Hydropower Turbines Market Research, 2033

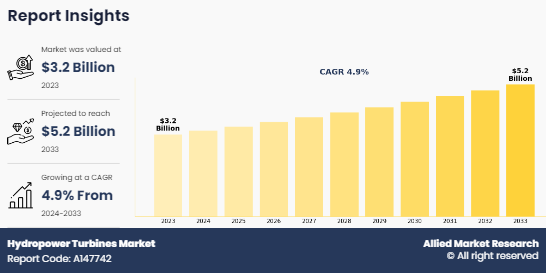

The global hydropower turbines market was valued at $3.2 billion in 2023 and is projected to reach $5.2 billion by 2033, growing at a CAGR of 4.9% from 2024 to 2033. The global hydropower turbines market is witnessing growth attributed to various factors, including increase in demand for renewable energy sources and advancements in hydropower turbine technology. However, market expansion is constrained by the availability of alternative energy sources such as solar and wind power generation. Despite this, the persistent demand within the energy sector for sustainable power generation solutions and government initiatives aimed at investing in hydropower turbines industry development present promising opportunities for the market growth.

Introduction

Hydropower turbines capture the energy of moving water and turn a shaft connected to a generator, thus producing electricity. They come in various designs and types, including francis, pelton, kaplan, and crossflow turbines, each suited for specific water flow and head conditions. Hydropower turbines play a crucial role in harnessing renewable energy from water resources, contributing to global electricity generation while minimizing environmental impact as compared to fossil fuel-based power generation.

Market Dynamics

The hydropower turbines market demands is driven by increase in demand for renewable energy sources and growing concerns about climate change and carbon emissions reduction. As major countries globally prioritize the transition towards sustainable energy sources, hydropower emerges as a reliable and clean alternative to traditional fossil fuels. Hydropower turbines harness the kinetic energy of flowing water to generate electricity without emitting greenhouse gases, making them an attractive option for mitigating the impacts of climate change. With governments and industries investing in renewable energy infrastructure, hydropower turbines are expected to play a crucial role in meeting the rise in global energy demand while advancing environmental sustainability goals.

The global energy landscape has seen significant shifts, with renewable energy sources such as hydropower gaining traction. From 2020 to 2022, hydropower capacity experienced a relative change of 4%, reaching a total capacity of 1,393 GW according to IEA. This growth reflects sustained interest and investment in hydropower infrastructure despite the diversification of the renewable energy mix. Solar energy saw a 46% relative change, while wind energy experienced a 23% relative change and an additional 167 GW of capacity added.

Despite these advancements, hydropower retains several advantages, such as reliability and energy storage capabilities. Hydropower turbines provide a consistent and predictable source of electricity, capable of adjusting output to meet fluctuating demand. In addition, hydropower facilities often serve dual purposes, offering flood control, irrigation, and water supply alongside electricity generation.

The hydropower turbines market remains resilient and expected for continued growth, with investments in R&D aimed at enhancing turbine efficiency, reducing environmental impacts, and integrating smart grid technologies. The complementary nature of different renewable energy sources suggests opportunities for hybrid systems that combine hydropower with solar, wind, or energy storage solutions, optimizing energy generation and grid stability.

The high initial investment costs associated with hydropower projects, including dam construction, turbine installation, transmission infrastructure, and environmental impact assessments, pose a significant barrier for expansion for the hydropower turbines market. These costs, which include the substantial capital required upfront, pose a significant risk to investors and project developers, slowing down the pace of hydropower project development. The lengthy project development timelines, spanning several years from initial planning and permitting to commissioning, further exacerbate the financial risks. In addition, the high initial investment costs limit the accessibility of hydropower projects to smaller-scale developers or regions with limited financial resources, potentially excluding regions with untapped hydroelectric potential from benefiting from this renewable energy source. The high initial investment costs of projects hinder hydropower turbines market growth potential as compared to other renewable energy alternatives.

The hydropower turbines market is expected to capitalize on the growing demand for reliable and sustainable energy sources in developing regions. Hydropower is a renewable energy source that provides a constant and reliable power supply, crucial for industrial activities, home power, and economic development. Its long lifespans and low operating costs make it financially viable for many developing countries. The abundant water resources in these regions make hydropower a prime energy source. Investing in hydropower capacity expansion aligns with sustainable development goals, as it reduces carbon emissions, mitigates climate change impacts, and enhances energy security by reducing dependence on fossil fuels. The development of hydropower infrastructure in these regions can stimulate local economies, create jobs, and improve living standards for communities near project sites. This socio-economic development aspect further enhances the appeal of investing in hydropower projects. Thus, the hydropower turbines market offers a sustainable solution to meet the energy needs of growing populations while contributing to economic development and environmental sustainability.

Among the patents analyzed in the growing hydropower turbines market in China, one stands out for its innovative approach to simulation systems. Patent number 1.116595708, credited to inventor Ji Huaijie, introduces an ROPN-based energy storage hydropower station water turbine start-stop analog simulation system. This groundbreaking system utilizes real-time operational neural network (ROPN) elements to mimic turbine behavior, facilitating optimization of start-stop processes in energy storage hydropower stations. Ji Huaijie's invention offers a comprehensive solution for analyzing turbine performance under varying conditions, ultimately aiding in the identification of optimal operating environments.

Segments Overview

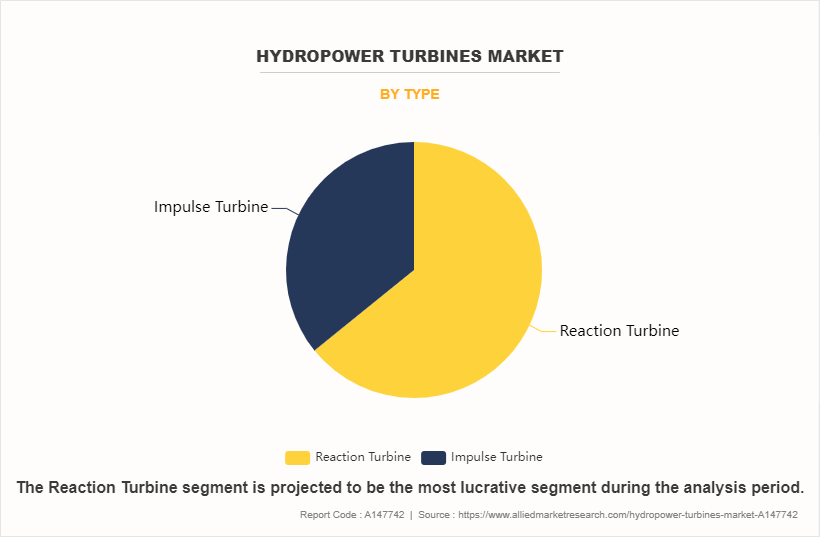

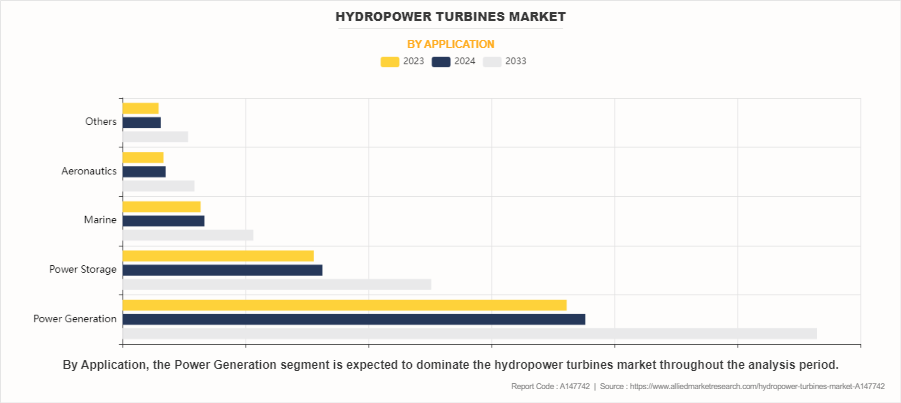

The hydropower turbines market is segmented into type, application, and region. On the basis of type, the market is bifurcated into reaction turbines and impulse turbines. On the basis of application, the market is segmented into power generation, power storage, marine, and aeronautics. Region-wise, the hydropower turbines market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The below is given hydropower turbines market overview on the basis of segments.

On the basis of type, reaction turbine dominated the market according for more than half of the hydropower turbines market share. Reaction turbines operate by harnessing both the kinetic energy and the potential energy of water flowing under pressure. Unlike impulse turbines, which operate at atmospheric pressure, reaction turbines are fully submerged in water. As a result, they are better suited for low to medium head applications, where the water pressure is sufficient to submerge the turbine blades.

On the basis of application, the market's application spectrum spans power generation, power storage, marine, and aeronautics sectors. Power generation is dominant in terms of hydropower turbines market size, followed by emerging applications in storage and niche markets such as marine and aeronautics. Hydropower turbines play a pivotal role in the generation of electricity by harnessing the power of flowing water. Hydropower turbines offer numerous advantages as a renewable energy source, including reliability, scalability, and minimal greenhouse gas emissions. Moreover, hydropower plants can be designed and scaled to suit diverse geographical and topographical conditions, from large reservoirs to small rivers and streams. This flexibility enables hydropower to contribute to energy access and economic development in regions with abundant water resources.

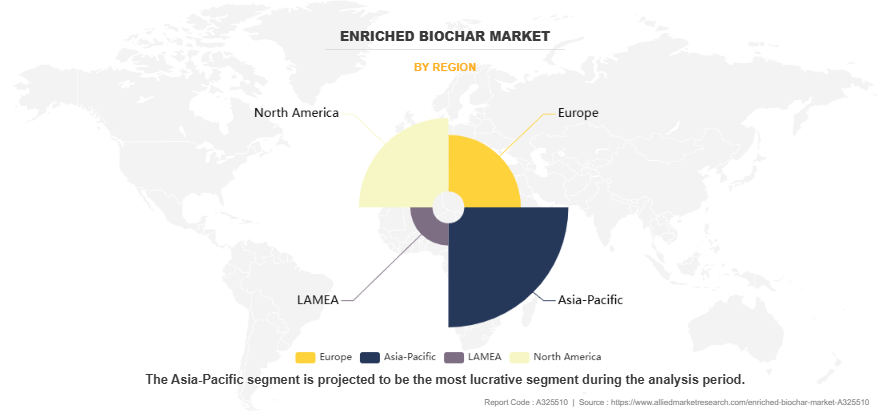

On the basis of region, the hydropower turbines market is analyzed across four key regions such as North America, Europe, Asia-Pacific, and LAMEA. North America and Europe collectively held a substantial market share of approximately 50% in 2023, driven by well-established hydropower infrastructure and ongoing refurbishment initiatives. Meanwhile, the Asia-Pacific region dominated the market with around 40% global market share in 2023, attributed to rapid industrialization and government investments in renewable energy projects. LAMEA regions, comprising Latin America, the Middle East, and Africa, witnessed growth potential, contributing around 10% of the global market share in 2023, with increase in focus on hydropower development to meet rising energy demands and promote sustainable power generation solutions.

Competitive Analysis

The major players operating in the hydropower turbines market include Siemens AG, General Electric CO., ANDRITZ AG, Cornell Pump CO., Gilbert Gikes & Gordon Ltd., Toshiba Energy, Harbin Electric Machinery, WWS Wasserkraft GmbH, Canyon Industries Inc., and Kirloskar Brothers Ltd.

Global Hydropower Capacity Growth

- Global hydropower capacity is forecasted to increase by 17% between 2021 and 2030.

- The above-mentioned growth is Led by countries such as China, India, Turkey, and Ethiopia, which have a significant positive impact on the hydropower turbines market in these countries.

- However, the projected growth for the 2020s was anticipated to be approximately 25% slower as compared to the expansion seen in the previous decade, which also slows down the development of the hydropower turbines market.

Notable Projects Completed in 2021

- Muskrat Falls Hydroelectric Generating Station (Canada): Opened on 23 September 2020, this project added 824 MW to the Lower Churchill Project.

- Nam Ou Plant (Laos): The remaining 600 MW of capacity at the 1,272 MW Nam Ou plant was brought online in September 2020.

- Upper Tamakoshi Project (Nepal): Contributing 456 MW, this project enhanced Nepal’s hydropower capacity by August 2021.

- Kameng Hydropower Station (India): Units 3 and 4 were added, increasing capacity by 300 MW was opened in February 2021.

- Dnesiter Pumped Storage Plant (Ukraine): A 324 MW unit was added, raising the plant’s installed capacity to 1,296 MW, opened in 2021.

Key Regulations in Hydropower Turbine Industry

The key regulations governing the hydropower turbines market in the U.S. are overseen by the Federal Energy Regulatory Commission (FERC). FERC issues licenses for hydropower projects, ensuring compliance with comprehensive environmental, safety, and operational standards. Environmental regulations in the U.S. focus on fish passage, water quality, and habitat protection, requiring turbine designs to incorporate fish-friendly technologies to minimize impacts on aquatic ecosystems. Safety regulations cover dam safety, emergency action plans, and regular inspections. Additionally, the Hydropower Regulatory Efficiency Act of 2013 aims to streamline the licensing process and promote the development of small hydropower projects, providing opportunities for turbine manufacturers catering to a diverse range of hydropower applications.

The regulatory landscape for the hydropower turbines market in Europe is diverse due to the continent's varied landscapes and river systems. The European Union (EU) plays a significant role in promoting sustainable hydropower through directives such as the Water Framework Directive and the Renewable Energy Directive. These directives aim to ensure the environmentally responsible development of hydropower resources while promoting renewable energy generation. Environmental impact assessments, fish migration pathways, and sediment management are key considerations in hydropower project development across European countries. Turbine manufacturers operating in Europe must adhere to EU regulations and national standards while addressing the specific environmental and operational challenges posed by the region's diverse hydrological conditions. Collaboration between turbine manufacturers, regulators, and stakeholders is essential to navigate regulatory complexities and promote the sustainable growth of the hydropower turbines market in Europe.

In China, where hydropower capacity is the highest globally, regulations primarily emphasize large-scale hydropower projects. The Chinese government encourages the development of pumped storage hydropower (PSH) and hybrid solar-hydropower plants, creating opportunities for turbine manufacturers specializing in high-capacity and innovative turbine technologies. Environmental impact assessments play a crucial role in project approvals due to China's diverse ecosystems and sensitive river basins. Turbine manufacturers operating in China's market must adhere to stringent environmental standards while meeting the demands for large-scale hydropower development, presenting both challenges and opportunities for innovation and sustainable practices in turbine design and operation.

India is rapidly expanding its hydropower capacity, with regulations focusing on environmental and social aspects to ensure sustainable development. Key regulations include the Forest (Conservation) Act, 1980, and the Environment Impact Assessment (EIA) process, which guide project approvals by evaluating environmental and social impacts. Balancing the country's energy needs with ecological conservation remains a significant challenge, requiring turbine manufacturers to develop solutions that minimize environmental impacts while meeting growing energy demands. Turbine manufacturers in India's market must navigate regulatory complexities and social considerations to contribute to India's hydropower expansion sustainably.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hydropower turbines market analysis from 2023 to 2033 to identify the prevailing hydropower turbines market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the hydropower turbines market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global hydropower turbines market trends, key players, market segments, application areas, and market growth strategies.

Hydropower Turbines Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 5.2 billion |

| Growth Rate | CAGR of 4.9% |

| Forecast period | 2023 - 2033 |

| Report Pages | 300 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Gilbert Gikes & Gordon Ltd., Siemens AG, Canyon Industries Inc., Toshiba Corporation, WWS Wasserkraft GmbH, Cornell Pump Co., Harbin Electric Machinery, General Electric, Andritz AG, Kirloskar Brothers Limited. |

Analyst Review

Chief Executive Officers (CXOs) and industry leaders in the hydropower turbine market are witnessing a transformative landscape, with substantial growth opportunities during the forecast period. This transition is driven by a growing global emphasis on sustainable energy solutions, as well as increase in demand for clean and renewable alternatives. CXOs recognize the critical role their industry plays in addressing the pressing need for ecologically friendly power sources, so aiding to mitigate climate change and meet renewable energy targets. A wide range of technologies, including reaction turbines and impulse turbines influence market dynamics, catering to capacities ranging from less than 1 MW to more than 10 MW that are utilized in power generation, power storage, maritime, and aeronautics sectors. CXOs efficiently manage a complex regulatory framework, capitalizing on incentives to drive innovation and investments, as governments globally embrace significant renewable energy policies.

CXOs in the hydropower turbine market recognize the imperative for energy storage solutions, grid modernization, and enhanced efficiency in renewable technologies. These aspects align with a broader commitment to sustainability and corporate social responsibility. CXOs perceive these challenges as opportunities for innovation and strategic planning, notwithstanding persistent hurdles such as initial capital costs and grid integration complexities. As the industry propels towards significant development, CXOs have high hopes in the trajectory towards a more sustainable and resilient energy future, leveraging their expertise to drive advancements and promote the widespread adoption of hydropower turbines across regions including North America, Europe, Asia-Pacific, and LAMEA.

The hydropower turbine is expected for transformative growth, with CXOs at the helm to guide the industry towards a future of sustainable energy solutions. These leaders are expected to catalyze innovation, drive investment, and foster the widespread adoption of hydropower turbines, which contribute to a cleaner, greener, and more sustainable energy landscape globally.

The global hydropower turbines market was valued at $3.2 billion in 2023 and is projected to reach $5.2 billion by 2033, growing at a CAGR of 4.9% from 2024 to 2033.

The major players operating in the hydropower turbine market include Siemens AG, General Electric CO., ANDRITZ AG, Cornell Pump CO., Gilbert Gikes & Gordon Ltd., Toshiba Energy, Harbin Electric Machinery, WWS Wasserkraft GmbH, Canyon Industries Inc., and Kirloskar Brothers Ltd.

The hydropower turbine market is segmented into type, application, and region. On the basis of type, the market is bifurcated into reaction turbines and impulse turbines. On the basis of application, the market is segmented into power generation, power storage, marine, and aeronautics. On the basis of region, the hydropower turbine market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Reaction turbine dominated the hydropower turbines market.

Asia-Pacific is the largest region for hydropower turbines market.

Power generation is the leading application of hydropower turbines market.

Government incentives and policies promoting hydroelectric power are the upcoming trends of hydropower turbines market in the world.

Loading Table Of Content...

Loading Research Methodology...