India Nano Silver Market Outlook - 2020–2027

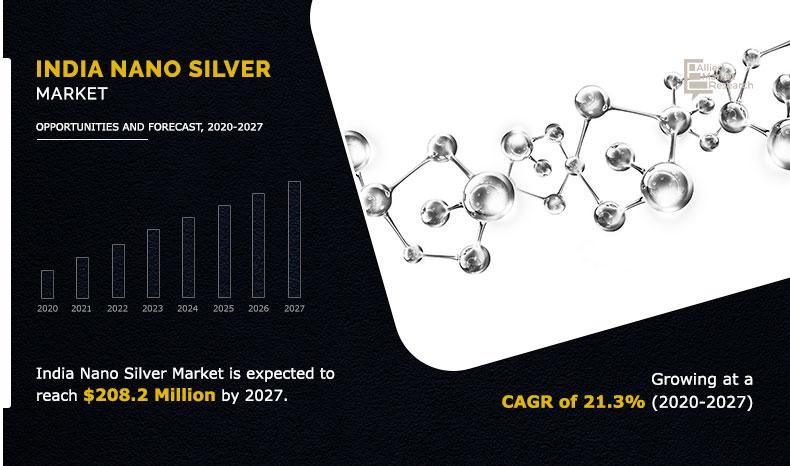

The India nano silver market size was valued at $61.6 million in 2019, and is projected to reach $208.2 million by 2027, growing at a CAGR of 21.3% from 2020 to 2027.

Nano silver is one of the most commonly used nanomaterials due to its high electrical conductivity, optical properties, and anti-microbial properties. The biological activity of nano silver depends on factors such as particle composition, size distribution, surface chemistry, size; shape, coating/capping, particle morphology, dissolution rate, agglomeration, efficiency of ion release, and particle reactivity in solution.

The growth of the India nano silver market is driven by rise in demand for nano silver from various antimicrobial application in end use industries. In addition, rapid growth of the electronics & pharmaceutical industry in India is projected to fuel the India nano silver market growth in the upcoming years. However, factors such as stringent environmental regulations owing to toxicity of nano silver products and high fluctuations in price of silver nano particles are the key factor restraining the market growth during the forecast period. On the contrary, rise in awareness and trend toward biological method of synthesis of silver nanoparticles is expected to create lucrative opportunity for the key players in the nano silver market.

For the purpose of analysis, the India nano silver market is segmented into method of synthesis and end user. The study highlights various types of method of synthesis available in the market such as physical, biological, and chemical reduction. The end users covered in the study include electrical & electronics, pharmaceuticals, food & beverages, clothing & textile, personal care & cosmetics, water treatment, and others.

The key players operating in the India nano silver market are American Elements, Filo Lifesciences Pvt. Ltd, Merck KGaA, Mincometsal, Nanochemazone, Inc., Nanocomposix, Nano Labs, Nanoshel LLC, Reinste Nanoventures Pvt. Ltd, and Sisco Research Laboratories Pvt. Ltd.

These key players are adopting various strategies such as partnership and agreement to stay competitive in the nano silver market.

For instance, in May 2020, Nanocomposix (Nanotechnology products manufacturer) signed an agreement with Amplicon Biotech to extend product distribution to consumers across India. Amplicon Biotech is a manufacturer that provides research, pharmaceutical, and diagnostic centers across India with life science reagents & supplies, technical, and instrumentation support.

Other players operating in the value chain of the India nano silver market are Otto Chemie Pvt. Ltd., Indian Platinum Pvt. Ltd., Nano Research Elements, Inc., Jigchem Universal, Sensors Tech Pvt. Ltd., Khandelwal Laboratories Pvt. Ltd., and others.

The India nano silver market is analyzed and estimated in accordance with the impacts of the drivers, restraints, and opportunities. The period studied in this report is 2020–2027. The report includes the study of the India nano silver market with respect to the growth prospects and restraints based on the regional analysis. The study includes Porter’s five forces analysis of the industry to determine the impact of suppliers, competitors, new entrants, substitutes, and buyers on the market growth.

Nano silver market, by method of synthesis

By method of synthesis, the chemical reduction segment held the largest India nano silver market share in 2019. This is attributed to rise in demand for nano silver products from various antimicrobial coatings, textiles, wound dressings, biomedical devices, and others. In addition, rise in demand for nano silver in pharmaceutical and medical applications is expected to fuel the growth of the market during the forecast period.

By Method Of Synthesis

Chemical reduction is projected as the most lucrative segment.

Nano silver market, by end user

By end user, the electrical & electronics segment dominated the highest share in the India nano silver market in 2019, and is expected to maintain the same during the forecast period. This is attributed to ongoing trend of designing compact and smart electrical & electronics products with high-end features. In addition, India is one of the major countries in Asia-Pacific electronics market, owing to which it is favorite destination for conductive ink manufacturers, which in turn is anticipated to propel the demand for nano silver in the upcoming years.

By End User

Electrical & electronics holds a dominant position in 2019 and would continue to maintain the lead over the forecast period.

COVID-19 impact on the market

Lockdown imposed due to the outbreak of the COVID-19 pandemic has resulted in temporary ban on the import and export; thereby, disrupting the supply chain and hampering the nano silver market growth in the second, third, and fourth quarter of 2020. In addition, at the start of 2nd quarter of 2021, there is increase in COVID-19 cases in India which is resulted in temporary lockdown to control the impact of pandemic, which is further expected to hamper the growth of the market to some extent in the country. However, the market is expected to fully recover in the third & fourth quarter of 2021 as the manufacturing and others industries will operate at full production and operational capacity. In addition, rise in vaccination across the country will lower the impact of COVID-19 by the end of 2021, which in turn is expected to drive the market growth in the upcoming years.

Key Benefits For Stakeholders

- The report includes in-depth India nano silver market analysis of different segments and provides market estimations between 2020 and 2027.

- A comprehensive analysis of the factors that drive and restrict the growth of the India nano silver market is provided.

- Porter’s five forces model illustrates the potency of buyers & sellers, which is estimated to assist the market players to adopt effective strategies.

- India nano silver market estimations and forecast are based on factors impacting the market growth, in terms of value.

- Key market players are profiled to gain an understanding of the strategies adopted by them.

- This report provides a detailed analysis of the current India nano silver market trends and future estimations from 2020 to 2027, which helps identify the prevailing market opportunities.

Key Market Segments

By Method of Synthesis

- Physical

- Biological

- Chemical Reduction

By End User

- Electrical & Electronics

- Pharmaceuticals

- Food and Beverages

- Clothing & Textile

- Personal Care & Cosmetics

- Water Treatment

- Others

India Nano Silver Market Report Highlights

| Aspects | Details |

| By METHOD OF SYNTHESIS |

|

| By END USER |

|

| By Region |

|

| Key Market Players | SISCO RESEARCH LABORATORIES PVT. LTD., NANO LABS, MERCK KGAA, NANOSHEL LLC, NANOCHEMAZONE, INC., MINCOMETSAL, FILO LIFESCIENCES PVT. LTD, NANOCOMPOSIX, REINSTE NANOVENTURES PVT. LTD, AMERICAN ELEMENTS |

Analyst Review

According to the perspective of the CXOs of companies in the market, the factors that drive the market are increase in application scope because of its superior properties, rise in demand from various industries, and surge in government funding and support. Silver nanoparticles are typically added in small quantities to improve the performance of the end product.

Factors such as rise in demand for nano silver from various antimicrobial application in end use industries and rapid growth of the electronics & pharmaceutical industry in India are anticipated to fuel the growth of the market in the upcoming years. However, factors such as stringent environmental regulations owing to toxicity of nano silver products and high fluctuations in price of silver nano particles are expected to hamper the market growth in India during the analyzed time frame. On the contrary, rise in awareness and trend towards biological method of synthesis of silver nano particles is expected to create opportunity in the India nano silver market in the coming years.

In terms of revenue growth, the CAGR of the India nano silver market is 21.3% during the forecast period

Rise in demand for nano silver from various antimicrobial applications in end-use industries and rise in demand for nano silver and rapid growth of electronics & pharmaceutical sector in India are expected to be the key trends in the India nano silver market.

The potential customers of the India nano silver market are electrical & electronics, pharmaceuticals, food & beverages, clothing & textile, personal care & cosmetics, water treatment, and others.

On the basis of method of synthesis, chemical reduction segment will drive the India nano silver market growth during the forecast period. By end user, electrical & electronics will fuel the India nano silver market growth.

The applications of the India nano silver market are in antimicrobial, biomedical devices, sensors, energy storage systems, automobiles and others.

Top players in the India nano silver market are American Elements, Filo Lifesciences Pvt. Ltd, Merck KGaA, Mincometsal, Nanochemazone, Inc., Nanocomposix, Nano Labs, Nanoshel LLC, Reinste Nanoventures Pvt. Ltd, and Sisco Research Laboratories Pvt. Ltd.

In terms of revenue, the market size of the India nano silver market is anticipated to reach $208.2 million by 2027, growing at CAGR of 21.3% from 2020 to 2027.

Loading Table Of Content...