Industrial Noise Control Market Research, 2033

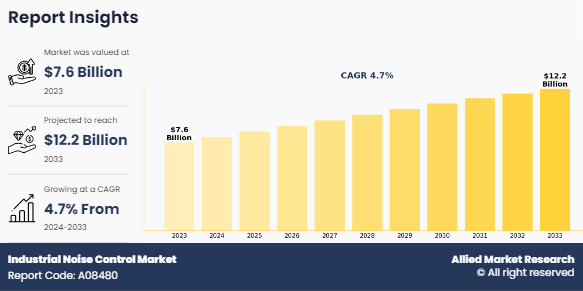

The Global Industrial Noise Control Market was valued at $7.6 billion in 2023, and is projected to reach $12.2 billion by 2033, growing at a CAGR of 4.7% from 2024 to 2033.

Industrial noise control refers to strategies and technologies used to reduce or manage unwanted sound produced by industrial activities. This noise, originating from machinery, equipment, and processes in factories, construction sites, and other industrial settings, can be harmful to workers’ health and nearby communities. Effective noise control measures include soundproofing materials, noise barriers, and regular maintenance of equipment to minimize sound emissions. In addition, regulatory frameworks set permissible noise levels and require monitoring to ensure compliance. The goal is to create a safer, healthier environment for workers and reduce the impact of industrial noise on surrounding areas.

Key Takeaways

- Based on product type, the noise control enclosures held the largest Industrial noise control market share in 2023. However, acoustic louvres is anticipated to grow at the fastest CAGR during the forecast period.

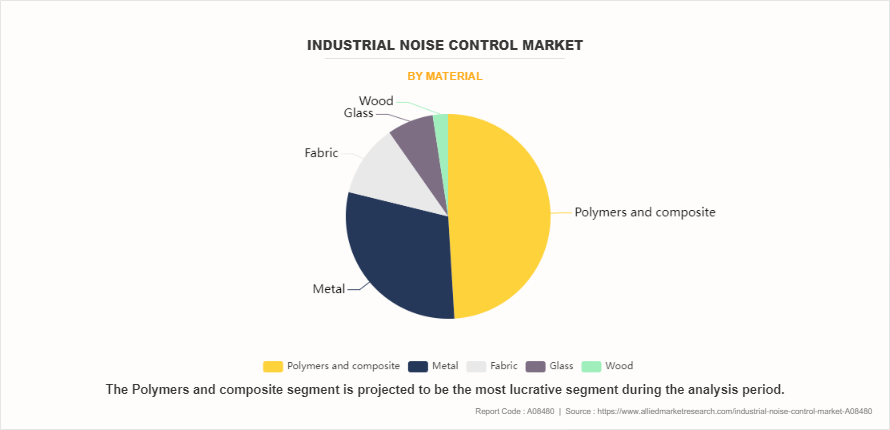

- Based on material, the polymers and composite segment dominated the Industrial noise control market size in terms of revenue in 2023. However wood is anticipated to grow at the fastest CAGR during the forecast period.

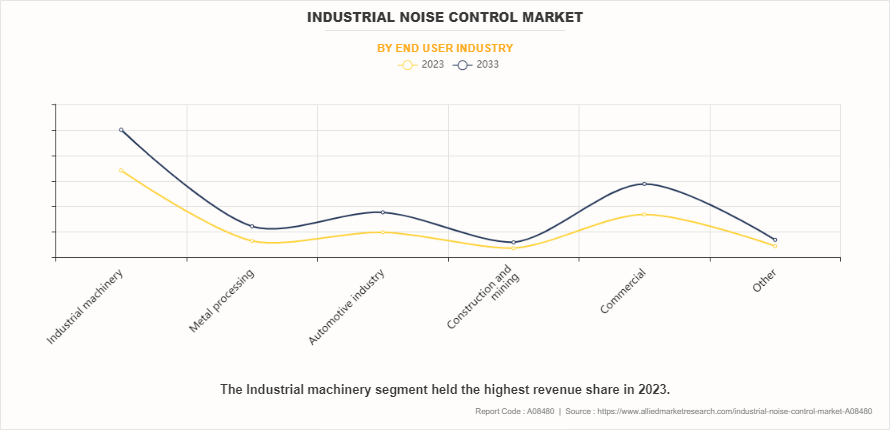

- Based on end user industry, the industrial machinery dominated the Industrial noise control market in terms of revenue in 2023. However metal processing industry is anticipated to grow at the fastest CAGR during the forecast period.

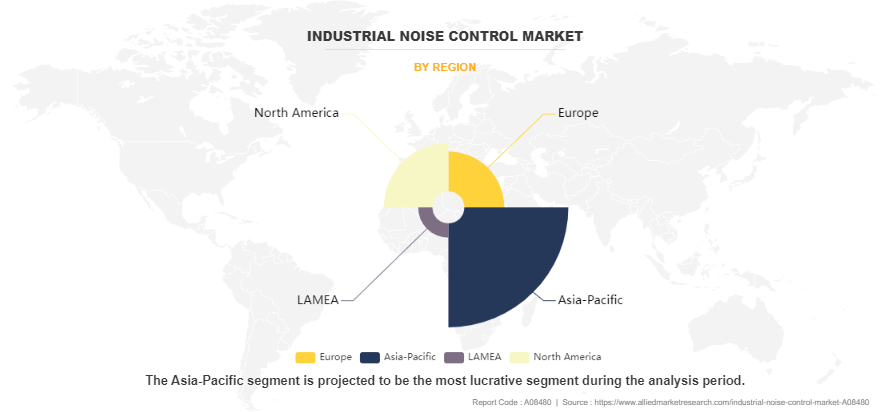

- Region-wise, Asia-pacific held the largest market share in 2023. However LAMEA is expected to witness the highest CAGR during the forecast period.

Segment Overview

The industrial noise control market is segmented into Product, Material, End User Industry and Region.

On the basis of product, the Industrial noise control market forecast is broken down into silencers, acoustic louvers, noise control enclosures, curtains and barrier walls, and others. In 2023, the noise control enclosures segment held the largest share of the Industrial noise control market due to increasing regulations on workplace noise levels and growing awareness of the health impacts of noise pollution. Industries such as manufacturing, energy, and construction, are expanding rapidly, thereby boosting the demand for effective noise control solutions.

On the basis of material, the market is classified into polymers & composite, metal, fabric, glass and wood. In 2023, the polymers & composite segment dominated the Industrial noise control market in terms of revenue due to increasing industrial activities and stricternoise regulations. These materials offer better noise absorption and vibration damping, making them essential for meeting regulatory standards and enhancing worker comfort.

On the basis of end user, the market is fragmented into construction industrial machinery, metal processing, automotive industry, construction & mining, commercial and other. In 2023, the industrial machinery segment held the largest share in the Industrial noise control industry due to increase in regulatory pressures, rise in awareness of workplace safety, and advancements in noise reduction technologies. Further, the adoption of advanced acoustic materials, integration of smart noise monitoring systems, and the use of predictive maintenance tools that identify and mitigate noise issues are rising.

On the basis of region, the Industrial noise control market is analyzed across North America, Europe, Asia-Pacific and LAMEA. In 2023, Asia-Pacific held the largest market share in the Industrial noise control industry due to the rapid industrialization, urbanization, and stringent government regulations on noise pollution. The region's booming manufacturing sector, particularly in China, India, and Southeast Asia, drives demand for noise control solutions in industries like construction, automotive, and heavy machinery.

Competitive Analysis

The key players profiled in the report include Envirotech Systems Limited., R. Kohlhauer GmbH, Ventac Co. Ltd., eNoiseControl, SysTech Design Inc., Technofirst, Sound Seal, Merford, Cellofoam International GmbH & Co. KG and Kinetics Noise Control, Inc. These key players have adopted strategies such as product launch, collaboration, and partnership to enhance their market penetration.

Market Dynamics

Rise in awareness of the adverse effects of industrial noise on workers' health is significantly driving the industrial noise control market growth. Prolonged exposure to high noise levels in industrial settings can lead to various health issues, including hearing loss, stress, and cardiovascular problems. For example, the Occupational Safety and Health Administration (OSHA) reports that roughly 22 million workers in the U.S. are exposed to hazardous noise levels, particularly in manufacturing, construction, and other industrial sectors. Noise levels above 85 decibels are considered dangerous for prolonged periods, but even sounds at just 70 decibels can cause hearingdamage over time. As awareness of these risks grows, companies are increasingly investing in noise control solutions to protect their employees.

For instance, manufacturers such as Sound Fighter Systems and Kinetics Noise Control are implementing soundproofing measures, noise barriers, and advanced noise-dampening materials to reduce the impact of loud machinery. In addition, sectorssuch as construction have started using quieter equipment and installing noise control systems to minimize workers' exposure to harmful noise. This growing awareness is also driven by regulatory pressures from organizations inlcuding OSHA. As a result, industries are adopting noise control technologies to comply with regulations as well as to improveoverall workplace safety and productivity. This increased demand for noise control solutions is fuelling the growth of the industrial noise control market.

However, Installing advanced noise control systems, such as acoustic barriers, soundproof enclosures, and specialized sound- dampening materials, requires substantial financial investment. For many businesses, the upfront costs of these installations, along with ongoing maintenance expenses, can be prohibitive. This financial burden often leads companies to either delay implementing noise control measures or opt for less effective, lower-cost alternatives that may not fully comply with regulatory standards. As a result, the high-cost barrier can hinder the market growth, particularly in regions or industries where economic conditions are tighter. Moreover, the complexity and cost of retrofitting existing facilities to accommodate noise control systems add to the challenge, further discouraging companies from making the investment. Thus, while the demand for noise control is recognized, high costs associated with it acts as a significant restraint on the market expansion.

Furthermore, Expansion in developing regions presents significant opportunities for the industrial noise control market due to rapid industrialization and urbanization. As economies in these regions grow, there is increase in construction, manufacturing, and infrastructure projects, all of which contribute to higher noise levels. This growth drives demand for effective noise control solutions to manage noise pollution and comply with evolving regulations. For example, in countries such as India and Brazil, large-scale infrastructure projects, such as new highways, urban development, and industrial facilities, generate substantial noise. As these nations continue to industrialize, the need for noise reduction becomes more important.

For instance, Mumbai’s Pali Hill, previously a serene area, is now engulfed in redevelopment chaos. However, amid a wave of construction, a silent development is taking shape that could set standards for building projects across Mumbai and perhaps other cities too. Similarly, in Southeast Asia, the expansion of manufacturing hubs and construction activities, particularly in countries like Vietnam and Thailand, creates a growing demand for noise control solutions. The adoption of noise control measureshelps companies in these regionsavoid penalties, enhanceworker safety, and improve operational efficiency. Furthermore, developing regions often face less stringent initial regulations, but as they advance, stricter noise control standards are likely to be implemented. Early adoption of noise control technologies in these markets can position companies advantageously as regulations tighten, creating substantial growth opportunities in the industrial noise control market.

Key Developments/Strategies

- November 2022 - Sound Seal introduced colorful, exterior-grade aerial baffles, banners, vivid noise barriers, and sound curtains. These products enhance the visual appeal while maintaining high acoustic performance. Aerial baffles and banners, available through the Architectural Division, are lightweight, customizable, and now offered in both interior and exterior-grade finishes.

- March 2022 - Sound Seal launched Timber-Stix acoustical panels, featuring wood-veneered facing and recycled plastic P.E.T. felt backing. These stylish, sustainable panels are versatile and easy to install on walls or ceilings, for quick, impactful visual enhancement.

- February 2022, Merford started a new production line in Gorinchem, which includes the Akoestikon sound-absorbing systems used in construction. The new line can swiftly switch from cold glue to hotmelt, enabling instant plate gluing, thereby significantly reducing the previous 24-hour wait time.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the industrial noise control market analysis from 2023 to 2033 to identify the prevailing industrial noise control market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the industrial noise control market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global industrial noise control market trends, key players, market segments, application areas, and market growth strategies.

Industrial Noise Control Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 12.2 billion |

| Growth Rate | CAGR of 4.7% |

| Forecast period | 2023 - 2033 |

| Report Pages | 320 |

| By Product |

|

| By Material |

|

| By End User Industry |

|

| By Region |

|

| Key Market Players | Technofirst, eNoiseControl, Envirotech Systems Limited, Cellofoam International GmbH & Co. KG, R. Kohlhauer GmbH, Sound Seal, Merford, Ventac Co. Ltd., SysTech Design Inc., Kinetics Noise Control, Inc. |

Analyst Review

The industrial noise control market is undergoing significant transformation, driven by increase in regulatory pressuresand rise in awareness of occupational health and safety. The market presents both challenges and opportunities. Regulatory bodies globally are tightening standards, compelling industries to adopt advanced noise control solutions. This creates a need for companies to innovate and offer more effective, scalable, and cost-efficient solutions. The integration of IoT and smart technologies into noise control systems is a significant driver, allowing for real-time monitoring and adaptive noise management, which can lead to enhanced operational efficiency and reduced downtime. In addition, the shift towards sustainable and eco-friendly solutionsis gaining momentum,as industries are increasingly concerned with reducing their environmental footprint.

However, the market is also becoming increasingly competitive, with numerous players vying for a share. The focus is on strategic partnerships, mergers, and acquisitions to consolidate their market position and expand their product offerings. A customer-centric approachis critical, as clients are looking for customized solutionsthat can be seamlessly integrated into existing systems. Overall, the industrial noise control market is poised for growth, and companies that can innovate, adapt, and align with evolving customer needs will be well-positioned to capitalize on the emerging opportunities.

The industrial noise control market is segmented into product, material, end user, and region. By product, the market is divided into silencers, acousticlouvres, noise controlenclosures, curtains and barrier walls, and others. By material,it is classified into polymersand composite, metal, fabric, and glass. By end user, it is segregated industrial machinery, metal processing, automotive industry,construction andmining, commercial, and others.The industry machinery segment is further classified into gas turbines, textile machinery, and others. Region-wise, it is analyzed across the North America (U.S., Canada, Mexico), Europe (UK, Germany, France, Italy, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Rest of Asia-Pacific), and LAMEA (Latin America, Middle East and Africa).

The key players profiled in the report include Envirotech Systems Limited., R. Kohlhauer GmbH, Ventac Co. Ltd., eNoiseControl, SysTech Design Inc., Technofirst, Sound Seal, Merford, Cellofoam International GmbH & Co. KG, and Kinetics Noise Control, Inc. These key players have adopted strategies such as product launch, collaboration, and partnership to enhance their market penetration.

Increasing demand for quieter work environments, stricter regulations, and advancements in technology are the upcoming trends of Industrial Noise Control Market in the globe.

The leading application of the Industrial Noise Control market is in industrial machinery industry.

Asia-Pacific is the largest regional market for Industrial Noise Control.

The industrial noise control market was valued at $7.6 billion in 2023.

Envirotech Systems Limited., R. Kohlhauer GmbH, Ventac Co. Ltd., eNoiseControl, SysTech Design Inc., Technofirst, Sound Seal, Merford, Cellofoam International GmbH & Co. KG, and Kinetics Noise Control, Inc are the top companies to hold the market share in Industrial Noise Control.

Loading Table Of Content...

Loading Research Methodology...