Image Recognition Market Overview

The global image recognition market was valued at USD 28.3 billion in 2022 and is projected to reach USD 126.8 billion by 2032, growing at a CAGR of 16.5% from 2023 to 2032. The increasing demand for automation is acting as a significant driver for the image recognition market size, as businesses and industries strive for enhanced efficiency and productivity, automation has become a crucial strategy. In addition, advancements in deep learning and computer vision have emerged as major drivers for the market.

Key Market Trends & Insights

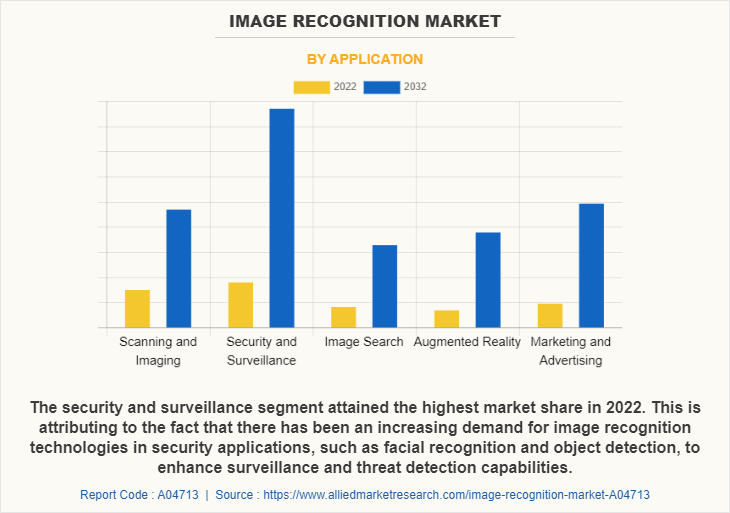

- By application, the augmented reality segment is forecasted to be the fastest growing segment

- By technology, facial recognition segment is forecasted to be the fastest growing segment during the forecast period.

- Region wise, the Asia-Pacific region is considered to be the fastest growing region during the forecast period

Market Size & Forecast

- 2022 Market Size: USD 28.3 Billion

- 2032 Projected Market Size: USD 126.8 Billion

- Compound Annual Growth Rate (CAGR) (2023-2032): 16.5%

- Asia-Pacific: Expected to witness fastest growth during forecast period.

How to Describe Image Recognition?

Image recognition, also known as computer vision or image classification, refers to the process of identifying and categorizing objects or patterns within digital images or videos. It is a subfield of artificial intelligence that involves developing algorithms and models to enable machines to understand and interpret visual data. It typically involves training a machine learning model using a large dataset of labeled images. The model learns to recognize and differentiate between different objects or features based on the patterns and characteristics it observes in the training data. Once trained, the model can then analyze new, unseen images and accurately classify or identify the objects or patterns within them. The goal of image recognition is to enable computers or systems to understand and interpret visual information in a manner similar to humans. This technology has a wide range of applications, including facial recognition, object detection, autonomous vehicles, medical imaging analysis, surveillance systems, and others.

Revolutionizing the way machines perceive and understand visual information. This technology has significantly enhanced image recognition capabilities, enabling systems to accurately identify and categorize objects, scenes, and even subtle details within images. Furthermore, growing applications in healthcare have also emerged as a significant driver for the image recognition market share, revolutionizing the way medical professionals diagnose and treat patients. With the advancement of technology, image recognition techniques have become increasingly accurate and efficient, allowing healthcare providers to analyze medical images such as X-rays, MRIs, and CT scans with unprecedented precision.

However, data availability hampers the growth of the market, this is because of privacy concerns, legal regulations, and proprietary limitations. Some image data may be protected by privacy laws, making it difficult to access or use for training purposes. Hence, intellectual property rights or proprietary restrictions may prevent the sharing or utilization of certain data sets, limiting the availability of valuable resources for training image recognition systems. Moreover, the concerns about the security of image databases and the risk of data breaches have further hampered image recognition market growth. On the contrary, technological advancements in cloud computing have revolutionized the market, providing opportunities for businesses to leverage the power of the cloud for processing, analyzing, and understanding visual data.

The report focuses on growth prospects, restraints, and trends of the image recognition market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the image recognition market.

Segment Review

The image recognition market is segmented on the basis of component, deployment mode, technology, application, industry vertical, and region. Based on component, it is segmented into hardware, software and services. By deployment mode, it is segmented into on-premise and cloud. According to technology, it is segmented into object recognition, QR/barcode recognition, facial recognition, pattern recognition, and optical character recognition. Based on application, it is segmented into scanning & imaging, security & surveillance, image search, augmented reality, and marketing & advertising. By industry vertical, it is segmented into IT & telecom, BFSI, healthcare, retail & e-commerce, government, media & entertainment, transportation & logistics, manufacturing, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By application, the scanning and surveillance segment attained the highest market share in 2022. This is attributing to the fact that there has been an increasing demand for image recognition technologies in security applications, such as facial recognition and object detection, to enhance surveillance and threat detection capabilities. On the other hand, the augmented reality segment is forecasted to be the fastest growing segment. This is due to the fact that augmented reality has gained significant traction in industries like gaming, e-commerce, advertising, and education, offering immersive and interactive experiences to users. With the advancements in mobile and wearable devices, augmented reality applications have become more accessible, leading to a surge in demand. Moreover, the integration of image recognition technology with augmented reality enhances its capabilities, enabling real-time object recognition and interaction, driving the projected growth in this segment.

Region wise, North America attained the highest growth in 2022. This is because the market in North America has been driven by various factors such as increasing demand for automation and digitization across industries, advancements in artificial intelligence (AI) and deep learning algorithms, and the widespread adoption of smartphones and other connected devices. In addition, with the North Americas robust technological infrastructure and high adoption rate of cutting-edge technologies, it provides a fertile ground for companies to develop and deploy innovative image recognition solutions, leading to increased efficiency, enhanced user experiences, and new business opportunities. Thus, all such factors lead to the growth of the image recognition market in the North America region.

However, the Asia-Pacific region is considered to be the fastest growing region during the forecast period. This is because various factors such as increasing adoption of smartphones, rising internet penetration, and growing e-commerce activities are driving the demand for image recognition technology in the Asia-pacific region.

Top Impacting Factors

Advancements in Deep Learning and Computer Vision

Advancements in deep learning and computer vision significantly contribute toward the growth of the image recognition market, revolutionizing the way machines perceive and understand visual information. In addition, deep learning, a subfield of artificial intelligence (AI), employs neural networks with multiple layers to process complex data and extract meaningful patterns. This technology has significantly enhanced image recognition capabilities, enabling systems to accurately identify and categorize objects, scenes, and even subtle details within images. On the other hand, computer vision encompasses a range of techniques and algorithms that allow machines to analyze and interpret visual data in a manner similar to human vision. Combining computer vision with deep learning has propelled image recognition to new heights, enabling more accurate and robust recognition systems. These advancements have wide-ranging applications across various industries, including healthcare, retail, automotive, and security.

Moreover, computer vision and deep learning have bolstered security systems, enhancing surveillance and threat detection capabilities. Advanced video analytics can automatically identify suspicious activities or individuals in real-time, minimizing response time and improving overall safety. Furthermore, the image recognition market has witnessed significant growth due to these advancements, with surge in demand for solutions that leverage deep learning and computer vision. Businesses are increasingly adopting these technologies to gain a competitive edge, enhance operational efficiency, and deliver improved user experiences. Furthermore, as research and development in deep learning and computer vision continue to progress, they are expected to make further breakthroughs in image recognition, fueling innovation and driving the market expansion.

Increase in Applications in the Healthcare Sector

Rise in applications of image recognition in the healthcare sector has emerged as a significant driver for the market, revolutionizing the way medical professionals diagnose and treat patients. With the advancement of technology, image recognition techniques have become increasingly accurate and efficient, allowing healthcare providers to analyze medical images such as X-rays, MRIs, and CT scans with unprecedented precision. For instance, in the field of radiology, image recognition algorithms can quickly identify abnormalities or potential diseases, aiding radiologists in their diagnoses.

This not only saves valuable time but also improves the accuracy of diagnoses, leading to better patient outcomes. Moreover, image recognition technology is being utilized in telemedicine applications, enabling remote healthcare providers to assess images and provide consultations to patients who are unable to visit a physical healthcare facility. These applications highlight the transformative impact of image recognition in healthcare, making it an indispensable tool for medical professionals and propelling the growth of the image recognition market.

Surge in Demand for Automation

Increase in demand for automation acts as a significant driver of the image recognition market, as businesses and industries strive for enhanced efficiency and productivity, automation has become a crucial strategy. Furthermore, image recognition, a branch of artificial intelligence, plays a pivotal role in automating various processes. For instance, in the retail sector, the need for automated checkout systems has been witnessed to increase significantly. Thus, by employing image recognition technology, these systems can accurately identify and track products, eliminating the need for manual scanning. This not only saves time but also reduces human error and enhances the overall customer experience.

Moreover, the demand for automation in industries such as manufacturing, healthcare, transportation, and security is driving the image recognition market. These industries are utilizing image recognition algorithms to automate quality control, medical diagnostics, object detection, facial recognition, and surveillance. Hence, the combination of automation and image recognition offers tremendous potential for increased efficiency, cost savings, and improved decision-making, thereby fueling the growth of the image recognition industry in the upcoming years.

Low Quality Data and Availability

The growth of the image recognition market is significantly affected by the quality and availability of data. Data quality refers to the accuracy, relevance, and completeness of the information used to train image recognition systems. When the data used for training is of low quality, containing errors, inconsistencies, or biases, it can result in subpar performance and unreliable outcomes. Poor data quality hinders the ability of image recognition algorithms to accurately identify and classify objects, leading to decreased confidence and trust in the technology.

Furthermore, the availability of data plays a crucial role in the growth of the image recognition market. Sufficient and diverse data sets are essential for training robust and effective image recognition models. However, acquiring large-scale, high-quality data sets can be a challenging task. This is particularly true for niche or specialized domains where relevant data may be scarce or difficult to obtain. Therefore, limited availability of data restricts the ability to train models adequately, leading to reduced accuracy, limited applicability, and slower development of image recognition solutions for specific industries or use cases.

Moreover, data availability can be restricted due to privacy concerns, legal regulations, and proprietary limitations. Some image data may be protected by privacy laws, making it difficult to access or use for training purposes. Hence, intellectual property rights or proprietary restrictions may prevent the sharing or utilization of certain data sets, limiting the availability of valuable resources for training image recognition systems. Thus, the growth of the image recognition market is constrained by the quality and availability of data. Poor data quality can result in unreliable outcomes, while limited availability of diverse and relevant data sets hampers the development of accurate and robust image recognition solutions.

Privacy and Security Concerns

Privacy and security concerns have emerged as significant restraints of the image recognition market. With the increasing installation of surveillance cameras and rise in penetration of social media platforms and other image-based technologies, the misuse and unauthorized access to personal information has become a prominent issue. In addition, individuals and organizations are increasingly worried about the privacy implications of image recognition systems, as they often involve the collection, storage, and analysis of massive volume of visual data.

For instance, facial recognition technology has faced widespread backlash due to its potential for mass surveillance and the infringement of individual privacy rights. Moreover, the concerns about the security of image databases and the risk of data breaches have hampered market growth. Thus, to address these concerns, policymakers and industry stakeholders should strike a balance between leveraging the benefits of image recognition while safeguarding privacy and ensuring robust security measures are in place.

Technological Advancements in Cloud Computing

With the increasing availability of high-speed internet and the development of powerful cloud infrastructure, image recognition algorithms can now be deployed and run efficiently in the cloud. This enables businesses and developers to leverage the vast computing resources of the cloud to process and analyze large volumes of image data in real-time. Furthermore, one notable instance of this is in the field of autonomous vehicles, image recognition algorithms are crucial for enabling self-driving cars to identify and interpret the objects and obstacles around them. Thus, by leveraging cloud computing, these algorithms can be continuously improved and updated depending on the latest data and advancements in machine learning.

In addition, the cloud provides the computational power and scalability required to process the immense visual data captured by autonomous vehicles, enabling them to make accurate and timely decisions on the road. Moreover, cloud-based image recognition services have become more accessible and affordable for businesses of all sizes. Instead of investing in expensive hardware and infrastructure, companies are now relying on cloud service providers to handle the heavy lifting of image processing and analysis. This not only reduces costs but also accelerates the time-to-market for image recognition applications, allowing businesses to quickly integrate this technology into their products and services.

Moreover, cloud computing offers flexibility and scalability, allowing image recognition solutions to adapt to changing needs. Whether ’it is processing images in real-time for security surveillance, optimizing inventory management through object recognition, or enhancing user experience in e-commerce by enabling visual search, cloud-based image recognition can be easily scaled up or down depending on demand, ensuring efficient and cost-effective operations. Hence, technological advancements in cloud computing have revolutionized the image recognition market, providing opportunities for businesses to leverage the power of the cloud for processing, analyzing, and understanding visual data.

Key Image Recognition Companies

The following are the leading companies in the image recognition market. These players have adopted various strategies to increase their market penetration and strengthen their position in the image recognition industry.

- Amazon Web Services, INC.

- Catchtoom

- IBM

- Imagga technologies ltd

- Intel Corporation

- LTU technologies

- Microsoft Corporation

- NEC Corporation

- Oracle.

Market Landscape and Trends

The image recognition market is expected to continue its growth trajectory in the coming years, driven by factors such as increasing demand for automation, advancements in deep learning techniques, and the growing need for enhanced security and surveillance systems. With ongoing research and development efforts, the market is likely to witness further advancements in image recognition algorithms, leading to improved accuracy and expanded application areas. As businesses across industries recognize the value of visual data, image recognition is poised to play a crucial role in shaping the future of technology and unlocking new possibilities.

Furthermore, one prominent trend in the imarket is the increasing adoption of deep learning algorithms and convolutional neural networks (CNNs). These advanced techniques have revolutionized image recognition by enabling highly accurate and efficient image analysis, object detection, and classification. The availability of large datasets and improved computing power has fueled the development of more sophisticated image recognition models, enabling better performance across a range of applications. In addition, the image recognition market is witnessing increased demand for mobile-based solutions as there is a widespread adoption of smartphones and the growing use of mobile applications, image recognition capabilities on mobile devices have become essential.

Furthermore, in terms of the competitive landscape, the image recognition market is highly dynamic and competitive. Established technology companies, as well as startups, are actively developing and offering image recognition solutions. In addition, key players in the market are investing in research and development to improve the accuracy, speed, and scalability of their image recognition algorithms. Therefore, these are some of the major market trends of market.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the image recognition market forecast from 2023 to 2032 to identify the prevailing image recognition market opportunity.

The image recognition market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the image recognition market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global image recognition market trends, key players, market segments, application areas, and market growth strategies.

Image Recognition Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 126.8 billion |

| Growth Rate | CAGR of 16.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 433 |

| By Component |

|

| By Deployment Mode |

|

| By Technology |

|

| By Application |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Google LLC, Amazon Web Services, Inc., Microsoft Corporation, IBM, Oracle Corporation., LTU Technologies, Inc., Imagga Technologies Ltd., NEC CORPORATION, Catchtoom, Intel Corporation. |

Analyst Review

The image recognition technology finds its application in facial recognition, object detection, medical imaging, and autonomous vehicles. Furthermore, advancements in artificial intelligence and deep learning algorithms have propelled image recognition to new heights, enabling it to permeate various industries. One notable trend is the integration of image recognition with augmented reality (AR) and virtual reality (VR) technologies. This fusion opens up possibilities for immersive experiences, such as real-time object recognition and interactive visualizations.

In addition, the advent of edge computing and the Internet of Things (IoT) allows for on-device image recognition, leading to reduced latency and improved privacy. Moreover, the industries such as retail, healthcare, automotive, and security are expected to leverage image recognition for enhanced customer experiences, personalized medicine, autonomous vehicles, and intelligent surveillance systems. The CXOs further added that increase in availability of large-scale image datasets and surge in adoption of cloud-based image recognition platforms offer significant business opportunities for start-ups and established companies alike. Hence, as image recognition continues to evolve, its potential for revolutionizing industries and transforming everyday life remains vast.

Furthermore, market players are adopting strategies such as product launch and business development to enhance their services in the market and improve customer satisfaction. For instance, in May 2023, AWS launched the general availability of face occlusion detection to improve face verification accuracy. The new FaceOccluded attribute in Amazon Rekognition DetectFaces and IndexFaces APIs detects if the face in an image is partially captured or not fully visible due to overlapping objects, clothing, and body parts. Similarly, in June 2020, CaixaBank, S.A. started a project to roll-out a facial recognition technology at over 100 ATMs across Spain to offer touchless payment withdrawal services to ATM users. The drastic shift of businesses toward digitization is anticipated to boost the usage of image detection and recognition technology. Therefore, such strategies are expected to boost the growth of the image recognition market in the upcoming years.

Some of the key players profiled in the report include Amazon Web Services, INC., Catchtoom, Google, IBM, Imagga technologies ltd, Intel Corporation, LTU technologies, Microsoft Corporation, NEC Corporation, and Oracle. These players have adopted various strategies to increase their market penetration and strengthen their position in the image recognition market.

The global image recognition market size was valued at $28.3 billion in 2022, and is projected to reach $126.8 billion by 2032

The global image recognition market is expected to grow at a compound annual growth rate (CAGR) of 16.5% from 2023-2032 to reach $126.8 billion by 2032

Major key players in the image recognition market research report include Amazon Web Services, INC., Catchtoom, Google, IBM, Imagga technologies ltd, Intel Corporation, LTU technologies, Microsoft Corporation, NEC Corporation, and Oracle.

The Asia-Pacific is expected to exhibit the fastest growing region during the forecast period

Advancements in Deep Learning and Computer Vision, Increase in Applications in the Healthcare Sector, Surge in Demand for Automation, Low Quality Data and Availability & Privacy and Security Concerns

Loading Table Of Content...

Loading Research Methodology...