Hydrogen Fuel Cell Vehicle Market Insights, 2033

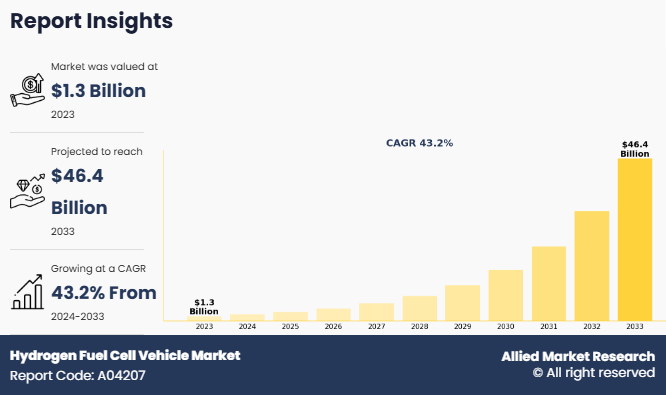

The global hydrogen fuel cell vehicle market size was valued at USD 1.3 billion in 2023, and is projected to reach USD 46.4 billion by 2033, growing at a CAGR of 43.2% from 2024 to 2033. The hydrogen fuel cell vehicle market is fueled by supportive government initiatives, R&D advancements, and rising demand for zero-emission vehicles, though limited infrastructure poses challenges. Growing adoption in commercial and heavy-duty applications presents lucrative opportunities, driven by strict emission regulations and global zero-emission targets.

Key Market Trends

· Technology Trend: Proton exchange membrane fuel cells are expected to witness strong growth in the market.

· Vehicle Type Trend: Passenger vehicles are projected to drive significant demand in the coming years.

· Range Trend: Vehicles with a range of 251–500 km are anticipated to capture notable market share.

Market Size & Forecast

- 2033 Projected Market Size: USD 46.4 billion

- 2023 Market Size: USD 1.3 billion

- Compound Annual Growth Rate (CAGR) (2024-2033): 43.2%

Report Key Highlighters:

The hydrogen fuel cell vehicle market size study covers 14 countries. The research includes regional and segment analysis of each country in terms of value for the projected period.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

The hydrogen fuel cell vehicle industry share is highly fragmented, into several players including

Introduction

Hydrogen fuel cell vehicles, also known as fuel cell electric vehicles (FCEVs), are a type of electric vehicle that utilizes hydrogen gas as fuel to generate electricity. Unlike battery electric vehicles, which rely on stored electrical energy in batteries, hydrogen fuel cell vehicles produce electricity onboard through a chemical reaction between hydrogen and oxygen. Hydrogen fuel cell vehicles are more efficient as compared to conventional internal combustion engine vehicles and produce no harmful tailpipe emissions. Hydrogen fuel cell vehicles only emit water vapor and warm air.

Market Dynamics

The hydrogen fuel cell vehicle industry growth is driven by supportive government initiatives for the development of hydrogen fuel cell technology, rise in research and development activities, and rise in demand for zero-emission vehicles. However, lack of refueling stations, insufficient hydrogen infrastructure and storage, and growing inclination towards electric vehicle segment hinder the growth of the market. On the contrary factors such as growing advancement in the commercial hydrogen fuel cell vehicle and development of hydrogen fuel cell commercial and heavy-duty vehicles offer lucrative opportunity for hydrogen fuel cell vehicle market forecast.

As hydrogen vehicles offer various benefits, various government and regulatory bodies are supporting the use of these vehicles. Moreover, governments around the world are implementing strict regulations to reduce greenhouse gas emissions and air pollution. To achieve the zero-emission target, regulatory bodies are increasingly promoting the use of zero-emission vehicles, especially in the transportation and logistics sector.

Several policies have been deployed by the different governments and regulatory bodies to promote the use of hydrogen fuel cell and other sustainable fuel vehicles. For instance, the state of California in the U.S. committed funds for the development of 100 hydrogen refueling stations throughout the country to meet its target of 1.5 million zero-emission vehicles by 2025, which is driving the growth of the hydrogen fuel cell vehicle market growth. Furthermore, introduction of Inflation Reduction Act (IRA) of 2022 is further expected to boost the sales of hydrogen electric vehicles in the U.S The law grants hydrogen fuel cell vehicles a $7,500 tax credit. The IRA will also provide a tax credit of $3 per KG for the generation of clean hydrogen. Thus, these types of subsidies and incentives, and strong government support are expected to drive the production and sales of hydrogen fuel cell vehicles during the forecast period.

What are the Recent Developments in the Hydrogen Fuel Cell Vehicle Market

Leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

On September 5, 2023,Toyota Motor Corporation launched a prototype of its Hilux model with hydrogen fuel cell electric powertrain . According to the company, the developed technology will help to accelerate the development of hydrogen fuel cell solutions and achieve its multi-path strategy for achieving carbon-free mobility. The new pick-up was revealed at Toyota UK’s vehicle plant in Derby, England, where it has been developed with a joint venture between consortium partners, and was supported by UK Government funding. The new vehicle utilizes core elements from the Toyota Mirai hydrogen fuel cell electric sedan technology that has proved its quality in almost 10 years of commercial production. Toyota Motor Corporation also stated that the newly developed vehicle produces no tailpipe emissions and emits just pure water. The vehicle stores hydrogen in three high-pressure fuel tanks, and can provide an expected driving range of more than 600 km.

On August 3, 2023, Ballard Power Systems, Inc. signed an agreement with Ford Trucks to supply a fuel cell system as part of the development of a hydrogen fuel cell-powered vehicle prototype. This strategy includes an initial purchase order for 2 FCmoveTM.-XD 120 kW fuel cell engines that are planned to be delivered by Ballard to Ford Trucks in 2023. According to Ford, it will develop a Fuel Cell Electric Vehicle (FCEV) F-MAX as part of this joint venture. The 120 kW FCmove-XD fuel cell engines will be integrated into Ford Trucks’ F-MAX 44-ton long-haul tractor truck. Ford plans to build and assemble the fuel cell-powered F-MAX in Turkey as part of the European Union Horizon Europe ZEFES (Zero Emission Freight EcoSystem) project goals.

On August 8, 2023, Ballard Power Systems, Inc. announced they have received an order for a total of 96 hydrogen fuel cell engines from long-standing customer Solaris Bus & Coach, a major European bus manufacturing company. The purchase orders include 52 fuel cell engines that will power Solaris Urbino hydrogen buses for deployment by public transport in Germany and 44 fuel cell engines that will power Solaris buses in European cities. This order resulted in the addition of more than 110 fuel cell buses by Solaris to date in Europe. that Solaris has deployed in Europe till date.

Which are the Top Hydrogen Fuel Cell Vehicle companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the hydrogen fuel cell vehicle industry.

- BMW Group

- TOYOTA MOTOR CORPORATION

- Honda Motor Co., Ltd.

- Mercedes-Benz Group AG (formerly Daimler AG)

- Stellantis NV

- AB Volvo

- Hyundai Motor Group

- AUDI AG

- MAN SE

- General Motors

Segmental Analysis

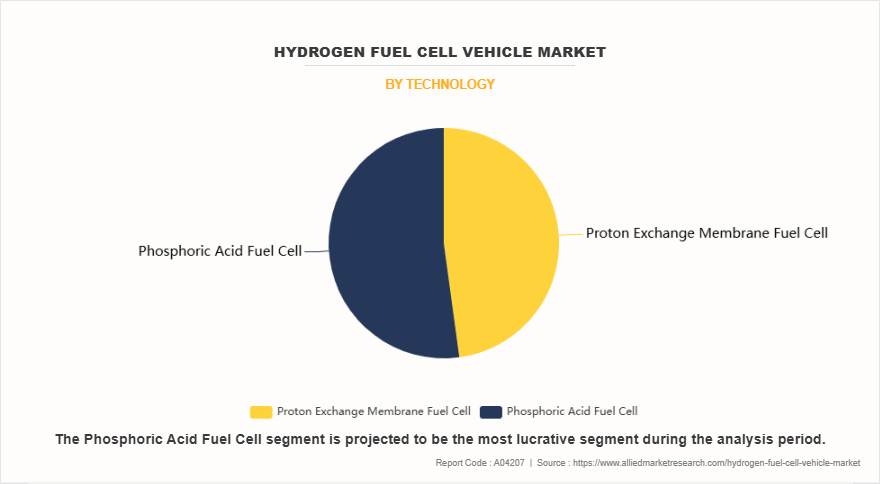

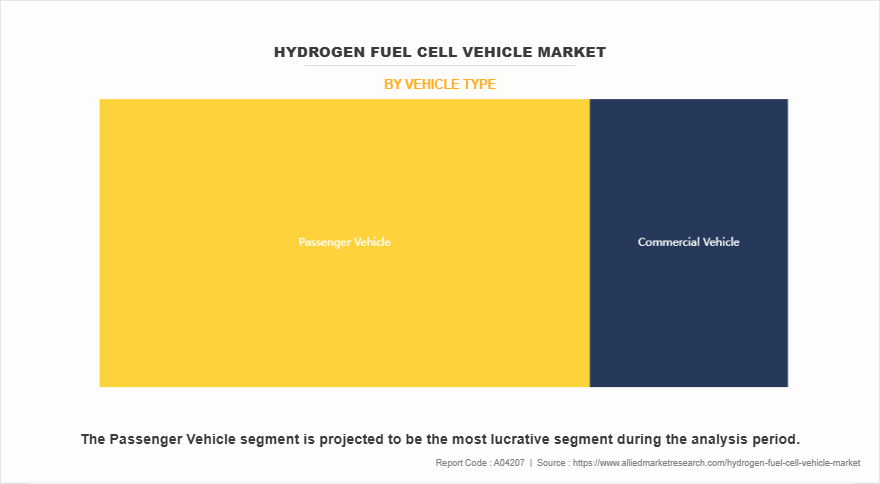

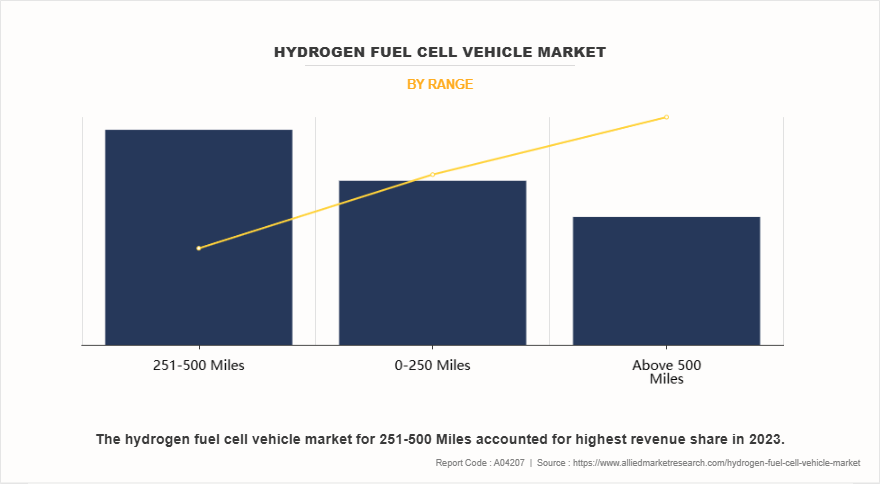

The hydrogen fuel cell vehicle market share is segmented into technology, vehicle type, range, and region. On the basis of technology, the market is segregated into proton exchange membrane fuel cell, and phosphoric acid fuel cell. Based on vehicle type, the market is segmented into passenger vehicle and commercial vehicle. On the basis of range, the market is fragmented into 0-250 miles, 251-500 miles, above 500 miles. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

By Technology

On the basis of technology, the global market is segmented into proton exchange membrane fuel cell, and phosphoric acid fuel cell. The proton exchange membrane segment accounted for the largest market share in 2023, as proton exchange membrane fuel cell offers high efficiency in converting hydrogen and oxygen into electricity, especially under varying load conditions. The increased efficiency is crucial for vehicles to provide good mileage and responsiveness. Additionally, proton exchange membrane fuel cells are compact and lightweight and are thus ideal in vehicles where space and weight constraints are important.

By Vehicle Type

Based on vehicle type, the hydrogen fuel cell vehicle market is segregated into passenger vehicles and commercial vehicle. The passenger vehicle segment accounted for a dominant market share in 2023, as hydrogen fuel cell technology is more affordable to implement in smaller vehicles due to their lower power requirements. The use of hydrogen fuel cell technology in commercial vehicles increases the overall production cost of the vehicle. Furthermore, commercial vehicles require higher energy capacity due to heavier payloads and thus, the hydrogen fuel cell technology is limited to the passenger vehicles segment.

By Range

On the basis of range, the market is analyzed into 0-250 Miles, 251-500 Miles, and Above 500 Miles. The 251-500 Miles segment dominated the market share in 2023, as 251–500-mile range hydrogen vehicles offer optimal balance between cost, range, practicality, and infrastructure limitations. 251–500-mile segment vehicles cater to a broader consumer base and align with daily and occasional long-distance driving needs.

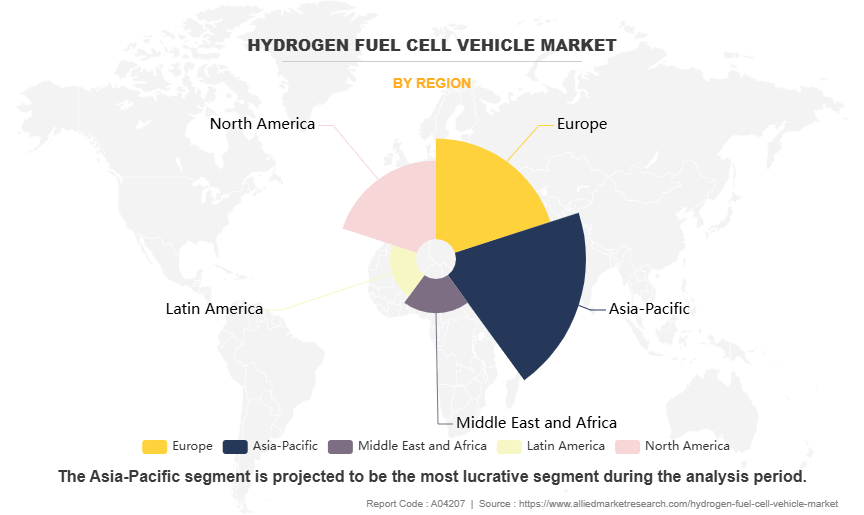

By Region

Region-wise, the global market is analyzed into North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America. The Asia-Pacific segment accounted for a dominated market share in 2023, owing to the presence of major players operating in the industry such as Hyundai Motor Group, Honda Motor Co., Ltd., TOYOTA MOTOR CORPORATION, and others. In addition, strong government support in the Asia-Pacific region, particularly in countries such as Japan, South Korea, and China, is driving the market for hydrogen fuel cell vehicles. The government in the region is offering subsidies, tax rebit, and incentives towards the purchase of new hydrogen fuel cell technology and other environmentally friendly vehicles. Furthermore, there are various government initiatives supporting the adoption of hydrogen fuel cell vehicles. For instance, the South Korea's Hydrogen Economy Roadmap has a goal of developing 6.2 million fuel cell vehicles by 2040. Additionally, the Japan's "Hydrogen Society" roadmap aims to establish a fully hydrogen-powered economy by 2050. Thus, government initiatives for the development of the hydrogen fuel cell vehicle technology are anticipated to drive the hydrogen fuel cell vehicle market growth.

What are the Top Impacting Factors

Key Market Driver

Development of Hydrogen Fuel Cell Commercial and Heavy-Duty Vehicles

In recent years there has been growing emphasis on development of heavy duty and commercial hydrogen fuel cell vehicles as these vehicles align well with the decarbonize initiative within the transportation sector, especially in areas where battery-electric vehicles fall short. Hydrogen fuel cell vehicles offer a compelling alternative. They provide high energy density, as they provide extended driving ranges and quick refueling times, which are essential for long-haul operations.

In recent years, numerous technologies have been launched in the market that support the eco-friendly concept to sustain the environment owing to rise in concerns of environment degradation and depletion of natural resources. Moreover, increase in awareness toward the consequences of air pollution and rise in levels of traffic & greenhouse gas emission drive the adoption of hydrogen fuel cell vehicle, as it is eco-friendly than other conventional vehicles. In addition, developments have been carried out by governments across the globe along with the key players operating in the industry to offer zero emission vehicles, which has created a positive trend toward the growth of the hydrogen fuel cell vehicle market demand across the globe. For instance, in December 2022, Toyota announced its plans to develop a hydrogen fuel cell version of its best-selling Hilux pickup. In addition, Toyota announced plans to produce hydrogen fuel-cell modules to replace heavy-duty diesel engines in Class 8 semi-trucks in 2023. Such developments create ample of hydrogen fuel cell vehicle market opportunity across the globe.

Restraints

Lack of Refueling Stations, and Insufficient Hydrogen Infrastructure and Storage

Hydrogen fuel cell vehicles offer several advantages, however, lack of refueling infrastructure for HFCV in most of the countries due to the limited number of hydrogen refueling stations, is hindering the growth of the market. The hydrogen refueling stations are limited to some countries such as U.S., China, Japan, South Korea, Germany, UK, and others. For instance, there were 226 operational hydrogen refueling stations in China, as of August 2024. Furthermore, limited presence of hydrogen refueling stations and high cost for development are the major factors impacting the growth of HFCV market in many developing countries such as Brazil, India, Mexico, and other African countries. The development of HFCV in underdeveloped countries is slower than in developed countries.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hydrogen fuel cell vehicle market analysis from 2023 to 2033 to identify the prevailing automotive valve opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global hydrogen fuel cell vehicle market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global hydrogen fuel cell vehicle market trends, key players, market segments, application areas, and market growth strategies.

Hydrogen Fuel Cell Vehicle Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 46.4 billion |

| Growth Rate | CAGR of 43.2% |

| Forecast period | 2023 - 2033 |

| Report Pages | 280 |

| By Range |

|

| By Technology |

|

| By Vehicle Type |

|

| By Region |

|

| Key Market Players | TOYOTA MOTOR CORPORATION, Stellantis NV, AUDI AG, Honda Motor Co., Ltd., MAN SE, Hyundai Motor Group, Mercedes-Benz Group AG (former Daimler AG), AB Volvo, General Motors, BMW Group |

Analyst Review

Hydrogen fuel cell generates electricity from hydrogen while the vehicle is running. Hydrogen fuel cell vehicles do not create any greenhouse gas (GHG) emissions during vehicle operation unlike diesel-powered and gasoline vehicles. Furthermore, extensive support from the government to propel hydrogen fuel cell infrastructure provides offers of growth opportunities for the sector.

By vehicle type, passenger vehicle is a dominant segment in 2016. Based on technology, the others fuel cell segment is expected to register the highest CAGR of 72.4% during the forecast period, followed by proton exchange membrane fuel cell and phosphoric acid fuel cell with CAGR 71.9% and 69.9% respectively.

Honda, Toyota, Hyundai, Daimler, Audi, BMW, Volvo, Ballard Power Systems, General Motors, and MAN are the key market players operating in the hydrogen fuel cell vehicle market.

Increase in focus towards heavy-duty vehicle are the upcoming trend in the hydrogen fuel cell vehicle market across the globe.

The 251-500 Miles is the leading segment of hydrogen fuel Cell vehicle market

Asia-Pacific is the largest region for hydrogen fuel cell Vehicle market.

The hydrogen fuel cell vehicle market was valued at $1.3 Billion in 2023.

Hyundai Motor Group, AB Volvo, Mercedes-Benz Group AG (former Daimler AG), AUDI AG, Honda Motor Co., Ltd., General Motors, BMW Group, MAN SE are some of the major companies operating in the market.

Loading Table Of Content...

Loading Research Methodology...