India powder coatings market outlook - 2025

The India powder coatings market accounted for $896.7 million in 2017 and is anticipated to reach $1,508.2 million by 2025, registering a CAGR of 6.6% from 2018 to 2025. Powder coatings is type of coating used specifically for coating of metals, for prevention against corrosion and for finishing applications. Powder coatings are superior compared to liquid coating, as they are free from volatile organic compounds (VOCs) unlike liquid coating.

The India powder coatings market is driven by increase in industrialization and rapid urbanization. Furthermore, the market is also driven by rise in demand from applications such as automotive, general industrial, furniture, and others. The India powder coatings market size is expanding at a significant pace owing to rising foreign direct investments (FDI) due to Make in India scheme. This market majorly consists of epoxy and polyester-based products and gains popularity in the Indian market as it exhibits abrasion, slippage, spillage, heat, and chemical resistance. The surface on which epoxy powder coatings is applied remains seamless, antistatic, and is easy to maintain. Growth in competition from substitutes is expected to hamper the growth of the India powder coating market. The India powder coatings market share in the Asia-Pacific market is experiencing considerable growth due to increase in infrastructural investment.

The India powder coatings market is segmented based on resin type, coating method, application, and region. Based on resin type, the market is divided into, thermoset and thermoplastic. The thermoset is further classified into epoxy, polyester, epoxy polyester hybrid and acrylic. Thermoplastic is further is bifurcated into polyvinyl chloride (PVC), nylon, polyolefin, and polyvinylidiene fluoride (PVDF). Based on coating method, it is bifurcated into electrostatic spray and fluidized bed. Based on application, it is fragmented into appliances, automotive, architectural, furniture, agriculture, construction, and earthmoving equipment (ACE), general industrial, and others. Based on region, the market is analyzed across North India, South India, East India, and West India.

India powder coatings market analysis covers in depth information of major industry participants. Some of the major key players operating in the market include Akzo Nobel India Ltd., Jotun India Private Limited, Marpol Private Limited, Rapid Engineering Co. Pvt. Ltd., Berger Paints India Limited, and PPG Asian Paints Private Limited., Maharani Paints Pvt. Ltd., Durolac Paints, Inc., Titan Paints & Chemicals Ltd., and Tulip Paints. Other players operating in the market include the Zigma Paints (P) Limited, Paramount Powders Pvt. Ltd., Chanda Paints Pvt. Ltd., and Par-Ferro Coatings Pvt. Ltd.

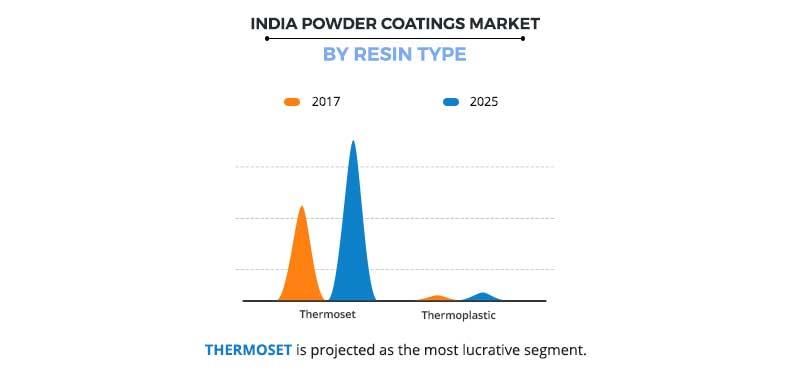

India Powder Coatings Market, by Resin Type

With regards to resin type, the thermoset segment occupied the highest share of 93.7% in terms of volume in the overall market in 2017 and is expected to continue its dominance throughout the analysis period. Rise in demand from automotive industry is one of the significant factors for the growth of thermoset in the India powder coatings market.

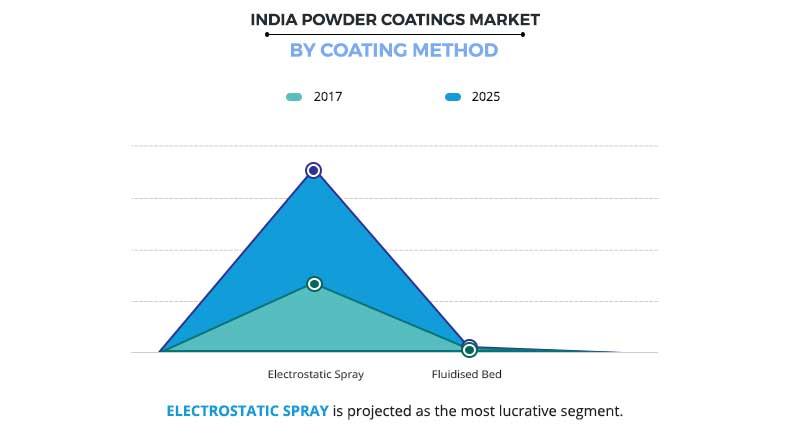

India Powder Coatings Market, by Coating Method

Based on coating method, the electrostatic spray method dominated the market in 2017. High transfer efficiency, as well as less overspray are the advantages offered by electrostatic spray. Owing to these advantages, it is majorly adopted across various end user industries. Electrostatic spray coating requires entire coating equipment, which is a huge investment for small areas of painting. This factor is expected to decrease the demand for electrostatic spray coatings for small scale applications in India during the forecast period.

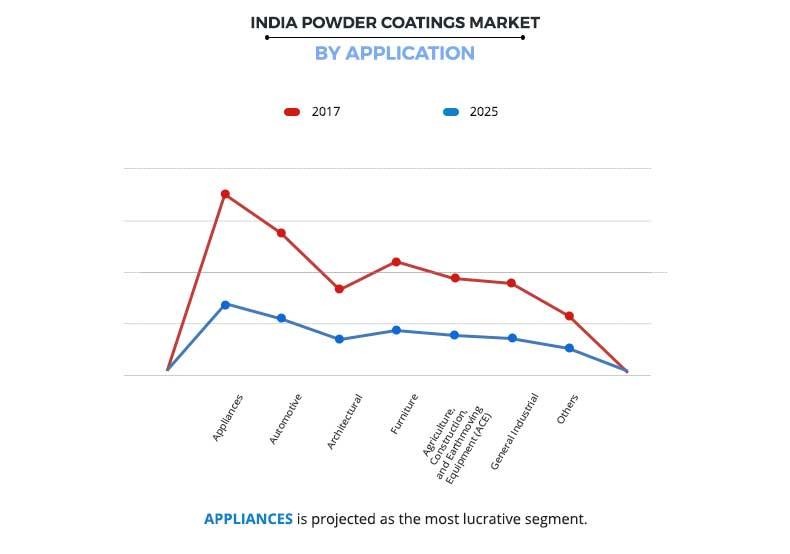

India Powder Coatings Market, by Application

Based on application, the appliances segment dominated the market in 2017. The trend toward replacing the monotone color of white appliances with polychromatic colors and special-effect pigmented coatings boosts the adoption of powder coatings in the appliances. Powder coating based on epoxy polyester resin blend is used for coating domestic appliances. Technological advancements in coil coatings drives the demand for consumer appliance coatings, thereby boosting the growth of the powder coatings market.

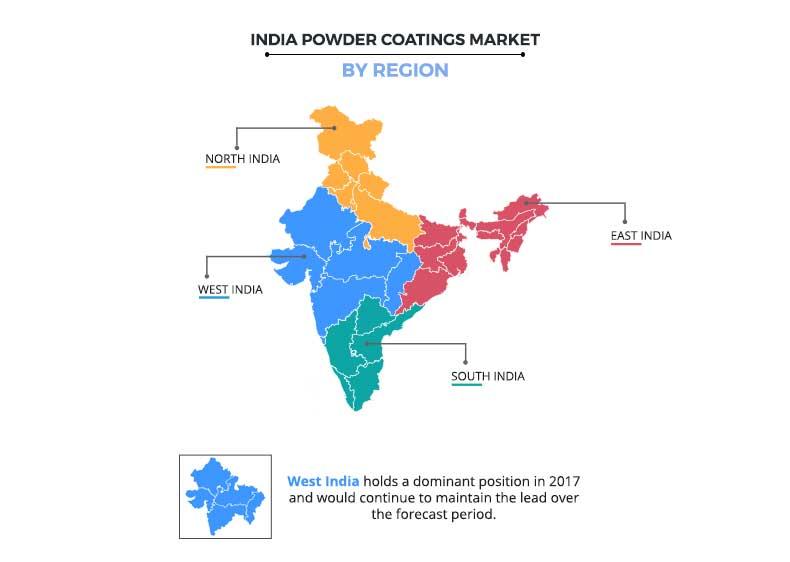

India Powder Coatings Market, by Region

Based on region, West India accounts for major share in the India powder coatings market. Favorable government initiatives such as Make in India lead to increase in industrial setups in states such as Gujarat and Maharashtra, which is expected to have a positive impact on the growth of the India powder coatings market. In addition, rise in investments to enhance the infrastructure development activities by Indian government in states such as Maharashtra will further provide lucrative growth opportunities for the powder coatings market.

Key Benefits for India powder coatings market:

- The report provides an in depth analysis of the India powder coatings market forecast with the help of current and future trends

- India powder coatings market trends are provided in the regional section of the report

- The major states in each region have been mapped according to their individual revenue contribution to the regional market.

- Porter’s five forces analysis helps to analyze the potential of the buyers & suppliers and the competitive scenario of the India powder coatings industry for strategy building

- The India powder coatings market size is mentioned in the report in terms of value as well as volume.

- It outlines the current trends and future scenario of the market from 2018 to 2025 to understand the prevailing opportunities and potential investment pockets

- The key drivers, restraints, and opportunities and their detailed impact analyses are elucidated in the study

- The profiles of key players along with their key strategic developments are enlisted in the India powder coatings market

India Powder Coatings Market Report Highlights

| Aspects | Details |

| By Resin Type |

|

| By Coating Method |

|

| By Application |

|

| By Region |

|

| Key Market Players | TULIP PAINTS, AKZO NOBEL INDIA LTD., BERGER PAINTS INDIA LIMITED, RAPID ENGINEERING CO. PVT. LTD., MARPOL PRIVATE LIMITED, TITAN PAINTS & CHEMICALS LTD., DUROLAC PAINTS, INC., PPG ASIAN PAINTS PRIVATE LIMITED, MAHARANI PAINTS PVT. LTD., JOTUN INDIA PRIVATE LIMITED |

Analyst Review

According to the CXOs, the India powder coatings market witnessed significant growth in the recent years. This is attributed to increase in the adoption of powder coating across numerous end users such as in general industrial, architectural, agriculture, construction, and earthmoving equipment (ACE), and VOC- & solvent-free properties of powder coatings. Furthermore, powder coatings are superior compared to liquid coating, as they are free from volatile organic compounds (VOCs) unlike liquid coating. In addition, they do not emit hazardous air pollutants (HAPs) that are dangerous for the environment. They are inflammable unlike the substitute products. Insurance costs in powder coating are moderate as compared to the high cost of liquid coating. In powder coating, the over sprayed particles can be recycled, whereas liquid coating particles are hazardous sludge. Furthermore, there are significant growth opportunities for the India powder coatings market owing to rapid increase in automobile production.

Loading Table Of Content...