Industrial Lasers Systems Market Research, 2030

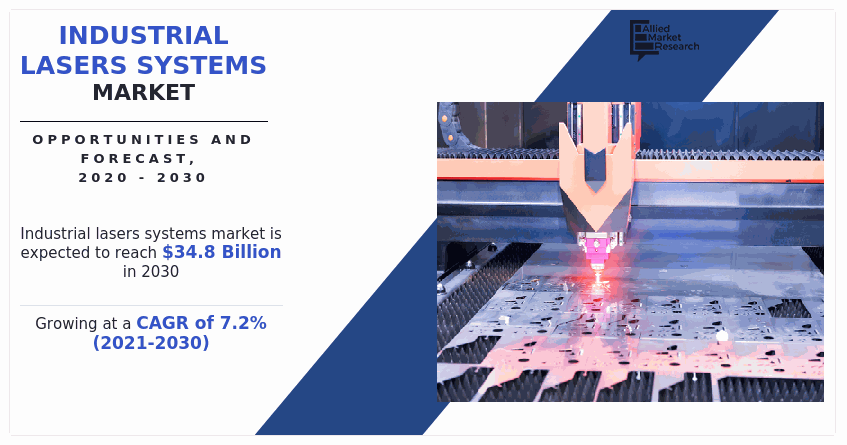

The global industrial lasers systems market size was valued at $17.3 billion in 2020, and is projected to reach $34.8 billion by 2030, growing at a CAGR of 7.2% from 2021 to 2030. Light amplification through emission of radiation is referred to as laser. An industrial laser is a mechanical instrument that generates a clear beam of light from a medium of regulated shape, size, and purity using molecules or atoms and stimulated emission. Various end-user sectors such as electronics, sheet metal processing, semiconductors, automotive, food & drinks, and medical have adopted industrial laser systems. This is attributed to the fact that these laser systems have wide range of applications such as welding, cutting, brazing, engraving, marking, labelling, and additive manufacturing.

Increase in trend of automation in industries for high efficiency, improved productivity, and accuracy has resulted in global industrial lasers systems market growth. Rise in adoption of laser systems is expected to register high market revenue, owing to increase in need for high precision laser systems for various applications on different materials. Furthermore, rise in demand for material processing in various sectors such as automotive, aerospace, industrial machinery, electronic, and construction is driving the industrial lasers systems market share growth. Furthermore, shift of automotive sector toward electric vehicle is generating demand opportunity for industrial laser systems.

In addition, due to the emergence of Industry 4.0 and Industrial IoT, many technical breakthroughs in the industrial environment, including industrial robotics, industrial automation, and 3D printing are projected to enhance the use of laser systems in industries. To improve efficiency and remain ahead of the competition, companies are combining existing production processes with many technical developments in lasers and laser systems. For instance, in January 2020, TRUMPF Group acquired GLOphotonics, a French-based laser technology company, which deals in hollo-core fibers. The fiber allows for a more direct and faster delivery of laser light from the source to the intended destination without power loss.

Segment Review

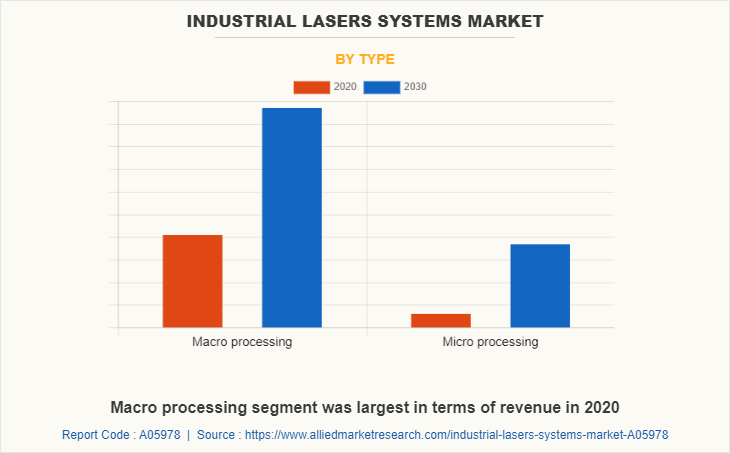

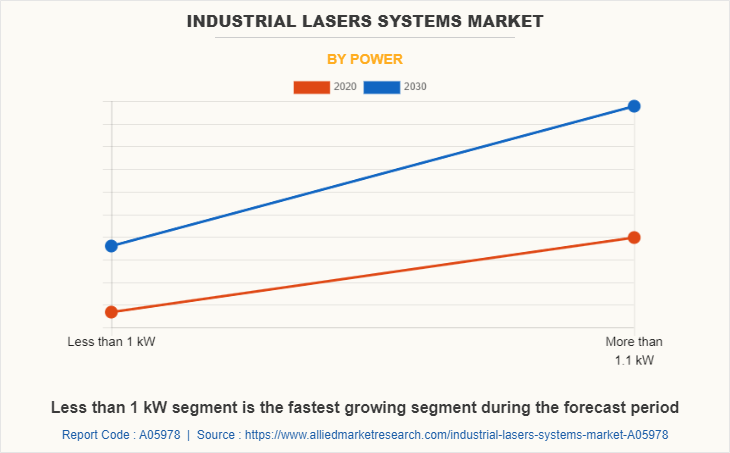

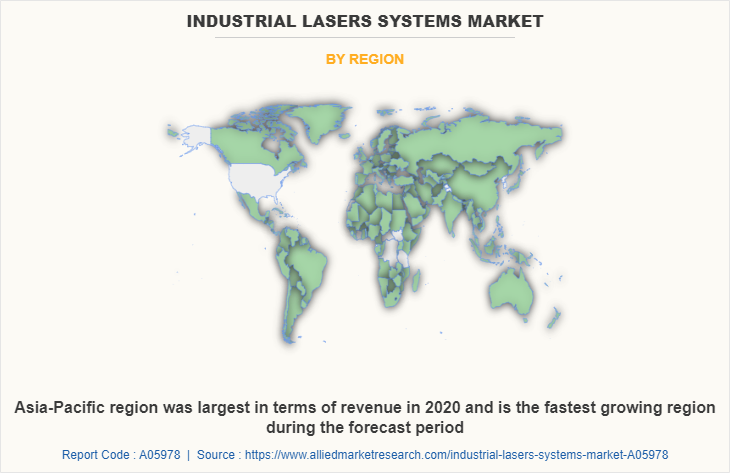

The market is segmented on the basis of type, power, application, and region. On the basis of type, the market is divided into macro processing and micro processing. On the basis of power, the market is divided into less than 1 kW and more than 1.1 kW. On the basis of application, the market is divided into cutting, welding, non-metal processing, additive manufacturing and others. Region wise, the global industrial lasers systems market is conducted across North America (the U.S., Canada, and Mexico), Europe (the UK, France, Germany, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

By type, the industrial lasers systems market is bifurcated macro-processing and micro-processing. The macro-processing segment generated highest revenue in market in 2020. This is attributed to adoption of macro-processing laser system in production of high-quality images through computer. Marking can be performed on all types of sensitive and complex materials including metals, ceramics, and plastics.

On the basis of power, the more than 1.1KW segment accounted for major share in the industrial lasers systems market in terms of revenue in 2020. Lasers are adopted in industries for high-speed cutting of metals, ceramics, and plastics. In the metal cutting industry, lasers are employed for sheet metal cutting.

The novel coronavirus (COVID-19) rapidly spread across various countries and regions in 2019, causing an enormous impact on lives of people and the overall community. It began as a human health condition and has now become a significant threat to global trade, economy, and finance. The COVID-19 pandemic halted production of many products in the industrial laser systems market, owing to lockdowns. Furthermore, the number of COVID-19 cases is expected to reduce in the future with the introduction of the vaccine for COVID-19 in the market. This has led to the reopening of industrial laser systems companies at their full-scale capacities. This is expected to help the industrial lasers systems market recover by the start of 2022. After COVID-19 infection cases begin to decline, equipment & machinery producers must focus on protecting their staff, operations, and supply networks to respond to urgent emergencies and establish new methods of working.

Region wise, Asia-Pacific was the largest revenue generator in 2020. This is attributed to the adoption of fiber laser systems in various industries such as metal processing, machinery manufacturing, medical, and defense. Furthermore, factors that drive the industrial lasers systems market are cheap labor, low manufacturing costs, and high adoption of material processing applications in this region.

Competition Analysis

The key players that operating in the global industrial lasers systems market are Amonics Ltd., Apollo Instruments Inc., Coherent Inc., IPG Photonics Corporation, Jenoptik Laser GmbH, CY Laser SRL, NKT Photonics A/S, LUMIBIRD, TRUMPF Group, and Toptica Photonics AG.

Key Benefits For Stakeholders

- The report provides an extensive analysis of the current and emerging industrial lasers systems market trends and dynamics.

- In-depth industrial lasers systems market analysis is conducted by constructing market estimations for key market segments between 2021 and 2030.

- Extensive analysis of the industrial lasers systems market is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The global industrial lasers systems market forecast analysis from 2021 to 2030 is included in the report.

- The report includes industrial lasers systems market opportunities and comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

Industrial Lasers Systems Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Power |

|

| By Application |

|

| By Region |

|

| Key Market Players | Amonics Ltd., Toptica Photonics AG., IPG Photonics Corporation, Coherent Inc., TRUMPF, Apollo Instruments Inc., Quantel Group, CY Laser SRL, Jenoptik Laser GmbH, NKT Photonics A/S |

Analyst Review

The global industrial laser system market is expanding owing to rise in adoption of laser systems in automotive, electronics, and machinery manufacturing sectors. Furthermore, rise in green manufacturing and increase in material processing have made laser systems the preferred choice. Furthermore, they can be used to produce marks of different sizes and complexities from serial alphanumeric codes to complex bitmap images. Reduced energy consumption and use of nonhazardous materials in fiber lasers are the major factors that boost the growth of the industrial laser systems market across the globe.

Prominent laser manufacturers are developing energy-efficient, eco-friendly fiber lasers, which offer high peak power, vibrational stability, maintenance-free turnkey operation, and superior quality edge finish. For instance, in January 2022, TRUMPF Group launched BrightLine Speed, a 3D cutting technology that increases speed and efficiency of sheet metal cutting. BrightLine Speed allows boost cutting speed by up to 60% for sheets up to 4 millimeters thick. Such advanced laser machines from the key players are providing lucrative growth opportunity for the global market.

The global industrial laser systems market was valued at $17,345.8 million in 2020

Region wise, Asia-Pacific was the largest revenue generator in 2020.

The cutting is the leading application of Industrial Lasers Systems Market

The market is projected to reach $34,764.6 million by 2030, registering a CAGR of 7.2% from 2021 to 2030.

Amonics Ltd., Apollo Instruments Inc., Coherent Inc., IPG Photonics Corporation, Jenoptik Laser GmbH, CY Laser SRL, NKT Photonics A/S, LUMIBIRD, TRUMPF Group, and Toptica Photonics AG.

Loading Table Of Content...