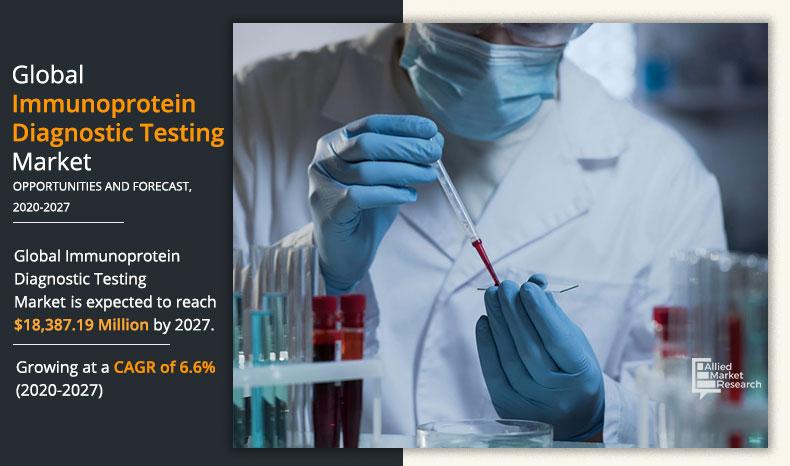

The global immunoprotein diagnostic testing market was valued at $10,136.40 million in 2019 and is projected to reach $18,387.19 million by 2027, registering a CAGR of 6.6% from 2020 to 2027. Immunoproteins are the proteins used as a target for immunological probes or therapies. Immunoprotein diagnostic testing is the procedure of diagnosing the level of immunoproteins in the body for the analysis of diseases related to specific proteins such as immunoglobulin, pre-albumin, and others.

The growth of the global immunoprotein diagnostic testing market is propelled by increase in incidence & prevalence of infectious and chronic diseases, rise in geriatric population, and growth in demand for early diagnostic services. In addition, technological advancements in immunodiagnostic instruments and introduction of novel automated systems are all set to augment the growth of immunoprotein diagnostic testing market during the forecast years. On the contrary, the complex regulatory framework for the approval of various immunoprotein diagnostic tests limits the growth of the market. Conversely, ongoing development in the condition-specific assays & tests and the need for early diagnosis in the emerging economies across the world provide profitable opportunities for the market growth.

The immunoprotein diagnostic testing market is segmented on the basis of type, application, technology, and region. Based on technology, the immunoprotein diagnostic testing market is classified into radioimmunoassay, immunoturbidity assay, immunoprotein electrophoresis, enzyme-linked immunosorbent assay, and others. Under the enzyme-linked immunosorbent assay, the market is further divided into chemiluminescence immunoassay, fluorescence immunoassay, and colorimetric immunoassay. Based on type, the market is categorized into C-reactive protein diagnostic test, complement system protein diagnostic test, pre-albumin diagnostic test, haptoglobin diagnostic test, immunoglobulin diagnostic test, free light chain diagnostic test, and others. Applications of immunoprotein diagnostic testing covered in the study include autoimmune disease testing, infectious disease testing, allergy testing, endocrine testing, oncology testing, toxicology testing, and others. Based on region, the market is analyzed across North America, Europe, Asia-Pacific and LAMEA.

COVID-19 Impact on Immunoprotein Diagnostic Testing Market

COVID-19 pandemic has raised up a critical challenge for the entire healthcare industry verticals, thereby impacting the immunoprotein diagnostic testing market as well. The market is currently facing newer challenges such as intermittent supply chain events in manufacturing, producing and distributing diagnostic kits and assays across the globe. Besides, trade restrictions and unavailability of human resources have further complicated the distribution of these test kits to the consumers. However, this deleterious impact is being remunerated by the increasing demand of these products for COVID-19 detection. Furthermore, pharmaceutical companies are presently granted emergency-use authorization for diagnostic kits and assays in order to cope up with the ongoing pandemic crisis. This has boosted the demand for diagnostic testing in several countries, thereby driving the growth of the immunoprotein diagnostic testing market. The overall, impact of the pandemic is expected to remain positive for the key players in the market, owing to the increasing number of COVID-19 cases as well as the ongoing R&D regarding the potential use of immunoproteins for developing antibodies against the SARS-CoV-2 virus.

By Technology

Enzyme-linked Immunosorbent Assay segment held a dominant position in 2019 and would continue to maintain the lead over the forecast period.

Technology Segment Review

Based on technology, the global immunoprotein diagnostic testing market is segmented into radioimmunoassay, immunoturbidity assay, immunoprotein electrophoresis, enzyme-linked immunosorbent assay, and others. Enzyme based immunoassay segment was the highest contributor to the global immunoprotein diagnostic testing market. This was attributed to growing use of immunoassays in cancer, POC IVD testing, infectious disease testing, therapeutic drug level monitoring, and the introduction of novel biomarkers. Advantages of ELISA, include long shelf life and ease of use, resulting in increased acceptance of these tests among academic and industrial sectors.

By Type

immunoglobulin Diagnostic Tests segment is projected as one of the most lucrative segment.

Type Segment Review

Based on type, the market is divided into C-reactive protein diagnostic tests, complement system protein diagnostic tests, pre-albumin diagnostic tests, haptoglobin diagnostic tests, immunoglobulin diagnostic tests, free light chain diagnostic tests and others. Immunoglobulin diagnostic tests segment was the largest revenue contributor, owing to increasing incidences of auto-immune diseases across the world.

By Application

Infectious disease testing segment was holding a dominant position in 2019 and would continue to maintain the lead over the forecast period.

Application Segment Review

Based on application, the global immunoprotein diagnostic testing market is categorized into autoimmune testing, infectious disease testing, allergy testing, endocrine testing, oncology testing, toxicology testing, and others. Infectious disease testing segment was the largest revenue contributor, due to higher prevalence of infectious diseases such as hepatitis B, hepatitis C, HIV-1, HIV-1/2, and human T-lymphotropic virus types I & II.

By Region

North America was holding a dominant position in 2019 and would continue to maintain the lead over the forecast period.

Region segment review

Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The North America immunoprotein diagnostic testing market accounted for the highest market share of 40.56% in 2019, and is expected to maintain this trend during the forecast period due to increase in demand for quick diagnostic services to detect chronic diseases, ongoing trend of preventive healthcare, and rise in the number of drug abuse and allergy cases. The Asia-Pacific immunoprotein diagnostic testing market is expected to grow at a CAGR of 7.7% during the forecast period, owing to increase in the number of patients suffering from chronic diseases and improvement in healthcare facilities in the region. The key players profiled in the report include Abbott Laboratories, Abcam PLC, Bio-Rad Laboratories, Danaher Corporation, Diasorin, Enzo Life Sciences, Ortho Clinical Diagnostics, Roche Diagnostics, Siemens Healthcare, and Thermo Fisher Scientific.

Key Benefits For Stakeholders

- This report provides a detailed quantitative analysis of the current immunoprotein diagnostic testing market trends and forecast estimations from 2019 to 2027, which assists to identify the prevailing market opportunities.

- An in-depth market analysis includes analysis of various regions, which is anticipated to provide a detailed understanding of the current trends to enable stakeholders formulate region-specific plans.

- A comprehensive analysis of factors that drive and restrain the growth of the global is provided.

- Region-wise and country-wise market conditions are comprehensively analyzed in this report.

- The projections in this report are made by analyzing the current trends and future market potential from 2020 to 2027, in terms of value.

- An extensive analysis of various regions provides insights that are expected to allow companies to strategically plan their business moves.

- Key market players within the immunoprotein diagnostic testing market are profiled in this report and their strategies are analyzed thoroughly, which helps in understanding competitive outlook of global immunoprotein diagnostic testing market.

Key Market Segments

By Type

- C-reactive Protein Diagnostic Test

- Complement System Protein Diagnostic Test

- Pre-albumin Diagnostic Test

- Haptoglobin Diagnostic Test

- Immunoglobulin Diagnostic Test

- Free Light Chain Diagnostic Test

- Others

By Application

- Autoimmune Testing

- Infectious Disease Testing

- Allergy Testing

- Endocrine Testing

- Oncology Testing

- Toxicology Testing

- Others

By Technology

- Radioimmunoassay

- Immunoturbidity Assay

- Immunoprotein Electrophoresis

- Enzyme-linked immunosorbent assay

- Chemiluminescence Immunoassay

- Fluorescence Immunoassay

- Colorimetric immunoassay

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Australia

- Japan

- India

- China

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Brazil

- South Africa

- Rest of LAMEA

Immunoprotein Diagnostic Testing Market Report Highlights

| Aspects | Details |

| By TECHNOLOGY |

|

| By Type |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | Enzo Biochem, Inc., Thermo Fisher Scientific Inc., Hoffmann-La Roche AG (Roche Diagnostics), Diasorin S.P.A, Bio-Rad Laboratories, Inc., Danaher Corporation, Siemens AG, Ortho Clinical Diagnostics, Abbott Laboratories, Abcam plc. |

Analyst Review

The immunoprotein diagnostic testing market is expected to witness a significant growth, owing to growth in diagnosis of infectious diseases and chronic diseases globally.

The adoption of immunoprotein diagnostic tests is expected to increase due to the increased prevalence of diseases such as cancer, cardiovascular diseases, allergies, urological disorders, and orthopedic diseases. In addition, rise in demand for immunoprotein diagnostic products for proteomics research is anticipated to boost the market growth. Remarkable technological advancements have been witnessed in immunoprotein testing to provide advanced diagnostic testing for patients who suffer from various diseases. Furthermore, the recent pandemic is anticipated to create an unprecedented demand for immunoprotein diagnostic kits and assays in coming months.

The total market value of Immunoprotein Diagnostic Testing Market is $18,387.19 million by 2027

The forecast period in the report is from 2020 to 2027

The market value of Immunoprotein Diagnostic Testing Market in 2019 was $10,136.40 Million

The base year for the report is 2019

Yes, Immunoprotein Diagnostic Testing companies are profiled in the report

The top companies that hold the market share in Immunoprotein Diagnostic Testing Market are Abbott Laboratories, Abcam PLC, Bio-Rad Laboratories, Danaher Corporation, Diasorin, and Roche Diagnostics

No, there is no value chain analysis provided in the Immunoprotein Diagnostic Testing Market report

Currently, the key trend in the Immunoprotein Diagnostic Testing Market is rising number of COVID-19 incidences across the globe

Loading Table Of Content...