India Pharmaceutical Packaging Market Research, 2033

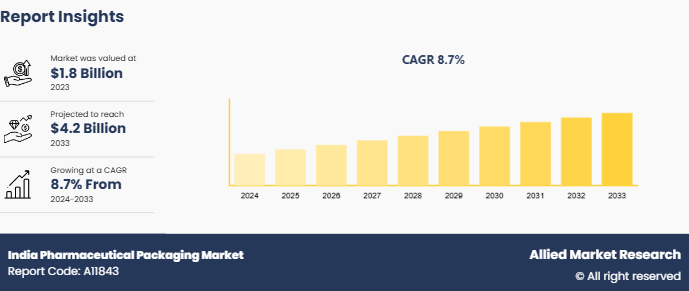

The India pharmaceutical packaging market size was valued at $1.8 billion in 2023, and is projected to reach $4.2 billion by 2033, growing at a CAGR of 8.7% from 2024 to 2033. Packaging plays a crucial role in the pharma industry, where its function extends beyond serving as a branding aid and providing barrier protection to products for the shelf-life period. It is increasingly playing a vital role in ensuring overall patient safety by carrying key information pertaining to the product, ensuring tamper-evidence, and traceability of products. Pharmaceutical packaging is usually the economic means of providing presentation, protection, identification, information, convenience, integrity, and stability of the product.

Key Market Dynamics

The pharmaceutical packaging market in India is evolving, shaped by the country's regulatory advancements and the adoption of innovative packaging technologies. One key driver for India pharmaceutical packaging market growth is the increasing adoption of blister packaging, which is gaining popularity due to its cost-effectiveness and ability to protect individual doses. Additionally, the rise of cold-chain logistics to support temperature-sensitive drugs, such as biologics and vaccines, is spurring demand for specialized packaging that can maintain product stability throughout distribution and contributing to the growth of India pharmaceutical packaging market forecast .

Another significant driver is the push for improved packaging standards to combat counterfeit drugs. As India is a major exporter of pharmaceuticals, strict packaging standards are becoming essential to ensure product authenticity and safety across international markets. This focus on anti-counterfeiting solutions, such as tamper-evident seals and unique identification codes, is contributing to india pharmaceutical packaging market opportunity.

Despite these opportunities, the india pharmaceutical packaging market growth faces challenges with respect to sustainability. India’s packaging sector is heavily reliant on plastic materials, which are now under scrutiny due to environmental concerns. Companies are increasingly pressured to adopt eco-friendly materials, but higher costs and limited availability of sustainable options remain constraints. Nonetheless, the growing emphasis on green packaging innovations presents a long-term opportunity for the India pharmaceutical packaging market trends, as companies gradually invest in recyclable and biodegradable packaging materials to align with global environmental standards.

Market Segmentation

The India pharmaceutical packaging industry is segmented into product, material type. By product, the market is classified into parenteral containers, plastic bottles, blister packaging, closures, specialty bags, labels, and others. On the basis of material type, the market is fragmented into glass, aluminum foils, plastics and polymers, paper and paperboards, and others.

Industry Trends

- The Indian government has implemented extensive and ongoing reforms to bolster the pharmaceutical industry. According to the India Brand Equity Foundation (IBEF) , the Indian government spent 2.6% of the country's GDP on healthcare in the financial year 2023. Government healthcare spending is anticipated to be 2.5% of the GDP in the financial year 2025.

Competitive Landscape

The key players operating in the India pharmaceutical packaging market share are CCL Industries Inc., West Pharmaceutical Services, Inc., Berry Global Group, Inc, Catalent Inc., Gerresheimer AG, SCHOTT Pharmaceutical Packaging, Amcor plc., Aptar Group, Inc., Nipro Corporation, BD (Becton, Dickinson and Company) . These players have adopted various developmental strategies to stay competitive in the India pharmaceutical packaging industry.

Key Benefits for Stakeholders

- Enable informed decision-making process and offer India Pharmaceutical Packaging Market Analysis based on current market situation and estimated future trends.

- Analyze the key strategies adopted by major market players in India pharmaceutical packaging market share.

- Assess and rank the top factors that are expected to affect the growth of India pharmaceutical packaging market size.

- Top Player positioning provides a clear understanding of the present position of market players.

- Detailed analysis of the India pharmaceutical packaging market segmentation assists to determine the prevailing market opportunities.

- Identify key investment pockets for various offerings in the market.

India Pharmaceutical Packaging Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 4.2 Billion |

| Growth Rate | CAGR of 8.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 90 |

| By Product |

|

| By Material Type |

|

| Key Market Players | BD (Becton, Dickinson and Company), Amcor plc., Berry Global Group, Inc, SCHOTT Pharmaceutical Packaging, Aptar Group, Inc., Gerresheimer AG, Catalent Inc., West Pharmaceutical Services, Inc., Nipro Corporation, CCL Industries Inc. |

The India Pharmaceutical Packaging Market is projected to grow at a CAGR of 8.7 % from 2024 to 2033

CCL Industries Inc., West Pharmaceutical Services, Inc., Berry Global Group, Inc, Catalent Inc., Gerresheimer AG, SCHOTT Pharmaceutical Packaging, Amcor plc., Aptar Group, Inc., Nipro Corporation, BD (Becton, Dickinson and Company) are the leading players in India Pharmaceutical Packaging Market

1. Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends. 2. Analyze the key strategies adopted by major market players in India pharmaceutical packaging market. 3. Assess and rank the top factors that are expected to affect the growth of India pharmaceutical packaging market. 4. Top Player positioning provides a clear understanding of the present position of market players. 5. Detailed analysis of the India pharmaceutical

For analysis, the India Pharmaceutical Packaging Market is segmented into product, and material type

Loading Table Of Content...