Immunoglobulin Market Research, 2032

The global immunoglobulin market size was valued at $13.5 billion in 2022, and is projected to reach $25.6 billion by 2032, growing at a CAGR of 6.6% from 2023 to 2032. The primary driver fueling the immunoglobulin market growth is the prevalence of target diseases like primary immunodeficiency, myasthenia gravis, and Idiopathic Thrombocytopenic Purpura. Notably, around 8 million people globally are estimated to be affected by primary immunodeficiency, emphasizing the significant patient population requiring immunoglobulin treatments. Similarly, myasthenia gravis affects approximately 36,000 to 60,000 individuals in the U.S., highlighting the substantial demand for therapeutic interventions. Moreover, the growing geriatric population, more susceptible to immune-related disorders, further underscores the market's momentum. These statistics underscore the critical role of immunoglobulin therapies in addressing the diverse healthcare needs arising from a range of prevalent medical conditions.

Key Takeaways

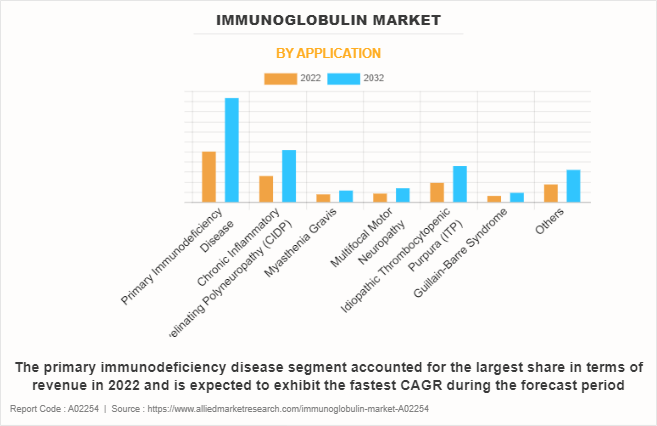

On the basis of application, the primary immunodeficiency disease segment dominated the immunoglobulin market size in terms of revenue in 2022 and is anticipated to grow at fastest CAGR during the forecast period.

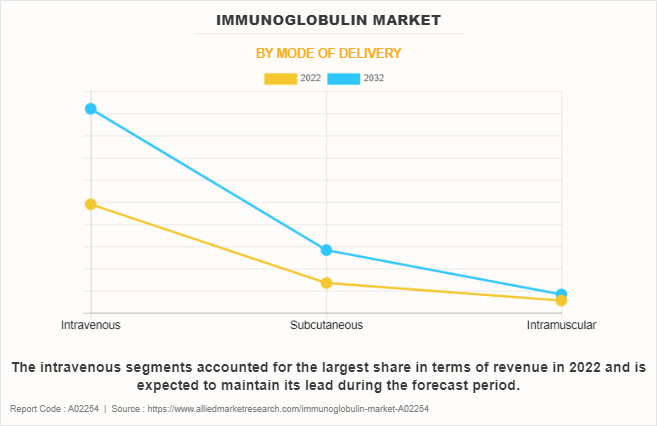

On the basis of mode of delivery, the intravenous segment dominated the market in terms of revenue in 2022. However, the subcutaneous segment is anticipated to grow at the fastest CAGR during the forecast period.

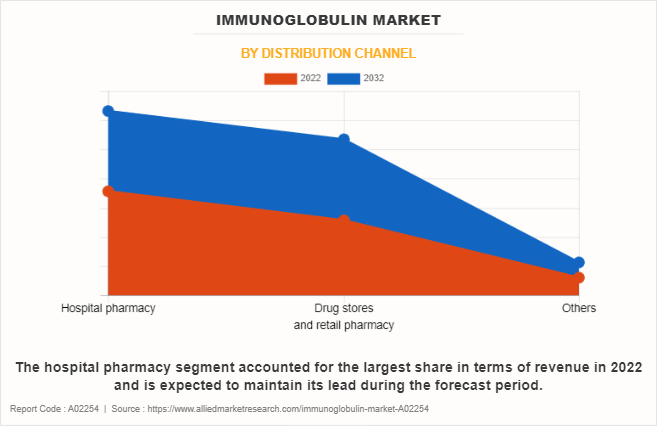

On the basis of distribution channel, the hospital pharmacy segment dominated the immunoglobulin market size in terms of revenue in 2022. However, the drug stores and retail pharmacies segment is anticipated to grow at the fastest CAGR during the forecast period.

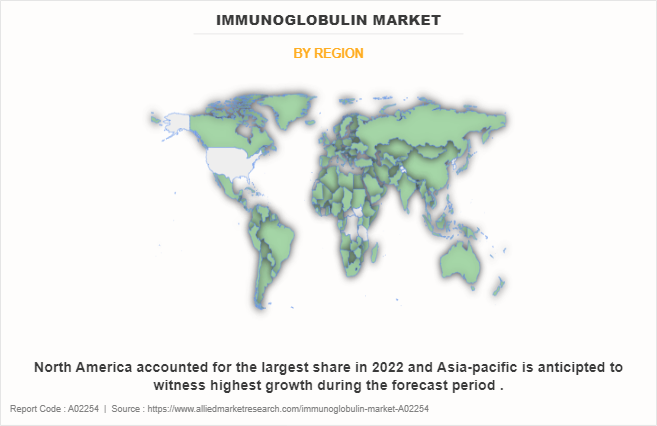

Region wise, North America generated the largest revenue in 2022. However, Asia-Pacific is anticipated to grow at the highest CAGR during the immunoglobulin market forecast period.

Immunoglobulins, also known as antibodies, are proteins produced by the immune system to recognize and neutralize foreign substances such as viruses and bacteria. Immunoglobulin treatment involves administering these antibodies to individuals with immune deficiencies or autoimmune disorders. This therapeutic approach aims to bolster the immune system's response, providing essential antibodies to combat infections or regulate aberrant immune activity. Immunoglobulin treatments are utilized for various conditions, including primary immunodeficiency diseases, autoimmune disorders such as myasthenia gravis, and certain neurological conditions. Administered intravenously or subcutaneously, immunoglobulin therapy plays a crucial role in managing and mitigating a spectrum of medical conditions affecting the immune system.

Market Dynamics

The continuous advancements in immunoglobulin purification and manufacturing processes are pivotal drivers of the market's growth. Innovations in purification techniques and production methodologies enhance the efficiency, quality, and scalability of immunoglobulin manufacturing. This progress ensures a more streamlined and effective production, addressing challenges related to supply chain stability and meeting the rising demand for immunoglobulin therapies. The ongoing refinement of manufacturing processes contributes to the overall improvement of accessibility, efficacy, and sustainability in the immunoglobulin industry

Further, the immunoglobulin market is experiencing growth owing to the presence of reimbursement policies and heightened awareness leading to increased adoption. Reimbursement policies play a crucial role in facilitating patient access by alleviating financial burdens. In addition, rising awareness about the efficacy of immunoglobulin therapies and their applications in various medical conditions contributes to greater acceptance among healthcare professionals and patients. This increased awareness, coupled with supportive reimbursement frameworks, fosters a favorable environment for immunoglobulin adoption, driving sustained market growth.

However, the immunoglobulin industry faces challenges due to complex manufacturing processes and reliance on a stable supply of plasma or alternative sources for antibody production. Intricate manufacturing poses production challenges, potentially leading to supply chain disruptions. Additionally, high treatment costs present a significant barrier, limiting patient accessibility and impeding market expansion. This affordability issue raises concerns about equal access to immunoglobulin therapies, hindering their widespread adoption. Overcoming these challenges requires strategic solutions, including streamlining production processes, diversifying antibody sources, and exploring avenues for cost reduction to ensure sustained accessibility and market growth.

The impact of a recession on the immunoglobulin market opportunity is complex. Economic downturns may strain healthcare budgets, potentially limiting patient access to immunoglobulin therapies due to financial constraints. Reduced healthcare spending and prioritization of essential services can affect treatment affordability. Economic uncertainties may impact pharmaceutical research and development funding. Grifols S.A. stated that in recessionary regions, net revenues and receivables may decline substantially, impacting operations. Despite this, the immunoglobulin market's resilience is tied to critical medical conditions, maintaining demand stability during economic challenges. However, market dynamics during recessions depend on factors such as healthcare policies, reimbursement frameworks, and patient priorities.

Segmental Overview

The immunoglobulin market is segmented on the basis of application, mode of delivery, distribution channel, and region. On the basis of application, the market is classified into primary immunodeficiency disease, chronic inflammatory demyelinating polyneuropathy (CIDP), myasthenia gravis, multifocal motor neuropathy, idiopathic thrombocytopenic purpura, Guillain-Barre syndrome, and others. On the basis of mode of delivery, the market is categorized into intravenous, subcutaneous and intramuscular. The intravenous segment is further divided into 5% concentration, 10% concentration, and others. The subcutaneous segment is further divided into 16.5% concentration, 20% concentration and others. Depending on distribution channel, the market is fragmented into hospital pharmacy, drug stores & retail pharmacy, and others. Region-wise, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and rest of LAMEA).

By Application

The immunoglobulin market is segmented into primary immunodeficiency disease, chronic inflammatory demyelinating polyneuropathy (CIDP), myasthenia gravis, multifocal motor neuropathy, idiopathic thrombocytopenic purpura, Guillain-Barre syndrome and others. The primary immunodeficiency disease segment accounted for the largest immunoglobulin market share in terms of revenue in 2022 and is expected to exhibit fastest CAGR during the forecast period. The expansion of the immunoglobulin market is influenced by various factors, such as the growing incidence of primary immunodeficiency disorders, increased awareness facilitating early diagnosis, and advancements in immunoglobulin therapies. As the research in understanding of these conditions improves and diagnostic capabilities advance, the need for therapeutic solutions such as immunoglobulin treatments is expected to be on the rise.

By Mode of Delivery

The immunoglobulin market is segmented into intravenous, subcutaneous and intramuscular. The intravenous segment accounted for the largest share in terms of revenue in 2022 and is expected to exhibit fastest CAGR during the forecast period owing to the effectiveness and established use of intravenous administration in various therapeutic applications. The method ensures swift and accurate delivery of medications, such as immunoglobulins, directly into the bloodstream, improving bioavailability and treatment efficacy. However, the subcutaneous segment is expected to register the fastest CAGR during the forecast period. This surge is linked to various factors such as advancements in subcutaneous delivery technologies, growth in preference among patients for at-home treatments, and the innovation of more convenient and user-friendly administration approaches.

By Distribution Channel

The immunoglobulin market is divided into hospital pharmacy, drug stores & retail pharmacy and others. The hospital pharmacy segment accounted for the largest immunoglobulin market share in terms of revenue in 2022 and is expected to maintain its lead during the forecast period. This supremacy is linked to various factors, encompassing the pivotal role of hospitals in managing acute and chronic illnesses, the provision of comprehensive healthcare services, and the heightened demand for immunoglobulin therapies within hospital environments. However, the drug stores & retail pharmacy segment is expected to exhibit the fastest CAGR during the forecast period. This is largely attributed to the expanding responsibilities of drug stores and retail pharmacies in delivering convenient healthcare services, aligned with the growing preference for outpatient care. The rising convenience associated with procuring immunoglobulin therapies from retail outlets, coupled with the potential for self-administration and at-home treatments, is a key factor contributing to the growth of this segment.

By Region

The immunoglobulin market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for the largest share in terms of revenue in 2022 and is expected to remain dominant during the forecast period owing to factors such as a well-developed healthcare infrastructure, a notable prevalence of diseases requiring immunoglobulin therapies, and the region's proactive adoption of advanced medical treatments. The established healthcare framework enables efficient delivery of immunoglobulin therapies, contributing to the region's robust market position. However, Asia-Pacific is anticipated to witness notable growth, owing to a sizable population base, heightened healthcare awareness, and a surge in cases of immunodeficiency disorders and autoimmune diseases. These factors collectively drive the demand for immunoglobulin therapies in the region. Additionally, pharmaceutical market expansion, government initiatives, and a surge in research and development activities contribute to the region's accelerated growth.

Furthermore, a rise in research activities as well as the well-established presence of domestic companies in the region are expected to provide notable opportunities for market growth.

Competition Analysis

Competitive analysis and profiles of the major players in the immunoglobulin market that operate in the market are provided in the report, such as CSL, Kedrion, SpA, Takeda Pharmaceutical Company Limited, Bio Products Laboratory Limited, Taibang Biological Group Co., Ltd Grifols, S.A., Octapharma AG, Pfizer Inc., LFB Group, and Prothya Biosolutions. The key players have adopted product launch, acquisition, investment, product approval as strategies to enhance their product portfolio.

Recent Product Launch in Immunoglobulin Market

In April 2020, Grifols S.A., a leading global producer of plasma-derived medicines, announced the launch of a new 3-mL (900-IU) vial for HyperRAB (rabies immune globulin [human]), a treatment for rabies postexposure prophylaxis.

Recent Acquisition in Immunoglobulin Market

In April 2022, Grifols S.A., a leading global producer of plasma-derived medicines, announced completion of the acquisition of 100% of the share capital of Biotest, a global supplier of plasma protein products and biotherapeutic drugs. This is a strategic and transformational transaction to accelerate growth and innovation.

Recent Approval in Immunoglobulin Market

In February 2021, Pfizer Inc., announced that the U.S. Food and Drug Administration (FDA) has approved the supplemental Biologics License Application (sBLA) for PANZYGA (Immune Globulin Intravenous [Human] ‐“ ifas 10% Liquid Preparation) to treat adult patients with a rare neurological disease of the peripheral nerves called chronic inflammatory demyelinating polyneuropathy (CIDP).

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the immunoglobulin market analysis from 2022 to 2032 to identify the prevailing immunoglobulin market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the immunoglobulin market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global immunoglobulin market trends, key players, market segments, application areas, and market growth strategies.

Immunoglobulin Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 25.6 billion |

| Growth Rate | CAGR of 6.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Application |

|

| By Mode of Delivery |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Kedrion, SpA, Bio Products Laboratory Limited, Prothya Biosolutions, Grifols, S.A., Pfizer Inc., Taibang Biological Group Co., Ltd., Takeda Pharmaceutical Company Limited, LFB Group, CSL, Octapharma AG |

Analyst Review

The upsurge in the number of patients suffering from life-threatening diseases and the rise in adoption of immunoglobulin therapy are expected to offer profitable opportunities for the expansion of the market. Further added that the presence of key players and the growing adoption of various strategies and focus on research and development are further anticipated to drive the market growth. In addition, the technological advancements in the purification and manufacturing of the plasma derived immunoglobulins are further contributing to the market growth.

North America has the highest market share in 2022 and is expected to maintain its lead during the forecast period, owing to the availability of improved facilities and rise in adoption of immunoglobulin in treatment. However, Asia-Pacific is expected to exhibit the fastest growth during the forecast period, owing to high population base, rise in chronic diseases, and the surge in healthcare expenditure

The total market value of immunoglobulin market is $13,480.98 million in 2022.

The forecast period for immunoglobulin market is 2023 to 2032

The market value of immunoglobulin market in 2032 is $25,642.46 million

The base year is 2022 in immunoglobulin market .

"Top companies such as CSL, Koninklijke Philips N.V., Grifols S.A. and Kedrion S.p.A. held a high market position in 2022. These key players held a high market postion owing to the strong geographical foothold in North America, Europe, Asia-Pacific, and LAMEA. "

The primary immunodeficiency disease segment is the most influencing segment in immunoglobulin market owing to several factors, including an increasing prevalence of primary immunodeficiency disorders, heightened awareness leading to early diagnosis, and advancements in immunoglobulin therapies.

The major factor that fuels the growth of the immunoglobulin market are rise in prevalence of immunodeficiency diseases, increase in adoption of immunoglobulin and growing geriatric population drive the growth of the global immunoglobulin market .

Immunoglobulins, or antibodies, are proteins produced by the immune system to recognize and neutralize foreign substances like viruses and bacteria. These Y-shaped molecules play a crucial role in the body's defense by binding to specific targets, marking them for destruction by other immune cells.

Loading Table Of Content...

Loading Research Methodology...