Industrial Camera Market Research, 2032

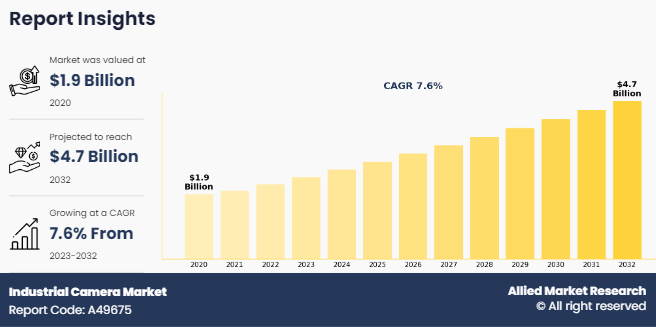

The Global Industrial Camera Market Size was valued at $1.9 billion in 2020, and is projected to reach $4.7 billion by 2032, growing at a CAGR of 7.6% from 2023 to 2032.

An industrial camera, also referred to as a machine vision camera, is a specialized camera designed to be used in industrial applications including factories and logistics. These cameras are used for inspection, measurement, and tracking in industrial settings. They are built to withstand harsh environments, offer high reliability & stability, and often come with features such as high-speed imaging, compatibility with industrial systems, and onboard image processing capabilities.

Report Key Highlighters

The industrial camera market studies more than 23 countries. The analysis includes a country-by-country breakdown analysis in terms of value ($million) available from 2022 to 2032.

The research combined high-quality data, professional opinion, and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the market.

The industrial camera market share is marginally fragmented, with players such as Basler AG, Allied Vision Technologies GmbH, Teledyne DALSA, FLIR Systems, Inc., Cognex Corporation, chromasens GmbH, IDS Imaging Development Systems GmbH, JAI A/S, Omron Corporation, and Baumer Group Major strategies such as product Launch, partnerships, expansion, and other strategies of players operating in the market are tracked and monitored.

Market Dynamics

The industrial camera market is witnessing an exceptional surge with the rapid growth of manufacturing and process industries worldwide, which incorporates numerous sectors including automotive, pharmaceuticals, food and beverages, electronics, and various others. Industrial cameras play a vital role in these industries in modernizing production process, optimizing performance, and ensuring uncompromised products quality throughout various business domains.

For example, in automobile production, industrial cameras are fundamental to high-quality inspection, assembly line verification, and robot guidance systems, contributing to streamlined operations, minimized defects, and greater productivity. In addition, the fact that the automobile enterprise is developing rapidly is anticipated to help the industrial camera market to grow. For instance, according to the Indian Brand Equity Foundation, the Indian passenger car market was valued at $32.70 billion in 2021, and it is anticipated to attain a value of $54.84 billion by 2027.

Similarly, in strictly regulated industries such as pharmaceuticals and food and beverages, industrial cameras are vital in ensuring stringent quality control protocols, facilitating compliance with stringent regulatory standards, and reinforcing consumer confidence in product safety and integrity. Furthermore, the increasing adoption of automation and Industry 4.0 technologies is fueling the demand for industrial cameras, as they represent critical elements of automatic manufacturing lines, smart manufacturing infrastructures, and IoT-driven devices. Moreover, enhanced operational performance & reduced possibility of human error and the ability gain live insights & data of the process to aid informed decision-making abilities help the market to grow.

In addition, the increasing warehousing and logistics sector presents increasing opportunities for industrial camera deployment, encompassing packages including stock management, barcode scanning, package sorting, and security surveillance. As industries more and more prioritize agility, accuracy, and operational excellence to remain dominant in the market, the demand for industrial cameras is poised to maintain its upward trajectory, using further innovation, and technological improvements in this dynamic and evolving market segment.

However, the high cost of industrial cameras presents a restraint on the growth of the industrial camera market. On average, the cost of basic industrial cameras vary from $250 to nearly $1000, while the cost of advanced cameras reach up to $8000. depending on the application and technology. While these cameras provide exceptional abilities and functionalities in taking process pictures vital for numerous industrial applications, their high prices offer a barrier to greater adoption, mainly for small and medium-sized organizations (SMEs) with budget constraints.

The initial investment required for purchasing industrial-grade cameras, alongside related equipment and software program, is high, which leads to reluctance among corporations to adopt these technologies. In addition, ongoing maintenance and support costs further add to the entire cost of possession, making it difficult for a few organizations to justify the investment in industrial camera systems. However, efforts via manufacturers to introduce more cost-effective solutions, advancements in technology eventually reducing the production cost over time, and growing awareness about the long-term benefits of industrial cameras may help mitigate this restraint and foster broader market penetration in the future.

Moreover, technological advancements and innovations in the industrial camera industry are anticipated to positively affect the market growth in the coming years. The increase in automation within the industrial sector offers a good industrial camera market opportunity for a boom in the industrial camera market. As industries across the globe continue to adopt automation technologies to enhance productivity, efficiency, and accuracy in manufacturing and process operations, the demand for industrial cameras is expected to surge.

These cameras play a critical function in computerized systems by providing actual-time visual statistics for tracking, inspection, management, and robotic guidance. Furthermore, the integration of business cameras with artificial intelligence (AI) and machine learning (ML) algorithms permits smart decision-making and predictive maintenance abilities. As industries continue to put money into automation technology to remain competitive and adapt to evolving market demands, the demand for industrial cameras is poised to enjoy robust growth, presenting lucrative opportunities for producers and providers within the market.

The industrial camera market has witnessed various obstructions in its regular operations due to the COVID-19 pandemic and inflation. Earlier, the global lockdowns resulted in reduced industrial activities, eventually leading to reduced demand for industrial cameras from the manufacturing sector. However, COVID-19 subsided, and the major manufacturers performed well in 2024. Contrarily, the rise in global inflation is a new major obstructing factor for the entire industry.

The inflation, which is an immediate result of the Ukraine-Russia war, and a few long-term effects of the COVID-19 pandemic, have delivered volatility in the expenses incurred on raw materials used for the production of industrial cameras. In addition, the price of oil and gas has increased extensively, and many countries, mainly the nations in Europe, Latin America, and developing economies in Asia-Pacific have experienced intense negative effects on the manufacturing industry. However, India and China are performing relatively well. In addition, inflation is anticipated to worsen within the coming years, as the possibility of the ending of the conflict between Ukraine and Russia is much less.

Segmental Overview

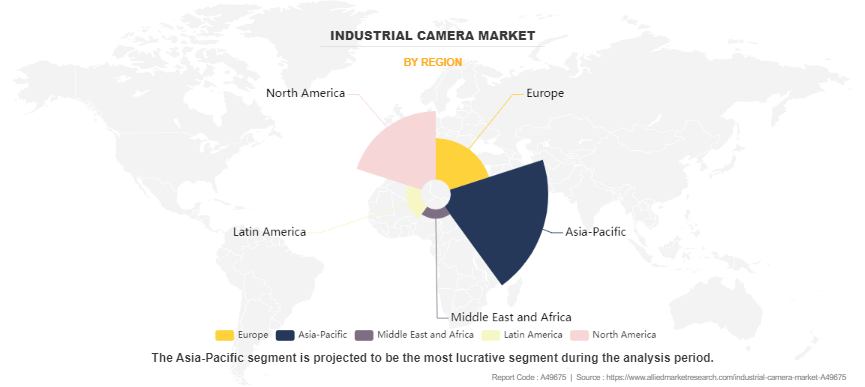

The industrial camera market is segmented on the basis of type, interface type, application, and region. By type, the market is categorized into area scan camera, line scan camera, and others. On the basis of interface type, it is categorized as USB 3.0, GigE and 5GigE, CoaXpress, CameraLink, and others. As per the application, the market is divided into industrial inspection & automation, and logistics and robotics. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

By Type,

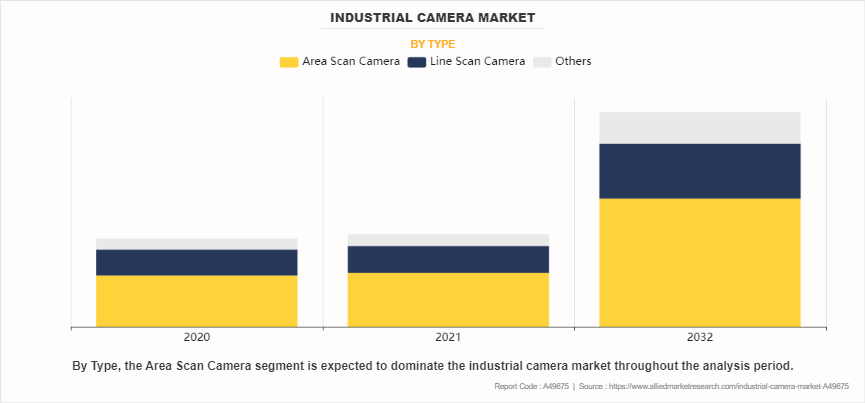

The industrial camera market is divided into area scan camera, line scan camera, and others. In 2020, the area scan industrial cameras segment dominated the market, in terms of revenue. In addition, the others segment, which primarily consists of 3D cameras and infrared cameras is expected to grow with a higher CAGR during the forecast period. Area scan cameras are versatile and suitable for a wide range of applications, including quality inspection, part identification, barcode reading, object recognition, and surveillance. They are commonly used in industrial automation, automotive manufacturing, electronics inspection, pharmaceuticals, food and beverage processing, and many other industries where fast and accurate image capture is required.

By Interface Type,

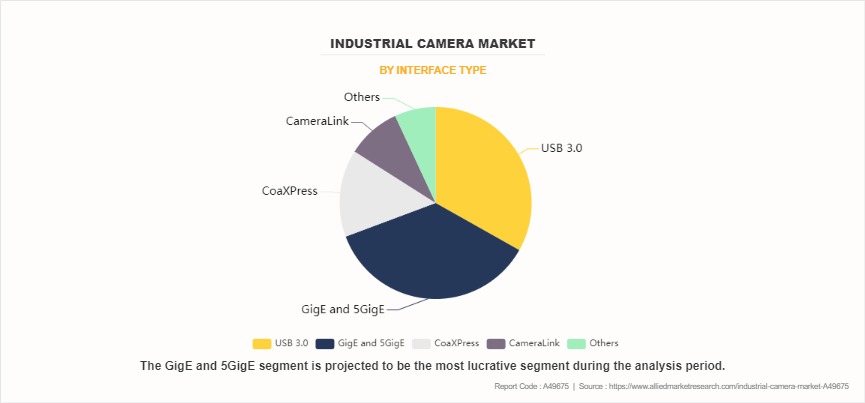

The market is bifurcated into USB 3.0, GigE and 5GigE, CoaXpress, CameraLink, and others. Among these, the GigE and 5GigE segment held a higher market share in terms of revenue in 2020. On the other hand, the CoaXPress segment is expected to grow with a higher CAGR during the forecast period. The benefits of the CoaXPress camera interface include high data transfer rates, long cable lengths, Power over CoaXPress (PoCXP) support, bidirectional communication, compatibility with machine vision systems, and high reliability in industrial environments.

By Application,

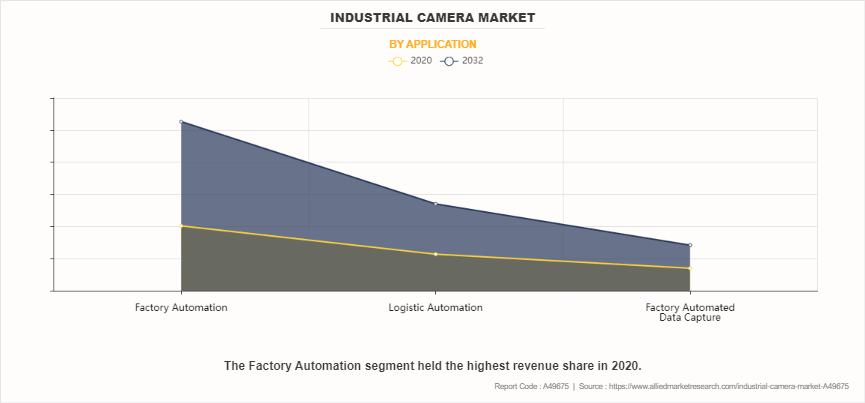

The industrial camera market is bifurcated into industrial inspection and automation, and logistics and robotics. In 2020, the industrial inspection and automation segment dominated the market, in terms of revenue, and the logistics and robotics segment is expected to grow with a higher CAGR during the forecast period. Growth of the industrial sector including semiconductor, pharmaceutical, food and beverages, and other industries are anticipated to accelerate growth of the market during the forecast period. For instance, in April 2023, Bosch, a German engineering firm, planned to acquire U.S. chipmaker TSI Semiconductors to expand its semiconductor business with silicon carbide chips (SiC). Such factors are anticipated to accelerate the industrial camera market growth during the forecast period.

By Region,

The industrial camera market is analyzed across North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. Asia-Pacific accounted for the highest market share in 2020 and the same region is expected to grow with the highest CAGR during the forecast period. Countries in Asia-Pacific such as India, China, Vietnam, and Indonesia have witnessed growth in industrialization, which, in turn, drives market growth. For example, the government of China released a plan ‐Made in China 2025. according to which, the government has set a goal to reach $305 billion by 2030, in terms of semiconductor industry output.

Competition Analysis

Competitive analysis and profiles of the major players in the industrial camera market, such Basler AG, Allied Vision Technologies GmbH, Teledyne DALSA, FLIR Systems, Inc., Cognex Corporation, chromasens GmbH, IDS Imaging Development Systems GmbH, JAI A/S, Omron Corporation, and Baumer Group, are provided in the report. Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the Industrial camera market.

Recent Development in the Industrial Camera Market

- In Jan 2024, Chromasens recently introduced two new models to its allPIXA neo series of industrial line scan cameras. These cameras feature an additional near-infrared (NIR) channel, enabling machine vision systems to operate simultaneously in both RGB and NIR wavelengths.

- In April 2023, Advantech, a prominent provider of industrial edge AI solutions, unveiled its latest offering in the form of the ICAM-520 industrial AI camera. Powered by NVIDIA® Xavier NX, this camera integrates an industrial-grade SONY MX 296 image sensor, sophisticated LED lighting, and a variable focus lens. It boasts both image acquisition and AI computing capabilities, providing a comprehensive solution for industrial applications.

Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging industrial camera market trends and dynamics.

- In-depth market analysis is conducted by constructing market estimations for the key market segments between 2022 and 2032.

- Extensive analysis of the industrial camera market is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive industrial camera market analysis of all regions is provided to determine the prevailing opportunities.

- The industrial camera market forecast analysis from 2023 to 2032 is included in the report.

- The key market players within Industrial camera market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the industrial camera industry.

Industrial Camera Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 4.7 billion |

| Growth Rate | CAGR of 7.6% |

| Forecast period | 2020 - 2032 |

| Report Pages | 198 |

| By Type |

|

| By Interface Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Cognex Corporation, JAI A/S, FLIR Systems, Inc., Allied Vision Technologies GmbH, Omron Corporation., teledyne dalsa, IDS Imaging Development Systems GmbH, Baumer Group AG, BASLER AG, chromasens GmbH |

Analyst Review

The industrial camera market has undergone a remarkable evolution in recent years, spurred by technological advancements, expanding applications across diverse industries, and the growing emphasis on automation and quality control.

Industrial cameras, also known as machine vision cameras, have evolved significantly since their inception. Initially developed for niche applications such as quality inspection in manufacturing plants, industrial cameras have now become indispensable tools across various industries. Early industrial cameras were bulky, expensive, and limited in functionality. However, advancements in sensor technology, image processing algorithms, and connectivity options have transformed industrial cameras into highly sophisticated and versatile devices.

Industrial cameras are increasingly being integrated with AI and machine learning algorithms to enable advanced image analysis, defect detection, and predictive maintenance. This integration enhances the intelligence and autonomy of industrial vision systems, making them more adaptable to dynamic production environments. Companies such as Basler AG, Teledyne Technologies Inc., FLIR Systems Inc., and Allied Vision Technologies GmbH are among the leading manufacturers of industrial cameras globally. These companies offer a wide range of camera models with varying specifications and capabilities to cater to diverse industrial applications.Beyond camera manufacturers, technology providers such as Sony Corporation, ON Semiconductor Corporation, and Intel Corporation play a vital role in supplying key components and technologies used in industrial cameras, including image sensors, processors, and connectivity solutions.

Demand for industrial cameras is on the rise in semiconductor, aviation & aerospace, and medical diagnostic equipment industries. The adoption of automation in industrial processes is also driving the market growth.

The latest version of the Industrial camera market report can be obtained on demand from the website.

The Industrial camera market size was valued at $1.9 billion in 2020.

The Industrial camera market size is estimated to reach $4.6 billion by 2032, exhibiting a CAGR of 7.6% from 2023 to 2032.

The forecast period considered for the industrial camera market is 2023 to 2032, wherein, 2022 is the base year, 2023 is the estimated year, and 2032 is the forecast year. The market is also analyzed historically between 2020 and 2021.

Factory Automation segment is the largest market for Industrial camera market.

Key companies profiled in the Industrial camera market report include Basler AG, Allied Vision Technologies GmbH, Teledyne DALSA, FLIR Systems, Inc., Cognex Corporation, chromasens GmbH, IDS Imaging Development Systems GmbH, JAI A/S, Omron Corporation, and Baumer Group.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Loading Table Of Content...

Loading Research Methodology...