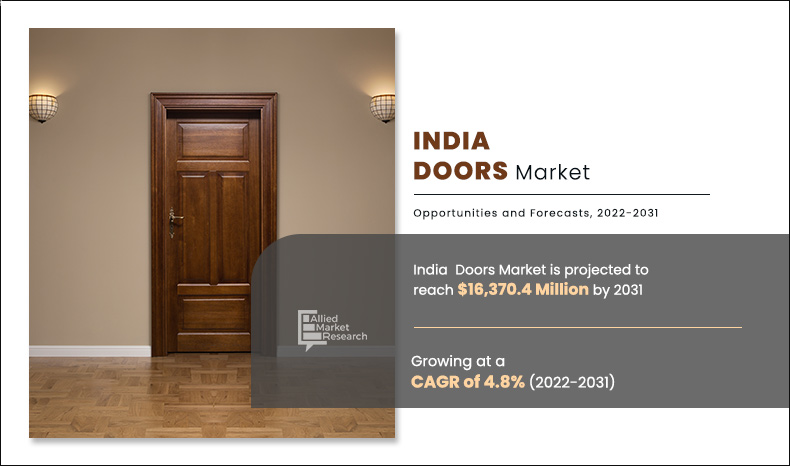

India Doors Market Research, 2031

The India Doors Market was valued at $10,209.3 million in 2021 and is projected to reach $16,370.39 million by 2031, registering a CAGR of 4.8% from 2022 to 2031. The India interior doors market for was 2,754 thousand metric tons in 2021 and is projected to reach 3,816 thousand metric tons by 2031, registering a CAGR of 3.2% from 2022 to 2031. A door includes a door panel, frames, and door hardware. It provides a barrier between rooms and other spaces within a house or a building and also functions as a barrier at the entrance of the building.

The two types of doors are interior and exterior. Interior doors are light-weight, thin, and may have hollow core. In addition, its function is to provide separation between rooms in a house. Moreover, the exterior door is installed at the entrance and is made to be strong to withstand harsh weather and prevent any forceful entry. Moreover, doors can be of many types and are categorized on the basis of the material that they are made of and may incorporate a decorated surface to match the interior or exterior design of the house or a building.

Market Dynamics

With the rise in population and urbanization, the construction sector in India is rising at a significant pace, which eventually drives the growth of the India doors market. India’s population is expected to grow to a significant number of 1.52 billion by 2036. Moreover, the country is expected to witness a 70% of increase in urban areas. About 39% of the population is estimated to live in urban areas by 2036, a significant increase from 31% in 2011. Moreover, the real estate industry has witnessed rapid growth in the last few decades and is expected to exhibit moderate growth in the future. The real estate sector, which includes housing, retail, hospitality, and commercial, is the second largest employment generator in India. According to the India Brand Equity Foundation (IBEF), the demand for residential properties has surged in the last few years, it estimates that India is among the top 10 price-appreciating housing markets internationally.

Moreover, Indian real estate attracted $5 billion institutional investments in 2020, and has attracted $55.18 billion of FDI from April 2000 to September 2022. In addition, major cities such as Bengaluru, Ahmedabad, Pune, Chennai, Goa, Delhi and Dehradun, are expected to be the most favored property investment destinations for NRIs, where Bengaluru is among the top. Moreover, according to the Investment Information and Credit Rating Agency (ICRA), the residential real estate sector witnessed surge in fourth quarter of year 2022, with 11% year-on-year (YoY) growth. Furthermore, the number of retail stores, hospitality buildings, and other commercial real estate buildings are growing significantly, providing much-needed infrastructure for India's growing needs. In addition, the IT sector jobs and other service sector jobs flourished in India, which is also a major reason for construction of commercial buildings for office purposes.

Thus, surge in construction projects across India is expected to drive the market growth. Commercial buildings mainly use doors made from glass and engineered wood, as these materials are aesthetically appealing, durable, and tough as well. Thus, surge in construction projects across India is expected to drive the market growth. In addition, surge in home renovation activities in India drives the India doors market growth. State and central governments in India offer tax credits as part of their green building regulations that have added to growth in home renovation, hence fueling the India interior doors market growth. For instance, in March 2022, the government of Kerala unveiled various incentive schemes to the ‘green’ rated buildings in the state, to encourage the construction of energy-efficient buildings. The incentives are projected to include discounts on building tax, stamp duty, and property tax.

However, high and fluctuating costs of construction materials and raw materials required to construct doors are anticipated to restrain the India doors market growth. The fluctuation in the prices is mainly attributed to global events such as Ukraine-Russia war, the COVID-19 pandemic, and global inflation, which have led to supply shortages in various industries including the construction industry.

Moreover, growth in demand for green and energy efficient buildings in India is expected to provide lucrative growth opportunities for players that operate in the India doors market. Green and energy efficient buildings require doors that are thermally as well as acoustically insulated. Companies such as Fenesta Building Systems and Windcraft fenestrations LLP offer doors that are recyclable and have better thermal properties, preventing transfer of energy through the doors. The demand for doors in India decreased in the year 2020 owing to low demand from construction industry, which was severely affected due to lockdowns imposed by the government. The COVID-19 pandemic shut-down the construction industry across the country, leading to a halt in India doors market.

The major demand for doors was previously noticed from residential construction sector; however, people in the country experienced financial crunch, leading to reduction in residential construction sector; thereby halting demand for equipment and machinery. However, owing to the introduction of various vaccines, the severity of the COVID-19 pandemic significantly reduced. This led to the full-fledged reopening of businesses involved in India doors market and led to increased activities in the construction sector. Furthermore, it has been more than two and a half years since the outbreak of this pandemic, and many companies have already shown notable signs of recovery. Contrarily, as of the beginning of 2023, the number of COVID-19 infection cases surged in China, which brought negative sentiments in the market. Thus, businesses involved in India doors market must focus on any upcoming crises.

Segmental Overview

The India doors market is segmented based on product type, wood door type, material, installation, and end user. By product type, the market is bifurcated into doors and frames. Depending on the wood door type, it is classified into solid wood door, panel door, flush door, and others. On the basis of material, it is divided into wood, glass, metal, and plastic. On the basis of installation, it is categorized as exterior and interior. And, on the basis of end user, the market is segregated into residential and non-residential.

By Product Type

Doors segment is projected to grow at a highest CAGR

By product Type:

The India doors market is divided into doors and frames. In 2021, the doors segment dominated the India doors market, in terms of revenue, and the same segment is expected to grow with a higher CAGR during the forecast. The high growth of the doors segment is mainly attributed to increased demand for aesthetically appealing doors, largely owing to the increase in disposable income of people in India. Moreover, with the surge in population and increase in the cost of real estate, the size of homes is expected to decrease. Thus, door types such as pocket doors, bifold doors, and other sliding doors that take up less space when opened are anticipated to increase at a rapid pace. Furthermore, frames are an integral part of any door. They come in various types such as open- and closed-door frames, fanlight door frames, and sidelight door frames. These frames enhance the architecture of the building, fanlight door frames, and sidelight door frames, are also used considerably across India.

By Wood Doors Types

Solid Wood Doors segment holds dominant position in 2021

By Wood Door Type:

The India doors market is classified into solid wood door, panel door, flush door, and others. The solid wood doors segment accounted for a higher India doors market share in terms of revenue in 2021. However, the panel doors segment is expected to grow with a higher CAGR during the forecast period. A solid door is made by assembling several smaller pieces of wood. Solid wood doors are durable and aesthetically appealing, making them suitable for premium spaces such as hotels, bungalows, and others. Moreover, panel doors consist of rectangular or square panels set between vertical and horizontal frames of a door known as stiles and rails, respectively. These types of doors are commonly found in residential and non-residential buildings as they possess high strength and provide an aesthetic look. Moreover, the others segment includes laminate doors, veneer doors, wooden fire-retardant door, and others.

By Material:

The India doors market is categorized into wood, glass, metal, and plastic. Among these, the wood segment accounted for a larger India doors market share in 2021; however, the engineered wood segment is anticipated to register a higher CAGR during the forecast period. Wood is one of the most dominant material types used to manufacture interior doors. Wood is advantageous as it is biodegradable, renewable, and carries the lowest carbon footprint. It is the preferred material of choice, owing to its thermal insulation properties, high strength, workability, and strong aesthetics. Technological advancements in wood used for construction, such as the development of formaldehyde-free wood and a surge in residential construction are expected to provide opportunities for market growth.

By Installation:

The India doors market is segregated into exterior and interior. Among these, the exterior segment accounted for a larger India doors market share in 2021, and the interior segment is anticipated to grow with a higher CAGR during the forecast period. Exterior doors are made tough to stand strong against forceful entry. In addition, these doors are resistant to extreme weather conditions such as heavy rain, winds, and others including resistance to insect infestation. Such factors related to exterior doors are driving its demand. Moreover, interior doors are anticipated to grow owing to increase in population, which is expected to lead to increased number of households in the country.

By End User

Residential segment holds dominant position in 2021

By End User:

The India doors market is categorized into residential and non-residential. Out of these two segments, the residential segment accounted for a larger India doors market share in 2021, and the non-residential segment is anticipated to grow with a higher CAGR during the forecast period. Rise in demand for residential buildings and increase in consumer expenditures on home improvement are expected to continue to drive the market. Increase in population, rise in disposable income, and rapid urbanization are expected to provide growth opportunities in India. Moreover, installation of bypass doors and French doors with swinging & sliding mechanism during construction of non-residential buildings has helped builders to enhance the overall appearance of commercial buildings.

Competition Analysis

Key companies profiled in the India interior doors market report include Century Plyboards (India) Limited, DCM Shriram Ltd. (Fenesta Building Systems), D.P. Woodtech Pvt. Ltd., Fancy Frames Glass Stores, Greenply Industries Limited, Guntier, Maxon Doors Pvt. Ltd., Greenlam Industries Ltd., NCL Industries Limited, Omfurn India Limited, Purewood Doors, Samor Cladding System Private Limited, Shreeji Woodcraft Pvt. Ltd., Spacewood Furnishers Pvt. Ltd., Truewood Door Industries, Sintex Plastics Technology, H.B. FULLER CO. (Koemmerling), NCL VEKA Pvt. Ltd., Prominance Window Systems, Instor India, Shakti Hörmann Private Limited, Kalco Alu-Systems Pvt. Ltd., JSW steel doors, PETRA Steel Doors LLP, and Poly Extrusions (India) Private Limited. To remain competitive, major companies have adopted development strategies such as business expansion and product launch. For instance, in August 2020, Fenesta Building Solutions, which is a wholly owned subsidiary of DCM Shriram Ltd., launched a new range of aluminum doors and windows for residential and commercial purposes.

Key Benefits For Stakeholders

- The report provides an extensive analysis of the current and emerging India doors market trends and dynamics.

- In-depth market analysis is conducted by constructing market estimations for the key market segments between 2021 and 2031.

- Extensive analysis of the India doors market is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive analysis of all regions is provided to determine the prevailing opportunities.

- The global India doors market forecast analysis from 2022 to 2031 is included in the report.

- The key market players within the India doors market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the India doors industry.

Analyst Review

According to the insights from CXOs of leading companies, the India door market witnessed significant growth in the past few years owing to a surge in spending on building construction activities. The rise in the trend of interior and exterior designing activities and spending on home renovation in India have led to a rise in demand for doors. Furthermore, the increase in the popularity of eco-friendly materials for designing and manufacturing doors in India has increased demand for doors from residential users.

Furthermore, an upsurge in the number of small houses has increased the demand for bypass doors, owing to their space-saving capabilities. The swinging mechanism of doors is widely used by homeowners and building developers. However, fluctuating cost of construction materials and unstable cost of materials used for manufacturing doors are anticipated to negatively affect the market growth. Contrarily, an increase in demand for energy-efficient doors due to the construction of green buildings is anticipated to provide lucrative opportunities for growth for the market.

The India doors market size was valued at $10,209.3 million in 2021.

Based on product type, the doors segment holds the maximum market share of the India doors market in 2021.

The India doors market is projected to reach $16,370.4 million by 2031.

Rise in the real estate industry and surge in renovation projects are the key trends in the India doors market.

The product launch is key growth strategy of India doors industry players.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

High cost of eco-friendly products are the effecting factors for India doors market.

The end users of India doors include residential and non-residential.

Loading Table Of Content...