India Polyacrylic Acid Market Research, 2032

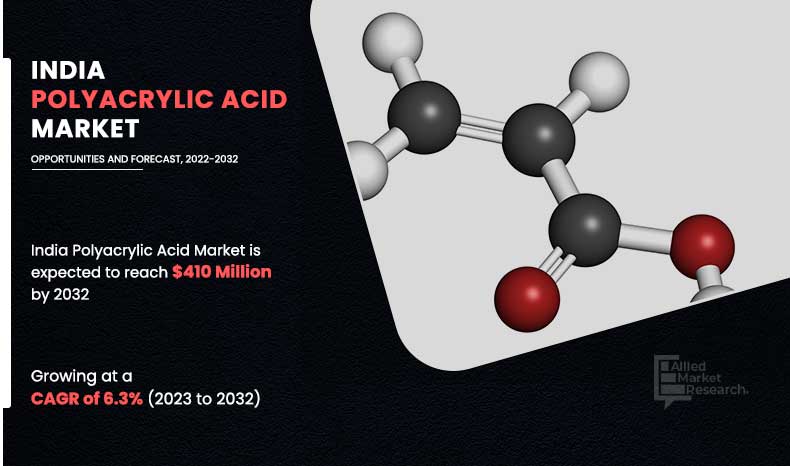

The India Polyacrylic Acid Market was valued at $ 227.4 million in 2022 and is estimated to reach $ 410.2 million by 2032, exhibiting a CAGR of 6.3% from 2023 to 2032.

The India polyacrylic acid market is experiencing growth due to several factors such as industrial growth, construction, and infrastructure development. However, fluctuating raw material prices hinder market growth to some extent. Moreover, the rise in the adoption of sustainable practices offers remunerative opportunities for expanding the India polyacrylic acid market.

Introduction

Polyacrylic acid is a polymer derived from acrylic acid, a simple monomer. It is characterized by a repeating structure of acrylic acid units linked together to form a chain. It is a versatile material used in various industries, including adhesives, sealants, detergents, cleaning products, superabsorbent polymers, personal care products, coatings, paints, agriculture, oil & gas industry, and medical & pharmaceutical applications.

Key Takeaways

- The India polyacrylic acid market is highly fragmented, with several players including Acuro Organics Limited, Akrema, Ashland Inc., Asmi Chem, BASF SE, Central Drug House, Dow Inc., Innova Corporate, Bhumi Chemicals, and RX Chemicals.

- More than 6,765 product literatures, industry releases, annual reports, and other such documents of major industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study covers India in terms of value and volume during the forecast period 2022-2032 is covered in the India polyacrylic acid market report.

- This study covers list of material suppliers, key manufacturers, whole and distributors and potential customers in India polyacrylic industry.

- The report also provides Pestel analysis and Swot analysis for every company considered in the study.

Market Dynamics

The market for polyacrylic acid in India is majorly driven by surge in demand for innovative and sustainable solutions, mirroring global trends in the packaging industry. The versatility of polyacrylic acid, whether in thickener-enhancing product formulations or as a scale inhibitor in water treatment, positions it as a versatile and indispensable material.

The India polyacrylic acid market is subject to influence from factors such as evolving consumer demands, regulatory standards concerning human health and the environment, and the emphasis on sustainable practices. As businesses seek environmentally conscious alternatives, the market may witness surge in demand for bio-based polyacrylic acid, aligning with the broader trend of eco-friendly packaging materials.

Despite the positive outlook, challenges such as fluctuating raw material prices of polyacrylic acid hamper market growth. The volatility in raw material prices poses a concern, necessitating strategic measures by industry players to manage and mitigate these effects. To overcome this challenge, companies operating in the India polyacrylic acid market may explore options such as hedging, long-term contracts, or supplier diversification to navigate through the fluctuations in raw material costs.

On the contrary, rapid development in the industries and urbanization in India are expected to open potential avenues for the development of the polyacrylic acid market during the forecast period. For instance, the Indian Government's initiatives toward smart cities and wastewater treatment have fostered the demand for polyacrylic acid products. India's initiatives for smart cities and wastewater treatment from 2022 to 2032 aim to address water scarcity and potential GDP loss. With 600 million Indians experiencing extreme water scarcity, India's current water treatment capacity is 27.3%, while its sewage treatment capacity is 18.6%. Over 1,162 projects have been completed, worth ₹34,751 crore, and over 100 smart cities have developed over 1,063 public spaces, worth ₹6,403 crore. However, rise in population and urbanization have led to excessive sewage discharge, causing eutrophication and deteriorating water quality. Around 65% of irrigated areas near urban centers are affected by untreated wastewater, posing health risks to consumers and farmers. India must adopt sustainable circular economy practices, including safe reuse of treated water, to address these challenges and improve water quality.

Segments Overview

The India poly acrylic acid market is segmented into type, application, and end-use industry. On the basis of Type, the market is bifurcated into synthetic and bio-based. Depending on application, it is segregated into thickeners, dispersant, scale inhibitor, emulsifiers, binders, and others (conditioners and clarifying agents). By end-use industry, it is fragmented into construction, paints & coatings, pulp & paper, adhesives & sealants, water treatment, pharmaceutical, cosmetic, and others (textile and consumer goods).

By Type

Synthetic type is projected as the most lucrative segment.

The India polyacrylic acid market is expected to grow significantly in the coming years, with the synthetic segment holding the highest market share in 2022. This growth is driven by factors such as the geriatric population, childbirths, water quality concerns, and technological advancements. The bio-based segment is expected to experience the highest CAGR of 6.8% from 2023 to 2032, driven by the demand for sustainable products and the circular economy. The scale inhibitor segment is expected to lead by 2032, driven by industrialization, environmental regulations, and technological advancements. The water treatment segment is expected to dominate the market.

By Application

Scale Inhibitors is projected as the most lucrative segment.

The scale inhibitor segment in India's polyacrylic acid market, accounting for nearly one-fourth of revenue, is expected to dominate due to industrialization, environmental regulations, and technological advancements. The thickeners segment, projected to grow at a 7.3% CAGR from 2023 to 2032, is driven by the growing demand for cosmetics and personal care products, with the eco-friendly nature of polyacrylic acid aligning with the industry's emphasis on natural and organic formulations.

By End-use

Water Treatment is projected as the most lucrative segment.

India's water treatment segment dominates the polyacrylic acid market, accounting for nearly one-third of revenue. This is due to increasing water pollution due to industrialization, urbanization, and population growth. The market presents opportunities for advanced water treatment chemicals. The cosmetics segment is projected to grow at a CAGR of 7.80%, driven by rising disposable income, lifestyle changes, and personal grooming awareness.

Competitive Analysis

The major players operating in the Europe biodiesel market include Acuro Organics Limited, Akrema, Ashland Inc., Asmi Chem, BASF SE, Central Drug House, Dow Inc., Innova Corporate, Bhumi Chemicals, and RX Chemicals.

Key Market Trends

- On the basis of type, the synthetic segment registered the highest accounting for more than four-fifths of the market share and is projected to maintain the same during the forecast period.

- On the basis of application, scale inhibitor registered the highest market share accounting for nearly one-fourth of the market share in 2022.

- On the basis of end-use industry, water treatment dominates the highest market share accounting for nearly one-third of the market share in 2022.

India Polyacrylic Acid Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By End-Use |

|

| Key Market Players | Acuro Organics Limited, Akrema, Asmi Chem, Dow Inc., Ashland Inc, RX Chemicals., BASF SE, Central Drug House, Bhumi Chemicals, Innova Corporate |

Analyst Review

According to the opinions of various CXOs of leading companies, the India polyacrylic acid market was dominated by the water treatment segment in 2023.

As per the insights of various industry leaders, the sales of polyacrylic acid is increasing significantly in in India, with particular prominence in applications related to water treatment and scale inhibition. In recent years, the escalating industrial activities in India have propelled the demand for efficient water treatment solutions, and polyacrylic acid, known for its effectiveness in inhibiting scale formation, has played a pivotal role.

The emphasis on environmental sustainability and implementation of stringent water quality regulations have further bolstered the market growth, as industries seek eco-friendly solutions to address water treatment challenges. Challenges such as fluctuating raw material prices and supply chain disruptions are being addressed through strategic initiatives aimed at building resilient supply chains.

The CXOs further added that with increasing awareness of environmental concerns, there is a growing trend toward adopting eco-conscious practices in the polyacrylic acid market, aligning products with sustainable materials and waste reduction strategies. Companies are investing in innovative technologies, including smart solutions for real-time tracking and data-driven insights, to enhance the efficiency and effectiveness of polyacrylic acid applications in various industries across India.

Industrial growth, construction and infrastructure development drives the growth of India Polyacrylic Acid Market.

The India Polyacrylic Acid Market was valued at $ 227.4 million in 2022 and is estimated to reach $ 410.2 million by 2032, exhibiting a CAGR of 6.3% from 2023 to 2032.

The major players operating in the India Polyacrylic Acid Market include Acuro Organics Limited, Akrema, Ashland Inc., Asmi Chem, BASF SE, Central Drug House, Dow Inc., Innova Corporate, Bhumi Chemicals, and RX Chemicals.

Rise in adoption of sustainable practices are the opportunities for the India Polyacrylic Acid Market.

The India poly acrylic acid market is segmented into type, application, and end-use industry. On the basis of product type, the market is bifurcated into synthetic and bio-based. Depending on application, it is segregated into thickeners, dispersant, scale inhibitor, emulsifiers, binders, and others (conditioners and clarifying agents). By end-use industry, it I fragmented into construction, paints & coatings, pulp & paper, adhesives & sealants, water treatment, pharmaceutical, cosmetic, and others (textile and consumer goods).

Fluctuating raw material prices restrains the growth of India Polyacrylic Acid Market

Scale Inhibitor segment dominated based by application in the market.

Loading Table Of Content...