IE4 Permanent Magnet Synchronous Motors Market Outlook – 2025

The global IE4 permanent magnet synchronous motors market size was valued at $85,153 thousand in 2013, and is projected to reach $206,623 thousand by 2025, growing at a CAGR of 9.8% from 2018 to 2025. IE4 permanent magnet synchronous motors is a super-premium efficiency class motor, which is designed and manufactured according to the energy efficiency motors program to encourage end users to use higher efficiency motors. The aim of utilization of IE4 permanent magnet synchronous motors is to reduce energy consumption and minimize CO2 emissions. These motors are further used to drive industrial fans, pumps, compressors, and other mechanical applications, which fuel their adoption.

In addition, IE4 motors find their application in numerous robotic processes. Factors such as speed, acceleration, torque requirements, control, and angular movements make IE4 motors an ideal choice for robotic system manufacturers. Efficiency and performance have increased owing to rising demand for superior machine control, thereby improving the performance of equipment where IE4 motors are installed. Efficiency and performance have increased owing to rising demand for superior machine control.

Upsurge in adoption of green technologies is gaining popularity across the world. The benefits energy-efficient IE4 motors offer over standard motors include low fan losses and high-quality insulation & lamination. Such factors have a prominent impact on the demand for energy-efficient IE4 motors across various end-use industries. In addition, implementation of stringent regulations and laws related to the environment, such the EP Act and Minimum Energy Performance Standards (MEPS), drives the demand for these motors across the globe. Industries such as material handling systems, compressed air, HVAC, refrigerators, pumps, and ventilation serve as the key consumers of energy-efficient IE4 motors, thus fueling their demand across the globe. In addition, the blowers and the wind power sectors are anticipated to exhibit high demand for these motors in the coming years.

However, increased preference for installation of IE2 motors by domestic manufacturers restrain the growth of the market. These manufacturers may not be able to adapt IE4 motors, owing to domestic production limitations, thus hampering the IE4 permanent magnet synchronous motors market growth.

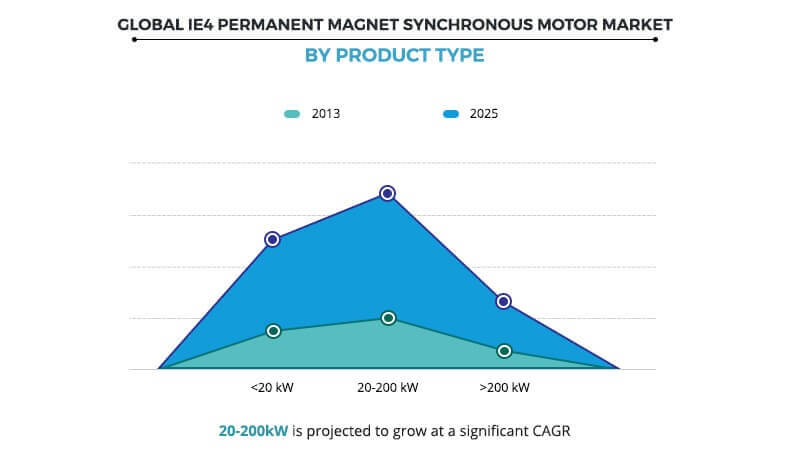

The global IE4 permanent magnet synchronous motors market is segmented into product, application, and region. Based on product, the global IE4 permanent magnet synchronous motors market is divided into less than 20 kW, 20–200 kW, and more than 200 kW. In 2017, the 20–200 kW segment held the largest share, due to increase in demand for energy-efficient conveyor systems in manufacturing and automotive industries.

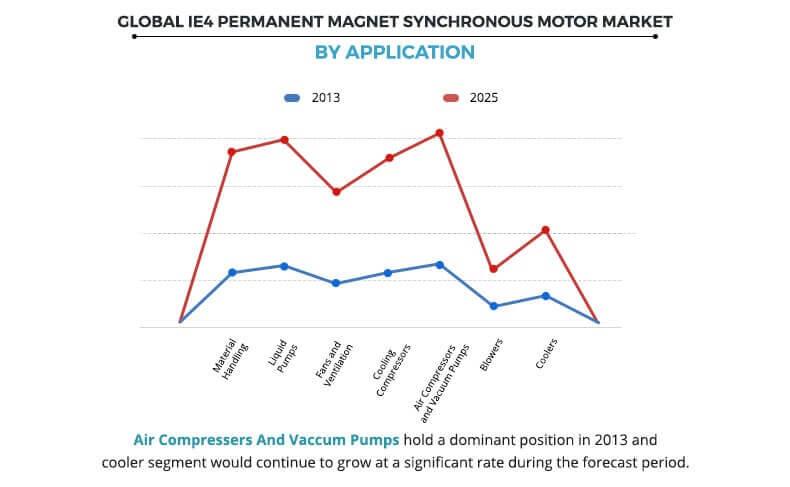

On the basis of application, the market is classified into material handling, liquid pumps, fans & ventilation, cooling compressors, air compressors & vacuum pumps, blowers, and coolers. In 2017, the air compressors & vacuum pumps segment held the largest share, due to increase in demand for compressors systems in manufacturing and automotive industries.

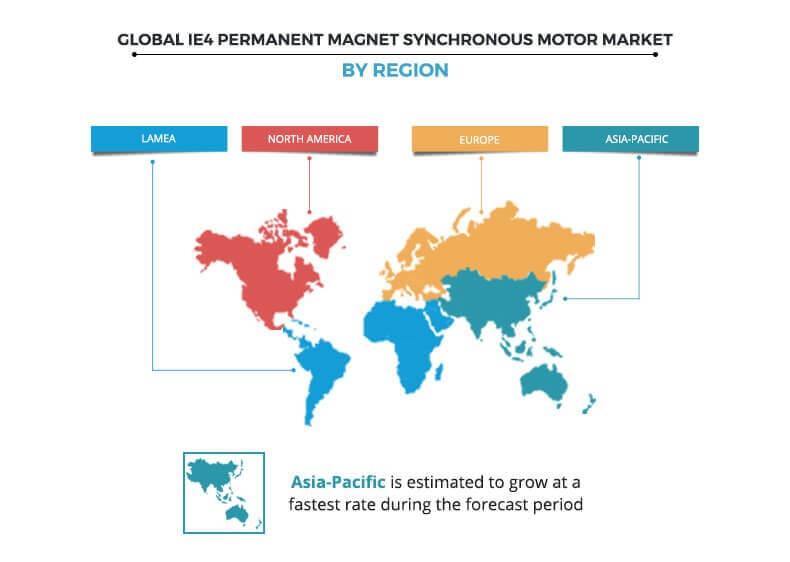

Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2017, Asia-Pacific accounted for the highest share, and is anticipated to secure the leading position during the forecast period. This is attributed to industrial growth in the developing countries such as India and China. China is a pioneer in the IE4 permanent magnet synchronous motors market. Therefore, IE4 permanent magnet synchronous motors market share is highest among the Asia-Pacific countries.

Competition Analysis

The major players operating in the global IE4 permanent magnet synchronous motors market include ABB, Altra Industrial Motion Corp, Anhui Wannan Electric Machine Co., Ltd., Bharat Bijlee, CG global, Danfoss, Fuji Electric Co., Ltd., Hitachi Ltd., Kaeser Kompressoren, Kienle + Spiess GmbH, KSB SE & Co. KGaA, Lafert, Merkes GmbH, Nidec, NORD Drive systems, O.M.E. Motori Elettrici s.r.l., OEMER, Siemens AG, Toshiba Corporation, Weg S.A., and VEM Group. Key players adopted product launch and partnership as its key developmental strategy to sustain the intense competition and improve its product portfolio. For instance, in December 2017, Nord Drivesystems expanded its portfolio of smooth-surface permanent-magnet synchronous motor by launching IE4 or Super Premium Efficiency synchronous motors for applications in food, beverage, and pharmaceutical industries. similarly, in January 2019, WEG S.A, established partnership with Iberian pork producer located in Badajoz, Spain. According to the partnership agreement WEG S.A has provided a W22 Magnet IE4 electric motors for compressors operation of its new refrigeration unit at the Mafresa facilities for cold production.

Many competitors in IE4 permanent magnet synchronous motors market adopted product launch and partnership as its key developmental strategies to sustain the intense competition and improve their product portfolio. For instance, Kaeser established partnership with a renowned motor manufacturer to develop IE4 motors for next-generation compressor packages. Moreover, in December 2017, Nord Drive Systems expanded its portfolio of smooth-surface permanent-magnet synchronous motor by launching IE4 or super-premium efficiency synchronous motors for applications in food, beverage, and pharmaceutical industries.

Key Benefits for Ie4 Permanent Magnet Synchronous Motors Market:

- The report provides an extensive analysis of the current and emerging IE4 permanent magnet synchronous motors market trends and dynamics in the global IE4 permanent magnet synchronous motors market.

- In-depth IE4 permanent magnet synchronous motors market analysis is conducted by constructing market estimations for the key market segments between 2018 and 2025.

- Extensive analysis of the market is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive analysis of all regions is provided to determine the prevailing opportunities.

- Global IE4 permanent magnet synchronous motors market forecast analysis from 2018 to 2025 is included in the report.

- Key market players within the IE4 permanent magnet synchronous motors market are profiled in this report and their strategies are analyzed thoroughly, which help to understand the competitive outlook of the global IE4 permanent magnet synchronous motors industry.

IE4 Permanent Magnet Synchronous Motors Market Report Highlights

| Aspects | Details |

| By Product |

|

| By Application |

|

| By Region |

|

| Key Market Players | Merkes GmbH, Fuji Electric Co., Ltd., ASEA BROWN BOVERI LTD (ABB), Hitachi Ltd., OEMER, NORD Drive Systems KG, Altra Industrial Motion Corp., Toshiba Corporation, KAESER KOMPRESSOREN, DANFOSS A/S, LAFERT GROUP, VEM Group, Kienle + Spiess GmbH, CG POWER AND INDUSTRIAL SOLUTIONS LIMITED, NIDEC CORPORATION, ANHUI WANNAN ELECTRIC MACHINE CO., LTD., KSB SE & Co. KGaA, Weg S.A., O.M.E. Motori Elettrici s.r.l., Siemens AG, BHARAT BIJLEE LIMITED |

Analyst Review

The global IE4 permanent magnet synchronous motors market is witnessing considerable growth in the emerging markets such as India, China, and others. This growth is attributable to the development of the automotive, machinery, and fan & ventilation industries and high demand for better energy-efficient electric pumps. Increase in demand for IE4 motors, particularly in emerging wind power markets, is further expected to fuel the market growth. However, rise in use of other energy-efficient motors as an alternative to IE4 motors is anticipated to hinder the market growth.

Asia-Pacific is witnessing the highest demand for IE4 permanent magnet synchronous motors, followed by Europe, North America, and LAMEA. The highest share of the Asia-Pacific market is attributable to increase in demand for conveyers in the automotive industry.

Leading manufacturers operating in the IE4 permanent magnet synchronous motors market include ABB, Altra Industrial Motion Corp, Anhui Wannan Electric Machine Co., Ltd., Bharat Bijlee, CG global, Danfoss, Fuji Electric Co., Ltd, Hitachi Ltd., Kaeser Kompressoren, Kienle + Spiess GmbH, KSB SE & Co. KGaA, Lafert, Merkes GmbH, Nidec, NORD Drive systems, O.M.E. Motori Elettrici s.r.l., OEMER, Siemens AG, Toshiba Corporation, Weg S.A., and VEM Group.

Loading Table Of Content...