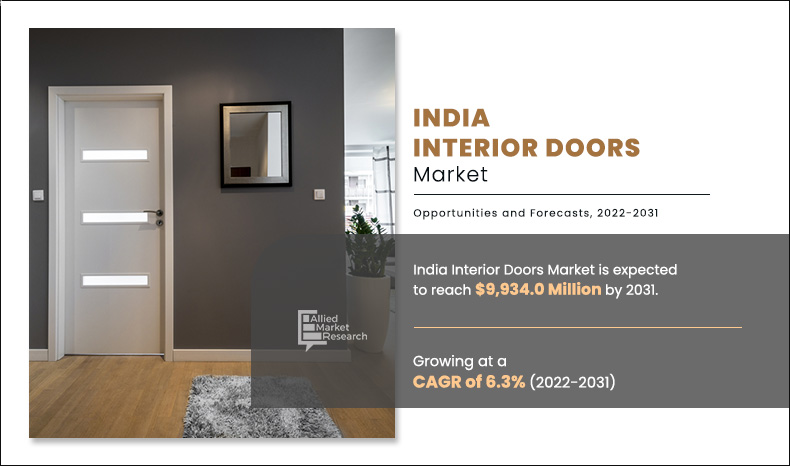

The India interior doors market size was valued at $4,993.2 million in 2020 and is projected to reach $9,934.0 million by 2031, registering a CAGR of 6.3% from 2022 to 2031.

An interior door includes door panel, frames, and door hardware. It provides a barrier between rooms and other spaces within a house or a building. Interior doors are light-weight, thin, and often have hollow core. In addition, its function is to provide separation between rooms in a house, unlike an exterior door that is installed at the entrance, and are made very strong to withstand harsh weather and stop or slow down any forceful entry. Further, an interior door may have insulation capabilities, however, it is an uncommon feature. Moreover, an interior door can be of many types and are categorized on the basis of their mechanism of working, material that they are made and may incorporate a decorated surface to match the interior design of the house.

Increase in commercial and residential construction has led to surge in demand for India interior doors. Moreover, growth in real estate and surge in renovation projects have created growth for India interior doors market opportunities. In addition, increasing demand for energy efficient doors and rising government investments in construction projects is providing lucrative growth in the market. However, high cost of eco-friendly products may restrain the market growth.

Rising population in India is the major factor which increases the demand of residential and non-residential constructions. According to the United Nations (UN), India will thus become the most populous country by 2024 and is expected to reach a total population of 1.5 billion by 2030 and 1.66 billion by 2050. This is expected to result in increase in residential and non-residential construction projects.

On the basis of product type, the doors segment has registered the highest revenue in 2020. The interior door provides entry and exit to a room or other space inside of a building. These doors are used in residential and commercial applications to provide privacy. Increasing investments in residential construction will create growth opportunities for India interior doors.

On the basis of material, the wood segment generated the highest revenue in 2020. Wood doors continue to maintain their beauty over time because they are extremely sturdy, withstanding years of heavy use. Wooden doors are best at resisting wear (they don't dent and scratches can be repaired) as long as it is maintained. Moreover, easy availability of woods is also one of the factors that drive the segment growth.

By Product Type

Hardware segment is projected to grow at a highest CAGR

The novel coronavirus (COVID-19) rapidly spread across various countries and regions in 2019, causing an enormous impact on the lives of people and the overall community. It began as a human health condition and has now become a significant threat to global trade, economy, and finance. The COVID-19 pandemic halted production of many products in the India interior doors market, owing to lockdowns. However, the number of COVID-19 cases is expected to reduce in the future with the introduction of the vaccine for COVID-19 on the market. This has led to the reopening of India interior doors companies at their full-scale capacities. This is expected to help the market recover by the end of 2022. After COVID-19 infection cases begin to decline, septic tank manufacturers must focus on protecting their staff, operations, and supply networks to respond to urgent emergencies and establish new methods of working.

Residential segment dominated the market in 2020, accounting for the highest India interior doors market share in terms of revenue. This is attributed due to increase in population and urbanization in India. Such factors will surge the residential construction projects. Moreover, increase in government investment in housing development sector is accelerating the India interior doors market growth. For instance, in February 2021, a $3.5 billion fund was allotted by Indian government to complete stalled housing projects which was set to deliver its first finished apartments in 2021. The fund will also hand over some 16 projects or more than 4,000 homes. Thus, all such factors are expected to drive the Global market.

By Mechanism

Swinging segment holds dominant position in 2020

The India interior doors market is segmented on the basis of product type, material, mechanism, and end user. By product type, the market is categorized into doors, frames and hardware. On the basis of materials, the market is divided into wood, metal, glass, fiberboard, fiberglass, vinyl and others. Depending on mechanism, it is fragmented into swinging, sliding, folding and revolving & others. On the basis of end user, it is categorized into residential and non-residential.

Competition Analysis

Key companies profiled in the India interior doors market report include Beautex Industries, Century Plyboards, D.S. Doors India Ltd., Fenesta Buildings System, Geeta Aluminium Company, Greenply Industries, Maxon Doors Pvt. Ltd., Greenlam Industries, Purewood Doors, and PVC Door India.

By End User

Residential segment holds dominant position in 2020

Key Benefits For Stakeholders

- The report provides an extensive analysis of the current and emerging India interior doors market trends and dynamics.

- In-depth India interior doors market analysis is conducted by constructing market estimations for key market segments between 2020 and 2031.

- Extensive analysis of the India interior doors market is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The India interior doors market forecast analysis from 2022 to 2031 is included in the report.

- The key players within Global market are profiled in this report and their strategies are analyzed thoroughly, which helps understand the competitive outlook of the India interior doors industry.

India Interior Doors Market Report Highlights

| Aspects | Details |

| By PRODUCT TYPE |

|

| By MATERIAL |

|

| By MECHANISM |

|

| By ENDUSER |

|

Analyst Review

The India interior door market witnessed a significant growth in the past few years, owing to surge in spending on building construction activities. Rise in trend of interior designing activities in and spendings on home renovation in India has led to rise in demand for interior doors. Furthermore, increase in popularity of eco-friendly materials for designing and manufacturing interior doors in India have increased demand for interior doors from residential users.

Further, increase in number of small houses has increased the demand for bypass interior doors, owing to their space saving capabilities. Swinging mechanism of interior doors is widely used by homeowners and building developers. In addition, advancements in IT technologies that enable homeowners to choose doors from the comfort of their houses have helped interior door manufacturers to expand their market reach.

Moreover, integration of latest design elements along with latest IT technologies and other latest advancements in interior doors and materials that they are manufactured with plays a key role in increasing demand for India interior doors; thereby, providing lucrative opportunities for growth for the market.

The India interior doors market size was valued at $4,993.2 million in 2020.

Based on product type, the doors segment holds the maximum market share of the India interior doors market in 2020.

The India interior doors market is projected to reach $9,934.0 million by 2031.

Rise in the real estate industry and surge in renovation projects are the key trends in the India interior doors market.

The product launch is key growth strategy of India interior doors industry players.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

High cost of eco-friendly products are the effecting factors for India interior doors market.

The end users of India interior doors include residential and non-residential.

Loading Table Of Content...