Indian Dental Consumables Market Overview:

The Indian Dental Consumables Market was valued at $116,397 thousand in 2016, and is projected to reach $232,527 thousand by 2023, registering a CAGR of 10.3% from 2017 to 2023. Dental consumables include medical devices such as dental sundries and small equipment that are used for the treatment of patients suffering from dental caries and periodontal diseases.

Segment Review

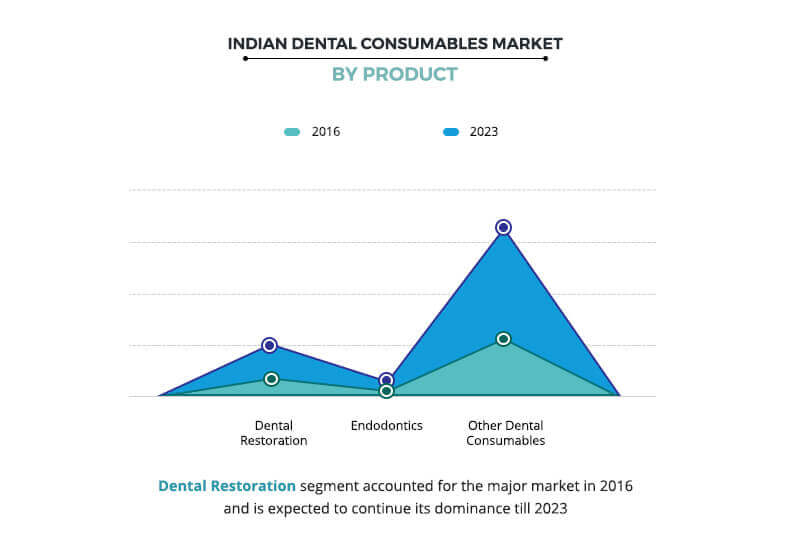

The other dental consumables segment is expected to generate maximum revenue for the Indian dental consumables market, owing to increase in prevalence of dental issues, which require use dental consumables for quality treatment.

Increase in Dental Tourism in India

The Indian dental consumables market is witnessing prominent growth, owing to increase in dental tourism due to low cost of dental treatment in the country and availability of specialized professionals who deliver quality treatment. Dental treatment in the developed nations such as Europe and North America is expensive as compared to India. The population suffering from dental problems in these geographical areas prefer to travel to India to get quality treatment at a low cost. Thus, increase in dental tourism is expected to propel the growth of the Indian dental consumables market.

The key players profiled in the report include 3M Company, Anand Meproducts Pvt. Ltd., Danaher Corporation, Dentsply Sirona, Indident, Institut Straumann AG, Mil Medical Dental Systems Pvt. Ltd., Osstem Implant Co., Ltd., Prime Dental Products Pvt. Ltd., Zimmer Biomet, and Mani Inc. Other prominent players operating in the market include KAVO G C, Ivoclar-Vivadent, Nobel Biocare, Mecktron, Aceton, and others.

Key Benefits

- The study provides an in-depth analysis of the Indian dental consumables market with current trends and future estimations to elucidate the imminent investment pockets.

- The report provides quantitative analysis of the industry from 2016 to 2023 to enable the stakeholders to capitalize on the prevailing market opportunities.

- Extensive analysis of the country market helps to understand the adoption of dental consumables for various treatment procedures.

- Competitive intelligence highlights the business practices, followed by leading market players across various geographies.

Indian Dental Consumables Market Segments:

By Product

- Dental Restoration

- By Material

- Metals

- Polymers

- Ceramics

- Biomaterials

- By Material

- Endodontics

- Endodontic Files (Root Canal Treatment)

- By Material Type

- Stainless Steel Files

- Alloy Files

- By Type

- Handheld RC Files

- Rotary Files

- By Material Type

- Obturators

- Permanent Endodontic Sealers

- Endodontic Files (Root Canal Treatment)

- Other Dental Consumables

- Dental Splints

- Dental Sealants

- Dental Burs

- Long Straight Shank (HP)

- Latch-type Shank (RA)

- Friction Grip Shank (FG)

- Dental Impression Materials

- Dental Disposables

- Bonding Agents

By Location

- Top Five Metro Cities

- Next 40 Towns

- Rest of India

Indian Dental Consumables Market Report Highlights

| Aspects | Details |

| By PRODUCT |

|

| By LOCATION |

|

| By Region |

|

| Key Market Players | DENTSPLY SIRONA INC., PRIME DENTAL PRODUCTS PVT LTD, DANAHER CORPORATION, INDIDENT MEDICAL DEVICES, OSSTEM IMPLANT CO., LTD., ADIN DENTAL IMPLANT SYSTEMS LTD., ZIMMER BIOMET HOLDINGS, INC., MANI, INC., ANAND MEPRODUCTS PVT., LTD., 3M COMPANY, INSTITUT STRAUMANN AG |

Analyst Review

The Indian dental consumables market is expected to witness significant growth in the near future, owing to high prevalence of dental problems such as dental caries and periodontal disease and increase in dental tourism. The other consumable segment is expected to generate the highest revenue in 2016, and is expected to maintain its lead during the forecast period. The top five metro cities occupy the major share due to large number of dentist practicing in cosmopolitan areas as compared to rural areas.

The factors that boost the growth of the Indian dental consumables market include rise in prevalence of dental problems, surge in investments for establishment of multispecialty hospitals offering dentistry, increased focus of the country to establish itself as a manufacturing hub for dental supplies, and rise in dental tourism in India due to low cost with quality treatment. However, price sensitivity of the dental consumables due to fluctuating currency exchange rates is expected to market. Furthermore, increased focus of the international players such as Dentsply Sirona, 3M, and others to invest and expand in India is expected to offer lucrative opportunity for the market

The top five metro cities segment dominated the Indian dental consumable landscape by contributing the largest revenue in 2016. Indian dentists and manufacturers of the consumables are expected to capitalize the rural areas, owing to presence of large patient pool and untapped areas. This is anticipated to further serve as a lucrative opportunity for the manufacturers, as India has the largest population in the world with prevalent dental issues.

Loading Table Of Content...