Indian Glaucoma And Cataract Surgery Devices Market Overview:

Indian Glaucoma And Cataract Surgery Devices Market is an asymptomatic eye-related disorder that occurs due to the buildup of fluid pressure inside the eye. This is a hereditary disorder that could cause damage to the optic nerve of the eye, hence immediate treatment is recommended as glaucoma in severe cases is expected to result in permanent loss of vision. Cataract is a condition wherein clouding of the lens occurs resulting in decreased vision. Cataract surgery is the removal of clouded natural lens, and involves implantation of artificial or intraocular lens. The Indian glaucoma and cataract surgery devices market was valued at $164 million in 2016, and is expected to reach $321 million by 2023, registering a CAGR of 10.1% from 2017 to 2023.

Increase in geriatric population coupled with the technological advancements in the devices used for glaucoma and cataract surgeries drive the market growth. In addition, the rise in focus of manufacturers on developing micro-invasive glaucoma drainage implants as they are employed in the treatment of glaucoma to provide a safer and less invasive means of reducing intraocular pressure (IOP) as compared to conventional glaucoma surgery devices supplements the market growth. However, dearth of skilled professionals, lack of reimbursement for the use of glaucoma and cataract surgical devices, and high cost incurred for cataract surgeries especially in developing economies impede the market growth. Moreover, initiatives taken by the government and many nonprofit organizations to generate awareness among individuals regarding the benefits of cataract surgeries, awareness regarding eye disorders and availability of advanced devices, creates lucrative opportunities in the market.

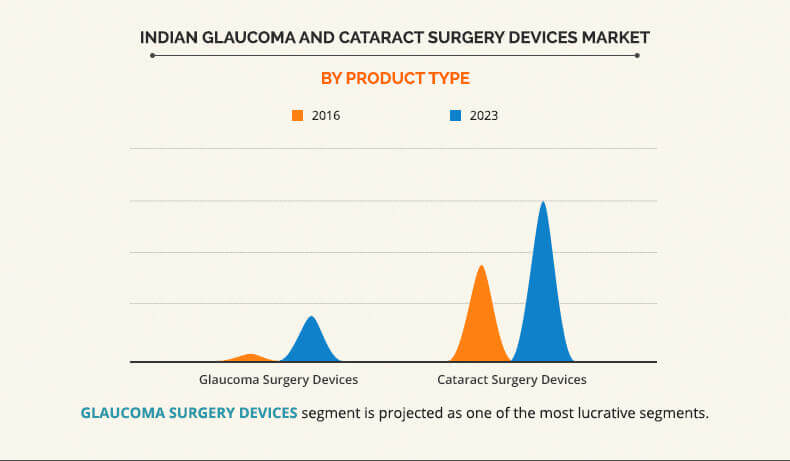

Product Type Segment Review

Based on the product type, it is bifurcated into glaucoma and cataract surgery devices. The glaucoma surgery devices market is further divided into glaucoma drainage device, glaucoma laser device, and implant & stent. The cataract surgery device is further classified into intraocular lens (IOL), ophthalmic viscoelastic device (OVD), and phacoemulsification equipment. Cataract surgery devices segment is the dominant segment contributing towards the growth of Indian glaucoma and cataract surgery market owing to the advancement in technology and high incidence of cataract among the geriatric population in India.

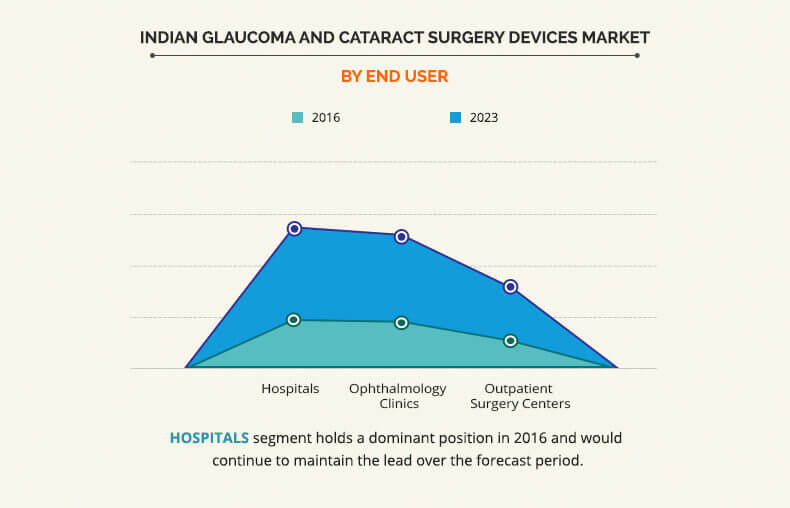

End User Segment Review

Based on end user, it is categorized into hospital, ophthalmology clinic, and outpatient surgical center. Hospital is the dominant segment as they are equipped with advanced surgical devices. However, outpatient surgical center is expected to be fastest growing segment owing to the growing demand for minimally invasive surgeries that are commonly performed in these centers.

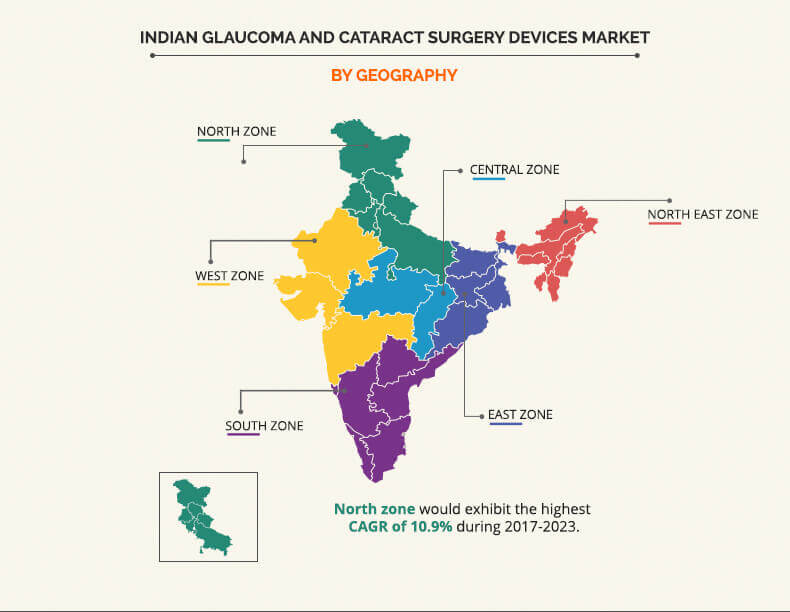

Indian Glaucoma and Cataract Surgery Devices Market: Key zones

Based on zones, the Indian glaucoma and cataract surgery devices market is divided into north zone, east zone, west zone, south zone, central zone, and north-east zone. West zone accounted for the largest market share in the Indian glaucoma and cataract surgery devices market in 2016, and is expected to retain its dominance throughout the forecast period.

The key players operating in the Indian glaucoma and cataract surgery devices market include Alcon, Inc. (Novartis AG), New World Medical, Inc., Johnson & Johnson, Bausch & Lomb, Inc. (Valeant Pharmaceuticals International, Inc.), Topcon Corporation, Lumenis Ltd., Allergan plc., Carl Zeiss Meditec AG, Essilor International S.A., HAAG-Streit Holding AG, Nidek Co., Ltd., Ziemer Ophthalmic Systems AG, and Ellex Medical Lasers Ltd.

Other prominent players in the value chain include Santen Pharmaceutical Co., Ltd., Abbott Laboratories, Inc., Zabbys, STAAR Surgical Company, Hoya Corporation, and Aurolab.

Key Benefits

- This report entails a detailed quantitative analysis of the current market trends from 2016 to 2023 to identify the prevailing opportunities.

- Market estimations are based on comprehensive analysis of the key developments in the industry.

- The Indian market is comprehensively analyzed with respect to product, surgery type, end user, and zone.

- In-depth analysis based on zones assists in understanding the regional market to assist in strategic business planning.

- The development strategies adopted by key manufacturers are enlisted to understand the competitive scenario of the market.

Indian Glaucoma and Cataract Surgery Devices Market Report Highlights

| Aspects | Details |

| By Product |

|

| By Surgery Type |

|

| By End Users |

|

| By Zone |

|

| Key Market Players | Novartis International AG (Alcon Inc.), Ellex Medical Lasers Ltd., Valeant pharmaceuticals International, Inc. (Bausch & Lomb Incorporated), New World Medical, Inc., Lumenis Ltd., Allergan Plc., Ziemer Ophthalmic Systems AG, Johnson & Johnson, HOYA Corporation, Topcon Corporation., Essilor International S.A., Nidek Co., Ltd., Metall Zug AG (HAAG-Streit Holding AG), Carl Zeiss Meditec AG |

Analyst Review

Glaucoma surgery devices are developed to achieve stable or low intraocular pressure (IOP) in the eye. Incisional surgeries that utilize drainage devices and implants are preferred when the laser surgeries as well as medications fail to achieve or maintain IOP in the eye. High adoption of conventional surgeries such as trabeculectomy and laser surgeries is observed in the market. However, minimally invasive glaucoma surgeries (MIGS) gain traction over the years with significant developments such as iStent, excimer laser trabeculectomy, and suprachoroidal shunts.

Cataract is a medical condition, which results in the clouding of the eye’s natural lens. This lens lies behind the pupil and the iris. Phacoemulsification surgery, extracapsular cataract extraction surgery, and manual small incision cataract surgery are different types of cataract surgeries performed to treat different conditions.

Owing to the high adoption of advanced technology and government initiative to improve the healthcare infrastructure, the north zone of India is projected to experience the fastest growth during the forecast period, whereas western zone accounted for the largest share contributed by the outstanding performance of two key states Gujrat and Maharashtra.

The cataract surgery devices market is dominated by well-established players such as Novartis International AG and Johnson & Johnson; hence, there is intense competition in the Indian market. There is a high adoption of cataract and glaucoma surgery devices, owing to increase in prevalence of the cataract-related diseases, which propels the market growth. High prevalence of glaucoma and cataract among the elderly population and development of innovative approaches to treat glaucoma and cataract are the key factors that drive the growth of the glaucoma and cataract surgery devices market.

Loading Table Of Content...