Identity analytics Market Overview:

Identity analytics embeds advanced analytics and big data technologies to detect the identity related threats across IT systems in the organizations. In identity analytics solutions machine learning functionalities are utilized to increase the efficiency of identity and access management (IAM). It automates the detection of access risks, access outliers, shared high privileged access (HPA) accounts, and orphan & dormant accounts. It also reduces the attack surface area for identities by replacing roles defined using manual processes and legacy rules, with machine-learning-based intelligent roles. The global identity analytics market size was valued at $512 million in 2017, and is projected to reach $3,619.8 million by 2025, growing at a CAGR of 27.8% from 2018 to 2025.

Rise in adoption by enterprises to improve their identity and access management systems, the need to ensure adaptive access certification by the enterprises, and increase in awareness about regulation and compliance management are some of the factors that drive the growth of the global identity analytics market. At present, the adoption of identity analytics is major in BFSI industry.

Segment review

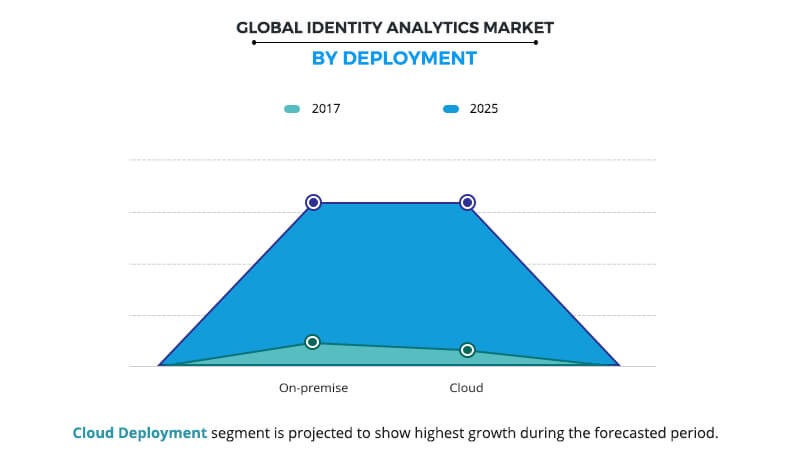

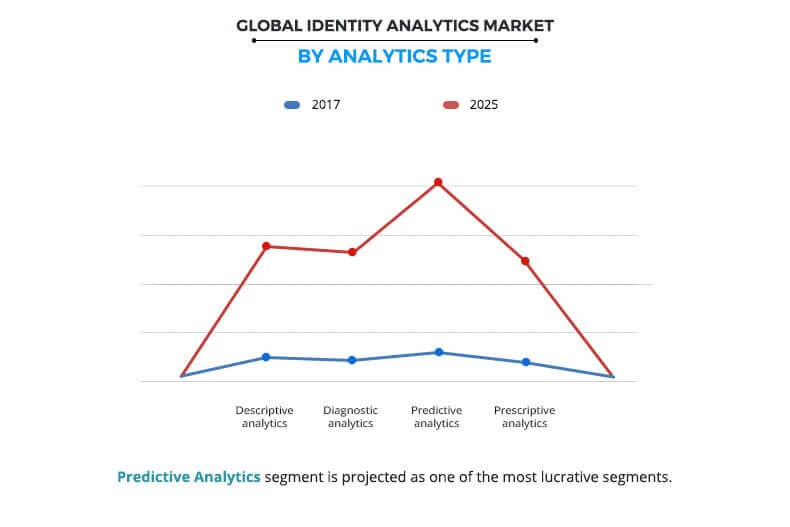

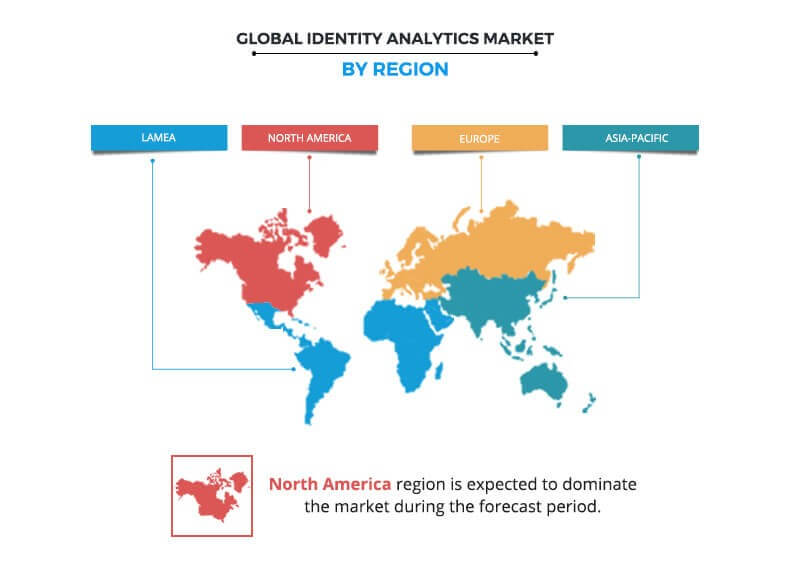

The global identity analytics market is segmented based on component, deployment, analytics type, analytics type, end user, and region. In terms of component, the market is bifurcated into software and services. Based on deployment, it is fragmented into on-premise and cloud. Depending on organization size, it is segregated into small and medium-sized enterprises (SMEs) and large enterprises. By analytics type, it is classified into descriptive analytics, diagnostic analytics, predictive analytics, and prescriptive analytics. By industry vertical segment, it is divided into BFSI, telecom & IT, government, manufacturing, retail, healthcare, and others. Based on region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

North America dominated the overall identity analytics market share in 2017, due to identity related risk awareness, regulation and compliance policies and rise in adoption of identity and access management (IAM) solutions.

The report focuses on the growth prospects, restraints, and identity analytics market trends. The study provides Porters five forces analysis of the identity analytics market to understand the impact of various factors such as bargaining power of suppliers, competitive rivalry, threat of new entrants, threat of substitutes, and bargaining power of buyers on the growth of the identity analytics market.

The key players operating in the global identity analytics market analysis include Evidian, Gurucul, Hitachi Id Systems, Happiest Minds, LogRhythm, ID analytics (Symantec), Verint Systems, NetIQ (Microfocus), Microsoft, and Oracle.

Top impacting factors

Rise in adoption by enterprises to improve their identity and access management systems and increase in need to make the work easier for citizen data scientists and business users are expected to drive the identity analytics market growth. However, security concerns related to critical data among different industry verticals is expected to restrict the growth of this market.

Increase in adoption by enterprises to improve their identity and access management systems

The power of big data and advanced analytics combining into identity analytics can help in detecting identity-based risks across organizations IT infrastructure, which drives the adoption of identity analytics in majority of the enterprises. The incapability of traditional identity and access management solutions in detecting and mitigating identity thefts is also driving the adoption of identity analytics by enterprises thus, boosting the market growth. In addition, increase in need to scale identity and access management solutions in large and small & medium enterprises is the major factor that drives the growth of the market. Also, increase in need to scale IAM systems with speed and flexibility is also the major factor that drives the adoption of identity analytics solutions among the enterprises.

Rise in awareness about regulation and compliance management

Identity analytics provides a unified and single management view across cloud and on-premise. Such approach is much needed in an enterprise environment and further aids in providing a closed-loop process for meeting compliance regulations and reducing risks, which drives the market growth. In addition, audit requirements and industry regulations are the key drivers for access certification, as overriding security issues are associated with it. Over privileged users are the major source of several high-profile data breaches, which is also the major factor that drives the need for the identity analytics among enterprises. Furthermore, it adopts a combined governance process across lines of business and IT, along with delivering necessary proofs of compliance for internal and external auditors, which is also the major factor driving the market growth.

Rise in demand for mobility solutions and growing identity theft

Numerous organizations are allowing their employees to bring their own devices (BYOD) at work places, which poses significant threat for the organization data and information, hence, provides the opportunity for the market growth. In addition, the increase in need to secure device and users from the illegal access is also one of the major factors that provides opportunities for the market growth. Moreover, cloud is projected to be the preferred delivery mechanism for analytics, mainly due to rise in concerns of security.

Key Benefits for Identity analytics Market:

- This study presents the analytical depiction of the global identity analytics market along with the current trends and identity analytics market forecast to determine the imminent investment pockets.

- The report presents information related to key drivers, restraints, and identity analytics market opportunity.

- The current market is quantitatively analyzed from 2017 to 2025 to highlight the financial competency of the identity analytics industry.

- Porters five forces analysis illustrates the potency of buyers & suppliers in the global identity analytics market.

Identity analytics Market Report Highlights

| Aspects | Details |

| By Component |

|

| By DEPLOYMENT |

|

| By Organization Size |

|

| By Analytics Type |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | NETIQ (MICROFOCUS), EVIDIAN, GURUCUL, HITACHI ID SYSTEMS, INC., ORACLE CORPORATION, MICROSOFT CORPORATION, HAPPIEST MINDS, LOGRHYTHM, INC., VERINT, ID ANALYTICS (SYMANTEC CORPORATION) |

Analyst Review

Identity analytics is capable of identifying high-risk user access and behavior profiles, rule- and exception-based access analysis and reporting, and continuous access monitoring and reporting. It offers a risk-based approach for managing system identities and access.

The global identity analytics market is projected to witness significant growth, especially, in Asia-Pacific due to rise in adoption of AI in business intelligence in this region. The market is projected to grow at a CAGR of 27.80% from 2018 to 2025, owing to rise in demand in security governance, enforcement concerns, distributed systems and workforce, as well as lower quality of security services within organizations and increase in adoption of mobility in enterprises.

Using identity analytics to discover and eradicate unnecessary access associated with enterprise identities can considerably reduce the damage if a user’s credentials are stolen. Furthermore, the market is witnessing the trend of using machine learning and AI in identity analytics solutions to enhance identity related solutions. In addition, increase in regulation policies to protect the user’s data, is anticipated to boost the growth of the market during the forecast period. Further, identity analytics, will soon be a prevailing driver of new purchases of Identity and Access Management Systems (IAM).

The key players profiled in the report include Evidian, Gurucul, Hitachi Id Systems, Happiest Minds, LogRhythm, ID analytics (Symantec), Verint Systems, NetIQ (Microfocus), Microsoft, and Oracle. The key market players have adopted various strategies such as merger & acquisition or strategic alliance with start-ups and well-established players to expand their market presence and enhance their product portfolio.

Loading Table Of Content...