Industrial Brakes Market Overview

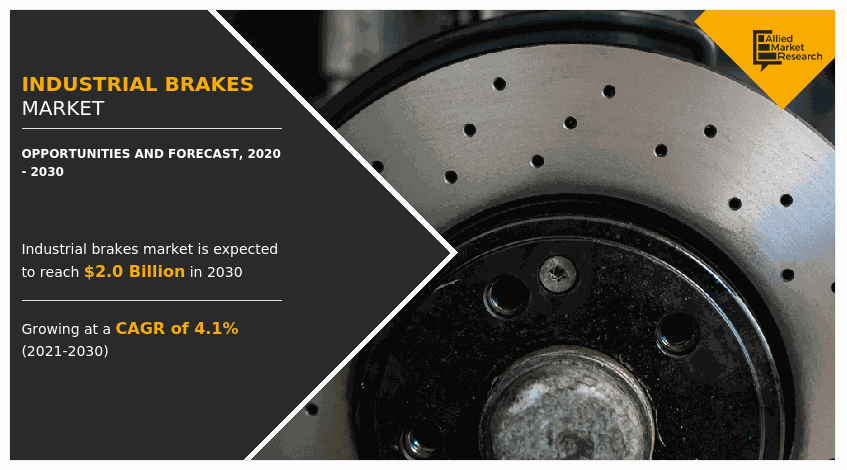

The global industrial brakes market size was valued at $1,295.20 million in 2020, and is projected to reach $1,957.31 million by 2030, growing at a CAGR of 4.1% from 2021 to 2030. This is driven by growing demand for safety and precision in heavy machinery across sectors like manufacturing, mining, and construction. Increasing automation, rising industrialization in emerging economies, and the need for efficient braking systems in high-performance equipment further contribute to the market’s steady expansion and technological advancement.

Market Dynamics & Insights

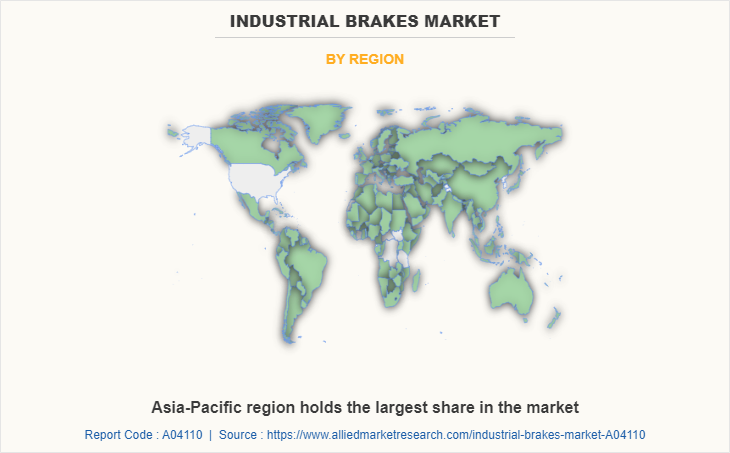

- The industrial brakes industry in Asia-Pacific held a significant share of over 42% in 2020.

- The industrial brakes industry in Africa is expected to grow significantly at a CAGR of 6.3% from 2021 to 2030

- By type, electrical segment is one of the dominating segments in the market and accounted for the revenue share of over 29.1% in 2020.

- By end-user, others segment is the fastest growing segment in the market.

Market Size & Future Outlook

- 2020 Market Size: $1.29 Billion

- 2030 Projected Market Size: $1.95 Billion

- CAGR (2021-2030): 4.1%

- Asia-Pacific: Largest market in 2020

- LAMEA: Fastest growing market

What is Meant by Industrial Brakes

Industrial brakes are the type of systems that are used for construction, forestry, axle, trailer, defense, agricultural, material handling, and utility applications. These brakes slow down or provide complete stoppage. These brakes use friction for holding rotating or movable parts in its place when required and converts kinetic energy that is generated through the friction between surfaces to halt the movement. These brakes provide complete safety that is growing in use in different industries.

The construction and manufacturing industry is growing, owing to rise in government spending over infrastructure projects and increase in demand for commercial and residential segments. Growth in construction projects is bringing more demand for construction equipment such as excavators, backhoe, graders, bulldozers, trenchers and many other construction equipment used for construction applications. This equipment has different performance needs to handle larger amount of weight. Brakes used helps in letting construction equipment to handle larger quantity of load. In addition, growing production and demand for equipment drives the industrial brakes market. In addition, use of robots for different industries is growing. For instance, industrial robots are used for manufacturing applications to provide pick and place operations. Major risks associated with using large robots over different industries is the non-commanded motion that requires immediate action to stop robots. Brakes used for robots help in providing dynamic stopping during emergency. In addition, growth in use of robots for better productivity in different industries and factories drive demand for the industrial brakes market.

However, industrial brakes are made up of different kind of materials such as kevlar, fiberglass, fibers, metal, and ceramic to provide high durability for regular industrial usage. Hence, manufacturing using these materials leads to higher cost. This is leading various industries to use servo motors as an alternative due to lower cost and similar functionality . In addition, different countries are bringing industrial safety standards such as minimum safety standards in Europe. This deals with safety and preventing injury and harm that could be caused to humans during the use of the equipment. Hence this is also preventing the use of certain industrial machines which is limiting the manufacturing of industrial brakes.

Furthermore, during the outbreak of the COVID-19 pandemic, construction, manufacturing, hotel, and tourism industries were majorly affected. Manufacturing activities were halted or restricted. Construction and transportation activities, along with their supply chains, were hampered on a global level. This led to decline in manufacturing of industrial brakes as well as their demand in the market, thereby restraining the industrial brakes market growth. Conversely, industries are gradually resuming their regular manufacturing and services. This led to re-initiation of companies manufacturing industrial brakes at their full-scale capacities, which helped the industrial brakes market share to recover by end of 2021.

Manufacturing of electric and automatic vehicles is growing, owing to certain benefits it offers over manual functioning vehicles such as reducing the speed prior to collision of vehicle, providing safety to pedestrians, reducing speed of moving vehicles, and handling emergency situations. Brakes used in vehicles are equipped with different sensors such as ultrasonic, infrared, radar, and lidar to scan objects and people nearby to vehicles. It helps in providing instant action for reducing speed, which provides better safety to users. Owing to this, various manufacturers are considering use of brakes with sensors, which is expected to offer new industrial brakes market opportunities.

Industrial Brakes Market Segment Overview

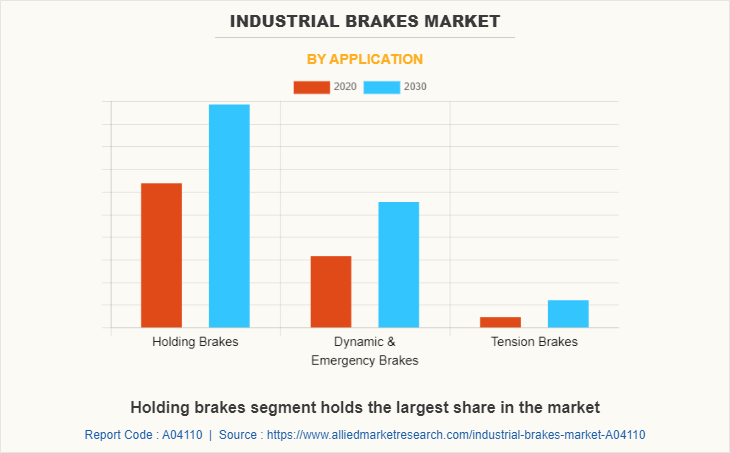

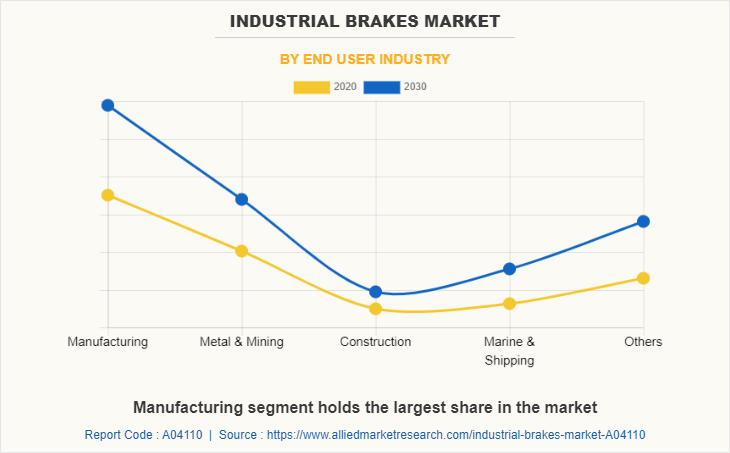

The global industrial brakes market is segmented on the basis of type, application, end user industry, and region. By type, the market is divided into mechanical, hydraulic, pneumatic, electrical, and others. By application, it is divided into holding brakes, dynamic & emergency brakes, and tension brakes. By end user industry, it is divided into manufacturing, metal & mining, construction, marine & shipping, and others. Region wise, the global industrial brakes market analysis is conducted across North America (the U.S., Canada, and Mexico), Europe (the UK, France, Germany, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

On the basis of type, in 2020, the electrical segment dominated the industrial brakes industry, in terms of revenue, whereas the others segment is expected to witness growth at the highest CAGR during the forecast period. As per application, in 2020, the holding brakes segment led the industrial brakes market, however, the tension brakes segment is expected to exhibit highest CAGR in the future. By end user industry, the manufacturing segment led the market in 2020, in terms of revenue; however, the others segment is anticipated to register highest CAGR during the forecast period. Region wise, Asia-Pacific garnered the highest revenue in 2020; however, LAMEA is anticipated to register highest CAGR during the forecast period.

Competition Analysis

The major players profiled in the industrial brakes market include AKEBONO BRAKE INDUSTRY CO., LTD., Altra Motion, Antec Group, Carlisle Brake & Friction, Comer Industries Spa (Walterscheid Powertrain Group), Coremo Ocmea S.p.A., Dellner Bubenzer , Eaton, Ringspann GmbH , and SIBRE.

Major companies in the market have adopted product launch, business expansion, agreement, and acquisition as their key developmental strategies to offer better products and services to customers in the industrial brakes market.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the industrial brakes market forecast from 2020 to 2030 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the industrial brakes market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global industrial brakes market trends, key players, market segments, application areas, and market growth strategies.

Industrial Brakes Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By End User Industry |

|

| By Region |

|

| Key Market Players | Coremo Ocmea S.p.A., ringspann gmbh, SIBRE, AKEBONO BRAKE INDUSTRY CO., LTD., Comer Industries Spa (Walterscheid Powertrain Group), Antec Group, carlisle brake & friction, Dellner Bubenzer, Eaton, Altra Motion |

Analyst Review

The global industrial brakes market witnessed a huge demand in Asia-Pacific followed by Europe & North America. Growth of the industrial brakes market is majorly driven by increasing activities in construction & manufacturing industries and rise in adoption of industrial robotics and automation processes.

Proliferation of industrial brakes is expected to enable consumers to gain next-generation visibility on purchased products. Increase in demand for effective anti-theft devices, owing to security concerns of enterprises regarding their products, highly contributes toward significant rise in demand for industrial brakes. Asia-Pacific is expected to have the fastest growth in the industrial brakes market, owing to rise in potential startups, surge in disposable income of consumers, increase in urbanization & industrialization, and growth in retail and health & pharmaceutical industries.

However, fluctuating prices of materials used for manufacturing industrial brakes and stringent regulations associated with industrial machineries acts as a major restraint for the industrial brakes market. On the contrary, providing technology driven brake systems enabled with sensors is expected to create opportunities for growth of the industrial brakes market during the forecast period.

Major companies in the market have adopted strategies such as product launch, business expansion, agreement, and acquisition to offer better services to customers in the industrial brakes market.

The industrial brakes market was valued at $1,295.2 million in 2020, and is expected to reach $1,957.3 million by 2030, registering a CAGR of 4.1% from 2021 to 2030.

The forecast period considered for the global industrial brakes market is 2021 to 2030, wherein, 2020 is the base year, 2021 is the estimated year, and 2030 is the forecast year.

To get latest version of global industrial brakes market report can be obtained on demand from the website.

The base year considered in the global industrial brakes market report is 2020.

The top companies holding the market share in the global industrial brakes market report include AKEBONO BRAKE INDUSTRY CO., LTD., Altra Motion, Antec Group, Carlisle Brake & Friction, Comer Industries Spa (Walterscheid Powertrain Group), Coremo Ocmea S.p.A., Dellner Bubenzer , Eaton, Ringspann GmbH , SIBRE.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

Loading Table Of Content...