Hydrogen Fueling Station Market Insights, 2035

The global hydrogen fueling station market size was valued at USD 756.4 million in 2024, and is projected to reach USD 22,015.6 million by 2035, growing at a CAGR of 35.9% from 2024 to 2035.

Report Key Highlights:

- The report covers a detailed analysis on the hydrogen fueling station market used in transportation industry.

- The hydrogen fueling station market has been analyzed from the year 2024 till the year 2035.

- Latest developments have been mentioned in the research study.

- Top companies operating in the industry has been profiled in the research study.

- The research study includes different segments & regions across which the market has been analyzed.

Hydrogen fueling stations market have gained tremendous focus after the successful progress with cell electric vehicles, which came into existence depending on hydrogen power. Thus, hydrogen filling stations have attracted much attention following the recent success of cell electric vehicles powered by hydrogen. These stations generally consist of a hydrogen storage system, a cooling system, and a dispenser with a nozzle that connects with the fuel cell vehicle. It is designed to route highly pressured hydrogen to the nozzle for refueling the vehicle with up to 700 bar or in other cases, 350 bar. The hydrogen refueling process is constantly monitored electronically & takes roughly three minutes to refuel a fuel cell electric vehicle (FCEV). Currently, the increased number of retail hydrogen fueling locations in select markets supports the initial rollout of fuel cell electric vehicles (FCEVs). Manufacturers including Honda, Hyundai, and Toyota are currently offering production FCEVs for sale or lease to customers in markets where hydrogen fuel is available, primarily in California (U.S.).

For instance, in December 2021, ITM Power PLC partnered with Hyundai Motors UK, an automobile manufacturing company, to develop a hydrogen refueling network for refueling Hyundai’s iX35 Fuel Cell Vehicles. The contract covers fuel dispensed across ITM Power's hydrogen refueling network. This is the fifth fuel supply contract ITM Power has signed, and Hyundai joins Toyota, Commercial Group, Arcola Energy and Arval as fuel customers. Moreover, various scale component manufacturers have unveiled significant efforts to boost their manufacturing capabilities & introduce innovative systems that will pave new opportunities for the global hydrogen fueling station market. For instance, in May 2023, Aers Energy België signed a contract with Air Products to develop a multi-fuel, hydrogen refueling station for trucks.

It will be located on a concession in the port of Zeebrugge. In Addition, in April 2022, TotalEnergies announced the opening a new hydrogen refueling station in Breda, The Netherlands. The station was a part of the Interreg project ‘Hydrogen region 2.0’, coordinated by H2 knowledge and cooperation platform WaterstofNet. Furthermore, the refueling station was capable of supplying hydrogen with both 700 and 350 bar filling pressures. The factors such as stringent government regulations to control increasing pollution, high suitability of hydrogen as fuel, and increase in R&D activities related to hydrogen fuel cell technology supplement the growth of the industry. However, high initial expenditure for producing hydrogen and lack of fuel infrastructure are the factors expected to hamper the growth of the market. In addition, technological advancements and future potential in the hydrogen fuel cell vehicle and increasing investments & encouragement in administrative policy framework creates market opportunities for the key players operating in the hydrogen fueling station market.

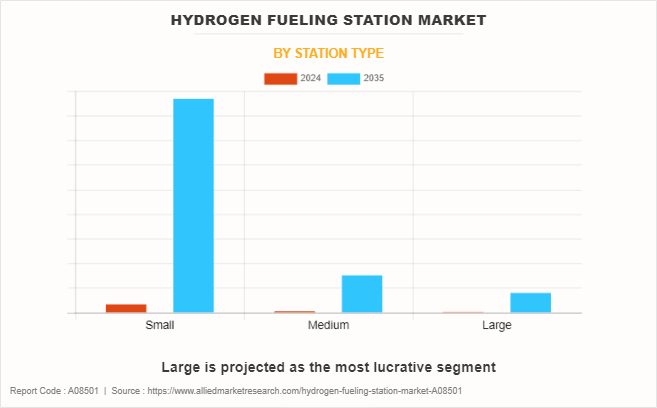

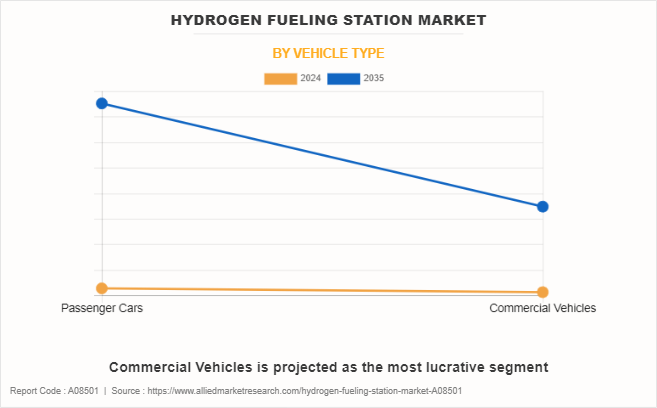

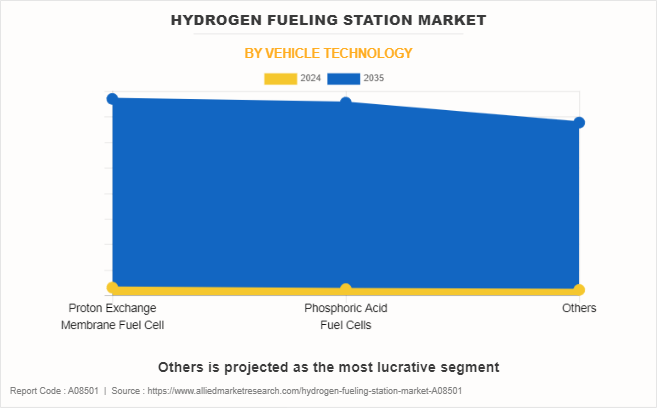

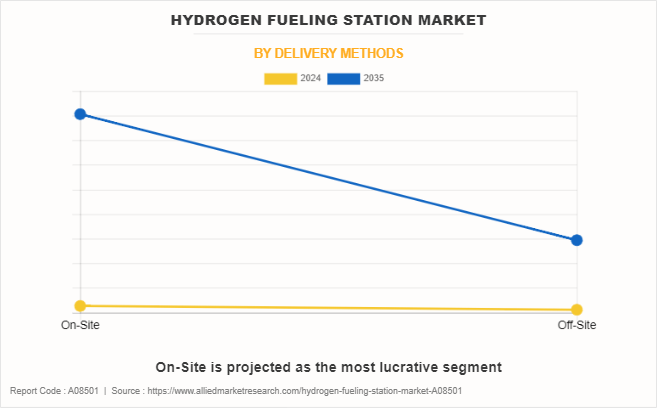

The global hydrogen fueling station market is segmented on the basis of station type, vehicle type, vehicle technology, delivery method, and region. By station type, the market is divided into small, medium, and large. By vehicle type, it is fragmented into passenger cars and commercial vehicles. By vehicle technology, it is categorized into proton exchange membrane fuel cell, phosphoric acid fuel cells, and others. By delivery methods, it is further classified into on-site and off-site. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The leading players operating in the hydrogen fueling station market are Air Liquide, Air Products and Chemicals, Inc., Ballard Power Systems, Black and Veatch Holding Company, China Petrochemical Corporation, Cummins Inc., FirstElement Fuel, Inc., FuelCell Energy, Inc., H2ENERGY Solutions LTD, ITM Power PLC, NEL ASA, Nuvera Fuel Cells, LLC, PDC Machines Inc., Shell, Linde PLC, TotalEnergies, and TrueZero.

Stringent government regulations to control increasing pollution

Unlike conventional power generation sources, fuel cells do not emit hazardous gases and pollution which is harmful for the environment. Also, depletion of natural resources, carbon emissions, and rise in cost of fossil fuels is paving way for alternate means of transportation and power generation. Therefore, continuous efforts have been taken by both public and private sectors to reduce carbon emissions and save fuel. Strict government regulations related to CO2 and SO2 emission drive the growth of the hydrogen fueling station industry globally. For instance, in 2020, the European Commission issued a regulatory proposal confirming an 81g/km target by 2025, and 59g/Km target by 2030. Strict government regulations such as 81g/km CO2 emissions in Europe and 113g/Km CO2 emissions after 2022 by Corporate Average Fuel Economy (CAFE) in the U.S., are the major factors supporting the growth of the hydrogen fueling station market. Hydrogen fuel cells are considered environment friendly as compared to the other conventional power generation systems, thereby increasing their demand worldwide. Strict government mandates in Asia-Pacific, mainly in China and Japan also contributes toward the growth of the hydrogen fueling market. In addition, “Go Green” revolution is another factor driving the market growth.

Increase in R&D activities related to hydrogen fuel cell technology

Increase in R&D activities related to hydrogen fuel cell technology has led to rise in joint developments and partnerships regarding adoption of hydrogen fueling stations. For instance, in July 2022, Shell collaborated with Shenergy Group, a state-owned enterprise owned by Shanghai government dealing in electricity, petroleum and natural gas, to set up a joint venture that worked to build a hydrogen refueling network in Shanghai. Furthermore, the joint venture plans to build six to 10 hydrogen refueling stations in Shanghai and the surrounding Yangtze River Delta in the next five years.

Moreover, governments across the globe are promoting the use of hydrogen powered vehicles. For instance, in 2019, the European Union (EU) started the H2Haul project, which will run for five years. This EU-funded project aims to deploy 16 zero-emission fuel cell vehicles at four sites i.e., Germany, Belgium, Switzerland, and France by 2024. Moreover, the California Air Resources Board (CARB), Toyota, Shell, and Kenworth started $82.0 million Zero-Emission and Near Zero-Emission Freight Facilities (ZANZEFF) project. With the use of this project Port of Los Angeles (POLA) is expected to establish a fuel-cell technology network for freight transport to move goods from “Shore to Store”. Hence, these factors are expected to propel growth of the hydrogen fueling station market during the forecast period.

High initial expenditure for producing hydrogen

Major automakers such as Daimler, Toyota, and Honda are planning for commercial launch of fuel cell vehicles, assuming fuel or refueling infrastructure to be supportive. Their fuel cell vehicle demonstration programs as well as future roll out plans depend on the availability of fuel pumps. California in the U.S. is the major center for fuel cell vehicle activities and is expected to be the largest market as it has the maximum number of hydrogen refueling stations. Moreover, heavy investment and intensive support by public and private entities are expected to be required to develop a supportive infrastructure. At present, there are only 573 refilling stations in the world (161 in Europe, 90 in North America, 14 in South America, and 308 in Asia), which are operational. Increase in demand in the fuel cell vehicles is suppressed by smaller number of refilling stations, which ultimately hinders the growth of the hydrogen fueling station market.

Technological advancements and future potential in the hydrogen fuel cell vehicle

In current business scenario, technological advancements have added additional features in these gadgets which have increased the fuel cell consumption. Various applications such as fuel cell vehicles, increase in use of fuel cell in the power backup system and many other applications are opportunistic for the growth of the hydrogen fueling station market. New technological advancement in the fuel cell technology leads to the development of new type of fuel cell such as solid oxide fuel cell (SOFC), polymer exchange membrane fuel cell (PEMFC), molten carbonate fuel cell (MCFC), phosphoric acid fuel cell (PAFC) and others, which help in reducing the cost of fuel cell. For instance, in February 2023, Air Liquide entered into a strategic partnership with TotalEnergies to develop a network of over 100 hydrogen stations for heavy duty vehicles in Europe.

Similarly, in April 2022, ITM Power PLC partnered with Motive, a 50/50 joint-venture owned between ITM Power PLC and Vitol, to support Motive with the development and roll-out of new green hydrogen refueling stations. This partnership helped facilitate increase of production, distribution and demand stimulation for hydrogen for transportation applications. Hence, the increase in adoption of fuel cell in various portable, stationary, and transportation applications is anticipated to provide opportunities for the development of the hydrogen fueling station market share.

Key Developments in Hydrogen Fueling Station Industry

- In June 2023, Air Liquide & Iveco Group opened the first high-pressure hydrogen station for long-haul trucks in Europe. This strategy marks a step forward in the two companies' commitment to the development of hydrogen mobility in Europe.

- In February 2023, Air Liquide entered into an agreement with TotalEnergies to develop a network of hydrogen stations for heavy-duty vehicles on major European road corridors. This strategy helps facilitate access to hydrogen, enabling the development of its use for goods transportation and further strengthening the hydrogen sector.

- In May 2023, Air Products and Chemicals, Inc. signed an agreement with Aers Energy België to develop a multi-fuel, hydrogen refueling station for trucks. The new station will be the first commercial-scale hydrogen refueling station in Europe with liquid hydrogen storage. It will be built and operated by Air Products in addition to other liquid hydrogen refueling stations the company is developing throughout Europe.

- In February 2021, Ballard Power Systems signed an agreement with Chart Industries, Inc. for the joint development of integrated system solutions that include a fuel cell engine with onboard liquid hydrogen (“LH2”) storage and vaporization for the transportation industry. Liquid hydrogen is well-suited for the transportation industry as its higher density, lower pressure, and ease of filling via liquid hydrogen pump contribute to the ability of larger mobile equipment to travel longer distances

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hydrogen fueling station market analysis from 2024 to 2035 to identify the prevailing hydrogen fueling station market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the hydrogen fueling station market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global hydrogen fueling station market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global hydrogen fueling station market trends, key players, market segments, application areas, and market growth strategies.

Hydrogen Fueling Station Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 22 billion |

| Growth Rate | CAGR of 35.9% |

| Forecast period | 2024 - 2035 |

| Report Pages | 355 |

| By Station Type |

|

| By Vehicle Type |

|

| By Vehicle Technology |

|

| By Delivery Methods |

|

| By Region |

|

| Key Market Players | H2Energy Solutions Ltd., Linde plc, ITM Power PLC, Ballard Power Systems, TrueZero, Cummins Inc., Nuvera Fuel Cells, LLC, SHELL, Air Products and Chemicals, Inc., PDC Machines Inc.,, FuelCell Energy, Inc.,, Nel ASA, Black & Veatch Holding Company, FirstElement Fuel Inc., TotalEnergies, China Petrochemical Corporation, Air Liquide |

The global hydrogen fueling station market size was valued at USD 756.4 million in 2024, and is projected to reach USD 22,015.6 million by 2035,

The global Hydrogen fueling stations market is projected to grow at a compound annual growth rate of 35.9% from 2024 to 2035.

Asia-Pacific is the largest regional market for Hydrogen Fueling Station

The leading players operating in the hydrogen fueling station market are Air Liquide, Air Products and Chemicals, Inc., Ballard Power Systems, Black and Veatch Holding Company, China Petrochemical Corporation, Cummins Inc., FirstElement Fuel, Inc., FuelCell Energy, Inc., H2ENERGY SOLUTIONS LTD, ITM Power PLC, NEL ASA, Nuvera Fuel Cells, LLC, PDC Machines Inc., Shell, Linde PLC, TotalEnergies, and TrueZero

The factors such as stringent government regulations to control increasing pollution, high suitability of hydrogen as fuel, and increase in R&D activities related to hydrogen fuel cell technology supplement the growth of the industry. However, high initial expenditure for producing hydrogen and lack of fuel infrastructure are the factors expected to hamper the growth of the market.

Loading Table Of Content...

Loading Research Methodology...