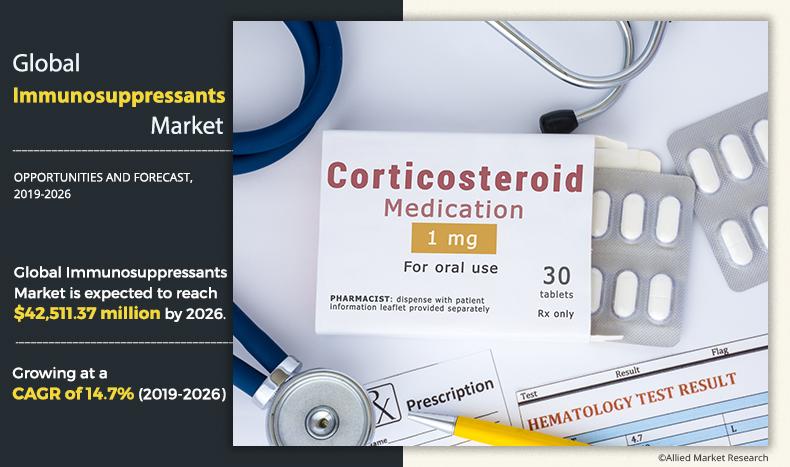

The global immunosuppressants market size was valued at $13,890.0 million in 2018 and is expected to reach $42,511.37 million by 2026, registering a CAGR of 14.7% from 2019 to 2026. Immunosuppressants belong to the drug family that helps in suppressing the immune response or agents. During organ transplantation, from a donor to a recipient, immune system of the recipient gets stimulated and thus, produces immune response like it does in response to other foreign material. This immune response causes serious damage to the transplanted or grafted organ. It is often called as rejection, which can be acute or chronic. This organ rejection is prohibited by using immunosuppressive drugs, which block the immune response and protect new organ and its function. They are mainly used to avert several autoimmune diseases including myasthenia gravis, arthritis, lupus, rheumatoid arthritis, Crohn’s disease, and organ transplant rejections such as transplant of kidney, liver, and heart. There are three stages of clinical immunosuppression: induction therapy, maintenance therapy, and treatment of an established acute rejection response.

Surge in prevalence of autoimmune disorders such as arthritis, multiple sclerosis, and alopecia areata is the major factor that drives the immunosuppressants market growth. In addition, surge in organ transplant procedures such as kidney transplant and liver transplant due to rise in incidences of organ failure further propel the growth of immunosuppressant market. For instance, according to the U.S. National Kidney Association, in 2014, 17,107 kidney transplants took place in the US. In addition, as per the U.S. Government Information on Organ Donation and Transplantation, 36,528 organ transplants were performed in 2018 in the country. However, dearth of availability of organ donors and high cost of these drugs are the limitations for the growth of this immunosuppressant market. For instance, as per the U.S. Government Information on Organ Donation and Transplantation, more than 113,000 number of individuals are on the national transplant waiting list as of July 2019. On the contrary, increase in use of tissue engineering for generation of implants provide growth opportunities for the market. In addition, rise in disposable income in developing economies and surge in awareness among individuals toward organ donation is anticipated to create lucrative opportunities for the market in the near future.

Global Immunosuppressant Market Segmentation:

The immunosuppressants market is segmented on the basis of drug class, indication, distribution channel, and region. By drug class, it is divided into corticosteroids, monoclonal antibodies, calcineurin inhibitors, mTOR inhibitors, anti-proliferative agents, and others. On the basis of indication, it is categorized into organ transplantation, autoimmune disorders, and non-autoimmune inflammatory diseases. By distribution channel, it is classified into hospital pharmacies, retail pharmacies, and online pharmacies. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Drug class segment review

By drug class, the calcineurin inhibitors segment accounted for majority of the immunosuppressants market share in 2018 and is expected to exhibit a prominent growth rate in the near future, owing to the fact that it is the most used immunosuppressant drug used after organ transplantation to suppress hyper immune response. The most widely prescribed calcineurin inhibitor drugs include cyclosporine and tacrolimus. This segment is also anticipated to be the fastest growing drug class segment during the forecast period.

By Drug Class

mTOR Inhibitors segment is projected as one of the most lucrative segments.

Indication segment review

Based on immunosuppressants market analysis, the auto-immune disorder segment dominated the immunosuppressants market in 2018, and is anticipated to maintain its dominance during the forecast period. This is attributed to the surge incidence of auto immune disorders across the globe. For instance, according to the U.S. National Institute of Environmental Health Sciences (NIH), autoimmune diseases are among the most prevalent diseases in the country affecting more than 23.5 million Americans.

By Indication

Organ Transplantation is projected as one of the most lucrative segments.

By region, North America accounted for majority of the market share in 2018, and is anticipated to continue this trend during the forecast period. This is attributed to the increase in prevalence of auto-immune disorders in this region. Moreover, organ failure incidences are also on the rise in this region, including kidney failure and liver failure. However, the Asia-Pacific region is anticipated to grow at the fastest rate during the forecast period. This is attributed to the surge in awareness among individuals toward organ donation. Further, rise in healthcare expenditure, growth in disposable incomes, and government measures toward making immunosuppressant drugs available for patients contribute to the market growth.

By Region

LAMEA region would exhibit the highest CAGR of 16.7% during 2019-2026.

Comprehensive competitive analysis and profiles of major immunosuppressant market players such as Astellas Pharma, Inc., Bristol Myers Squibb, F. Hoffmann La Roche Ltd., GlaxoSmithKline Plc., Intas Pharmaceuticals Ltd., Johnson & Johnson, Mylan Laboratories Inc., Novartis AG, Pfizer, Inc., and Sanofi S.A are provided in this report.

Key Benefits for Stakeholders:

- The immunosuppressant market analysis is based on a comprehensive analysis of key developments in the industry.

- The development strategies adopted by key market players are enlisted to understand the competitive scenario of the global immunosuppressant market.

- The study provides an in-depth analysis of the market trends to elucidate imminent investment pockets.

- The global immunosuppressants market trends are studied from 2018 to 2026.

- Information about key drivers, restrains, and opportunities and their impact analysis on the market size is provided.

- Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the industry.

- The quantitative analysis of the global immunosuppressants market forecast from 2019 to 2026 is provided to determine the market potential.

Immunosuppressants Market Report Highlights

| Aspects | Details |

| By Indication |

|

| By Drug Class |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | AbbVie Inc., Novartis International AG (Sandoz), Sanofi S.A., Mylan N.V., INTAS PHARMACEUTICALS LTD. (Accord Healthcare Ltd.), Astellas Pharma Inc., GlaxoSmithKline Plc., Johnson & Johnson (Janssen Pharmaceuticals, Inc.), Bristol-Myers Squibb Company, Pfizer Inc. |

Analyst Review

Immunosuppressants are the drugs that suppress the strength of immune system or drugs that reduce the immune response. These drugs help in making the body less likely to reject a transplanted organ, such as a liver, heart, or kidney. In addition, immunosuppressants are also used to treat autoimmune disorders such as lupus, psoriasis, and rheumatoid arthritis.

The immunosuppressants market is anticipated to witness a steady growth in the future, owing to rise in prevalence of autoimmune disorders across the globe, and rise in adoption of organ transplantation. Further, surge in development of immunosuppressant drugs such as monoclonal antibodies, mTOR inhibitors, and anti-proliferative agents further propel the market growth. However, side effects of these drugs, such as these drugs make immune system weaker, and high cost of these drugs is expected to hamper the market growth in the future. On the contrary, continuous focus of researchers toward the development of artificial organs is anticipated to create lucrative opportunities in the near future.

Loading Table Of Content...