notably contribute toward the growth of the global market.

The global hydrogen compressor market was valued at $2,254.6 million in 2022, and is projected to reach $3,321.1 million by 2032, registering a CAGR of 4.0% from 2023 to 2032.

The base year considered in the global Hydrogen Compressor market report is 2022.

The oil-free is the leading lubrication type of the Hydrogen Compressor Market.

Asia-Pacific is the largest regional market for Hydrogen Compressor.

Rise in demand for hydrogen compressor from end-user industry vertical are are the upcoming trends of Hydrogen Compressor Market in the world.

Ariel Corporation, Atlas Copco AB, Burckhardt Compression AG, Fluitron, Inc, HAUG Sauer Kompressoren AG, Hitachi, Ltd., Chart Industries (Howden Group), IDEX Corporation, Ingersoll Rand, Inc., and Nel ASA are the top companies to hold the market share in Hydrogen Compressor.

The top 10 market players are selected based on two key attributes- competitive strength and market positioning.

The report contains an exclusive company profile section, where the leading 10 companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Loading Table Of Content...

Loading Research Methodology...