Hyper-Converged Infrastructure Market: 2026

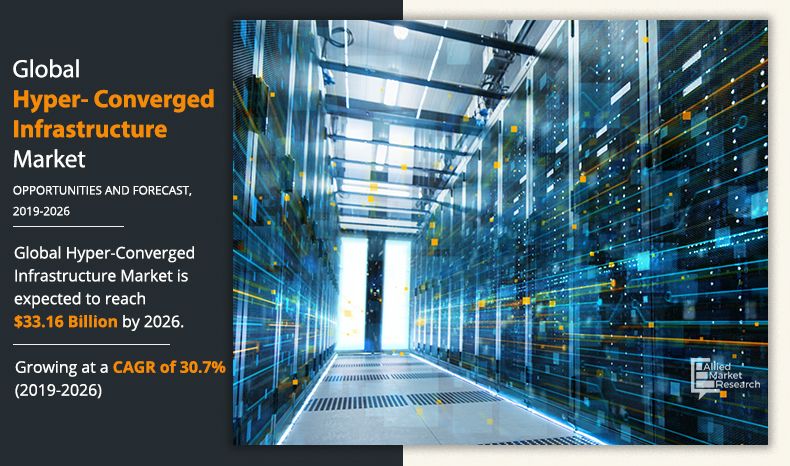

The hyper-converged infrastructure market size was valued at $3.84 billion in 2018, and is projected to reach $33.16 billion by 2026, growing at a CAGR of 30.7% from 2019 to 2026.Hyper-converged infrastructure (HCI) is a single system framework that includes storage, computing, and network resources that help companies to easily deploy and manage with a single user interface.

Hyper-convergence infrastructure has gained high traction from the recent past among enterprises to draw its potential to streamline the deployment of new workloads, ease infrastructure management, and optimize infrastructure costs. This has further supported the growth of the hyper-converged infrastructure market during the forecast period. HCI architecture is designed for a pay-as-you-go cost model and has the ability to scale incrementally which has positively impacted the growth of the market. Business-critical applications which are currently deployed on three-tier IT infrastructure will transition to hyperconverged infrastructure as it offers integrated stack systems, integrated infrastructure systems, and integrated reference architectures.

Among the industry vertical, the BFSI industry dominated the global hyper-converged infrastructure market in terms of revenue in 2018 and is expected to continue this trend during the forecast period. As the financial sector is highly influential towards meeting their customer needs. With rising digitization has challenged this sector to deliver great digital experiences. Thus, proliferation of robust digital transformation strategies now includes hyper-converged infrastructure to increase its infrastructure agility. Moreover, financial firms are inclining toward HCI to drive agility and lower costs for the strategic initiatives such as distributed it and remote offices/branch offices, virtual desktop deployment, business-critical applications, and disaster recovery. This is a major factor expected to drive the growth of the hyper-converged infrastructure market among the BFSI industry.

By Component

Hardware is projected as one of the most lucrative segments.

The hyper-converged infrastructure market in North America dominated in terms of revenue share in 2018. Rise in shift toward innovative technology that provides cloud-like economics for existing data centers without the need to compromise in its performance, availability, or reliability is a major factor that drives the adoption of HCI market in the region. This allows HCI adopters to witness improved operational efficiency, scalability, and accelerated deployment time.

The report focuses on the hyper-converged infrastructure market growth prospects, restraints, and analysis. The study provides Porter’s five forces analysis of the hyper-converged infrastructure industry to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the market.

By Application

Data center consolidation is projected as one of the most significant segments.

Segment Review

The hyper-converged infrastructure market segmentation includes component, application, industry vertical, and region. By component, it is categorized into hardware and software. On the basis of application, it is divided into remote office or branch office, virtualization desktop infrastructure (VDI), data center consolidation, backup recovery or disaster recovery, critical applications virtualization, and others. Depending on industry vertical, it is categorized into BFSI, IT & telecommunications, government, healthcare, manufacturing, energy & utilities, education, and others. Based on region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players operating in the global hyper-converged infrastructure market forecast include Cisco Systems, Inc., Dell Inc., Hewlett Packard Enterprise Company, Huawei Technologies Co., Ltd. , Microsoft Corporation , NetApp, Inc. , Nutanix, Inc. , Pivot3 , Scale Computing, and VMware, Inc. Major players operating in this market have witnessed high growth in demand for hyper-converged infrastructure, especially due to on-going data center modernization projects or initiatives among data center industry across the globe. This study includes hyper-converged infrastructure market analysis, trends, and future estimations to determine the imminent investment pockets.

By Industry Vertical

BFSI is projected as one of the most significant segments.

Top Impacting Factors

Growing need for data protection and disaster recovery and reduction in Capital Expenditure (CAPEX) and Operational Expenditure (OPEX) are major factors driving the growth of the hyper-converged infrastructure market trends. These factors are attributed to the growth of the market as major infrastructure vendors are adopting hybrid and multi-cloud deployments as either backup strategies or data disaster recovery options or as an alternative for on-premises infrastructure. However, vendor lock-in is a major factor expected to hinder the market growth to a certain extent. Furthermore, rise in investments in data center infrastructures is an opportunistic factor of the market.

Growing Need for Data Protection and Disaster Recovery

The growth of data centers will anticipate high adoption of hyper-converged infrastructure owing to its architecture that disrupts the enterprise datacenter by fragmenting it’s data silos to manage the storage, network, and compute stack with simplicity and flexibility. Hence, rise in need for data protection solution purpose built and integrated with HCI is garnering high traction among data center industries which in turn is expected to support growth of the market.

Reduction In Capital Expenditure (Capex) and Operational Expenditure (Opex)

A costly endeavor for any organization is data center infrastructure. Hyper-converged infrastructure is gaining high traction as it lowers the infrastructure costs by collaborating or integrating commodity hardware with a simple operational model. This is a major factor expected to drive the growth of the global hyper-converged infrastructure market during the forecast period. In addition, the commodity hardware is also used to host applications as virtual machines or containers due to HCI’s hardware agnostic approach.

By Region

Asia-Pacific would exhibit the highest CAGR of 36.3% during 2019-2026.

Covid-19 Impact on the Hyper-Converged Infrastructure Market -

- The global lockdown has not impacted on the hyper-converged infrastructure market as the operations in the IT industry are carried out normally by ‘working from home’ structure. And, as a result, the use of hyper-converged infrastructure in IT industry has a constant demand across the world.

- Moreover, the new installation of hyper-converged infrastructure has been postponed during the coronavirus pandemic. The on premises working has been banned during the active lockdown therefore the upcoming IT organizations has postponed the installation of hyper-converged infrastructure.

Key Benefits for Stakeholders:

- This study includes the market opportunity, analysis, trends, and future estimations to determine the imminent investment pockets.

- The report presents information related to key drivers, restraints, and opportunities of the hyper-converged infrastructure industry.

- The hyper-converged infrastructure market share is quantitatively analyzed from 2018 to 2026 to highlight the financial competency of the industry.

- Porter’s five forces analysis illustrates the potency of the buyers & suppliers in the market.

Hyper-Converged Infrastructure Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Application |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Nutanix, Inc., Dell, Technologies Inc., Microsoft Corporation, VMware, Inc., Scale Computing, Huawei Technologies Co., Ltd., Pivot3, HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP, Netapp, Inc. |

Analyst Review

In the digitally growing businesses, major leading executives have shifted their focus on organization strategies that adopt hyperconvergence solutions in the data center. With existence of converged IT systems that became tedious due to the multiple layers in the system architecture, business leaders have witnessed to leverage hyperconverged systems due to intelligence of the system architecture that shifts to the more agile software layer. Hence, with growth in data centers across the globe especially in North America, the global hyper-converged infrastructure market is expected to garner high traction in the coming years.

Hyper-converged infrastructure gained momentum in early stages of development due to its ability to provide virtual desktops. With ever increasing digital data and diversified sources businesses are inclining towards high performance plus linear scaling architecture which is primary scope of a hyper-converged infrastructure. As the hyper-converged infrastructure has evolved from traditional server workloads such as web servers, standard applications, test & development to mission critical workloads such as SAP, SQL, and Oracle, the market has gained high adoption rates, which is supporting the market growth positively.

The market has gained high traction across the regions, chief information officers(CIO), and data center managers to adopt hyperconverged systems for any new data center server purchases. An imperative adoption of the infrastructure toward consolidating workloads and hardware within the data center is expected to further boost growth of the market in North America. For instance, in 2016 Morgan Stanley company stated that among the c-level executives 60% of CIOs have plans to purchase hyperconverged servers within a year, with a three-fold growth from 2015.

The key players operating in the global market includes Cisco Systems, Inc., Dell Inc., Hewlett Packard Enterprise Company, Huawei Technologies Co., Ltd., Microsoft Corporation , NetApp, Inc., Nutanix, Inc., Pivot3, Scale Computing, and VMware, Inc. Major players have adopted various revenue and business growth strategies to enhance and develop their product portfolio, strengthen their hyper-converged infrastructure market share, and help them increase their market penetration.

Global Hyper-Converged Infrastructure Market is expected to grow at CAGR of 30.7% from 2019 to 2026.

Growing need for data protection and disaster recovery and Reduction in Capital Expenditure (CAPEX) and Operational Expenditure (OPEX) are factors that drive market growth

To get updated version of hyper-converged infrastructure market report

The Hyper-Converged Infrastructure Market is projected to reach $33,168.7 million by 2026

Remote office or branch office, Virtualization Desktop Infrastructure (VDI), Data center consolidation, Backup recovery or disaster recovery, Critical applications Virtualization,and others are applications of Hyper-Converged Infrastructure industry

On the basis of top growing big corporation we select top 10 players.

Among the applications segemnt the Backup recovery or disaster recovery sub-segment will drive market growth in the coming years

Asia Pacifc region possess greater business opportunities in the coming future

The Hyper-Converged Infrastructure Market in 2018 was $3842.8 million

Cisco Systems, Inc., Dell Inc., Hewlett Packard Enterprise Company, Huawei Technologies Co., Ltd. , Microsoft Corporation , NetApp, Inc. , Nutanix, Inc. , Pivot3 , Scale Computing, and VMware, Inc. are the key market players in Hyper-Converged Infrastructure Market

Loading Table Of Content...