India HDPE Pipes Market Outlook - 2026

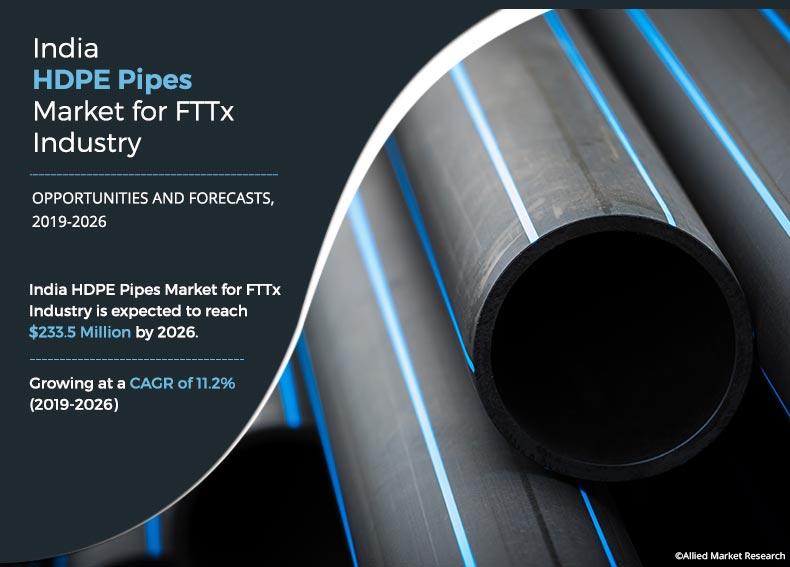

The India HDPE Pipes Market size for FTTx Industry was valued at $99.9 million in 2018, and is expected to reach $233.5 million by 2026, registering a CAGR of 11.2% from 2019 to 2026. High density polyethylene (HDPE) pipes are made from raw materials such as PE 63, PE 80, and PE 100. One of the significant advantages of utilizing HDPE pipes is that they are 6-8 times lighter than cast iron and galvanized iron pipes. HDPE pipes can be easily molded and welded together because of its high chemical resistance property. In addition, they are non-corrosive in nature, which makes them an ideal choice for many applications.

The increase in demand for electricity in India has enforced players operating in the power sector to increase their existing capacity of energy generation. The increase in existing capacity refers to the expansion of energy generation infrastructure, which correspondingly surges the demand for HDPE pipes or ducts. In addition, the government of India has aimed to manage the supply-demand gap, as there is a continuous increase in demand for electricity from the industrial sector of India. Furthermore, India is also committed to clean energy and reduce carbon emissions, owing to which it is one of the significant players in the renewable energy sector. India’s increased focus on renewable energy is outlined in the national budget that aims at the increasing share of renewable energy in total energy production. The target is to increase production to 175 GW by 2022. This includes 100 GW solar, 60 GW wind, 10 GW biomass, and 5 GW small hydropower capacity, supported by a budgetary allocation. All the above-mentioned factors have positively impacted the market as HDPE is significantly used in transmission systems of power plants specifically in renewable energy plants.

The India HDPE Pipes Market for FTTx Industry is segmented on the basis of product type, industry vertical, and application area. Based on type, the market is divided into standard ducts, micro ducts, pathways, and others. Based on the industry vertical, it is categorized into telecom, power, transport, building & infrastructure, and others. On the basis of application area, the market is studied across backbone, metropolitan, and mobile backhaul. The India HDPE Pipes Market share for FTTx industry has been analyzed across all segments.

The India HDPE pipes market analysis for FTTx industry covers in-depth information of major industry participants. Some of the major players in the India HDPE pipes market for FTTx Industry include Dutron Group, Miraj Pipes & Fittings Pvt. Ltd., Gamson India Private Limited, Nagarjuna Polymers, Apollo Pipes, Mangalam Pipes Pvt. Ltd, Jain Irrigation Systems Ltd., Berila Electricals Pvt. Ltd., Eonn Plast India, and Alex Pipe India Pvt. Ltd.

Other players in the value chain of the India HDPE pipes market for FTTx Industry include GSK Irrigation Private Limited., Kunststoff Pipes LLP, Khyati Polymers, Elegant Polymers, and Sarovar Polymers Pvt. Ltd.

India HDPE Pipes Market for FTTx Industry, by Product Type

Based on product type, the micro duct segment is anticipated to grow at the fastest rate. High-density polyethylene micro ducts are used in the communication industry, telecom, cable, broadband, Wi-Fi, command and control for pipelines (SCADA), and intelligent transportation systems (ITS). HDPE micro ducts offer clean, smooth, low-friction placement for microfiber cables, which reduces the chances of damage to these cables. The low coefficient of friction in HDPE micro ducts enables longer microfiber placement by blowing installation equipment. There is an increase in the demand for high-density polyethylene micro duct, owing to its beneficial characteristics such as cost-effectiveness, space-saving features and airtight enclosure for the cables that provide flexibility to the cables. Also, the inner surface is coated with materials that protect the cables from the surrounding environment.

By Product Type

Micro Ducts is projected as the most lucrative segment.

India HDPE Pipes Market for FTTx Industry, by Industry Vertical

On the basis of industry vertical, the telecommunication industry is expected to gain the highest market share. The government of India is taking several initiatives to boost communication connectivity specifically in rural areas. The government’s initiative to boost connectivity consequently surges the demand for HDPE pipes or ducts as they are used in the telecom sector to protect cables.

By Industry Verticals

Telecom is projected as the most lucrative segment.

India HDPE Pipes Market for FTTx Industry, by Application Areas

On the basis of the application area, mobile backhaul is anticipated to garner the highest market share.

By Application Areas

Mobile Backhaul is projected as the most lucrative segment.

Key Benefits for India HDPE Pipes Market :

- The report provides an in-depth analysis of the forecast along with the current and future trends of the India HDPE pipes market

- This report highlights the key drivers, opportunities, and restraints of the India HDPE pipes market along with the impact analyses in the forecast period

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the HDPE pipes industry for strategy building

- A comprehensive analysis of the factors that drive and restrain the India HDPE pipes market growth for FTTx industry is provided

- The qualitative data in this report aims on market dynamics, India HDPE pipes market trends for FTTx industry, and developments

- An extensive analysis of various regions provides insights that are expected to allow companies to strategically plan their business moves

- The profiles of key players along with their key strategic developments are enlisted in the report

- The India HDPE pipes market size for FTTx industry is provided in terms of revenue

India HDPE Pipes Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By Industry Vertical |

|

| By Application Areas |

|

| Key Market Players | APOLLO PIPES, ALEX PIPE INDIA PVT. LTD., GAMSON INDIA PRIVATE LIMITED, DUTRON GROUP, BERLIA ELECTRICALS PVT. LTD., MIRAJ PIPES & FITTINGS PVT. LTD., MANGALAM PIPES PVT LTD., JAIN IRRIGATION SYSTEMS LTD., NAGARJUNA POLYMERS, EONN PLAST INDIA |

Analyst Review

According to CXOs, the market is expected to gain significant growth in the coming years. India is among the most important markets for HDPE pipes, which is attributed to the considerable production of high-density polyethylene polymers. The demand for polyethylene pipes or ducts has witnessed a high growth due to an increase in the end user applications ranging from telecom to the power sector. HDPE pipes are dominantly used in the transmission systems in the power sector, specifically, the renewable energy sector is growing at a considerable rate in India, owing to favorable government policies toward clean energy generation. They further stated that fluctuation in prices of raw material such as polyethylene hinders the market growth. The prices of HDPE pipes are greatly impacted by the prices of crude oil, as one of the major raw materials used for manufacturing HDPE pipes is polyethylene (a crude oil derivative). This enforces HDPE pipe manufacturers to increase pipe prices, which creates a problem for numerous end-users such as telecommunication companies, the power sector, agriculture industries, and others. However, new developments and innovation in PE pipes are expected to provide growth opportunities to the market.

The market size for India HDPE Pipes for FTTx Industry was valued at $99.9 million in 2018, and is expected to reach $233.5 million by 2026.

The forecast period of the India HDPE Pipes market for FTTx industry is from 2019 to 2026.

The market value of the India HDPE in FTTx industry is $111.0 million in 2019

The base year of the India HDPE market in FTTx industry is 2018

Yes, the report provides value chain analysis

Based on industry vertical, telecom is the main segment registering promising growth in the market

India is not only the second-largest telecommunication sector in the world but also has a significant growth potential. The government of India is taking several initiatives to boost connectivity specifically in rural areas. The government’s initiative to boost connectivity consequently surges the demand for HDPE pipes or ducts as they are used in the telecom sector to protect cables.

On the basis of type, pathways hold the maximum market share in the India HDPE Pipes Market for FTTx Industry report

According to key industry leaders, the market is anticipated to gain a significant growth attributed to the emerging telecommunication sector in India. They further stated that the market is hindered by the fluctuation in raw material prices i.e. polyethylene, as the increment in polyethylene prices results in the increment of HDPE pipe prices.

Telecommunication and Power are the trending industries in the India HDPE Pipes market for FTTx industry report

Loading Table Of Content...