Industrial Controls Market Outlook, 2034

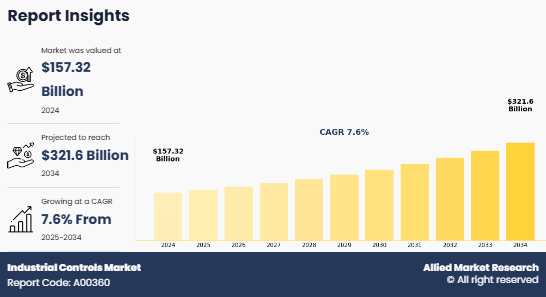

The global industrial controls market size was valued at $157.3 billion in 2024, and is projected to reach $321.6 billion by 2034, growing at a CAGR of 7.6% from 2025 to 2034. Industrial Control Systems (ICS) refer to a combination of hardware and software used to monitor, control, and automate industrial processes across various sectors, including manufacturing, power generation, oil and gas, and mining. These systems ensure operational efficiency, safety, and reliability by integrating Supervisory Control and Data Acquisition (SCADA), Distributed Control Systems (DCS), and Programmable Logic Controllers (PLC). Moreover, ICS enables real-time data collection, process optimization, and predictive maintenance, reducing downtime and enhancing productivity. Furthermore, with advancements in cybersecurity and IoT integration, modern ICS solutions offer improved remote monitoring and automation capabilities. As industries move toward smart manufacturing, ICS plays a crucial role in enabling seamless digital transformation, increasing efficiency, and ensuring regulatory compliance.

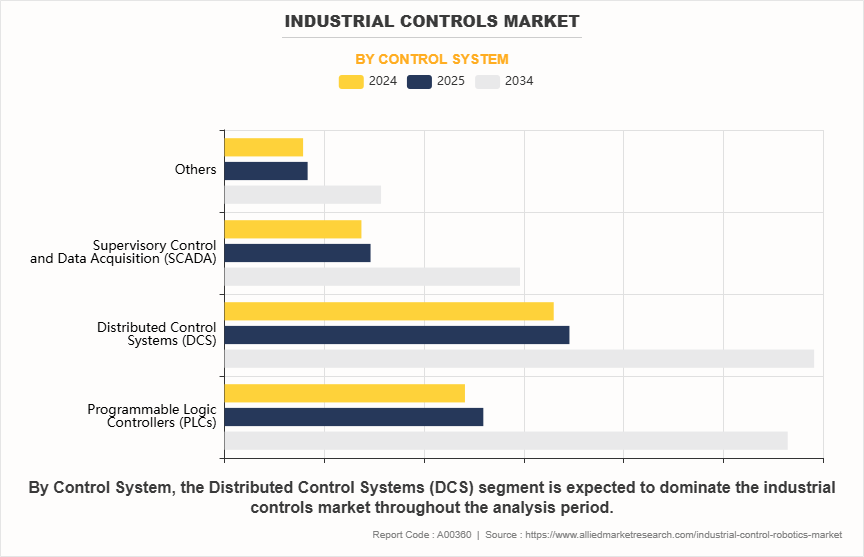

The increasing adoption of automation across industries is a key driver for the growth of the Industrial Control Systems (ICS) market. With industries striving for higher efficiency, reduced operational costs, and improved productivity, the need for real-time monitoring and automated control systems has become crucial. Supervisory Control and Data Acquisition (SCADA), Programmable Logic Controllers (PLC), and Distributed Control Systems (DCS) play a vital role in managing complex industrial operations by ensuring seamless process control, data acquisition, and system integration.

One of the biggest factors driving ICS adoption is Industry 4.0, which emphasizes smart factories and interconnected systems. The use of Industrial Internet of Things (IIoT)-enabled control systems has enabled companies to improve data-driven decision-making, predictive maintenance, and asset management. Predictive maintenance, in particular, allows industries to detect failures before they occur, reducing downtime and maintenance costs. Additionally, regulatory compliance and safety requirements in industries such as oil & gas, power generation, and pharmaceuticals are further pushing the demand for advanced ICS solutions. The focus on energy efficiency and sustainability is another factor driving adoption, as companies seek solutions that can optimize energy consumption and reduce environmental impact.

However, despite its rapid adoption, Industrial Control Systems face significant challenges, primarily due to cybersecurity risks. As industries shift towards IoT and cloud-based control systems, they become increasingly vulnerable to cyber threats such as ransomware, malware, and unauthorized access. Many legacy ICS infrastructures were not originally designed with modern cybersecurity measures, making them easy targets for hackers. A cyber breach in an industrial control system can lead to disruptions in operations, financial losses, and severe safety hazards. Additionally, the lack of standardized security protocols across industries creates difficulties in implementing robust cybersecurity measures, posing a major restraint to ICS adoption.

Furthermore, the integration of Artificial Intelligence (AI) and Machine Learning (ML) presents significant growth opportunities for the ICS market. AI-powered control systems can enhance predictive maintenance, optimize resource allocation, and improve fault detection, reducing downtime and increasing efficiency. ML algorithms can analyze large volumes of real-time data to enhance process optimization, automation, and decision-making. Furthermore, AI-driven cybersecurity solutions are being developed to detect anomalies in real-time, protecting ICS infrastructure from cyber threats. As industries continue their digital transformation journey, the adoption of AI, ML, and intelligent automation in industrial control systems will unlock new possibilities for operational efficiency, process optimization, and cybersecurity resilience, ensuring sustained market growth in the coming years.

Segmental Overview

The Industrial Controls Market is segmented on the basis of control system, component, end user, and region.

Based on the control system, the market is categorized into Programmable Logic Controllers PLCs, Distributed Control Systems (DCS), Supervisory Control and Data Acquisition (SCADA), and Others.

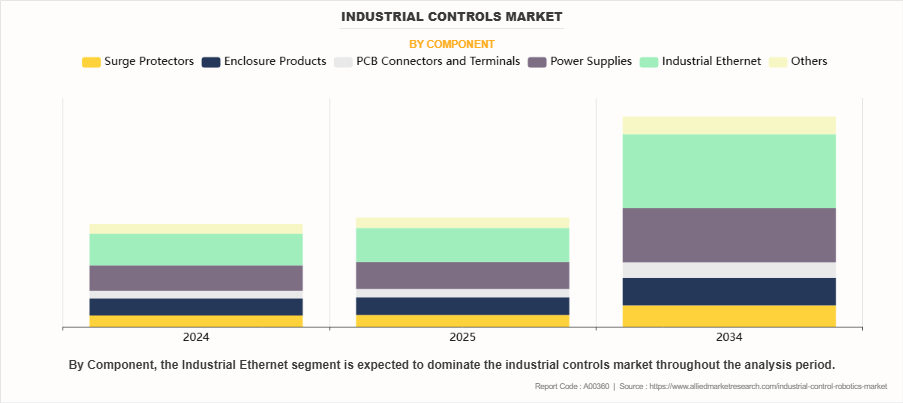

Based on component, the market is categorized into surge protectors, enclosure products, PCB connectors and terminals, power supplies, industrial Ethernet, and others.

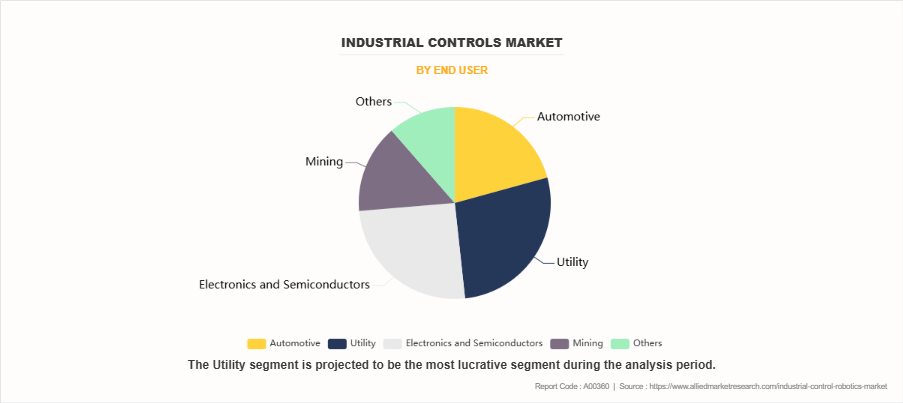

By end user, the industrial controls market is classified into automotive, utility, electronics & semiconductors, mining, and others.

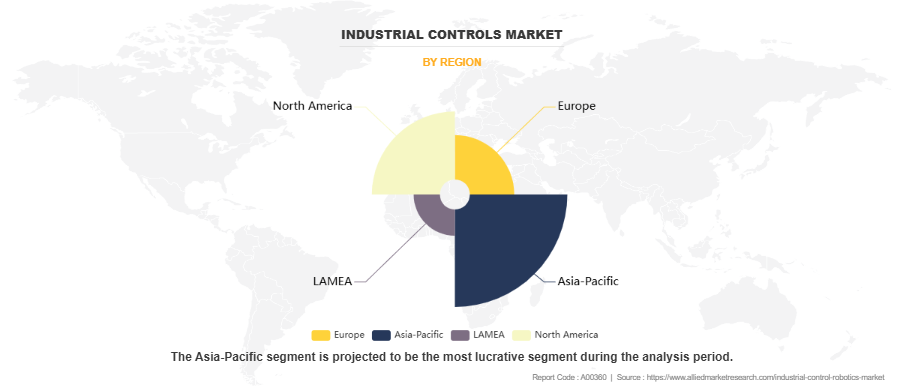

Region-wise, the Industrial Controls Market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competition Analysis

The major players that operate in the Industrial Controls Market have adopted key strategies such as product launch, business expansion, and others to strengthen their market outreach and sustain stiff competition in the market. The key players profiled in this report are Siemens AG, ABB Ltd, Mitsubishi Electric Corporation, Schneider Electric, Honeywell International Inc., Rockwell Automation, Inc., Emerson Electric Co, Omron Corporation, KEYENCE CORPORATION, and Yokogawa Electric Corporation.

Key Developments/ Strategies

Siemens AG, ABB Ltd, Mitsubishi Electric Corporation, Schneider Electric, Honeywell International Inc., Rockwell Automation, Inc., Emerson Electric Co, Omron Corporation, KEYENCE CORPORATION, and Yokogawa Electric Corporation are the top companies holding a prime share in the Industrial Controls Market. Top market players have adopted various strategies, such as product launch, partnership, acquisition, Collaboration, innovation, and product development, to expand their foothold in the Industrial Controls Market.

- In September 2024, Rockwell Automation, Inc. launched Logix SIS, a state-of-the-art Safety Instrumented System (SIS) designed to meet the evolving safety requirements of modern industrial environments. This integrated solution offers SIL 2 and SIL 3 certifications, ensuring comprehensive safety across various applications. Logix SIS combines the latest 1756 controllers, FLEX 5000 I/O platform, and Studio 5000 Logix Designer application, providing a high-availability system that streamlines implementation and reduces engineering time.

- In April 2024, Honeywell announced a definitive agreement to acquire Compressor Controls Corporation (CCC) from INDICOR, LLC, for $670 million in an all-cash transaction. This acquisition, valued at approximately 15 times CCC's projected 2023 EBITDA on a tax-adjusted basis, is expected to be immediately accretive to Honeywell's GAAP earnings per share.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the industrial controls market from 2024 to 2034 to identify the prevailing industrial controls market opportunity.

- The Industrial Controls Market Forecast is offered along with information related to Industrial Controls Industry key drivers, industrial controls industry restraints, and industrial controls market opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the industrial controls market segmentation helps determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global industrial controls market trends, key players, segments, factory automation application, Industrial Controls Market Share, and industrial controls market growth strategies.

Industrial Controls Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 321.6 billion |

| Growth Rate | CAGR of 7.6% |

| Forecast period | 2024 - 2034 |

| Report Pages | 426 |

| By Control System |

|

| By Component |

|

| By End User |

|

| By Region |

|

| Key Market Players | Emerson Electric Co. , KEYENCE CORPORATION, Schneider Electric, Mitsubishi Electric Corporation, ABB Ltd., Yokogawa Electric Corporation, Honeywell International Inc., Siemens, Rockwell Automation, Inc., Omron Corporation |

Analyst Review

Industrial controls are majorly used to control and monitor industrial automated processes. Rise in adoption of various IoT-enabled smart solutions increase the demand for industrial controls. Moreover, rise in demand for mass production in manufacturing industries also drive the growth of the industrial controls market. However, cyberattack is a major threat to ICS, as these systems are connected to the internet.

Some of the leading companies in the market innovated new technologies and systems to expand the portfolio of industrial control systems and witnessed significant market growth. For instance, Yokogawa developed an N-IO standard field enclosure and a control system virtualization platform, which enables the control of multiple virtual devices on a single server and stores IO devices used by the CENTUM VP integrated production control system and the ProSafe-RS safety instrumented system.

Industrial control systems are interconnected to monitor, control, and perform various industrial tasks & automate processes. North America is anticipated to dominate the industrial controls market during the forecast period, owing to the presence of key network security companies, as the cyberattack is the major threat to industrial control systems.

Key players in the global industrial controls market include ABB Ltd., Mitsubishi Electric Factory Automation, Siemens, Honeywell International Incorporation, Emerson Electric Corporation, Schneider Electric SA, Omron Corporation, Rockwell Automation, Inc., Kawasaki, and Yokogawa Electric Corporation. Market players adopt product launch and expansion as their key developmental strategies to keep pace with the demands of end users. Acquisitions and collaborations are the other strategies adopted by market players to expand their control systems offerings and boost their production processes. This has helped companies to develop efficient products as well as expand their sales across different regions.

Integration of AI and Machine Learning in ICS, and Growth of Cybersecurity Solutions for ICS Protection are the upcoming trends of Industrial Controls Market in the globe

Electronics and Semiconductors is the leading application of Industrial Controls Market

Asia-Pacific is the largest regional market for Industrial Controls

In 2024, $157.3 was the estimated industry size of Industrial Controls

Siemens AG, ABB Ltd, Mitsubishi Electric Corporation, Schneider Electric, Honeywell International Inc., Rockwell Automation, Inc, Emerson Electric Co, Omron Corporation, KEYENCE CORPORATION, and Yokogawa Electric corporation are the top companies to hold the market share in Industrial Controls

Loading Table Of Content...

Loading Research Methodology...