Industrial Cooling Systems Market Research: 2032

The Global Industrial Cooling Systems Market was valued at $16.6 billion in 2022, and is projected to reach $31.3 billion by 2032, growing at a CAGR of 5.2% from 2023 to 2032.

Industrial cooling systems are composed of a complex structure of equipment, techniques, and procedures. This technology is required by a wide range of industries, including manufacturing, power generating, chemical processing, data centers, and many others that generate a lot of weight while conducting their activities. The primary objectives of an industrial cooling systems are damage prevention, optimum working conditions maintenance, machinery efficacy assurance, and lengthening the machinery through remote access by tools or techniques.

Market Dynamics

There is an increasing demand for drugs and vaccines on a global scale owing to rise in population and pollution levels. Additionally, the quickly rising intake of junk food and the evolving workplace culture have both significantly raised the prevalence of lifestyle diseases among the general population. Activated pharmaceutical ingredients (API) are a common component of many medications, and they are easily impacted by environmental conditions such as temperature, humidity, and light. The availability of specialized cooling systems for pharmaceutical storage applications is also increasing from major firms. Thus, the necessity of storing pharmaceutical products such as medicines and vaccines in a cool place to maintain its effectiveness and chemical stability has increased the demand for industrial cooling systems market solutions.

In addition, growth in various sectors such as manufacturing, construction, power generation, petrochemical and data center, drives the demand for industrial cooling systems. Additionally, growth in industrial activities expands the need for cooling systems to work properly without equipment failure.

However, some industrial sectors are not aware of the most recent technological developments and the advantages of modern industrial cooling systems market. They are also not aware of the advantages such as potential energy savings, increased efficiency, and other benefits of modern cooling technology. These factors are restraining market expansion.

Furthermore, the increased emphasis on sustainability and environmental responsibility provides opportunities for industrial cooling systems market growth that provide energy efficiency, use eco-friendly refrigerants, and minimize environmental impact. Manufacturers who can provide sustainability cooling solutions have a competitive advantage in the market. Additionally, the market for industrial cooling systems market has a lot of possibilities due to the Internet of Things and smart technology integration. IoT-enabled sensor and data analytics can increase predictive maintenance, optimize system performance, enable remote monitoring, and control, and boost overall effectiveness. Businesses who use this technology may be able to provide sophisticated intelligent cooling solutions.

Furthermore, several commodities, including food items, oil, and gas, saw a surge in price due to the Russia-Ukraine conflict. Due to supply chain interruptions, there are now more expensive shipping costs, fewer available containers, and less warehouse space. Since there have been delays in shipments and congestion, certain ports have been closed, and orders are being retracted, which influences industry and consumers globally. The decline in investor confidence has also increased stock market volatility. Economic instability has risen due to the strained commercial ties between Russia, Ukraine, and their different trading partners. Hence, all such factors have reduced export possibilities.

Segmental Overview

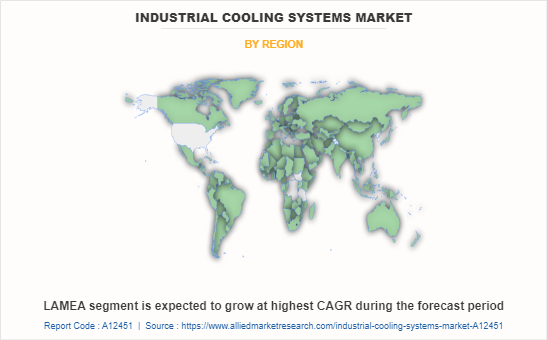

The global industrial cooling systems market is segmented into product type, function, end-user industry, and region. By product type, the market is fragmented into air cooling, evaporative cooling, water cooling, and hybrid cooling. By function, it is bifurcated into stationary cooling, and transportation cooling. Depending on end-user industry, it is fragmented into food & beverages, chemical, pharmaceuticals, utility & power, oil & gas, and others. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, South Korea, India, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

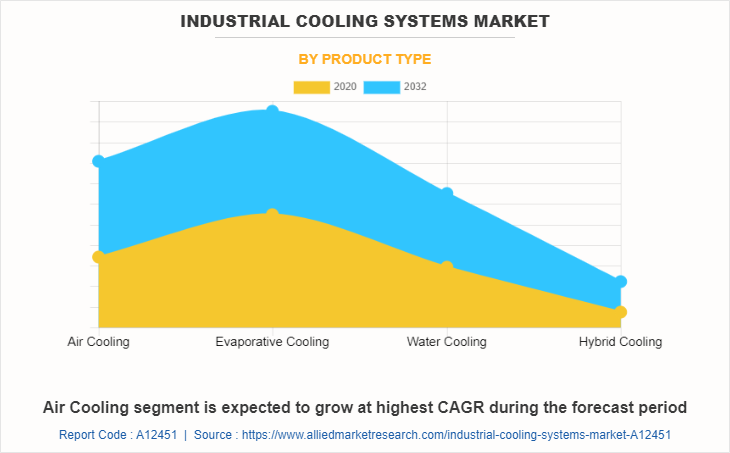

By Product Type:

The industrial cooling systems market analysis is divided into air cooling, evaporative cooling, water cooling, and hybrid cooling. Industrial air coolers are widely used in factories, workshops, data centers, and warehouses to maintain the necessary temperature. To supply cool air and lower the temperature in various facilities, air coolers primarily employ cooling pads and fans. In addition, water evaporation is used in evaporative cooling systems to lower air temperature. These devices work under the premise that water requires a lot of heat to vaporize.

Evaporative coolers give cooler air to interior spaces of buildings by using hot air from exterior building areas to evaporate water. Furthermore, a condenser and cooling tower are the main components of a typical industrial water-cooling system. Recirculating condenser water is used to condense a refrigerant in water-based industrial cooling systems market. Moreover, A hybrid cooling system is any mix of several cooling systems, including cooling towers, air-cooled condensers, surface condensers, and air-cooled heat exchangers. Using less water and energy, hybrid cooling systems combine dry and evaporative cooling technologies.

Evaporative cooling is expected to be the largest revenue contributor during the forecast period. Air cooling is expected to exhibit the highest CAGR share in the product type segment in the industrial cooling systems market during the forecast period.

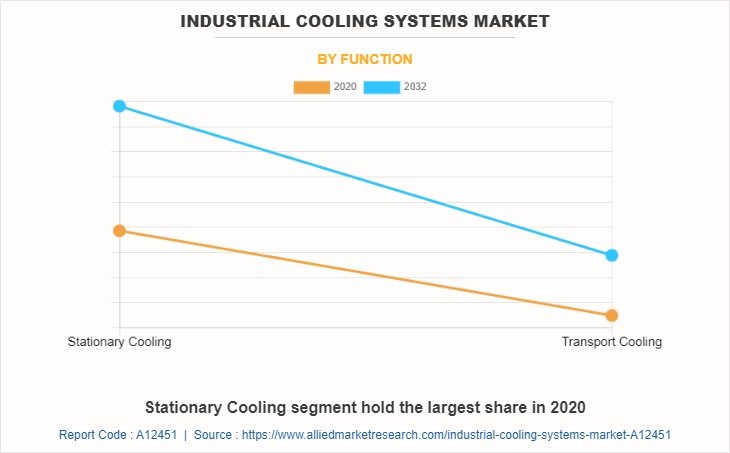

By Function:

The industrial cooling systems market is divided into stationary cooling, and transportation cooling. An industrial facility's specific space or process can be cooled by installing a stationary cooling system at a fixed location. Numerous industries, including food and beverage, power production, oil and gas, and pharmaceuticals, make substantial use of stationary cooling systems. In addition, it is essential to transport perishable goods with a transport cooling system, commonly referred to as a transport refrigeration unit.

On pickup trucks, semi-trucks, vans, shipping containers, and rail carts, transport cooling systems are mounted. These systems installed in motor vehicles are made up of insulation material, a compressor, a condenser, and an evaporator. The transporting cooling segment is expected to be the largest revenue contributor during the forecast period, and the stationary cooling segment is expected to exhibit the highest CAGR share in the function segment in the industrial cooling systems market during the forecast period.

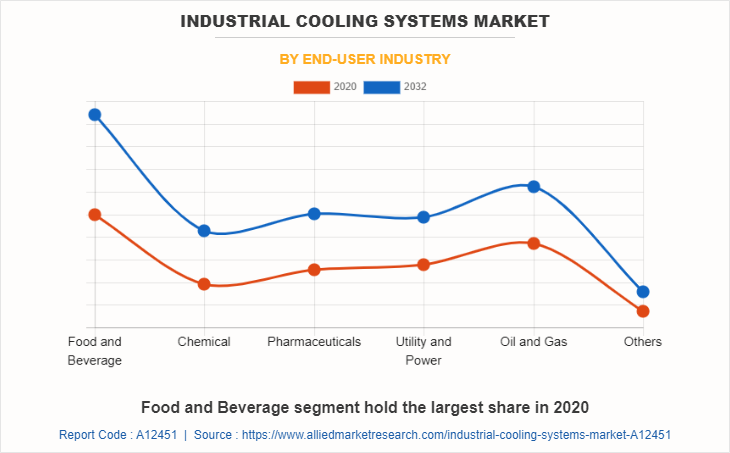

By End-User Industry:

The industrial cooling systems market is divided into food & beverages, chemical, pharmaceuticals, utility & power, oil & gas, and others. The producing, storing, packaging, and distribution of diverse food and beverage items are all part of the food and beverage sector. The industry is heavily regulated, and it must implement cutting-edge procedures to preserve product quality and stop product deterioration. In addition, a vast variety of raw materials are used by the chemical industry to create a variety of solid, liquid, and gaseous products. The chemical industry frequently uses raw resources such as phosphates, sulfur, limestone, and fossil fuels. It also uses air, water, and air.

Furthermore, the pharmaceutical industry is engaged in the research, development, production, and distribution of medications with the goal of treating ailments. Since it directly impacts the health and wellbeing of the entire world's population, the pharmaceutical business is subject to strict regulation. Moreover, most businesses in the utility industry provide services for electricity, water, gas, and telephones. The production, transmission, and distribution of electric power to businesses and the public are all activities of the electric power sector. Besides, the oil & gas industry operates through three segments, including upstream, downstream, and mid-stream.

The upstream segment is involved in exploration, midstream segment focuses on transportation of extracted raw material to refineries, and downstream segment is involved in converting raw oil & gas to products such as gasoline, jet fuel, and asphalt, and the other segments. Industrial cooling systems are used in data centers and steel mills. Datacenters are facilities that integrate an organization's IT operations and equipment for storing, processing, and data dissemination purposes. Chemical segments are expected to be the largest revenue contributor during the forecast period, and the food & beverage segment is expected to exhibit the highest CAGR share in the end user industry segment in the industrial cooling systems market opportunity during the forecast period.

By Region:

The industrial cooling systems market size is analysed across North America, Europe, Asia-Pacific, and LAMEA. In 2022, Asia-Pacific held the highest revenue in industrial cooling systems market share. and LAMEA is expected to exhibit the highest CAGR during the forecast period.

Competition Analysis

The major players profiled in the industrial cooling systems market include Airedale International Air Conditioning Ltd., Baltimore Aircoil Company Inc., Brentwood Industries, Inc., Emerson Electric Co., GEA Group Aktiengesellschaft, Hamon Group S.A., Johnson Controls International plc, Schneider Electric SE., SPX Corporation., and Star Cooling Tower Pvt Ltd.

Major companies in the market have adopted acquisition, product launch, business expansion, and others as their key developmental strategies to offer better products and services to customers in the industrial cooling systems market.

Some examples of expansion and acquisition on the market.

In June 2023- Johnson Controls increased the scope of its sustainable solutions by purchasing this business, addressing the rising need for refrigerant technologies with exceptionally low global warming potential and aiding customers in achieving net zero emissions.

In June 2023, Johnson Controls has acquired Gordon Brothers Industries (GBI), the biggest supplier of industrial refrigeration solutions in Australia. This acquisition now provides refrigeration system design, construction, services, and parts.

Key Benefits for Stakeholders

The report provides an extensive analysis of the current and emerging industrial cooling systems market trends and dynamics.

In-depth industrial cooling systems market is conducted by constructing market estimations for key market segments between 2020 and 2032.

Extensive analysis of the industrial cooling systems market is conducted by following key product positioning and monitoring of top competitors within the market framework.

A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

The industrial cooling systems market forecast analysis from 2023 to 2032 is included in the report.

The key players within the industrial cooling systems market are profiled in this report and their strategies are analyzed thoroughly, which helps understand the competitive outlook of the industrial cooling systems industry.

Industrial Cooling Systems Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 31.3 billion |

| Growth Rate | CAGR of 5.2% |

| Forecast period | 2020 - 2032 |

| Report Pages | 220 |

| By End-user Industry |

|

| By Product Type |

|

| By Function |

|

| By Region |

|

| Key Market Players | SPX Corporation., Airedale International Air Conditioning Ltd., Schneider Electric SE., Johnson Controls International plc, Star Cooling Tower Pvt Ltd., GEA Group Aktiengesellschaft, Brentwood Industries, Inc., Baltimore Aircoil Company Inc., Hamon Group S.A., Emerson Electric Co. |

Analyst Review

Increase in industrialization and the growth of sectors such as manufacturing, power generation and data center drive the demand for efficiency in the level industrial cooling system. In addition, growth in emphasis on energy efficient environmental stability and regulatory compliances fuel adoption of advanced film technology in industries. However, the initial high initial investment cost and operational expenses associated with industrial cooling system poses a challenge for a smaller industry or those with limited budgets. Additionally, complexities in system design integration and maintenance required label professional required skilled labor professional limited the ability of expertise and hindered the widespread of adoption. Furthermore, the expanding demand for cooling solutions in developing nations, such as in the manufacturing of electric vehicles and renewable energy sources, has created a new market region with considerable development potential.

The global industrial cooling systems market was valued at $16,625.2 million in 2020, and is projected to reach $31,333.5 million by 2032, registering a CAGR of 5.2% from 2023 to 2032

The forecast period considered for the global industrial cooling systems market is 2020 to 2032, wherein, 2022 is the base year, 2022, and 2032 is the forecast year.

The latest version of global industrial cooling systems market report can be obtained on demand from the website.

The base year considered in the global industrial cooling systems market report is 2022.

The major players profiled in the industrial cooling systems market include Airedale International Air Conditioning Ltd., Baltimore Aircoil Company Inc., Brentwood Industries, Inc., Emerson Electric Co., GEA Group Aktiengesellschaft, Hamon Group S.A., Johnson Controls International plc, Schneider Electric SE., SPX Corporation., and Star Cooling Tower Pvt Ltd.

The top ten market players are selected based on two key attributes - competitive strength and market positioning

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Based product type the evaporative cooling segment was the largest revenue generator in 2020.

Loading Table Of Content...

Loading Research Methodology...