In Vitro Toxicity Testing Market Research, 2030

The global in vitro toxicity testing market size was valued at $18,565.2 million in 2020 and is projected to reach $59,147.6 million by 2030, growing at a CAGR of 12.0% from 2020 to 2030. In vitro is the process that helps examine harmful chemicals over the isolated part of the organism. It is used to identify hazardous chemical substances and helps detect toxicity at early stages of the development of new products, such as drugs, cosmetics, and food additives. The in vitro toxicity testing (IVTT) is mainly used for safety evaluation in drug development and also for ranking the chemicals according to their potency. The absorption, distribution, metabolism, excretion (ADME), dose response, and threshold response of the drug can also be determined by in vitro toxicity testing. A rise in need for in vitro toxicity testing in various industry verticals such as pharmaceuticals, chemicals, and food industry, which fuels the growth of the in vitro toxicology testing market. In addition, rise in awareness of testing of various cosmetics, foods, and other products, which fuels the growth of the in vitro toxicology testing market.

The global in vitro toxicology testing market is expected to witness notable growth during the analysis period due to the increase in number of R&D procedures, which require in vitro testing, ban on animal testing, and increase in awareness about the environmental concerns. In addition, advancement in genetics and genetic screening approaches and emergence of new approaches of 3D cell culture boost the in vitro toxicity testing market growth.

At present, the absorption segment has witnessed large-scale adoption of in vitro toxicity testing market. Toxic substances and dose screening are some of the other segments in the global in vitro toxicity testing market. These segments are anticipated to witness increase in market share due to increase in demand for in vitro toxicity testing in pharmaceutical, chemicals, cosmetics, and household products. Moreover, stringent government regulations to reduce cruelty while performing experiment on animals, increase global illicit drug abusers, and enhanced efficiency of in vitro toxicity testing in diagnosis are some other driving factors of the market. However, decrease in adoption rate of IVTT and incapability of IVTT to detect toxicities due to autoimmunity and immunostimulation can hinder the market growth.

Major players, such as GlaxoSmithkline Plc (GSK), General Electric Company, and others are adopting acquisition to improve their product portfolio to maintain competition in the market. For instance, GlaxoSmithkline Plc completed the acquisition of Tesaro Inc. which is an onclogy focused company in Waltham, Massachusetts in January 2019. This acquisitions significantly strengthens GSK's pharmaceuticals business, accelerating the build of GSK's pipeline and commercial capability in oncology. Such instances are expected to provide lucrative in vitro toxicity testing market opportunity for the major players for the growth of the market. In vitro toxicity testing market forecast from 2020 to 2030.

The COVID-19 pandemic forced many companies in the global in vitro toxicity testing market to halt business operations for a short term to comply with new government regulations to curb the spread of the disease. This halt in operations directly impacts revenue flow of the global in vitro toxicity testing market. In addition, there is a halt in manufacturing of industrial products, owing to lack of raw materials and manpower in the lockdown period. Further, no new consignments are received by companies that operate in this sector. Hence, halt in industrial activities and lockdowns for several months has affected the global in vitro toxicity testing market and the market is anticipated to witness a slow recovery during the forecast period.

The in vitro toxicity testing market is segmented into type, technology, end user, and region. On the basis of type, the market is categorized into absorption, toxic substances, and dose. Currently, the absorption segment dominates the global in vitro toxicity testing market.

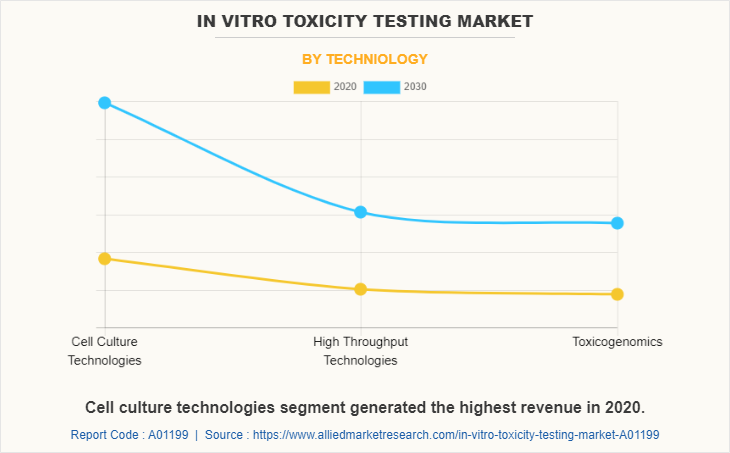

On the basis of technology, the in vitro toxicity testing market is segment into cell culture technologies, high throughput technologies, and toxicogenomics. The cell culture technologies segment generated the highest revenue in 2020.

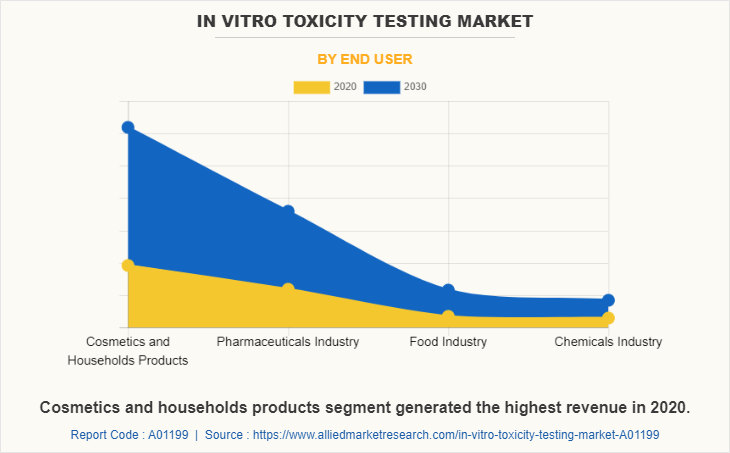

On the basis of end user, the market is categorized into pharmaceuticals, cosmetics & household products, chemicals industry, and food industry. The cosmetics and households products segment have the highest in vitro toxicity testing market share in 2020.

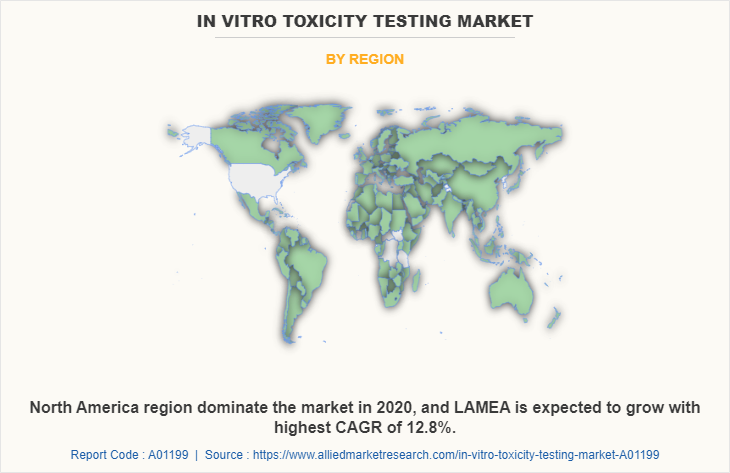

On the basis of region, the in vitro toxicity testing market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America has the highest revenue growth, followed by Europe. LAMEA is predicted to grow faster than Asia-Pacific with a CAGR of 16.7% during the forecast period. The LAMEA segment is expected to dominate the in vitro toxicity testing market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the in vitro toxicology industry segments, current trends, estimations, and dynamics of the in vitro toxicity testing market analysis from 2020 to 2030 to identify the prevailing in vitro toxicity testing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the in vitro toxicity testing market segmentation, and in vitro toxicity testing market forecast assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global in vitro toxicity testing industry.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global in vitro toxicity testing market trends, key players, market segments, application areas, and market growth strategies.

In Vitro Toxicity Testing Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Techniology |

|

| By End User |

|

| By Region |

|

| Key Market Players | Laboratory Corporation of America Holdings, Catalent Inc, Thermo Fisher Scientific, Inc., ACACIA PHARMA GROUP PLC, AstraZeneca plc, General Electric Company, Heron Therapeutics Inc, TESARO INC., Helsinn Holding S.A. |

Analyst Review

In vitro toxicity testing market holds a substantial scope for growth globally. Currently, North America is the lucrative segment that holds the largest market share. However, in the coming years, Asia-Pacific is expected to grow significantly with increase in demand for in vitro toxicity testing market in the food and chemical industries. Recent advances in technology, such as mass spectrometry and chromatography such as liquid chromatography and HPLC are expected to increase the demand for in vitro toxicity testing. Factors such as less time consumption, cost-effectiveness, and accurate testing with more reliability have further fueled the market growth. Numerous players are stepping in the in vitro toxicity testing market with innovative products, which is expected to provide potential growth opportunities for market expansion. Rise in cases of drugs abuse has increased the use of in vitro toxicity testing, which boosts the market growth. Moreover, increase in drug discovery and emerging approaches such as 3D cell culture assays are expected to provide lucrative opportunities for the market growth. In vitro toxicity testing is now highly preferred to in vivo tests, which is anticipated to increase its use in various applications.

North America region dominate the market in 2020.

Catalent Inc, Thermo Fisher Scientific Inc, and Helsinn Holdings S..A., are the key companies holds the largest share.

A rise in need for testing for pharmaceuticals, and chemical indusstry, are the key trends in the in vitro toxicity testing market.

The global in vitro toxicity testing market was valued at $18,565.2 million in 2020 and is projected to reach $59,147.6 million by 2030, growing at a CAGR of 12.0% from 2020 to 2030.

A in vitro toxicity testing is used in applications such as households, pharmaceuticals, food and chemical industry.

Loading Table Of Content...