India Optical Fiber and Accessories Market Outlook - 2026

The India optical fiber and accessories market size was valued at $461.6 million in 2018 and is projected to reach $1.66 billion by 2026, growing at a CAGR of 17.2% from 2019 to 2026. Optical fiber refers to the medium and technology that is used to transmit information through a plastic or glass strand from one source to another. The information is transmitted through optical cables as rapid light pulses. The receiving end of a fiber optic transmission translates the light pulses into binary values. The optical fiber offers numerous advantages such as increased bandwidth, decreased size and weight, electromagnetic interference immunity, data security, electrical isolation, and others. These are used in communication applications, which include telecom, utility, community access television (CATV), military, and others and in non-communication applications such as sensor, fiber optic lighting, and others. The Optical Fiber Accessories Market was valued at $303.2 million in 2018 and is estimated to reach $741.9 million by 2026, growing at CAGR of 11.7% from 2019 to 2026.

Rise in need for fast and improved networking and network services and an increase in penetration of broadband connections in India are anticipated to be the major drivers of the India optical fiber and accessories market growth. Moreover, rise in demand for optical communication and sensing applications for different purposes, high demand for optical fiber cable (OFC) in the IT & telecom sector, increase in internet penetration, and surge in adoption of fiber to the home (FTTH) connectivity make way for the industry growth. However, high installation cost and enhanced adoption of wireless communication systems are expected to impede the market growth. Conversely, rising government investments in fiber optic network cable (OFC network) infrastructures are expected to present major opportunities for India optical fiber and accessories market expansion during the forecast period. For instance, the Indian government has been investing in OFC network infrastructure to increase internet penetration across the country, which is in line with the government's initiatives such as Digital India and Smart Cities Mission.

Segment Review

The India optical fiber and accessories market opportunities are analyzed across various segments including component, cable category, end use, and region. In components segment, comparative analysis is done between current market trends and revenue of copper cables and optical fibers. Also, the import data for each cable type and accessory has been tracked. This segment is bifurcated into fiber optic cable, fiber optic cable accessories, copper cable, and copper cable accessories. The copper cable segment dominated the overall market in 2018 and is expected to continue this trend during the forecast period, as it offers numerous advantages that include high speed, lower latency, guaranteed bandwidth to every connected device, reliability, higher security for data, and others. By cable category, it comprises CAT5, CAT5E, CAT6, CAT6A, CAT7, CAT8, and others, among which the CAT6 segment dominated the market in terms of revenue during 2018 and is expected to the follow same trend during the forecast period.

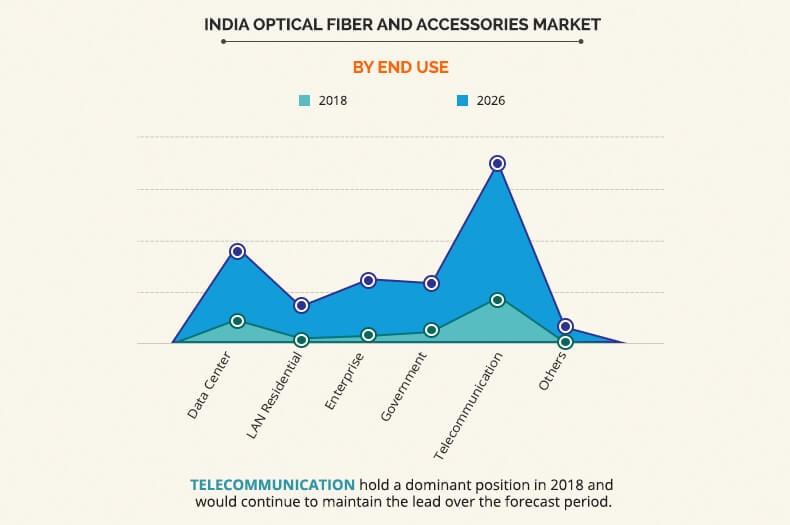

Based on end use, the India optical fiber and accessories market is categorized into telecom & IT, public sector, healthcare, energy & utilities, aerospace & defense, manufacturing, and others. The telecommunication segment dominated the overall market in 2018 and is expected to continue this trend during the forecast period owing to growth in need for greater bandwidth and faster speed connections. These factors have increased the demand for optical fiber cable and connectors in the telecom sector.

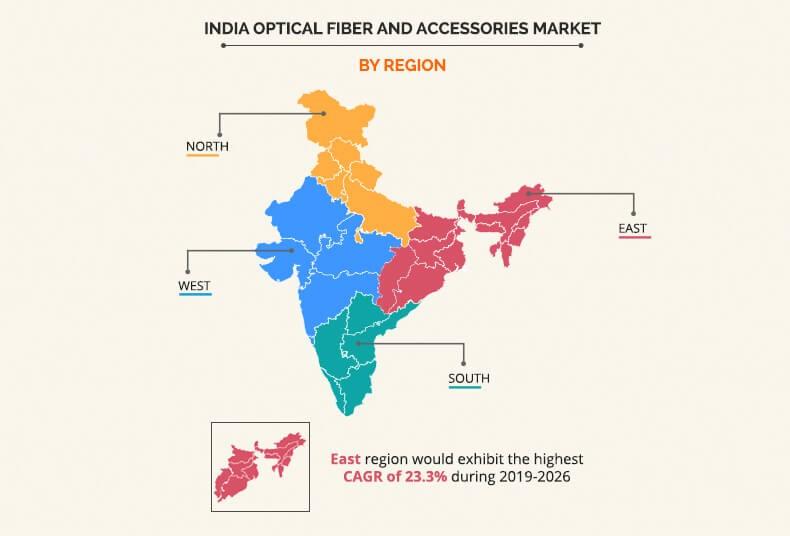

Based on region, the India optical fiber and accessories market is analyzed across North (includes Delhi, Haryana, Himachal Pradesh, and Uttar Pradesh), South (includes Andhra Pradesh, Telangana, Karnataka, Kerala, Pondicherry, and Tamil Nadu), East (West Bengal, Bihar, Jharkhand, Odisha, Chhattisgarh, and Assam), and West (includes Goa, Gujrat, Maharashtra, Rajasthan, and Madhya Pradesh).

The report focuses on the growth prospects and restraints of the market based on the analysis of the India optical fiber and accessories market trends. The study provides Porter’s five forces analysis of the industry to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the growth of the market.

Top Impacting Factors

The India optical fiber and accessories market is influenced by a number of factors such as widespread implementation of 5G, increase in adoption of fiber-to-the-home (FTTH) connectivity, emergence of Internet of Things (IoT), technological advancements in the fiber optic cable technology, and rise in investments in optical fiber cable (OFC) network infrastructure. These factors collectively provide opportunities for the market growth. However, high installation cost and increase in deployment of wireless communication systems are expected to hamper the market growth during the forecast period. Thus, each factor has its definite impact on the India optical fiber and accessories market.

Following are the key factors affecting the India optical fiber and accessories market.

Widespread implementation of 5G

The demand for more data and better coverage across the world has been on the rise among consumers. The 5th generation wireless connection is expected to be the next advancement in technology, as it can transmit more data while providing a more steady and reliable connection. The characteristics of 5G, such as higher data speeds and throughputs, are greatly influenced by these heavy-duty optical fiber networks that affect both the wireless side and wireline side of the infrastructure. Moreover, formidable network performance goals of 5G are heavily predicated keeping in mind the huge availability of fiber connectivity. 5G is currently being tested in several markets and is expected to begin widespread implementation in 2020. Existing networks are anticipated to be completely upgraded or replaced before they begin 5G implementation. The demand for optical fiber has been increasing owing to shortage of fiber and long-term plans for installation of networks, owing to which network providers have been negotiating directly with fiber manufacturers to secure a long-term supply of optical fiber.

Increase in adoption of fiber to the home (FTTH) connectivity

FTTH is a popular integrated communication technology that uses fiber optic technology to enable faster and more effective communication. The technology connects homes to the operator through optic fiber wires. It is the most advanced technology for building the next generation of communication networks. For instance, fiber connections are used by more than 130 million homes.

Rise in investments in optical fiber cable (OFC) network infrastructure

The growth of 5G is anticipated to be fueled by the hike in consumer data and proliferation of internet of things (IoT) devices. According to International Telecommunications Union (ITU), the market for IoT devices is projected to generate over $1.7 trillion by 2019. Also, owing to these developments, investments on fiber infrastructure are expected to surpass $144.2 billion during 2014–2019. Moreover, numerous countries have invested in optical fiber deployments, which has been creating opportunities for the market. Furthermore, to meet the set standards, operators from emerging economies, such as India, have been increasingly investing in optical fiber and related technologies. For instance, main drivers for the increase in deployment of optical fiber cable in India are increased 4G deployments in Tier-1 and Tier-2 cities and enhanced fiber-to-the-home (FTTH) deployments by telecom operators, ISPs, and MSO providers. In March 2017, ACT Fibernet launched 1 Gbps broadband service in Hyderabad, India, which is 20 times faster than the market average of 50 Mbps. Also, increase in fiber demand, owing to the rural broadband project “BharatNet”, Smart Cities Mission, and large connectivity projects by the Defense, is expected to increase the investment of optical fiber in India.

Technological advancements in the fiber optic cable technology

Advances in technology to improve bandwidth and reduction in attenuation rate have created numerous opportunities for the fiber optics market. The key players of the market have been developing low-loss optical fiber to develop and deliver new generations of optical fiber technology, thereby fueling the expansion of broadband connectivity. For instance, Fujikura, Ltd. launched high performance silica core fiber in November 2017, which is designed for next-generation, long-haul terrestrial networks, and optical transmission systems with high-speed digital signal processing. In addition, Sterlite Technologies, Ltd. announced its new high-quality optical communication products and services in June 2016, which include innovative optical fiber and data cable technologies to deliver smarter and long-lasting networks.

Competitive Analysis

The key players profiled in the report include Sterlite Technologies Limited., Finolex Cables Ltd., Birla Cable Limited, Vindhya Telelinks Ltd., Universal Cables Limited, Polycab India Limited, Gupta Power Infrastructure Ltd., KEC International Limited, APAR Industries Limited, and Aksh OptiFibre Ltd. These key players have adopted strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations to enhance their reach in India optical fiber and accessories market.

Key Benefits for India Optical Fiber and Accessories Market:

- This study comprises analytical depiction of the India optical fiber and accessories market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall India optical fiber and accessories market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current India optical fiber and accessories market forecast is quantitatively analyzed from 2019 to 2026 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the India optical fiber and accessories industry.

- The report includes the India optical fiber and accessories market share of key vendors and market trends.

India Optical Fiber and Accessories Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Cable Category |

|

| By End Use |

|

| By Region |

|

| Key Market Players | POLYCAB INDIA LIMITED, BIRLA CABLE LTD. (MP BIRLA GROUP), STERLITE TECHNOLOGIES LIMITED, VINDHYA TELELINKS LTD. (MP BIRLA GROUP), APAR INDUSTRIES LTD., UNIVERSAL CABLES LTD. (MP BIRLA GROUP), AKSH OPTIFIBRE, KEC INTERNATIONAL LTD. (RPG ENTERPRISES), FINOLEX CABLES LIMITED, GUPTA POWER INFRASTRUCTURE LIMITED |

Analyst Review

The India optical fiber and accessories market is experiencing a healthy growth rate, owing to the ongoing implementation of 5G network and upcoming FTTH network projects across the globe. Moreover, an increase in consumer demand for fast networking has fueled the need for the deployment of fiber optic cables to improve the broadband connectivity. This increase in the demand for larger bandwidths for communication is expected to drive the growth of the market. The optical fiber industry is expected to provide promising growth prospects throughout the forecast period, owing to increase in investments and research undertaken by prominent optical fiber cable manufacturers in the industry to develop and upgrade the fiber optics technology application area. In addition, rise in awareness of the benefits of adopting the technology propels the market growth.

A number of companies have been working aggressively in building new plants to fuel the demand for optical fiber preform and optical fiber drawing tower capacities. Moreover, growth in data traffic on smartphones, tablets, and other mobile devices is driving the demand for fiber in India. Moreover, factors such as increase in industrialization; rise in penetration of internet in the emerging countries; and development of the telecom industry coupled with upcoming infrastructure projects in transport, energy, institutional sites, networks, and residential projects are expected to drive the growth of the fiber optic market. Furthermore, a number of schools and educational institutions are modifying the education system to e-classrooms, which require the fiber-to-the-home (FTTH) network. This is expected to increase the demand for fiber optic cables.

The India optical fiber and accessories market is highly competitive, owing to strong presence of the existing vendors. Optical fiber vendors with access to extensive technical and financial resources are anticipated to gain a competitive edge over their rivals, as they have the capacity to cater to the market requirements. The competitive environment in this market is expected to further intensify with increase in technological innovations, product extensions, and different strategies adopted by the key vendors.

Loading Table Of Content...