Industrial Air Blower Market Reseach, 2027

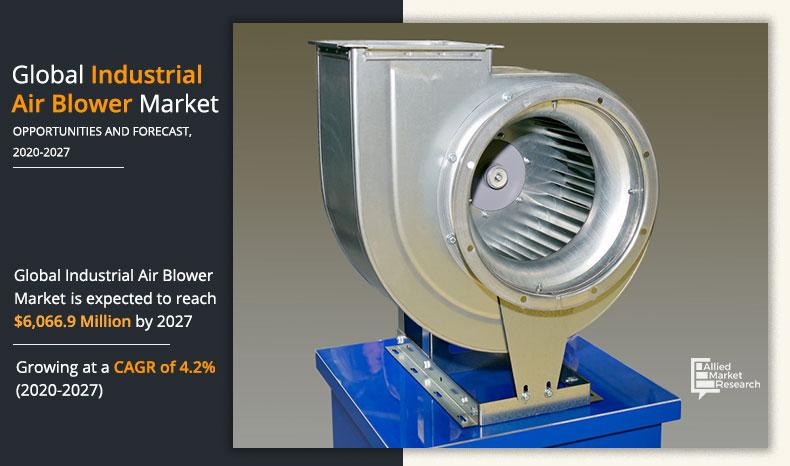

The industrial air blower market size was valued at $4,961.4 million in 2019, and is expected to reach $6,066.9 million by 2027, registering a CAGR of 4.2% from 2020 to 2027.

Industrial air blowers are electromechanical devices used to induce air or gas flow through ducts and electrical enclosures to create flow for exhaust, cooling, ventilating, and other purposes. Industrial blowers are also termed as industrial fans or blower fans. Industrial air blowers are mainly categorized into two types, namely, centrifugal blowers and positive displacement blowers. The centrifugal blowers are most widely used because of their simple mechanism. Centrifugal blowers are available in single or multi-staged units. It mainly consists of a number of blade orientations, which are driven using electric motors through a belt and sheave arrangement or directly coupled to drive motors. Whereas, positive displacement blowers consist of multiple co-rotating shafts to move air in a controlled manner. Industrial air blowers are used for industrial air exhausting, combustion air for burning, and industrial vacuum applications. In addition, industrial air blowers are used in air handling units and heating, ventilating, and air conditioning (HVAC) units to incorporate air flow in industrial buildings and enclosed structures.

Industrial air blowers are gaining popularity in the food & beverages industry as they provide oil free operations and help in maintaining hygienic conditions. Thus, the growing food & beverages alongside pharmaceutical industry is expected to drive the market of industrial air blowers. Moreover, air blowers are used to convey air in both vacuum and pressured atmospheres. This proves them effective for use in the mining sector as well. The growing mining processes in North American countries is thereby assisting the lucrative growth of the industrial air blower market.

However, with very less alternatives for industrial air blowers, their high maintenance costs and high operating costs can restrain the industrial air blower market growth. High fuel consumption leads to increase in operational costs for operating air blowers. Moreover, during the outbreak of COVID-19, construction, manufacturing, hotel, and tourism industries were majorly affected. Manufacturing activities were also stopped or restricted to a huge extent. Construction and transportation activities, along with their supply chains hampered on a global level. This led to decline in manufacturing of air blowers, which directly hampers the growth of market. Although, food & beverage, wastewater treatment plants and pharmaceutical companies were running on full capacity, which led to stability in service business type of the industrial air blower market. However, gradually all industries are resuming its regular manufacturing and services. This is further expected to lead to re-initiation of air blower manufacturing companies at their full-scale capacities, which is expected to help the market to start to recover by start of 2022.

By Movement Of Air

Centrifugal segment holds the largest share in Industrial Air Blower market

The growing industrialization in countries such as India and China, is expected to propel the demand for industrial air blowers. The increasing productions have led to the increase in demand for industries in these regions. Thereby, propelling the growth of the industrial air blower market during the forecast period.

Segment Review

The industrial air blower market is segmented into movement of air, business type, end-user industry, and region. On the basis of movement of air, the market is divided into positive displacement and centrifugal. Depending on business type, it is classified into equipment sales and services. By end-user industry, it is segregated into food & beverage, wastewater treatment, pharmaceutical, chemicals & petrochemical and others. By region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, the UK, France, Italy and rest of Europe), Asia-Pacific (China, Japan, South Korea, India, and Rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

By End-user Industry

Others segment holds dominant position in 2019

By movement of air, in 2019, the centrifugal segment dominated the industrial air blower market, in terms of revenue and the positive displacement segment is expected to witness growth at the highest CAGR during the forecast period. On the basis of business type, the equipment sales segment led the market in 2019, in terms of revenue and services is anticipated to register highest CAGR during the forecast period. By end-user industry, the others segment led the market in 2019, in terms of revenue and wastewater treatment is anticipated to register the highest CAGR during the forecast period.

Competition analysis

The major players profiled in the industrial air blower industry include Air Control Industries Ltd., Airtech Blower Industries, Atlantic Blowers, Atlas Copco, Compressor Pump and Services, Inc., Everest Blower Systems Pvt. Ltd., GP Motors, Howden, HSI Blower and Kaeser Kompressoren. Major companies in the market have adopted strategies such as business expansion, partnership, acquisition, and product launch, to offer better products and services to customers in the industrial air blower market.

By Region

Asia-Pacific holds a dominant position in 2019 and LAMEA is expected to grow at a highest rate during the forecast period.

Key Benefits For Stakeholders

- The report provides an extensive analysis of the current and emerging industrial air blower market trends and dynamics.

- In-depth industrial air blower market analysis is conducted by estimations for the key segments between 2020 and 2027.

- Extensive analysis of the market is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of four major regions is provided to determine the prevailing opportunities.

- The industrial air blower market forecast analysis from 2020 to 2027 is included in the report.

- The key market players operating in the market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the market industry.

Industrial Air Blower Market Report Highlights

| Aspects | Details |

| By MOVEMENT OF AIR |

|

| By BUSINESS TYPE |

|

| By END-USER INDUSTRY |

|

| By Region |

|

| Key Market Players | Everest Blower Systems Pvt. Ltd., Compressor Pump and Services, Inc., Atlas Copco, Airtech Blower Industries, Atlantic Blowers, GP Motors, Air Control Industries Ltd., Kaeser Kompressoren, Howden, HSI Blower |

Analyst Review

The industrial air blower market is mainly driven by rise in manufacturing plants of the food & beverage industry. In addition, efficiency in operation for mining industry is a driving factor of the industrial air blower market. Further, growth in pharmaceutical industries and wastewater treatment plants due to urbanization are driving the industrial air blower market. The industrial air blower market was valued at $4,961.4 million in 2019, and is expected to reach $6,066.9 million by 2027, registering a CAGR of 4.2% from 2020 to 2027.

However, high maintenance costs and high operating costs have adversely affected the installation of industrial air blower in heavy industries. On the contrary, increase in industries in developing countries will drive the growth of the industrial air blower market during the forecast period.

Major companies in the market have adopted strategies such as acquisition, partnership, business expansion, and product launch, to offer better services to customers in the industrial air blower market.

By end-user industry, the others segment is the highest share holder of global industrial air blower market.

By movement of air, in 2019 the centrifugal segment dominated the global industrial air blower market, in terms of revenue and is expected to maintain this trend during the forecast period.

To get latest version of global industrial air blower market report can be obtained on demand from the website.

The global industrial air blower market size was valued at $4,961.4 million in 2019, and is projected to reach $6,066.9 million by 2027, growing at a CAGR of 4.2% from 2020 to 2027.

The forecast period considered for the global industrial air blower market is 2020 to 2027, wherein, 2019 is the base year, 2020 is the estimated year, and 2027 is the forecast year.

The top ten market players are selected based on two key attributes - competitive strength and market positioning

The base year considered in the global industrial air blower market report is 2019.

The top companies holding the market share in the global industrial air blower market report include Air Control Industries Ltd., Airtech Blower Industries, Atlantic Blowers, Atlas Copco, Compressor Pump and Services, Inc., Everest Blower Systems Pvt. Ltd., GP Motors, Howden, HSI Blower and Kaeser Kompressoren.

The report contains an exclusive company profile section, where leading 10 companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Loading Table Of Content...