Incretin-Based Drugs Market Research, 2032

The global incretin-based drugs market size was valued at $34.4 billion in 2022, and is projected to reach $73.9 billion by 2032, growing at a CAGR of 7.9% from 2023 to 2032. The growth of the incretin-based drugs market is driven by a rise in prevalence of type-2 diabetes around the globe and surge in prescription of incretin-based drugs for the treatment of this condition. According to an article by Centers for Disease Control and Prevention (CDC) published in 2023, about 38 million Americans have diabetes (about 1 in 10), and approximately 90-95% of them have type 2 diabetes. Type 2 diabetes most often develops in people over age 45, but more children, teens, and young adults are also developing it. Such rise in prevalence of type 2 diabetes in the U.S. and other countries around the globe, increases the demand for incretin-based drugs for treatment. This propels the incretin-based drugs market growth.

Key Takeaways:

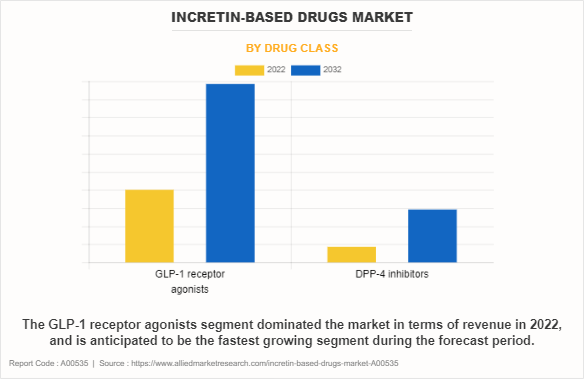

- The GLP-1 receptor agonists segment dominated the global incretin-based drugs market size in 2022.

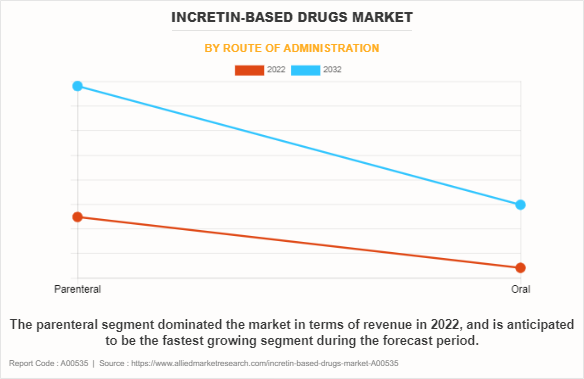

- The parenteral segment dominated the global market in 2022 and is anticipated to be the fastest-growing segment

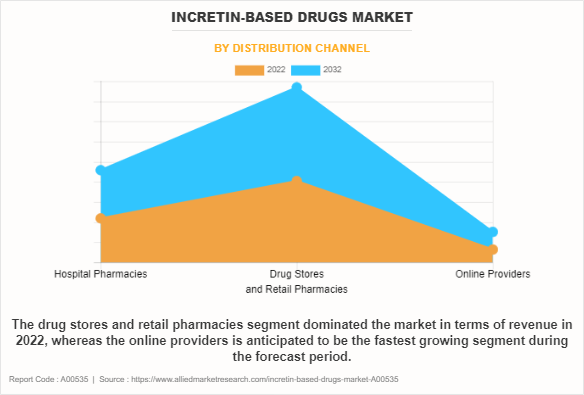

- The drug stores and retail pharmacies segment held the largest incretin-based drugs market share.

- On the other hand, the online providers segment is anticipated to be the fastest growing segment during the forecast period.

- The North America region dominated the market in terms of revenue in 2022.

Incretin-based drugs are used to treat type 2 diabetes mellitus. The incretin system is a natural hormonal pathway that regulates blood sugar levels. There are two main categories of incretin drugs, GLP-1 (glucose-1 receptor agonist) and DPP (diprepressin-4) inhibitors. Glucose-1-receptor agonists (GLP-1) work by mimicking the action of GLP-1, a naturally occurring incretin hormone. It also inhibits glucose production (reduces glucose absorption) and delays gastric emptying. Some GLP-1-receptors are approved for weight loss due to their ability to aid in weight loss. DPP-4 inhibitors (DPPP-4 inhibitors) work differently. It blocks the enzyme DPP-4, responsible for breaking down incretin hormones like GLP-1. By inhibiting the action of DPP-4 on the incretin hormone, it stimulates the insulin release and reduces glucagon secretion, aiding in glucose regulation

Market Dynamics

Rise in prevalence of type 2 diabetes is the major factor driving the growth of the market. As the global type 2 diabetes population continues to rise, there is a growing need for innovative therapies to manage this long-term condition. This is where incretin drugs play a crucial role, as they help to regulate blood glucose levels by increasing insulin secretion and decreasing glucagon release.

Furthermore, the incretin market has seen a surge in recent years due to the research and development of diabetes therapies that use incretin. Researchers are looking for ways to make these therapies more effective, safer, and easier to use for patients. Some of these new drugs include longer-acting formulations that can be dosed in shorter amounts. For example, once-weekly injections of GLP-1 receptors are becoming increasingly popular and are easier to use than daily injections. As a result of these advances in incretin drugs, the market has seen an increase in adoption of these advanced drugs.

However, side effects associated with the excessive use of macrolide antibiotics may act as a restraint to the market growth. Macrolide antibiotics may lead to side effects such as nausea, vomiting, abdominal pain, and diarrhea. It may also include rare side effects such as cardiac arrhythmias and abnormal liver function.

In addition, the high price of incretin drugs can be a major obstacle to market growth in many ways. Cost is a major issue, especially in areas where healthcare costs are high for individuals, healthcare providers, or insurance companies. Patients may also face barriers to access due to the high cost.

Also, approval procedures by regulatory agencies, such as the FDA in the U.S. or the EMA in Europe, can also cause delays in the introduction of new incretin drugs to the market. These delays can prevent patients from accessing innovative therapies in a timely manner, slow down-market growth, and limit access to advanced treatment options.

However, surge in research and development of incretin-based drugs along with strong pipeline products is anticipated to drive the market during the forecast period. This increase is due to the recognition that incretin drugs, including GLP- 1 receptor agonists (GLP-1) and DPP4 inhibitors (DPP-4 inhibitors), are essential building blocks in addressing the complex issues associated with diabetes and metabolic diseases.

For instance, the U.S. Food and Drug Administration approved Mounjaro in May 2022 for the treatment of type 2 diabetes. Based on the results of these studies, which showed that people taking Mounjaro lost weight, Lilly started to study Mounjaro as weight loss therapy in additional studies.

In a recession, government and private research funding tends to decline as economic activity and economic indicators decline. Consumer spending, business investment, and job losses all contribute to a decrease in healthcare budgets. This is especially true when it comes to funding research and development (R&D) in the pharmaceutical industry. The pharmaceutical industry faces a number of challenges during a recession. There is likely to be a decrease in market demand for new and advanced incretin-based drugs.

There may be increased affordability concerns about the availability of incretin-based medications as they have high cost, which may lead to drug pricing reforms in times of economic hardship. The recession may disrupt clinical trials, which are essential for the development of new drugs. These trials may delay the introduction of new drugs, which could impede innovative treatment development and impede market growth. Despite these challenges, a significant number of ongoing clinical trials and pre-existing regulatory approvals helped to mitigate the overall effect of a recession.

Segmental Overview

The incretin-based drugs market is segmented based on drug class, route of administration, distribution channel, and region. On the basis of drug class, the market is divided into GLP-1 receptor agonists and DPP-4 inhibitors. On the basis of route of administration, the market is classified into oral and parenteral. By distribution channel, the market is categorized into hospital pharmacies, drug stores & retail pharmacies and online providers. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

By Drug Class

The GLP-1 receptor agonist segment dominated the market in terms of revenue in 2022 and is anticipated to be the fastest growing segment during the incretin-based drugs market forecast period. GLP-1 (glucose-1-aminobutyric acid) agonists have seen a surge in popularity due to its use in treating diabetes, obesity, and other conditions. These drugs are known to help regulate blood sugar levels, especially after meals, and may also help with weight management by increasing feelings of satiety.

In addition, GLP-1 is prescribed in various forms, including injections and oral tablets, and is available under a variety of brands, including Trulicity, Byetta, Bydureon and Victoza. These drugs are readily available and cost-effective in developed and some developing countries, leading to the segment's growth in these areas.

By Route of Administration

By route of administration, the parenteral route held the major incretin-based drugs market share terms of revenue in 2022 and is anticipated to be the fastest growing segment during the forecast period. Injectable drugs are administered via prefilled pens and offer a range of benefits, such as reducing blood sugar, improving cardiovascular health, and helping you lose weight in a single treatment.

By Distribution Channel

By distribution channel, the drug stores and retail pharmacies segment dominated the market in terms of revenue in 2022, owing to the easy accessibility of medications as these channels are available in the locality of the patients and patients can access medications at any time whenever needed.

On other hand, the online providers segment is anticipated to be the fastest growing segment during the forecast period, which is attributed to the advantages such as cost effectiveness, doorstep delivery and others that are offered by online providers.

By Region

The incretin-based drugs market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The growth in this region is attributed to the well-developed healthcare infrastructure in this region, along with significant prevalence of type 2 diabetes in people in this region. Furthermore, these companies often carry out extensive marketing and educational campaigns, as well as partnerships with healthcare providers, to increase awareness of the benefits and efficacy of incretin drugs to physicians, patients and the wider healthcare community.

On the other hand, Asia-Pacific is anticipated to be the fastest growing segment during the forecast period. Rising healthcare expenditure and developing healthcare infrastructure in this region is also contributing to market growth. This increased healthcare spending directly influences the demand for innovative and effective treatments such as incretin-based drugs, especially as the burden of chronic diseases like diabetes grows. This is further expanding the incretin-based drugs industry in Asia-Pacific region.

Competitive Analysis

Competitive analysis and profiles of the major players in the incretin-based drugs industry, such as Eli Lilly and Company., Merck & Co., Inc., GlaxoSmithKline plc, Sanofi, Sun Pharmaceutical Industries Ltd., Lupin, Boehringer Ingelheim International GmbH, Novo Nordisk A/S, AstraZeneca plc, and Takeda Pharmaceutical Company Ltd are provided in the report. Major players have adopted investments, agreement, and product approval as a key developmental strategy to improve the product portfolio and gain a strong foothold in the incretin-based drugs market.

Recent Product Approvals in the Incretin-based drugs market

- In March 2022, Novo Nordisk announced that the U.S. Food and Drug Administration (FDA) approval of 2.0 mg dose of Ozempic (semaglutide subcutaneous injection), a glucagon-like peptide-1 (GLP-1) analogue for the treatment of adults with type 2 diabetes.

- In June 2020, Novo Nordisk announced that the Japanese Ministry of Health, Labour and Welfare has approved its Rybelsus, the first and only oral glucagon-like peptide-1 receptor agonist (GLP-1 RA) in a tablet, for the treatment of adults with type 2 diabetes.

- In April 2020, Novo Nordisk announced that the European Commission (EC) has granted marketing authorization for Rybelsus for the treatment of adults with insufficiently controlled type 2 diabetes. The marketing authorization applies to all 27 European Union member states and the UK.

- In January 2020, Novo Nordisk announced that the U.S. Food and Drug Administration (FDA) has approved a label expansion based on a supplemental New Drug Application (sNDA) for Ozempic.

Recent Investment in the Incretin-based Drugs Market

- In November 2023, Novo Nordisk announced plans to invest more than 42 billion Danish kroner to expand existing manufacturing facilities in Kalundborg, Denmark. The investment, which includes GLP-1 products, will increase Novo Nordisk’s ability to meet future market demands.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the incretin-based drugs market analysis from 2022 to 2032 to identify the prevailing incretin-based drugs market opportunities.

- The market research is offered along with information related to key drivers, restraints, and incretin-based drugs market opportunity.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the incretin-based drugs market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global incretin-based drugs market trends, key players, market segments, application areas, and market growth strategies.

Incretin-Based Drugs Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 73.9 billion |

| Growth Rate | CAGR of 7.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Drug Class |

|

| By Route of Administration |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | AstraZeneca plc, Lupin, Merck & Co., Inc., Takeda Pharmaceutical Company Ltd., Sun Pharmaceutical Industries Ltd., Boehringer Ingelheim International GmbH, Novo Nordisk A/S, Eli Lilly and Company., Novartis AG, Sanofi |

Analyst Review

The market is on a trajectory that points to an exciting growth opportunity in the healthcare industry. The market for innovative therapies, particularly GLP-1 receptor agonists (GLP-1) and DPP- 4 inhibitors (DPP-4 inhibitors), is on the rise due to its key role in the management of type 2 diabetes.

As the number of people living with diabetes continues to rise, so does the demand for advanced treatment medications. The potential benefits of incretin drugs in terms of glycemic control, weight management, and cardiovascular health makes it an essential part of diabetes management protocols. Companies are focused on innovation, accessibility, and collaboration across the entire healthcare ecosystem to develop advanced incretin–based medications. Furthermore, the growing focus on R&D, in combination with partnerships between pharma companies and research institutes, is paving the way for breakthrough discoveries, creating an environment conducive to novel and improved incretin-based therapies.

Furthermore, North America region dominated the market in terms of revenue in 2022, whereas the Asia-Pacific region is anticipated to be the fastest growing region during the forecast period. Rapidly developing economies within Asia-Pacific, coupled with huge diabetic populations, growing healthcare investments, and rising awareness about advanced treatment options, are expected to drive substantial market growth.

The base year is 2022 in incretin-based drugs market.

The forecast period for incretin-based drugs market is 2023 to 2032.

The market value of incretin-based drugs market in 2032 is $73.9 million.

The total market value of incretin-based drugs market is $34.4 million in 2022.

Major players profiled in this report are Eli Lilly and Company., Merck & Co., Inc., GlaxoSmithKline plc, Sanofi, Sun Pharmaceutical Industries Ltd., Lupin, Boehringer Ingelheim International GmbH, Novo Nordisk A/S, AstraZeneca plc and Takeda Pharmaceutical Company Ltd.

The GLP-1 receptor agonist segment is the most influencing segment in the market as there is a significant adoption of these drugs for type 2 diabetes treatment.

Key factors driving the growth of the incretin-based drugs market includes rising prevalence of diabetes, recent product approvals and product launches in the market and recent advancement in incretin-based pharmacotherapies.

Asia-Pacific is anticipated to be the fastest growing segment during the forecast period, which is attributed to rising healthcare expenditure, and developing healthcare infrastructure.

Loading Table Of Content...

Loading Research Methodology...