Industrial Dehumidifier Market Research - 2031

The global industrial dehumidifier market size was valued at $839.3 million in 2021, and is projected to reach $1411.7 billion by 2031, growing at a CAGR of 5.2% from 2022 to 2031.

Industrial dehumidifier is a crucial component of various process and manufacturing industries. It is used for reducing and controlling humidity across industries such as warehouses, corporate offices, garages, and factories. This is achieved by blowing ambient air via a fan around the condenser coils containing a refrigerant. The moisture in the ambient air gets condensed over the condenser coil and it is then collected in a tank. Industrial dehumidifier comprises four basic parts, which are fan compressor, reheater, compressor cooling coils, and reservoir unit.

Market Dynamics

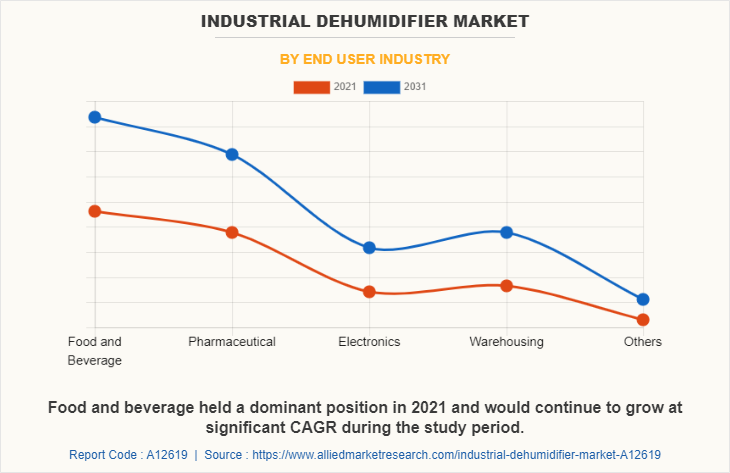

A large number of processes and manufacturing industries are susceptible to high level of moisture in the air. Since high humidity can corrode machineries, it can lead to bacterial growth in the premises, which eventually can lead to spread of diseases. Moreover, the industries such as pharmaceutical and food & beverages utilize processes that produce immense humidity. In addition, these industries deal with products that are consumed by people, thus, any contamination in the products can result in drastic consequences, such as diseases or death. As a result, such industries extensively use industrial dehumidifiers as a precautionary measure to avoid any untoward incidents.

Furthermore, the electronics industry is witnessing rise, owing to growth in demand for electronics products, surge in penetration of e-commerce platforms, and increase in disposable income of people across the world. Electronics are highly susceptible to moisture content in the air, therefore, the electronics industry makes significant use of industrial dehumidifiers. Furthermore, rise in global trade and e-commerce industry is witnessing a rapid growth which in turn is fueling the growth in the number of warehouses. As a result, demand for industrial dehumidifiers has experienced a major boost as warehouses are one of their major end users. Thus, growth of e-commerce industry is a major industrial dehumidifier market opportunity.

Major players in the industry offer a wide range of industrial dehumidifiers for applications in various industries. Furthermore, they have launched new and advanced dehumidifiers to stay competitive in the market. Manufacturers such as Refcon Technologies & Systems Pvt. Ltd. and Risen Thermohygro Services Pte. Ltd. offer a wide range of industrial dehumidifiers for application in various industries.

The novel coronavirus spread rapidly across various countries and regions, causing an enormous impact on the lives of people and overall community. It began as a human health condition and later became a significant threat to global trade, economy, and finance. The COVID-19 pandemic halted production of many components of industrial dehumidifiers due to the lockdown. The economic slowdown initially resulted in reduced spending on various industrial dehumidifiers by different users.

However, owing to the introduction of various vaccines, the severity of COVID-19 pandemic significantly reduced. As of mid-2022, the number of COVID-19 cases has significantly reduced. This led to full-fledged reopening of industrial dehumidifier manufacturing companies at their full-scale capacities. Furthermore, it has been more than two years since the outbreak of this pandemic, and many companies have already shown notable signs of recovery.

Industries situated in coastal regions as well as cold areas drive the constant demand for industrial dehumidifiers. Moreover, rise in industrialization in southern Asia is expected to boost the demand for industrial dehumidifiers. Furthermore, various government initiatives meant to support the growth of small-scale industries especially in developing nations are anticipated to positively influence the industrial dehumidifier market growth.

Segmental Overview

The industrial dehumidifier market is segmented into Type, Installation and End User Industry.

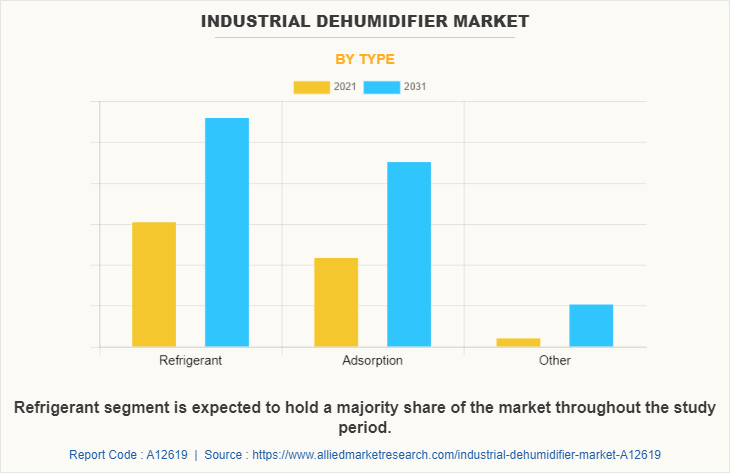

By type, the market is categorized into refrigerant, adsorption, and others.

On the basis of installation type, it is bifurcated into floor and ceiling.

Depending on end-user industry, it is divided into foods & beverages, pharmaceuticals, electronics, warehousing, and others.

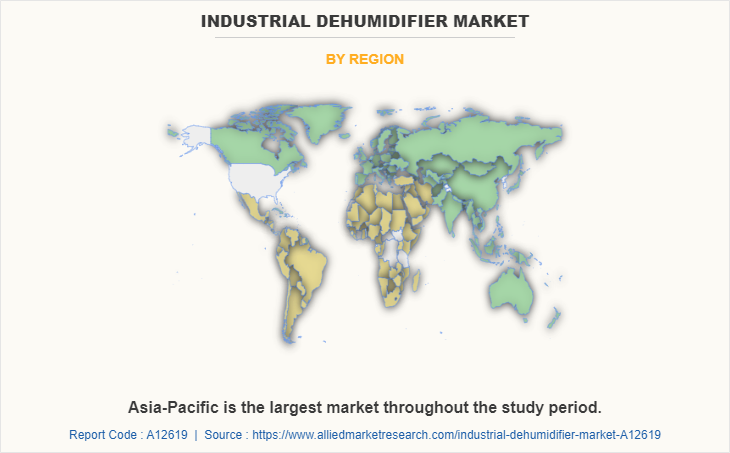

Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific held the largest industrial dehumidifier market share in 2021, and is anticipated to maintain this trend throughout the forecast period. This is attributed to the growth of the pharmaceutical industry.

Competition Anslysis

The key companies profiled in the industrial dehumidifier market forecast report include Bry-Air, Carrier Global Corporation, Condair Group, Dantherm Group, Hangzhou Conloon Electric Co., Johnson Controls International Plc, Munters Group AB, Refcon Technologies and Systems Pvt. Ltd., Trane Technologies Plc, and Zhejiang Oulun Electric Co., Ltd.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the industrial dehumidifier market analysis from 2021 to 2031 to identify the prevailing industrial dehumidifier market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the industrial dehumidifier market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global industrial dehumidifier market trends, key players, market segments, application areas, and market growth strategies.

Industrial Dehumidifier Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Installation |

|

| By End User Industry |

|

| By Region |

|

| Key Market Players | Carrier Global Corporation, Trane Technologies Company, LLC., Blue Star Limited, Airedale International Air Conditioning Ltd., ORION MACHINERY CO., LTD., Mitsubishi Electric Corporation, Daikin industries, ltd., Hiver Aircon Pvt. Ltd. |

Analyst Review

The global industrial dehumidifier market has witnessed significant growth in the past few years owing to surge in the number of manufacturing and process facilities.

Rise in the pharmaceutical industry, especially in the countries, such as Brazil, India, China, and Italy, has fueled the demand for industrial dehumidifiers. In addition, growth in food & beverages sector in countries, such as South Korea, Germany, and the U.S., has increased the demand for industrial dehumidifiers. Moreover, rise in global trade has boosted the number of warehouses. Warehouses being major users of industrial dehumidifiers, rise in their numbers is anticipated to drive the growth of industrial dehumidifiers. Furthermore, desiccant industrial dehumidifiers are extensively used in small and medium scale industries; thus, rise in number of small and medium scale industries is boosting the demand for desiccant dehumidifiers.

Integration of latest technologies that have enabled refrigerants to be more energy-efficient is expected to boost the demand for industrial dehumidifiers. Furthermore, rapid growth in the manufacturing sector in the emerging economies, such as Bangladesh, Vietnam, and Indonesia, is anticipated to provide lucrative opportunities for the industrial dehumidifier market expansion.

Development of energy efficient industrial dehumidifiers is one of the major trends in the market.

Industrial Dehumidifiers are used for maintaining required humidity in various industries such as food and beverage, pharmaceutical, electronics and warehousing.

Asia-Pacific is the largest regional market for Industrial Dehumidifier.

$839.3 Million is the estimated industry size of Industrial Dehumidifier.

Bry-Air, Carrier Global Corporation, Condair Group, Dantherm Group, Hangzhou Conloon Electric Co. Ltd. and Johnson Controls International Plc are some of the top companies to hold the market share in Industrial Dehumidifier.

The product launch is key growth strategy of Industrial Dehumidifier industry players.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

$1,411.7 Million is expected to be the estimated industry size of Industrial Dehumidifier in 2031.

Loading Table Of Content...