Implantable Medical Devices Market Research, 2030

The global implantable medical devices market was valued at $91,868.94 million in 2020, and is projected to reach $179,032.75 million by 2030, growing at a CAGR of 7.2% from 2021 to 2030. Implantable medical devices are the devices or tissues, which are placed inside or on the surface of the body. Many implants are prosthetics, intended to replace missing body parts. Some other implants deliver medication, monitor body functions or provide support to organs and tissues. The implants are placed permanently for diagnostic, monitoring, or therapeutic purposes or they can also be removed once they are no longer needed. The long-term implants have the advantage of being in a constant-temperature environment where adhesive joint has the additional challenge of complex loading conditions and ever increasing device-lifetime requirements.

The implantable medical devices market growth is driven by the rise in prevalence of chronic diseases coupled with the rapidly ageing population, surge in cardiovascular & neurological illnesses, and improvements in active implanted medical devices. Moreover, increased awareness and technological advancements in medical implant, rise in the investments & funds to develop technologically advanced products, and upsurge in the applications of neurostimulators contributes toward the growth of the market. However, high implantation cost and lack of trained professionals in the medical surgeries sector are expected to hinder the market growth. Conversely, the increase in number of the reimbursement policies offers implantable medical devices market opportunity.

Coronavirus (COVID-19) was discovered in late December, 2019, in Hubei province of Wuhan city in China. The disease is caused by a virus, namely, severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), which is transmitted among humans. Amidst the initial outbreak of COVID-19, the reduced hospitals admissions of the patients to undergo implant surgery were observed. It was due to the reason that people feared getting infected during a period of distancing and lockdown. Various regions reported reduction in patients’ admission in the hospital indicating that many patients with moderate and severe disabilities avoided the hospital visits. Overall, the impact of COVID-19 on the implantable medical devices industry was recorded to be fairly negative. This was attributed to decrease in the demand for the implant surgeries. Moreover, the market players have reduced the investment in raw materials and resources owing to the decline in number of hospital admission of the patients to undergo the implant surgeries.

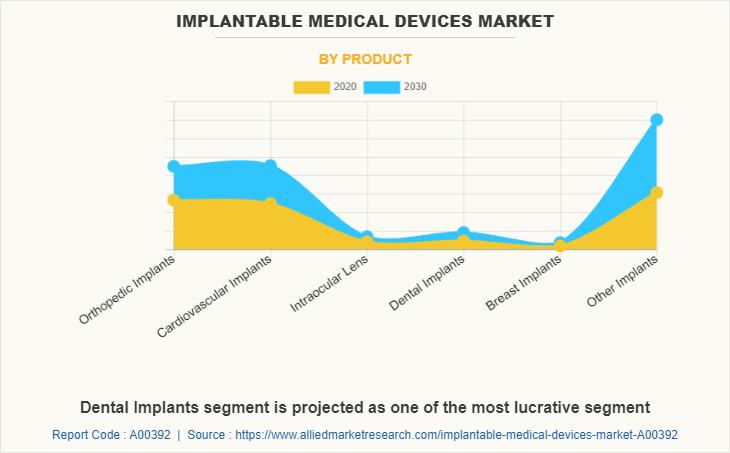

The implantable medical devices market is segmented on the basis of product and region. Based on product, the implantable medical devices market size is categorized into orthopedic implants, dental implants, breast implants, cardiovascular implants, intraocular lenses, and other implants. The orthopedic implants are further classified as spinal implants and reconstructive joint replacements. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Product segment review

By the product, the global implantable medical devices market is classified into orthopedic implants, dental implants, breast implants, cardiovascular implants, intraocular lenses, and other implants. Other implants segment was the major implantable medical devices market share to the global implantable medical devices market size in 2020, and is anticipated to remain dominant during the implantable medical devices market forecast period due to technological advancements in the implantable medical devices, increase in adoption of implantable medical devices, rise in incidence rate of chronic cardiovascular diseases, and surge in number of advanced and effective product launches.

Region Segment Review

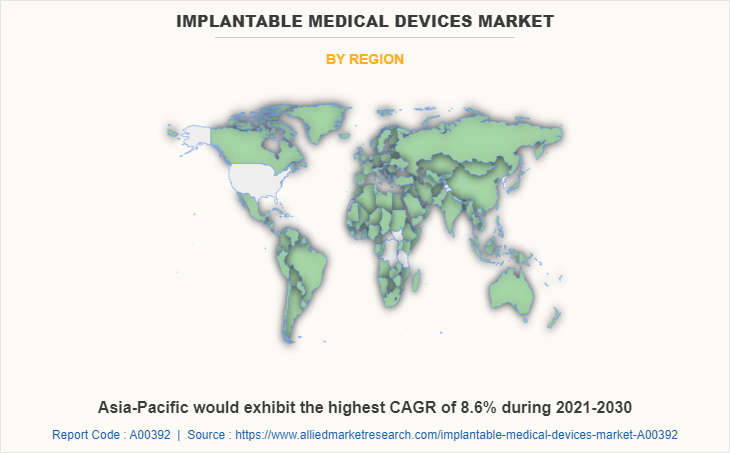

North America accounted for major share of the global implantable medical devices market share in 2020, and is expected to remain dominant throughout the forecast period. This has attributed to increase in incidences of chronic diseases, surge in demand for implantable medical devices, availability of advanced healthcare facilities with trained medical professionals, rise in number of R&D activities coupled with large presence of key players, and upsurge in investment made by governments in the healthcare system. However, Asia-Pacific is expected to experience the highest growth rate during the forecast period. Moreover, Japan and China are expected to grow at high CAGR in Asia-Pacific implantable medical devices market majorly due to improvement in healthcare infrastructure, rise in number of hospitals equipped with advanced instruments, development of the R&D sector, surge in healthcare reforms, and technological advancements in the field of implants.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the implantable medical devices market analysis from 2020 to 2030 to identify the prevailing implantable medical devices market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the implantable medical devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global implantable medical devices market trends, key players, market segments, application areas, and market growth strategies.

Implantable Medical Devices Market Report Highlights

| Aspects | Details |

| By PRODUCT |

|

| By Region |

|

| Key Market Players | Integra LifeSciences Holdings Corporation, Globus Medical, Inc., C. R. Bard, Inc., Biotronik SE and Co. KG, Abbott Laboratories, LivaNova PLC, Cardinal Health, Inc., Boston Scientific Corporation, CONMED Corporation, Johnson and Johnson |

Analyst Review

The adoption of medical implants (such as cardiac, orthopedic, dental, and breast implants) is likely to witness a significant rise with increased prevalence of chronic diseases and rapidly aging population. The implantable medical devices market has piqued the interest of healthcare providers owing to several benefits offered by these devices to monitor and treat the clinical disorders. There have been remarkable technological advancements in medical implants to provide advanced treatment options for the management of diseases. As the market is saturated with steady growth rate in developed nations, Asia-Pacific and LAMEA regions are expected to offer high growth opportunities to the key players.

The growth in incidence of chronic diseases, rapidly aging population, technological advancements, rise in acceptance of medical implants, and improvement of healthcare infrastructure in emerging nations are some of the major factors that drive this market. However, high cost of treatment associated with medical implants, reimbursement issues, and stringent regulatory policies for the approval of these implants are expected to restrain the market growth. Currently, orthopedic implants market is the largest segment of implantable medical devices market, followed by other implants segment.

Rise in obesity and a surge in osteoporosis-related fracture among all age groups are projected to maintain the need for orthopedic interventions. In addition, emerging markets have gained more importance for the majority of the medical implant manufacturers and distributors. A rapid growth was observed in the shipments of these devices to provide improved healthcare services in emerging nations, and this is expected to offset the challenging conditions in mature markets such as North America and Europe.

The total market value of Implantable Medical Devices market is $179,032.75 million in 2030.

Top companies such as Cardinal Health, Inc., Abbott Laboratories, Medtronic plc, Danaher Corporation, Becton, Dickinson and Company , Stryker Corporation held a high market position in 2020. These key players held a high market postion owing to the strong geographical foothold in different regions.

Other implants segment is the most influencing segment owing to the rise in prevalence of chronic diseases coupled with the rapidly ageing population.

The forecast period for Implantable Medical Devices market is 2020 to 2030

The market value of Implantable Medical Devices market in 2020 is $91,868.94 million.

The base year for Implantable Medical Devices market is 2020

The surge in cardiovascular & neurological illnesses, improvements in active implanted medical devices, increased awareness, technological advancements in medical implant and rise in the investments & funds to develop technologically advanced products are the key trends in the Implantable Medical Devices market report.

Asia-Pacific has the highest growth rate of 8.6% in the market which is growing due to presence of large patient population, strong presence of key players, ease of devices availability, well developed healthcare infrastructure, favorable reimbursement policies in healthcare system, higher number of research and development.

Yes, the Implantable Medical Devices market companies are profiled in the report.

Yes, the Implantable Medical Devices market report provides PORTER Analysis

Loading Table Of Content...