India Home Automation Market Outlook - 2026

The India home automation market size was valued at $1,790.9 million in 2018, and is expected to reach at $13,574.1 million by 2026, growing at a CAGR of 29.8% during the forecast period 2019-2026.

Smart home refers to homes with appliances such as electronic devices is controlled or operated by user via smartphone or a mobile app. Smart devices include appliances such as lighting devices, air conditioning units, ovens, refrigerators, audio & video entertainment systems, and cooling & heating units. The user monitors and controls the functions of smart home devices with home automation technology. There are two types of home automation technology—wireless system and wiring system. The wireless system includes Z-wave, Wi-Fi, Infrared (IR), Bluetooth, and others. The wired systems include cabling for the integration of sensors and smart home systems in the home with internet cables and connectors.

The advantages of home automation are safety and security, convenience, low utility costs, and time saving. The main focus to implement home automation in India is security, and energy efficiency. The home automation technology allows to control the heating and cooling systems in home, which can save considerable energy. Moreover, lights can be automatically switched on or off during sunrise or sunset as well as while leaving or entering the respective room.

The cost effectiveness is one of the driving factors for the India home automation market. Multiple cities, especially Pune, and Mumbai, witness considerable growth in adoption of smart home system every year that are backed by various competitors, which offers home automation at a low cost, thus increasing the India home automation market scope. Surge in economical video surveillance for security solutions that are integrated with real-time analytics are anticipated to boost the growth of the India home automation market. Moreover, the development of smart kitchen appliances such as smart coffeemaker, intelligent oven, precision cooker, and smart grill, has enhanced IoT for smart homes, which continues to provide profitable business opportunities to the players in India home automation market.

However, the market penetration of home automation systems in India is less as compared to other developing nations, owing to the limited connectivity and lower average bandwidth. Furthermore, the lack of standardization of products and components in smart home can lead to failure of the system. Such factors hamper the India home automation market growth.

There has been a rise in smart home startups such as Oakter, Inoho, IFIHomes, and Home Brain in India owing to the government of India programs such as ‘Make in India’, and ‘Digital India’. Many players are developing advanced technologies and devices for the smart home industry in India. For instance, Schneider Electric launched the Easergy P3 in the Indian market in May 2018. It is a medium-voltage protection relay, which combines real-time analytics with advanced technologies and solutions powered by Internet Of Things. Similarly, Apple Inc. developed HomeKit that allows iPhone users to control individual smart home devices such as garage door openers, lights, and security cameras. These factors offer lucrative growth opportunities for the India home automation market.

Segment Review

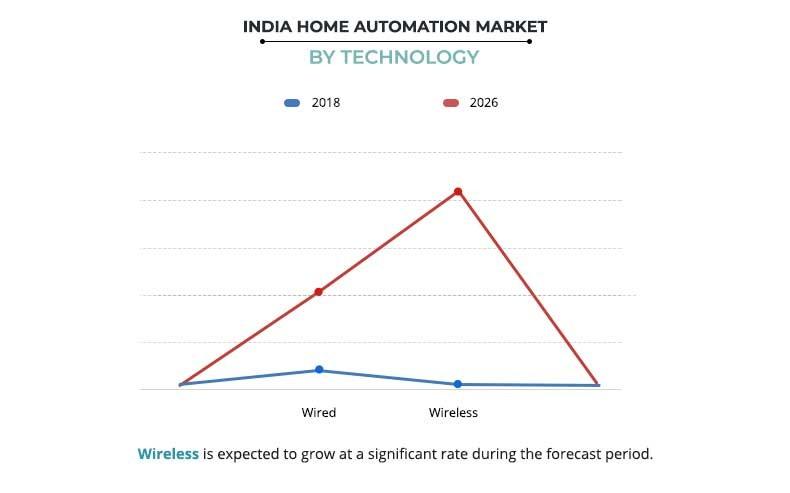

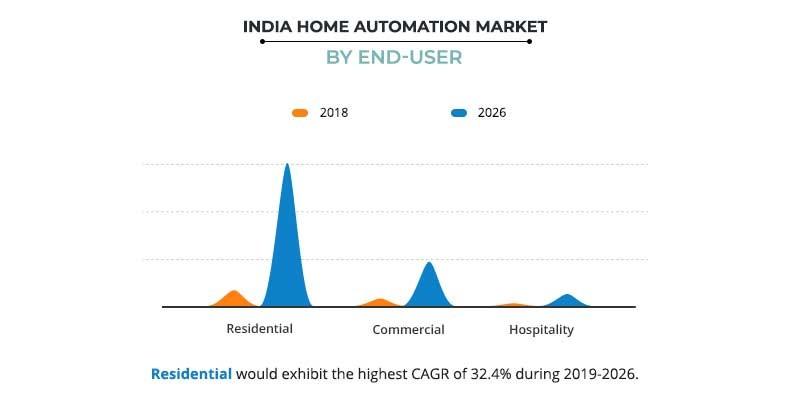

The India home automation market is segmented on the basis of product, technology, and end user. By product, the India home automation market is segregated into lighting, security & safety, HVAC, entertainment, and others. The lighting segment is further divided into relays, dimmers, switches, and others. Security & safety is sub-segmented into bells, locks, security cameras, and others. In 2018, the India home automation share is highest among the Security & safety segment, owing to the growth in urbanization. The HVAC segment is further classified into thermostats, sensors, control valves, and others. Entertainment is subdivided into home theater system, audio, volume & multimedia controls, and others. The others segment includes wall panels, ceiling plates, fans, and wires. Depending on technology, the market is bifurcated into wired and wireless. By end user, it is fragmented into residential, commercial, and hospitality.

Competition Analysis

The key players operating in the market include Fueblabs, Larsen & Toubro, Schneider, Johnson Controls, Harman International, Home Brain, PERT, Silvan Innovation, Oakter, and Elan Home Systems. Many players in the India home automation market adopted product launch, product development, collaboration, and business expansion as their key developmental strategies to sustain the intense competition and improve their product portfolio.

For instance, Harman Professional Solutions collaborated with Zoom Video Communications, Inc. in February 2019 to improve their products for the controller applications for commercial spaces. Through this collaboration companies have developed AMX Acendo Core Collaboration System and the Zoom Meetings service with Zoom Rooms Controller app. Similarly, Johnson Controls launched Metasys 10.0, in December 2018. It is designed to deliver more unified building management. It provides the facility personnel with smarter building automation, faster responses to critical alarms, and new integrations in fire detection, security, and lighting systems with a single common interface. Furthermore, Nortek Security and Control, LLC expanded its Nortek Security & Control New Home Program in February 2019, which includes a complete line-up of solutions. It also includes smart home control, automation, security, access control, and entertainment solutions that cover every aspect of the home.

Key Benefits for India Home Automation Market:

- The report provides an extensive analysis of the current and emerging India home automation market trends and dynamics.

- In-depth India home automation market analysis is conducted by constructing market estimations for the key market segments between 2018 and 2026.

- Extensive analysis of the market is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive analysis of all regions is provided to determine the prevailing opportunities.

- The India home automation market forecast analysis from 2018 to 2026 is included in the report.

- Key market players are profiled in this report and their strategies are analyzed thoroughly, which help to understand the competitive outlook of the India home automation industry.

India Home Automation Market Report Highlights

| Aspects | Details |

| By TYPE |

|

| By TECHNOLOGY |

|

| By END USER |

|

| Key Market Players | PERT INFOCONSULTING PVT. LTD., NORTEK SECURITY & CONTROL LLC (“NSC”), HARMAN INTERNATIONAL INDUSTRIES INCORPORATED, LARSEN & TOUBRO LIMITED, OAKTER HOME AUTOMATION, SILVAN INNOVATION LABS PVT. LTD., HOME BRAIN, SCHNEIDER ELECTRIC SE, FUEB LABS, JOHNSON CONTROLS INTERNATIONAL PLC |

Analyst Review

The home automation market holds high potential in the residential sector. The current business scenario experiences rapid development in smart appliances and devices leading to the readiness to adopt this home automation technology, particularly in the urban areas such as Mumbai, New Delhi, Pune, Gurugram, and Noida. Competitors in this industry adopt various innovative techniques to provide customers with advanced and innovative features. For instance, NSC launched new facial recognition touch panels, video doorbell with built-in analytics at the Consumer Electronics Show (CES) in January 2019. The new touch panels automatically identify the person (who has been previously registered) and trigger a series of commands based on that person’s preferences including lighting levels, temperature and music.

Integration of home automation solution with smart devices are some of the major drivers for this market. However, high cost and lack of standardization of systems and devices impede the growth of this market. Factors such as technological innovations, favorable government policies, and urban renewal and planning programs by the government of India, are expected to create lucrative opportunities for the key players operating in the India home automation market.

The key companies have focused on product launch, product development, collaboration, and business expansion to strengthen their foothold in the market. For instance, in August 2018, Schneider Electric inaugurated ‘Xperience Point’ in Gurugram. The new store hosts the company’s entire suite of products for home automation. This includes products such as variety of color plates, distribution board covers, protection devices. In addition, they also displayed products that are digitized and connected to ensure sustainability and efficiency, along with providing style and comfort quotient to the homes.

Similarly, in April 2019, Schneider Electric established its new center and office facility in Pune, India. The new office is designed on an open office concept. The office works as an integrated facility for all the business operations in India. It aims to strengthen their marketing operations, and expand the smart home products & system businesses in India.

Loading Table Of Content...