Indian Modular Switch Market Overview:

Indian Modular Switch Market is expected to garner $1,595.0 million by 2022, registering a CAGR of 22% during the forecast period 2016-2022.

Modular switches are an advanced version of conventional switches, which cater to the increasing need for safety and aesthetics among individuals. These switches provide added safety, customization, variety, and other novel features as compared to traditional switches. Easy availability of these modular switches at affordable prices in the Indian market has increased their adoption in various applications across verticals such as commercial and residential buildings, IT & telecommunication sector, hospitality, healthcare, retail, and others. The key players in the market are focused on developing technically advanced modular switches at affordable prices. The rapid boom in the construction sector in India has created huge growth opportunities for market players. In 2015,

The key players operating in the Indian modular switch market promote their products through digital and physical modes of advertisements.

Online Marketing

In the recent past, penetration of Internet in India and purchase of products through e-commerce portals have increased rapidly. Modular switch marketing through company websites, social networking sites, and e-commerce portals, such as IndiaMART and Urjamart have enabled key players to increase their presence among online customers. In addition, major players have focused on expanding their online distribution network to improve their customer services and sustain the market competition.

Television (TV) Advertisement

TV is one of the most effective advertising media platforms in India. In terms of key performance metrics including new customers and sales, advertising through TV outperforms other marketing media such as digital marketing and other offline marketing. Major players, such as Havells and Anchor have heavily invested in TV advertisements to promote their brands.

Physical Modes of Advertisement

Brand promotion via local newspapers helps companies to promote awareness about their products among the populace. Business-to-business exhibitions and campaigns are anticipated to enable these players to gain a competitive advantage in the market.

Thus, key players are expected to promote their products through effective and innovative online videos, social media campaigns, and email message campaigns. In addition, promotions through corporate gifts help prominent players to expand their presence, especially in the commercial sector.

Currently, Anchor by Panasonic has the largest number of modular switches sales offices pan India. Furthermore, Anchor by Panasonic has the maximum numbers of sales offices, i.e., 21 in West India as compared to other regions.

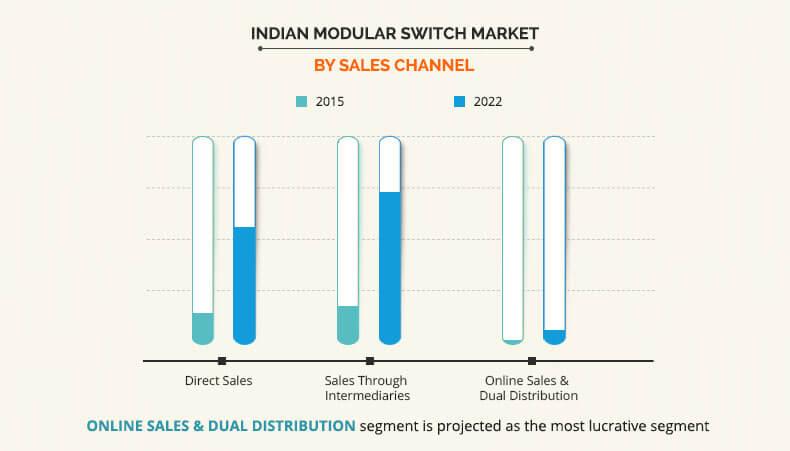

The Indian modular switch market is segmented based on sales channel into direct sales, sales through intermediaries, and online & dual distribution. In India, sales through intermediaries mode plays a vital role in reaching out to maximum number of customers across various cities. Moreover, these intermediaries play a crucial role in the sales of modular switch brands in India. As per AMR analysis, about 15.0% purchases out of every 100 purchases are directly or indirectly influenced by retailers and other intermediaries. Thus, key players offering modular switches have focused on expanding their distribution networks across the country. For instance, Legrand has 600 dealers and 7,400 retailers in India; Havells has a network of 2,500 dealers and 100,000 retailers; whereas Anchor has 5,000 dealers and 450,000 retailers.

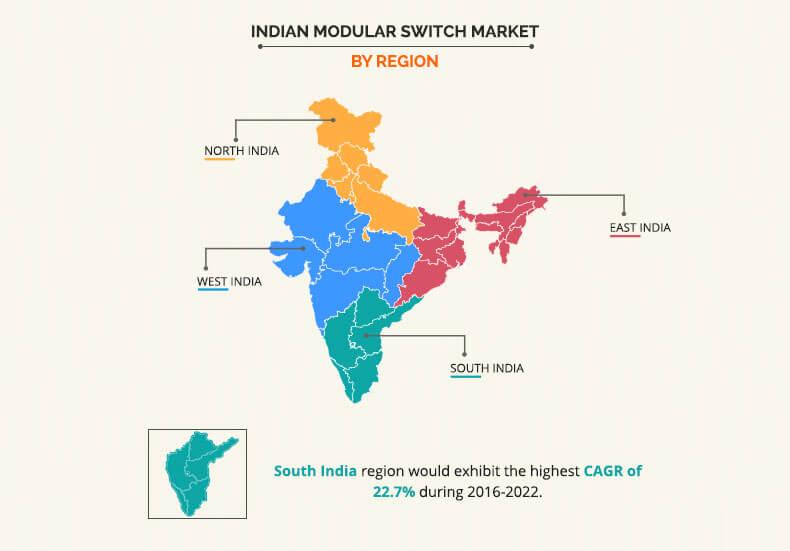

In terms of geography, South India is anticipated to dominate the market by 2022, owing to increase in construction of new malls and other real estate projects in the region. In addition, supportive government initiatives along with attractive FDI policies have encouraged and attracted international retailers to enter the Indian market. This is anticipated to increase the development of malls and retail stores in India, due to increasing demand for durable and aesthetic modular switches. Thus, these factors are expected to drive the market growth and create opportunities for modular switch manufacturers.

Competitive intelligence of prominent modular switch manufacturers provides key insights in terms of strategies implemented by them to improve their market shares. Some of the leading manufacturers profiled in this report include Havells India Limited, Legrand, Anchor Electricals Pvt. Ltd. (Panasonic Corporation), GM MODULAR, Koninklijke Philips N.V., Schneider Electric SA, Wipro Lighting, ORPAT Group, ABB Group, and KOLORS.

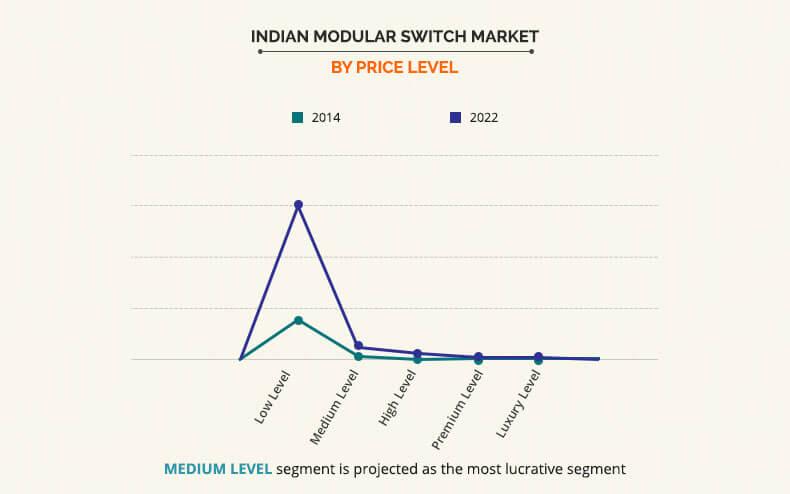

Increasing Concerns Towards Industrial Safety

Increasing safety and security concerns among end users has increased the adoption of modular switches among customers. Furthermore, low-income groups are inclined towards installing low-priced, childproof, flame-proof modular switches at their residences. Furthermore, the adoption of smart and attractive modular switches among end user verticals is anticipated to increase in the near future. Thus, the overall impact of this factor is projected to increase by 2022.

Obligatory Regulations by Governing Organizations

Implementation of government norms and regulations to minimize mishaps due to lack of maintenance of electronic products has encouraged end users to deploy safe and durable modular switches. This factor is anticipated to play a crucial role in the adoption of modular switches among various end users verticals, especially in the industrial and commercial sectors.

Rapid Growth in Real Estate Industry

Construction activities in India is projected to grow at a significant rate. Moreover, government rules and regulations regarding the installation of modular switches in residential and commercial establishments and growing inclination of end users towards feature-laden modular switches are anticipated to encourage builders and contractor to deploy modular switches in their construction projects. Hence, the impact of this factor is projected to increase during the forecast period.

Key Benefits

- The report includes an extensive analysis of the factors that drive and hamper the growth of the Indian modular switch market.

- The report provides quantitative as well as qualitative trends to help stakeholders in understanding the prevailing market scenario.

- The report provides in-depth analysis of the key market segments based on price level, sales channel, and verticals to understand the regional market trends.

- Competitive intelligence of the market highlights the business practices followed by the companies operating across various regions.

India Modular Switch Market Report Highlights

| Aspects | Details |

| By Sales Channel |

|

| By Industry Vertical |

|

| By Country |

|

Analyst Review

The Indian modular switch market is projected to grow at a significant rate during the forecast period. West India region is expected to dominate the Indian market by 2022. The market in South India is projected to grow rapidly during the forecast period, owing to the improvement in standards of living and growth in the real estate sector.

The modular switches market in commercial sector in India is projected to grow at the highest CAGR during the forecast period due to proactive initiatives of Indian Government for the development of infrastructure and construction industry. Furthermore, increasing demand for attractive, trendy, and feature-laden modular switches is anticipated to boost the market growth during the forecast period.

Modular switches have gained popularity across various end user verticals such as public sector, healthcare, and banking & financial sector, residential sector, and industrial owing to the increase in technological awareness, improvement in lifestyle of Indian population, and rise in disposable income. Furthermore, introduction of several rules and regulation by the government regarding electronics products is anticipated to drive the market, which could provide significant growth opportunities for market players.

The key players operating in the market have heavily invested in R&D activities to launch advanced modular switches such as touch screen modules and sensors at affordable prices to ensure higher performance and efficiency. In addition, these players are have focused on launching innovative products as well as increase their promotional activities to increase their footprints and profit margins in the Indian market.

Loading Table Of Content...