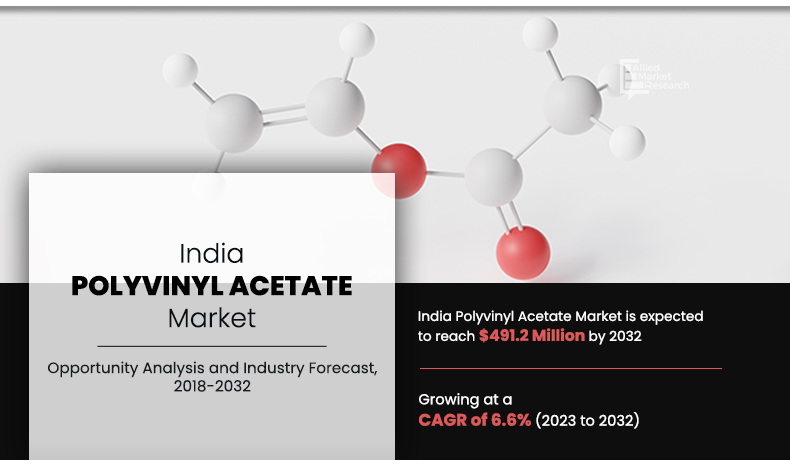

The India polyvinyl acetate market was valued at $219.9 million in 2018 and is estimated to reach $491.2 million by 2032, exhibiting a CAGR of 6.6% from 2023 to 2032. Rise in demand for adhesives drives the growth of India polyvinyl acetate market. Polyvinyl acetate exhibits excellent adhesive properties, including strong bonding strength, fast curing times, and good flexibility making them suitable for various substrates such as wood, paper, fabric, and plastics. However, availability of substitutes from synthetic polymers restraint the growth of India polyvinyl acetate market. Surge in demand for woodworking and furniture industry provide lucrative opportunities to the market.

Introduction

Polyvinyl acetate (PVA) is a synthetic polymer derived from the polymerization of vinyl acetate monomers. It is commonly known as white glue, wood glue, or PVA glue. PVA is a versatile material widely used in various domains due to its adhesive properties, flexibility, and non-toxic nature. PVA is a type of thermoplastic polymer that forms when vinyl acetate monomers undergo polymerization, a chemical process where smaller molecules (monomers) combine to form larger molecules (polymers). The resulting polymer has a linear structure with repeating units of vinyl acetate. The polymerization reaction is typically catalyzed by initiators or heat, leading to the formation of long-chain molecules with strong adhesive properties.

PVA-based packaging adhesives provide strong and reliable bonds, ensuring that packages remain securely sealed during storage, handling, and transportation. In addition, they offer good adhesion to various packaging materials, including cardboard, paperboard, and plastics, making them versatile solutions for packaging needs. Decorative laminates, such as those used in flooring, countertops, and furniture, often incorporate PVA as a bonding agent. PVA-based adhesives are applied between layers of decorative paper and substrate materials, such as particleboard or medium-density fiberboard (MDF), to create durable and aesthetically pleasing laminates. The adhesive ensures that the layers adhere firmly together, enhancing the structural integrity and longevity of the laminated products.

Polyvinyl acetate adhesives are also used in the bookbinding industry due to their ability to form flexible and durable bonds between paper and book covers. The flexibility of PVA adhesive ensures that the binding remains intact even with repeated use, making it a popular choice for both paperback and hardcover books. In the packaging industry, PVA-based adhesives are preferred for their non-toxic nature and low odor, making them suitable for food packaging applications. These adhesives comply with stringent regulatory standards and are safe for direct or indirect contact with food items, ensuring consumer safety and product integrity.

PVA serves as a thickening agent in various products across different industries including textile, personal care and others in India. Its ability to increase viscosity and improve the consistency of liquid formulations makes it valuable in applications such as paints, coatings, inks, and cosmetics. In paints and coatings, PVA acts as a binder and thickener, enhancing the coverage, durability, and flow properties of the formulations. In cosmetics, it contributes to the texture and stability of products such as creams, lotions, and hair gels.

Key Takeaways

- The India polyvinyl acetate market is highly fragmented, with several players including Aadhunik Industries, B JOSHI AGROCHEM PHARMA, Central Drug House, Chemipol (Kothari Group Of Industries), Penta Bioscience Products, Kalikund Enterprise, MOHIT ORGANIC RESOURCES PRIVATE LIMITED, Pidilite Industries Limited, SIVA CHEMICAL INDUSTRIES, and Triveni Interchem Private Limited (Group Of Triveni Chemicals).

- More than 6,765 product literatures, industry releases, annual reports, and other such documents of major industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study covers nearly 20 countries. The segment analysis of each country in terms of value and volume during the forecast period 2018-2032 is covered in the India polyvinyl acetate market report.

Market Dynamics

PVA adhesives find applications across numerous industries, including woodworking, packaging, paper converting, textiles, automotive, construction, and assembly. They are used for bonding furniture, laminates, cartons, labels, diapers, filters, automotive interiors, and much more. The Indian government increased public spending on infrastructure. For instance, in of May 2022, the Ministry of Statistics and Program Implementation's Infrastructure and Project Monitoring Division reported a staggering 1,559 projects in the pipeline, with a combined value of approximately $354 million. Polyvinyl acetate adhesives are gaining popularity in adhesives which is for use in various construction projects with the increased public spending on infrastructure.

Synthetic polymers and alternative adhesives offer enhanced performance characteristics tailored to specific applications. For instance, cyanoacrylate adhesives provide fast curing times and high bond strength, making them suitable for rapid assembly processes. Similarly, epoxy adhesives offer excellent chemical resistance and bonding strength, particularly for bonding metals. The widespread availability and adoption of substitute synthetic polymers have led to market saturation in certain industries and applications in India. As a result, PVA manufacturers in India face intense competition and pricing pressure, making it challenging to expand their market presence and increase sales volumes.

Segments Overview

The India polyvinyl acetate market is segmented into grade, and application. On the basis of grade, the market is classified into partially hydrolyzed, medium hydrolyzed, and fully hydrolyzed. On the basis of application, the market is categorized into adhesive, packaging adhesives, decorative laminates and furniture assembly, and thickening agent.

On the basis of grade, the partially hydrolyzed segment dominated the India polyvinyl acetate market. Partially hydrolyzed PVA is commonly used in the formulation of water-based adhesives. The hydroxyl groups introduced through hydrolysis enhance the adhesive properties, making it suitable for applications such as woodworking, paper bonding, and packaging.

By Grade

Partially hydrolyzed is projected as the most lucrative segment.

On the basis of application, the adhesive segment dominated the India polyvinyl acetate market. PVA is often used in woodworking for bonding wood pieces together. It provides a strong bond and dries clear, making it suitable for many woodworking projects. Polyvinyl acetate glue is also gaining popularity in the paper and cardboard industry for various applications, such as bookbinding, paper crafts, and packaging.

By Application

Adhesive is projected as the most lucrative segment.

Competitive Analysis

The major players operating in the India polyvinyl acetate market include Aadhunik Industries, B JOSHI AGROCHEM PHARMA, Central Drug House, Chemipol (Kothari Group of Industries), Penta Bioscience Products, Kalikund Enterprise, MOHIT ORGANIC RESOURCES PRIVATE LIMITED, Pidilite Industries Limited, SIVA CHEMICAL INDUSTRIES, and Triveni Interchem Private Limited (Group Of Triveni Chemicals).

Key Market Trends

- On the basis of grade, partially hydrolyzed registered the highest market share accounting for nearly half of the market share.

- Based on application, adhesive segment dominated the India polyvinyl acetate market growing with the CAGR of 6.5%.

Historic Trends of India Polyvinyl Acetate

- The establishment of the Indian Institute of Chemical Technology (IICT) and other research institutions, there was a growing interest in developing indigenous chemical manufacturing capabilities. However, PVAc production remained limited, and India relied heavily on imports for such specialized chemicals.

- In the 1980s India focused on industrialization and self-reliance through initiatives like the Green Revolution and the establishment of public sector undertakings (PSUs), there was some growth in the chemical industry. PVAc might have seen increased usage during this period, especially in sectors like construction and packaging.

- In the 2010s The Indian chemical industry continued to evolve, with a focus on sustainability, innovation, and meeting global standards. PVAc manufacturers might have adopted greener production processes and developed specialized formulations to cater to diverse market needs.

India Polyvinyl Acetate Market Report Highlights

| Aspects | Details |

| By Grade |

|

| By Application |

|

| Key Market Players | Central Drug House, Triveni Interchem Private Limited, SIVA CHEMICAL INDUSTRIES, Aadhunik Industries, Kalikund Enterprise, MOHIT ORGANIC RESOURCES PRIVATE LIMITED, B JOSHI AGROCHEM PHARMA, Chemipol (Kothari Group of Industries), Penta Bioscience Products, Pidilite Industries Limited |

Analyst Review

According to the opinions of various CXOs of leading companies, the India polyvinyl acetate market was dominated by the partially hydrolyzed segment.

Advancements in packaging technology drive the growth of the India polyvinyl acetate market. PVA-based adhesives offer superior adhesion to various substrates such as paper, plastic films, and aluminum foil. In India, the demand for sustainable packaging has surged, prompting the use of eco-friendly materials like PVA. Innovative packaging formats such as stand-up pouches and resealable closures further drive the application of PVA adhesives by enhancing product visibility and shelf life.

However, the availability of substitutes from synthetic polymer is expected to restrain industry expansion. Synthetic polymers such as cyanoacrylate, epoxy, and polyurethane adhesives offer tailored performance benefits for various applications. Cyanoacrylate provides rapid curing and high strength, epoxy excels in chemical resistance, while polyurethane offers flexibility and impact resistance. In India, PVA manufacturers struggle with market saturation due to the widespread adoption of alternative adhesives, leading to intense competition and pricing pressures, and thus, hindering their growth prospects.

Rise in demand for adhesives and advancements in packaging technology drives the growth of India polyvinyl acetate market.

The India polyvinyl acetate market was valued at $ 219.9 million in 2018 and is estimated to reach $ 491.2 million by 2032, exhibiting a CAGR of 6.6% from 2023 to 2032.

The major players operating in the India polyvinyl acetate market include Aadhunik Industries, B JOSHI AGROCHEM PHARMA, Central Drug House, Chemipol (Kothari Group Of Industries), Penta Bioscience Products, Kalikund Enterprise, MOHIT ORGANIC RESOURCES PRIVATE LIMITED, Pidilite Industries Limited, SIVA CHEMICAL INDUSTRIES, and Triveni Interchem Private Limited (Group Of Triveni Chemicals).

Surge in demand woodworking and furniture industry and the rise in demand for paper and packaging are the opportunities for the India Polyvinyl Acetate Market.

The India polyvinyl acetate market is segmented into grade, and application. On the basis of grade, the market is classified into partially hydrolyzed, medium hydrolyzed, and fully hydrolyzed. On the basis of application, the market is categorized into adhesive, packaging adhesives, decorative laminates and furniture assembly, and thickening agent.

Availability of substitutes from synthetic polymers restrains the growth of India Polyvinyl Acetate Market

Adhesive segment dominated based by application in the market.

Loading Table Of Content...