Industrial Gloves Market Research, 2032

The global industrial gloves market size was valued at $8.7 billion in 2022, and industrial gloves industry is projected to reach $20.2 billion by 2032, growing at a CAGR of 8.9% from 2023 to 2032.

Introduction

Industrial gloves are specialized protective handwear designed to safeguard workers’ hands from hazards encountered in diverse industrial environments. Governments and regulatory bodies worldwide are imposing stringent safety standards in industries like manufacturing, construction, chemicals, and healthcare, boosting demand for industrial gloves. In 2023, the Occupational Safety and Health Administration (OSHA) introduced a comprehensive plan emphasizing the necessity for appropriate Personal Protective Equipment (PPE), including gloves, across various industries. This initiative mandates employers to provide suitable PPE and maintain accurate records of workplace injuries to mitigate risks.

Report Key Highlighters:

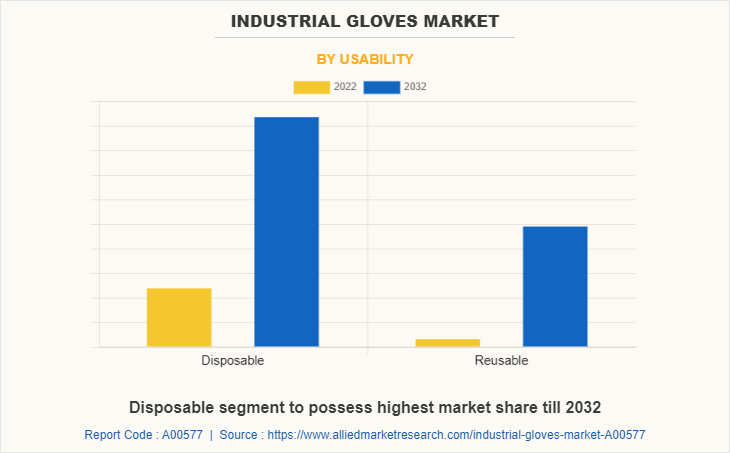

- The global industrial gloves market covers sub-segments of both disposable and reusable gloves in detailed manner.

- The market has been analyzed in terms of value ($Million) and volume (Million Pairs). The anlysis in the report is provided on the basis of usability and four major regions covering more than 15 countries.

- The global industrial gloves market report includes detailed study covering underlying factors influencing the industry opportunities and trends.

- The report also provides detailed key participants analysis across the supply chain.

- The report also provides competitive landscape providing company profiles of major revenue contributers in the global industrial gloves market.

Market Dynamics

Growing awareness about worker safety is expected to drive the growth of the industrial gloves market. Organizations are realizing that prioritizing employee health and safety is a regulatory necessity and essential for maintaining productivity and reducing costs associated with workplace injuries. This shift in perspective has led companies to invest significantly in comprehensive safety programs aimed at protecting their workforce. The International Labor Organization (ILO) launched a comprehensive strategy to enhance workplace safety globally, focusing on improving labor inspection systems and promoting a culture of safety across various sectors. In 2024, the ILO reported that over 70% of the global workforce faces climate change-related risks, leading to numerous deaths annually. This has prompted calls for revised regulations to protect workers from climate-induced hazards. By adopting superior protective gloves, companies can ensure that employees are better equipped to handle dangerous tasks safely, thereby reducing the risk of accidents and work-related illnesses. This growing emphasis on safety culture is driving the demand for innovative, durable, and comfortable gloves that meet the specific needs of different industries.

However, discomfort and reduced dexterity is expected to restrain the growth of the industrial gloves market. Discomfort and reduced manual dexterity are significant challenges associated with the use of industrial gloves, often leading to resistance from workers to wear them consistently. Gloves, especially those that are thicker or bulkier, can substantially impair hand dexterity, making it harder to perform fine motor tasks that require coordination. For example, studies have shown that wearing metacarpal gloves commonly used in heavy-duty industries can double the time required to complete dexterity tasks compared to bare hands and significantly reduce the ability to perform motor tasks requiring precision. This reduction in dexterity is often related to glove thickness and material flexibility, with thicker and less flexible gloves causing greater impairment.

Moreover, innovation in eco-friendly gloves is expected to provide lucrative opportunities in the industrial gloves market. Innovation in eco-friendly gloves is rapidly transforming the personal protective equipment (PPE) industry, addressing urgent environmental concerns while appealing to the growing segment of eco-conscious buyers. Biodegradable gloves leverage advanced materials such as plant-based polymers, natural rubber latex, and specialized biodegradable plastics like PLA (Polylactic Acid) and PBAT (Polybutylene Adipate Terephthalate). These materials are sourced from renewable resources and engineered to decompose within months to a few years under the right landfill or composting conditions, up to 90% faster than conventional gloves. For example, some tri-polymer disposable gloves have demonstrated over 84% biodegradation within just 92 days in industrial composting environments. This accelerated breakdown not only reduces long-term waste but also helps mitigate the global waste crisis as landfill capacities are stretched.

The global industrial gloves market forecast is segmented into usability and region. On the basis of usability, the market is categorized into disposable and reusable. On the basis of material type for disposable, the market is categorized into natural rubber, nitrile, vinyl, neoprene, polyethylene, and others. On the basis of end-use for disposable, the market is classified into aerospace, disk drives, flat panels, food, hospitals, medical devices, pharmaceuticals, semiconductors, and others. On the basis of gloves type for reusable, the market is categorized into dipped gloves, knitted gloves, supported knitted gloves, and others. On the basis of protection for reusable, the market is categorized into general purpose/mechanical protection, chemical/liquid protection, and product protection. On the basis of end-use for reusable, the market is divided into machinery, oil & gas, metal fabrication, automotive, chemical, construction, plane manufacturing, food processing, office building cleaners, healthcare, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

"A Look at the Industrial Industrial glovess Market in Developing Countries"

The industrial industrial glovess market is an essential sector, especially for workers in developing countries. As the manufacturing industry continues to witness growth, the need for industrial glovess is increasing. However, in many developing countries, the use of industrial glovess is often overlooked or not given much priority.

The demand for industrial glovess in developing countries has been driven by a growing awareness of the need for occupational health and safety. This awareness has been fueled by international organizations, such as the International Labor Organization, World Health Organization and others, which have been advocating for better working conditions for workers in developing countries. In addition, many companies that operate in developing countries are now required to comply with international safety standards, which has further increased the demand for industrial gloves.

One significant challenge facing the industrial industrial gloves market in developing countries is the availability of affordable, high-quality gloves. Local manufacturers in these countries have been producing a significant number of gloves, but a concern is that the quality of these gloves is subpar and may not meet global safety standards. One contributing factor to this issue is the insufficient investment in research and development by these manufacturers. The result is that many workers are using gloves that offer limited protection or may even be harmful to their health.

Another challenge is the lack of awareness and education about the importance of industrial gloves. In many developing countries, workers may not be aware of the risks they face or the need for industrial gloves. In addition, employers may not prioritize the use of industrial gloves due to a lack of knowledge or budget constraints.

Despite these challenges, the industrial industrial gloves market in developing countries is showing significant potential for growth. Local manufacturers are beginning to invest in research and development, and international companies are partnering with local businesses to improve the quality of gloves produced. In addition, there is a growing trend towards sustainable and environment-friendly gloves, which presents an opportunity for manufacturers to differentiate themselves in the market.

"How Changes in Healthcare Regulations are Affecting the Industrial gloves Market"

Healthcare regulations are having a significant impact on the industrial gloves market. Governments around the world are increasing regulations and guidelines for personal protective equipment (PPE) used in healthcare settings to ensure the safety of healthcare workers and patients. These regulations are changing the way industrial gloves are made, tested, and used, which is affecting the industrial gloves market.

One of the main ways healthcare regulations are affecting the industrial gloves market is by increasing the standards for PPE. Governments are mandating that healthcare workers use gloves that meet certain performance standards to protect against chemical exposure, infectious diseases, and other hazards. These regulations are driving innovation in the market, as manufacturers develop new materials and technologies to meet these higher standards. For example, gloves are now being made with antimicrobial coatings to reduce the risk of contamination and using materials that provide better grip and sensitivity.

Another way healthcare regulations are affecting the industrial gloves market is by increasing the use of gloves in healthcare settings. Regulations are mandating that healthcare workers use gloves more frequently and for longer periods, which is driving the demand for gloves. Healthcare regulations are also mandating that healthcare workers change gloves more frequently, which is increasing the volume of gloves used in healthcare settings.

The increased regulations are also impacting the way industrial gloves are tested and certified for use in healthcare settings. Governments are requiring more stringent testing and certification processes for industrial gloves, which is increasing the time and cost required to bring new gloves to the market. Manufacturers need to ensure that their gloves meet these new standards to be able to sell their products in the healthcare market.

Finally, healthcare regulations are driving changes in the supply chain for industrial gloves. Governments are mandating that healthcare providers source their gloves from reputable suppliers and that they have adequate supplies to meet their needs. This is driving the demand for gloves from established suppliers and creating new opportunities for manufacturers to enter the market.

The global industrial gloves market forecast is segmented into usability and region. On the basis of usability, the market is categorized into disposable and reusable. On the basis of material type for disposable, the market is categorized into natural rubber, nitrile, vinyl, neoprene, polyethylene, and others. On the basis of end-use for disposable, the market is classified into aerospace, disk drives, flat panels, food, hospitals, medical devices, pharmaceuticals, semiconductors, and others. On the basis of gloves type for reusable, the market is categorized into dipped gloves, knitted gloves, supported knitted gloves, and others. On the basis of protection for reusable, the market is categorized into general purpose/mechanical protection, chemical/liquid protection, and product protection. On the basis of end-use for reusable, the market is divided into machinery, oil & gas, metal fabrication, automotive, chemical, construction, plane manufacturing, food processing, office building cleaners, healthcare, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Industrial Gloves Market, By Type

By usability, disposable gloves segment accounted for the largest revenue share in the global industrial gloves market in 2022. This growth in demand can be attributed to the presence of demand for disposable gloves in various end-use industries or sectors such as medical, pharmacy, and others. In industries such as chemical manufacturing and automotive maintenance, workers often handle hazardous substances. Disposable gloves, particularly those made from nitrile or neoprene, resist chemicals, oils, and solvents, reducing the risk of skin irritation or chemical burns. In sectors like waste management and biotechnology, disposable gloves act as a barrier against biological agents, including bacteria and viruses. Their single-use nature ensures that workers are not exposed to pathogens, maintaining a hygienic work environment. In February 2024, Ansell Ltd. announced the full acquisition of Careplus (M) Sdn Bhd (Careplus). This acquisition increased Ansell’s production capacity of surgical gloves to meet the growing global demand and strengthen its supply chain and ensure greater control over the quality of its products.

By end use for disposable gloves, it is divided into aerospace, disk drives, flat panels, food, hospitals, medical devices, pharmaceuticals, semiconductors, and others. The semiconductor segment accounted for the largest revenue share in the global industrial gloves market in 2022. This growth in demand can be attributed to the increase in demand for consumer electronics across the globe. The demand for semiconductors and electronics assembly has surged considerably. This factor is expected to increase the demand for nitrile gloves in the semiconductor industry in the near future.

By gloves type for reusable gloves, it is divided into dipped gloves, knitted gloves, supported knitted gloves, and others. The supported knitted gloves segment accounted for the largest revenue share in the global industrial gloves market in 2022. Rise in demand for cut-resistant gloves across a range of industries has been encouraging manufacturers to develop gloves with advanced materials that provide superior cut resistance. In addition, there is a strong emphasis on comfort, with manufacturers using advanced knitting techniques and materials to improve breathability and reduce hand fatigue. This is expected to provide ample opportunities for the development of the market.

By protection type for reusable gloves it is divided into general purpose/mechanical, chemical/liquid, and product protection. The general purpose/mechanical segment accounted for the largest revenue share in the global industrial gloves market in 2022. The demand for gloves with advanced ergonomic designs, reinforced stitching, double-layered materials, and embedded sensors that can monitor vital signs or detect exposure to harmful substances is expected to provide ample opportunities for the development of the market.

By end use for reusable gloves, it is divided into machinery, oil & gas, metal fabrication, automotive, chemical, construction, plane manufacturing, food processing, office building cleaners, healthcare, and others. The oil & gas segment accounted for the largest revenue share in the global industrial gloves market in 2022. In the oil & gas industry, crushing, pinching, cutting, and puncturing hazards make up most of the serious hand injuries to workers that have led to an increase in the demand for protection gloves across the oil & gas industry.

Industrial Gloves Market, By Region

Region-wise, North America accounted for the largest market share in the industrial gloves market. The usage of industrial gloves in North America, encompassing countries like the U.S., Canada, and Mexico, has seen steady growth driven by increase in industrialization, stringent workplace safety regulations, and rise in awareness of occupational health hazards. In the U.S., the demand for industrial gloves is particularly strong in sectors such as manufacturing, construction, healthcare, and chemical processing. In May 2024, the U.S. government increased tariffs on Chinese-made personal protective equipment (PPE), including industrial gloves, from 7.5% to 25%, effective in 2026. This move aimed to support domestic manufacturers by reducing competition from low-cost imports and encouraging investment in local production facilities.

Competitive Landscape

The major players analyzed in the industrial gloves report are Top Gloves Corporation Berhad, Hartalega Holdings, Kossan Rubber Industries Bhd, Riverstone Holdings Limited, Careplus Group Berhad, Supermax Corp., Ansell Healthcare, SHOWA, Inc., Honeywell International Inc., and Semperit AG Holding.

In April 2024, Ansell announced a $640 million deal to acquire Kimberly-Clark's personal protective equipment assets, including brands like Kimtech and KleenGuard and industrial gloves. This acquisition aims to enhance Ansell's reach in sectors like cleanroom manufacturing and the scientific market.

In November 2024, Honeywell agreed to sell its personal protective equipment division to Protective Industrial Products for $1.33 billion, marking its exit from the PPE market.

In September 2024, the Indian Rubber Gloves Manufacturers Association (IRGMA) supported the Central Drugs Standard Control Organization's (CDSCO) new guidelines for industrial gloves, advocating for the implementation of the QCO to prevent substandard imports.

Which is the topmost industry in the Industrial Gloves Market?

Industrial gloves play a crucial role in the manufacturing process of rubber gloves, serving both protective and functional purposes across the globe. The production of rubber gloves involves handling raw materials and chemicals that can be hazardous. Workers are exposed to substances like latex compounds, accelerators, and vulcanizing agents. Industrial gloves, such as nitrile or latex gloves, provide a barrier against skin contact with these chemicals, reducing the risk of irritation, allergic reactions, and long-term health issues. In July 2024, The Indian Rubber Gloves Manufacturers Association (IRGMA) urged the Ministry of Environment, Forests and Climate Change to ban the import of chlorinated gloves due to bio-waste violations. The Central Pollution Control Board and West Bengal Pollution Control Board supported this move, aligning with the Quality Control Order (QCO) under the Medical Devices Rules 2017. In August 2023, the Indian government issued directives to ensure that imported gloves comply with the Legal Metrology (Packaged Commodities) Rules, 2011, reducing the influx of substandard gloves and promoting domestic manufacturing.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the industrial gloves market analysis from 2022 to 2032 to identify the prevailing industrial gloves market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the industrial gloves market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global industrial gloves market trends, key players, market segments, application areas, and market growth strategies.

Industrial Gloves Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 20.2 billion |

| Growth Rate | CAGR of 8.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 691 |

| By Usability |

|

| By Region |

|

| Key Market Players | Riverstone Holdings Limited, Supermax Corporation Berhad, Hartalega Holdings BHD, Careplus Group Berhad, Globus Group, Top Glove Corporation BHD, Kossan Rubber Industries BHD, Semperit AG Holding, Ansell Limited, Honeywell International Inc. |

Analyst Review

According to the CXOs of leading companies in the market, the global industrial gloves market has witnessed a significant increase in demand in recent years. This can be attributed to the growing awareness about the importance of safety measures in the workplace and the rise in the number of workplace injuries. Industrial gloves have become a critical component in ensuring worker safety across various industries such as machinery, oil & gas, metal fabrication, automotive, chemical, construction, plane manufacturing, food processing, office building cleaners, and healthcare.

The CXOs highlight that the use of industrial gloves in the U.S. has seen a significant increase in recent years, particularly in the healthcare and food processing industries. The consumption of industrial gloves is highest in the U.S. due to the strict regulatory requirements in these industries. The U.S. Food and Drug Administration (FDA) mandates the use of industrial gloves in the food processing industry to prevent contamination and ensure hygiene standards are met. Similarly, the Occupational Safety and Health Administration (OSHA) requires employers to provide industrial gloves to workers who are exposed to workplace hazards, including chemical and biological agents.

Moreover, the use of industrial gloves has also increased in the manufacturing industry where gloves protect workers from heat and other temperature concerns, chemicals, and cuts & bruises. The surge in the application of industrial gloves in the chemical, pharmaceutical, and oil & gas industries is also driving the growth of the industrial gloves market. With the increasing awareness of workplace safety, companies are expected to invest more in protective equipment, including gloves, to ensure the safety of their workers.

According to the CXOs, Asia-Pacific is projected to register significant growth as compared to the saturated markets of North America and Europe. The growth of the industrial gloves market in Asia-Pacific can be attributed to the increasing demand for industrial gloves in developing countries such as China and India. These countries have witnessed a significant increase in manufacturing activities, leading to an increased demand for industrial gloves. Furthermore, the rise in awareness of workplace safety and the implementation of stringent regulations by the government are driving the growth of the industrial gloves market in the region.

Increasing awareness regarding personal safety and hygiene and growth in end-use industries are the key factors boosting the Industrial gloves market growth.

The market value of Industrial gloves in 2032 is expected to be $20.2 billion

Top Gloves Corporation Berhad, Hartalega Holdings, Kossan Rubber Industries Bhd, Riverstone Holdings Limited, Careplus Group Berhad, Supermax Corp., Ansell Healthcare, SHOWA, Inc., Honeywell International Inc., and Semperit AG Holding

Oil and gas industry is projected to increase the demand for Industrial gloves Market

The global industrial gloves market forecast is segmented into usability and region. On the basis of usability, the market is categorized into disposable and reusable. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Expansion in emerging markets is the Main Driver of Industrial gloves Market.

Loading Table Of Content...

Loading Research Methodology...